When assessing the current landscape of the ASX, there has been a significant shift of investor dollars towards a highly select group of companies. Much has been made in the headlines about the WAAAX stocks (Wisetech, Altium, Afterpay, Appen and Xero). The share price performance of these companies has been exceptional, and in our opinion an element of FOMO (fear of missing out) has driven valuations to multiples much higher than their comparable global peers.

Impact of WAAAX moves

The demand for the WAAAX businesses has produced what we believe to be a disconnect between price and value that has developed over the past two-plus years. This disconnect exists between micro-caps and the wider market.

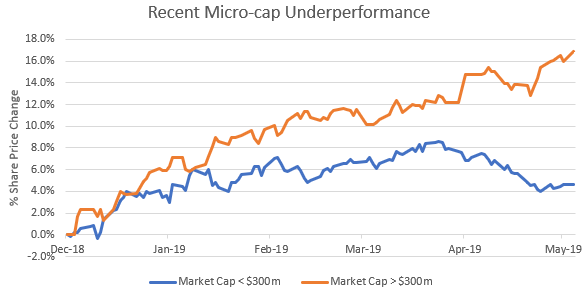

For the purpose of this article, we define a micro-cap as a company with a market capitalisation of less than $300 million. To illustrate, we have separated the domestic market (ex-resources) into two groups in 2019 to date: those with a market capitalisation above $300 million, and those below.

The chart below shows that since the recent lows of December 2018, companies with a market cap of less than $300 million have returned approximately 4.6%, whereas companies with a market cap of greater than $300 million returned almost 17%. It's an extraordinary difference.

Source: Bloomberg

The reality of micro-cap investing

Micro-cap investing is not suited to all. It is a much more inefficient part of the market that takes patience and tolerance to navigate successfully. In our experience, the growth and development of companies generally takes longer than originally anticipated. When a company achieves certain milestones or hits its targets, often it is not immediately reflected in the share price. There are also many other factors to consider such as liquidity, management expertise, capital requirements and investment time horizon, all of which require significant analysis in an area of the market which is not widely covered by analysts.

Micro-cap investing can also be an opportunity to obtain a meaningful position in a high-quality company before share price growth occurs. The holy grail of investing is finding a company with quality fundamentals that is growing its earnings before the wider market discovers it. Whilst these earnings continue to grow, its trading multiple expands, meaning investors are willing to pay a higher price for shares in this company. Many of the best ASX companies start out as micro-caps and have made those patient investors fortunes along the way.

Why has the current micro-cap disconnect happened?

In our opinion, this trade-off between ‘reality’ and ‘opportunity’ in micro-cap investing creates an area of the market that is cyclical in the court of public opinion. Investing in listed micro-caps goes in and out of fashion based on how much emphasis investors are placing on each end of the reality/opportunity spectrum.

There have been recent examples of institutional investors losing mandates to invest in the micro-cap sector. When a mandate is lost, a fund must return the deployed funds in a timely manner to the relevant mandate provider (e.g. an industry fund, non-for profit, charity, organisation, university, family office). This can result in large scale selling which is not correlated to the fundamentals of the underlying company.

As a result, many retail investors follow suit by selling their shares as lower share prices often triggers further selling. Furthermore, leading into the end of a financial year, retail investors may look to manage their taxable income by undertaking tax-loss selling on those positions which have underperformed during the financial year to offset their gains. Share prices then fall further, this time on very low volumes.

This disconnect can become self-fulfilling. The result is an environment in micro-caps where liquidity, and particularly buying demand, disappears.

When does this disconnect end?

Whilst the current environment may not paint a rosy picture of micro-cap investing, we are firmly of the view that the public opinion pendulum will at some stage swing back to more normalised levels. Micro-cap investing will again come into vogue. When will this disconnect end? Just like everyone else, we do not know.

What gives us confidence in our investment approach is the principle that despite short term disconnects between price and value, over the long term, price should match value. This is particularly the case in micro-cap investing.

In his book ‘What Works on Wall Street’, Jim O’Shaughnessy analyses compound annual returns for a period of 50 years of US equities, segmented into the market capitalisation bucket. During this period, micro-cap stocks outperformed large cap stocks by on average close to 3% p.a. The power of compounding means such that a difference of circa 3% p.a. means an outsized return of over at the end of that 50 years. As Charlie Munger said:

“The big money is not in the buying or the selling, but in the waiting.”

We believe this current period of disconnect for ASX micro-caps has further widened the inefficient playing field that is micro-cap investing. During this period of ‘waiting’, we can increase ownership of quality businesses at low prices and also revisit companies we know well that have seen an earnings multiple reduction. Some have seen earnings multiples reduce for legitimate reasons that may be only short-term headwinds, others for reasons less relevant to the business fundamentals such as mandate or tax-loss selling. These are the opportunities we like to see when making new long-term investments.

For those willing to spend the time doing the work on micro-caps, we believe there are compelling risk-adjusted returns on offer.

Robert Miller is a Portfolio Manager at NAOS Asset Management, a specialist fund manager of three listed investment companies (LICs) with concentrated exposures to Australian listed industrial companies outside of the ASX-50, and a sponsor of Cuffelinks. NAOS' LICs are in micro-cap stocks (ASX:NCC), small-caps (ASX:NSC) and mid-caps (ASX:NAC).

This content is for general information only and must not be construed as investment advice. It does not take into account the investment objectives of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice.

For more articles and papers from NAOS, please click here.