The world's best investor, Warren Buffett, has suffered from the same disease that plagues every other successful fund manager in the world - fading out-performance over time. My analysis here is not covered in any of the books or articles on Buffett that I have seen.

Even Warren Buffett peaked long ago

In my last article (1), I showed how even the very small proportion of fund managers that do add value by beating their market benchmark over a decent time period, that their out-performance always fades over time.

After studying hundreds of funds, my conclusion was:

"All active fund managers peak early in their careers (in terms of beating their market index anyway) and then it is all downhill from there. Even for the best in the world."

This includes the greats like Warren Buffett, Peter Lynch, George Soros, John Templeton, and local ‘stars’ like Kerr Neilson, Hamish Douglass, and everybody else. The reasons are different in each case.

Yes, the pattern is the same for Warren Buffett.

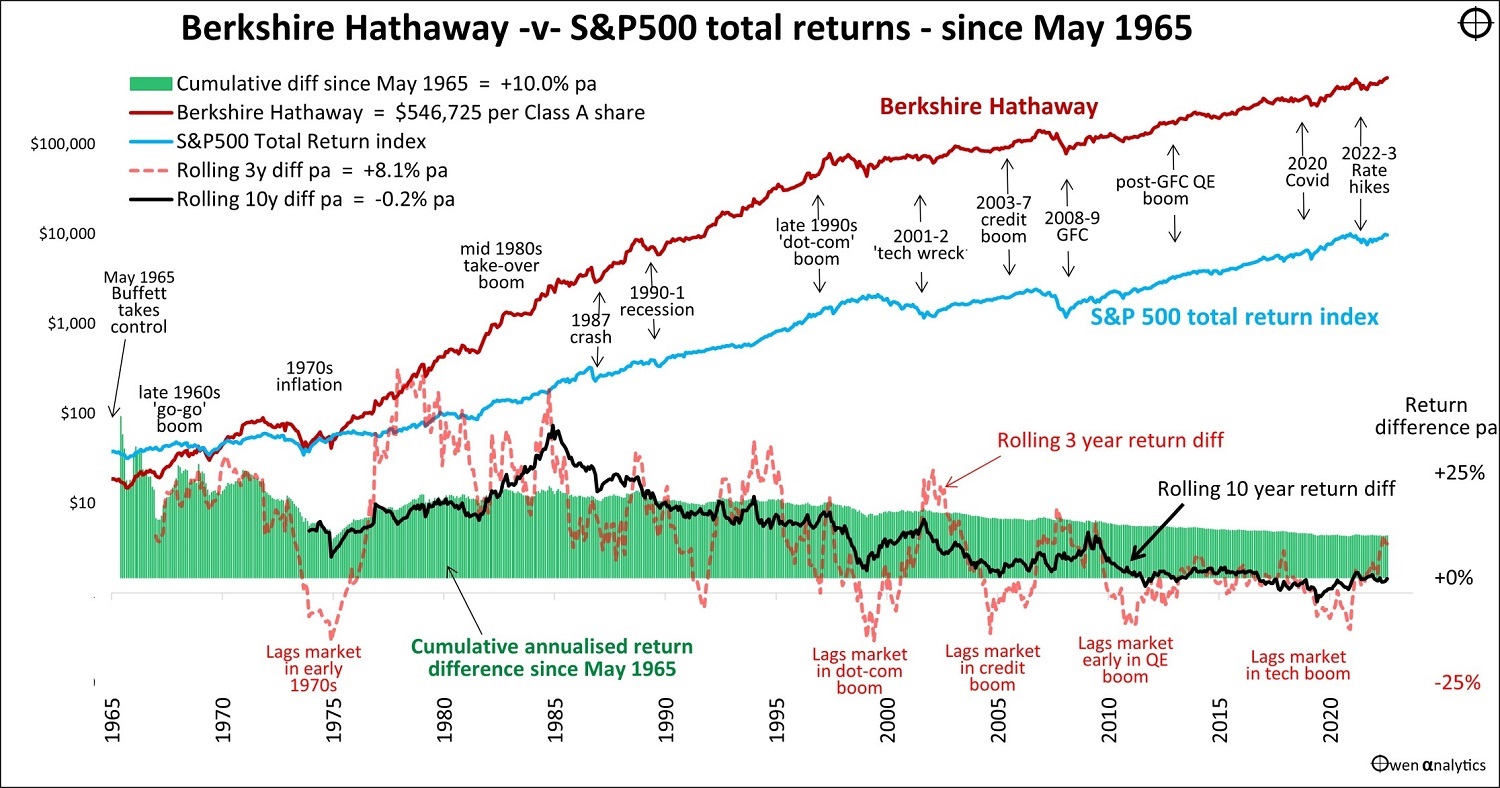

I am a long-term shareholder in Berkshire Hathaway, so I have a vested interest in measuring its performance. It has beaten the S&P500 total return index by an astounding 10% pa since May 1965 when Buffett took over, but most of that out-performance was in the early decades.

