To mark the launch of the S&P/ASX Franking Credit Adjusted Indices, S&P Dow Jones Indices recently held a series of panel discussions on tax-aware investment management (TAIM). Panellists included the ASX, asset consultants Mercer and Towers Watson, fund managers Parametric Australia, Plato Investment Management and Warakirri Asset Management and wealth manager and advisor, HLB Mann Judd. I moderated each session.

The sessions explored the potential for superannuation funds to better manage Australian equities from an after-tax perspective, especially allowing for franking credits.

Australia’s dividend imputation system operates to neutralise the double taxation of corporate earnings. It was not until 2000 that excess franking credits were allowed to be claimed by low rate and tax exempt taxpayers, such as super funds. Previously, the imputation system resulted in low rate taxpayers forgoing tax credits attached to their dividends. For super funds this was significant, having had a 15% tax imposed on their taxable income in 1988.

What difference does tax make to investment returns?

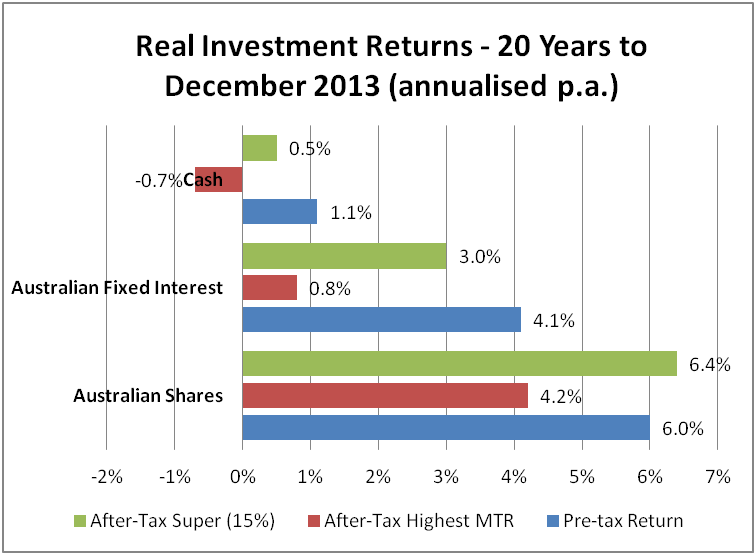

The evidence that taxes materially affect investment returns includes the annual Russell Investments/ASX Long-term Investing Report, which measures pre and post-tax returns for various asset classes over 20 year periods, as shown in Figure 1 for a selection of asset classes:

Figure 1: Long-term pre vs post tax real returns for select asset classes

Source: Russell Investment/ASX 2014 Long-term Investing Report, June 2014

Figure 1 shows the annualised inflation-adjusted index returns on a pre-tax and post-tax basis for a superannuation fund in accumulation mode and the highest personal marginal tax rate (MTR).

Given the risk equivalence, each investor’s actual return is heavily tax-dependent. Top rate taxpayers received a markedly lower net return than a superannuation fund. In the case of Australian shares, the after-tax return for a super fund actually exceeded its pre-tax equivalent due to the imputation credit. Other data sources indicate a post-tax lift in benchmark (pre-tax) Australian equity returns in the order of 0.30% to 0.60% per annum in accumulation phase, and 1.40% to 1.70% per annum in pension mode.

Does superior pre-tax performance translate to superior post-tax outcomes?

The asset management industry today exists, in the main, to deliver alpha, which, absent other explanations, is suggestive of manager skill. Alpha is usually demonstrated by a strategy’s performance against an agreed benchmark, most typically an index that represents the market return or beta.

Since its introduction in April 2000, the S&P/ASX 300 index, a pre-tax benchmark incorporating the 300 largest companies listed on the ASX by float-adjusted market capitalisation, has become a key marker that most large-cap active Australian equity funds aim to surpass. But what about taxes? As a ‘cost’ of investing, shouldn’t taxes also be incorporated into the evaluation of manager performance? And if they were, would it change pre-tax performance outcomes when viewed through a post-tax lens?

In a 1993 paper entitled ‘Is Your Alpha Big Enough to Cover Its Taxes?’, Tad Jeffery and Robert Arnott (founder of Research Affiliates) concluded that disregarding tax effects can have a significant negative impact on post-tax returns for the typical active equity manager. Subsequent studies have put this return drag in the range of 1% to 3% per annum.

Revisiting the issue in 2011, Rob Arnott, Andrew Berkin & Paul Bouchey studied the pre-tax returns of over 400 active US equity mutual funds, calculating their post-tax returns relative to passive equivalents, thus determining their tax alpha. Once again the results were the same: positive investment alpha almost inevitably came at the cost of a greater level of negative tax alpha. The authors concluded that “active management involves more than letting our gains run and cutting our losses: it involves paying attention to the trade-off among risk, return and taxes whenever an investment decision is made and whenever assets go through a transition.”

