Editor’s note: This is an edited transcript of UniSuper’s latest investment update with CIO, John Pearce, in which he discusses what’s behind the recent market rally, and whether it's on solid ground. The full video and transcript can be viewed here.

---

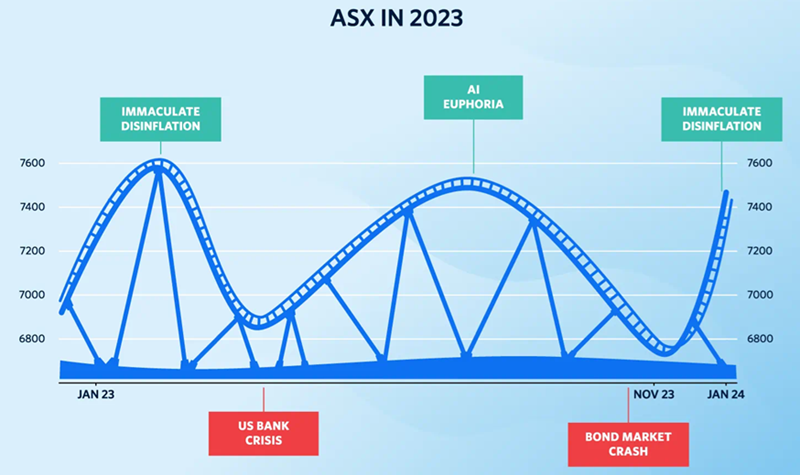

In non-technical terms, the market has been ripping. Since the lows in October last year, the Aussie market's up about 14% and the US market is up about 18%. Why? Well, before I dive into the answer, I’d like to show you this graph. I'm sure some of you will remember as I presented it in November last year - it shows the performance of the Australian stock market over the course of 2023, and the graph depicts the rollercoaster ride that the market found itself on. And I said Mr. Market was in his usual mood swings and there were four distinct phases. We got off to a very good start for the year when the mood was very positive with the prospect of immaculate disinflation.

Then of course, we had the regional bank crisis in the US. You remember Silicon Valley Bank. Then, we had the market being gripped by euphoria around artificial intelligence (AI). And then Mr. Market got into a bit of a swoon because the bond market crashed.

Let's roll the clock forward to 31 January this year, and what do we see? Another sharp rally.

Figure 1: The ‘rollercoaster’ performance of the Australian stock market over the course of 2023

Once again, I put it down to the prospect of immaculate disinflation.

Is this justifiable? Well, firstly, let's define exactly what immaculate disinflation is. Disinflation is simply a fall in the rate of inflation, and the market is pretty confident that we're going to trend towards that magical 2.5%, 3% level that central banks are typically targeting. What's immaculate about this? It's all going to happen without having to crash the economy.

Central banks are not having to tighten to the point where we're forcing the economies into a recession. If you think about this combination, strong economies, low inflation - that is utopia for company profits and share prices.

Is the market rally justified?

So let's get back to that question: is the market rally on solid ground or are we experiencing just another bout of irrational exuberance?

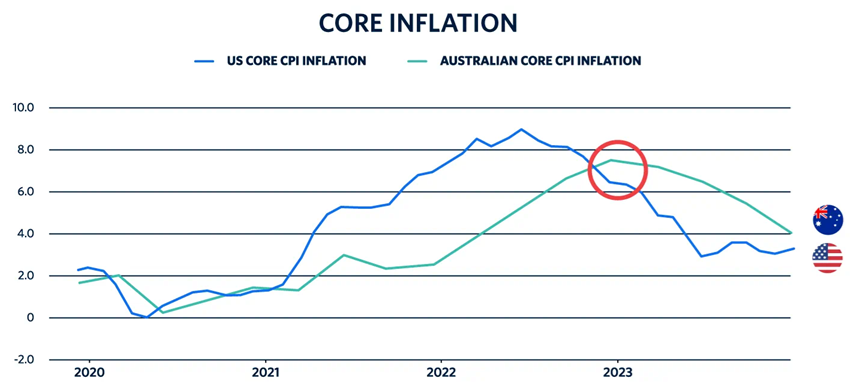

Market commentators love being pessimistic and negative about things, but let me give you three reasons why I think the market could indeed be on solid ground. Firstly, the concept of disinflation is real. Take a look at this graph showing core inflation in both Australia and the US. It's all heading down. Contrast where we are today to where we were in January last year when we experienced this bout of euphoria. Inflation in the US was around 6.5%, it's now closer to 3% - inflation in Australia was around 7.6%, it's now getting closer to 4%, so all very much heading in the right direction.

Figure 3: Core inflation in Australia and the US from 2020 to 2024

Point number two, and this is really important - the Federal Reserve, the most important central bank in the world, really important for other developed countries as well - look at the pivot that the central bank in the US has undertaken.

And to give you an idea of the speed of the so-called Fed pivot, I'd like to refer to the comments made by Jerome Powell, the all-important chair of the Fed Reserve. It was not that long ago, in November of last year, that the chair was basically saying, “Hey, we're still going with these rate hikes- watch out, market”. Then in December, “Hmm, we believe that is room for a pause”. Then in January, two months after November, he's basically saying, “There are grounds for rate cuts this year, but March is probably too early”. Wow. That's a hell of a pivot in a very short period of time. I would have ruled out any possibility of rate cuts if you asked me in November last year.

So they’re three reasons why the market could indeed be on solid footing.

Risks for the market

Of course, what could go wrong? And once again, there's no shortage of risk factors that people will allude to. Let me talk about the three most common risks that commentators like to talk about.

First, geopolitical conflict. Now, I've been around long enough to beware of fund managers parading as geopolitical experts, and what I can say in my four decades or so of working in markets, I can't recall a time when the world was totally at peace, when there was no conflict, and frankly, I don't see much difference today. And what's more, when there is an outbreak of hostilities, historically, it tends to be a good buying opportunity. Second, the prospect of a hard landing. Now we can have an exogenous shock such as a pandemic, we can't stop that from happening. But hard landings are typically driven by policy, and given the current posturing of central banks, I don't think a hard landing is a high probability.

The one that I am concerned about is the possibility of reacceleration of inflation. So the market at the moment is saying that inflation indeed will trend down to that 2.5%, 2% mark and we're going to get rate cuts.

And if we don't get that, well, the market could get into a bit of a tailspin. I'm not so sure. Firstly, I'm not sure what's so magical about a 2% inflation rate versus a 3% or 3.5% inflation rate. Also, I don't believe that we necessarily need rate cuts to sustain the current market rally. However, it does change if we get a reacceleration in the rate of inflation.

Could that happen? It could, but I won't be blaming central banks if it does, I'll be blaming governments. To me, economies are really strong at the moment. Governments around the world should be printing large surpluses. They are not - many governments are still printing large deficits. It's imprudent, and I hope that they will become more prudent. What about the prospect of a Trump victory? Well, the election happens in November, there's plenty of time before then so we'll leave that for another day.

As we sit today, if you ask me what do I think about the current state of the economic and financial world, I say it feels about normal and that's not a bad place to be.

John Pearce is Chief Investment Officer at UniSuper, a sponsor of Firstlinks. This article provides general information and may include general advice. It doesn’t take into account your financial situation, needs or objectives. Consider your situation before making financial decisions, because we haven’t, as well as the PDS and TMD relevant to you at unisuper.com.au/pds, and whether to consult a qualified financial adviser. Past performance isn’t an indicator of future performance.

For more articles and papers from UniSuper, click here.