Superannuation funds and tax-aware investing

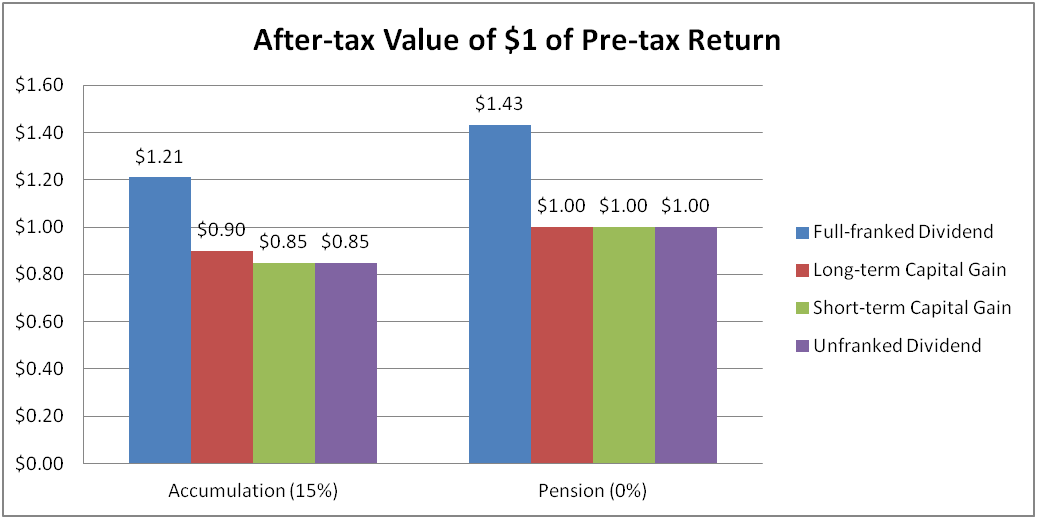

What difference do tax rates have on returns experienced by super fund members? In the case of Australian shares that pay dividends, a great deal as Figure 2 shows:

Figure 2: Post-tax value of a $1 dividend received

Source: Plato Investment Management Ltd (using 2012/13 personal tax rates including Medicare Levy)

Members in accumulation mode might incur a tax of between 10% and 15%, or receive an uplift of up to 21%, on their Australian shares. Members over age 60 and in pension mode either have no tax effect or receive an uplift of up to 43% on each dollar of fully franked dividend attributed them.

Cooper Review issues a tax-aware challenge

The 2010 final report of the Super System (Cooper) Review contained a section on managing for after-tax returns, including a submitter observation that taxes are often the single biggest expense for most super funds. It noted that the Australian fund management industry, unlike its US counterpart, has no obligation to calculate or report after-tax returns, and that there was a near-universal use by super trustees of pre-tax market indices as benchmarks against which fund managers were assessed and remunerated.

The Cooper Review made a recommendation to include an obligation on each APRA-regulated super fund to explicitly consider the tax consequences of its investment strategy, a change adopted into law with effect from 1 July 2013. Consideration must now be given to the overall investment strategy not just in respect of risk and return, adequate diversification, liquidity and costs, but also the expected tax consequences of investments held by each APRA-regulated fund.

Murray Review and the winds of change

Whilst the Cooper Review raised the bar for super fund tax awareness, the Financial System Inquiry (Murray Review) revisited the imputation system with somewhat different conclusions. It noted that: “The case for retaining dividend imputation is less clear than in the past. For investors (including superannuation funds) subject to low tax rates, the value of imputation credits received may exceed tax payable. Unused credits are fully refundable to these investors, with negative consequences for Government revenue.”

The FSI could not make specific tax recommendations, but its insights were taken into account in the recently released Treasury Re:think tax whitepaper. The whitepaper notes that the value of franking credits claimed by individuals, super funds and charities is around $19 billion per annum. It also notes that Australia is one of only a handful of countries (along with New Zealand, Canada, Chile and Mexico) to still refrain from the double taxation of dividends. Somewhat ominously Treasury’s whitepaper asks if the imputation system still serves Australia well, or whether the taxation of dividends could be improved.

Tax matters, so manage its impact on returns

Institutional asset management as practised today evolved from foundations laid decades ago by Modern Portfolio Theory: that risk and expected return are inescapably entwined and that intelligent diversification provides as close to a free lunch as an investor can hope to achieve. MPT is, however, a simplified world without fees and taxes where all investors have the same time horizon. Real-world investing, rather than being ‘frictionless’, involves taxes that materially impact outcomes and as a result tax awareness should be central to the investment decision making process.

A commitment is required on the part of superannuation funds and the asset managers they appoint to optimise post-tax risk-adjusted returns for the members who own the assets they manage. The benefits of such a commitment would likely be enhanced investment outcomes and individuals better funded in their retirement years.

Harry Chemay consults across superannuation and wealth management, focusing on post-retirement outcomes. He has previously practised as a specialist SMSF advisor, and as an investment consultant to APRA-regulated superannuation funds.

This article is based on a more detailed piece written for the S&P Dow Jones Indices tax aware website.

Nothing in this article constitutes taxation advice. Where data has been provided in relation to tax rates or the application of certain taxes, these are for illustration and education only and should not be relied upon by the reader. Readers should seek advice from a suitably qualified taxation professional on their particular circumstances.