Berkshire Hathaway has not added any value against the S&P500 index since 2002. Its out-performance fade curve is the same as other value-adding share funds in Australia and other markets.

Tracking performance decay over time

Here is my chart for Berkshire Hathaway since May 1965 when Buffett took control.

Click to enlarge.

The red line is the Berkshire’s share price. Since 1965, the company has paid no dividends and has reinvested all earnings, so the share price is essentially the ‘Total Return’ series. The shares have not split over the period and the price of BRK Class A shares has grown from $12.37 to $546,725 per share at the end of August 2023.

The blue line is the S&P500 total return index. This is the most appropriate benchmark because Berkshire’s investments have always been US companies (listed and unlisted), with few exceptions (notably Chinese car maker BYD).

The black line shows annualised rolling 10-year excess returns above the benchmark. This is our main historical measure for long-term investors.

The orange dotted line is the annualised rolling 3-year excess returns above the benchmark. This is a good way to see performance through different cycles and market conditions.

Beat the market by 10% pa since inception

The green bars in the lower section of the chart show the annualised cumulative excess returns over the benchmark since May 1965. This is the annualised ‘since inception’ out-performance over time. It has beaten the S&P500 total return index by 10% pa compound over 58 years! No other fund manager in history has ever come close to this over such a long period.

Warren Buffett, along with his side-kick Charlie Munger, is without doubt the greatest portfolio share investor in history. I use the term ‘portfolio investor’ to differentiate him from founder/owners like Rockefeller, Carnegie, Musk, Bezos, Gates, etc. They built their own companies, but Buffett invested in other peoples’ companies, which is a different skill.

Buffett put just $100 of his own money into his first fund in 1956. He earned the rest of his stake by taking his out-performance fees in units in his fund, rather than cash, and then rolled it into Berkshire Hathaway in 1965. So, he turned his original $100 in 1956 into $120 billion today.

Peaked in 1965 (year one) then downhill

Like all active fund managers, Buffett peaked early. In fact, he peaked in the very first year in Berkshire. He beat the S&P by a whopping +37% in 1965, and that was the peak of the annualised cumulative value add (green bars).

1965 was actually not his best individual year. He had several better years – and they were all early on. He beat the market by +105% in 1976, +84% in 1979, +67% in 1968, +66% in 1971, +54% in 1977, +53% in 1989. These were partially offset by some poor years in between, so the cumulative ‘since inception’ peak was in 1965.

It was all downhill from the early peak, albeit still generating higher returns than anyone else in history.

- By the end of the 1960s, the annualised cumulative value add was +27% pa.

- By the end of the 1970s it was +19.7% pa.

- By the end of the 1980s it was +20.4% pa.

- By the end of the 1990s it was +15.1% pa.

- By the end of the 2000s it was + 13.1% pa.

- By the end of the 2010s it was +10.5% pa.

Today, the annualised cumulative value add is down to ‘just’ 10% pa. What’s not to like? As a prospective investor you might say: “Wow the since inception return is still 10% pa over 58 years. It should still be a great investment!”

That's why fund managers and their sales reps love talking about 'since inception' returns. But they are meaningless.

The problem with ‘since inception’ numbers

This highlights the big problem with ‘since inception’ numbers. The great-looking ‘since inception’ return of 10% pa masks the fact that most of that out-performance was generated in the early years, half a century ago.

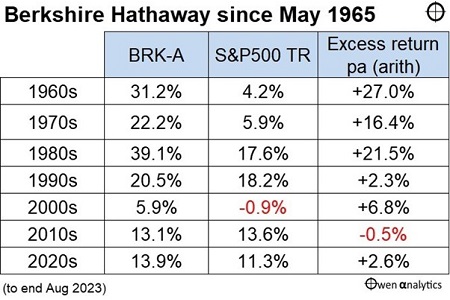

We see a clearer picture of performance by looking at returns per decade:

In the 1990s, it added almost no value as Buffett lagged the market by deliberately avoiding the crazy ‘dot-com’ boom. This earned him a lot of derision at the time but he was vindicated when he added value in the 2000s by avoiding the ‘tech wreck’. However, virtually no value was added in the 2010s and 2020s.

Rolling 10-year value-add

The black line (rolling 10-year value added pa) is the key. It shows rolling 10 year annualised value add is currently zero. In fact, the black rolling 10-year value add line has been running at around zero for the past 10 years since 2012, because it has added no value at all since 2002.

That’s a long time going nowhere. It didn’t actually go nowhere of course. It has gained 650% since 2002, but so has the passive S&P500 total return index. That’s better than the 490% return from the Australian market over the same period.

Rolling 3-year value-add

The orange dashes (rolling 3-year value added pa) is a good way of showing where the value is added or detracted through market cycles.

Buffett’s pattern has been very consistent over seven decades. His ‘value investing’ strategy lagged the overall market in booms (by avoiding fads/bubble stocks) but then added value in the busts when the fads/bubble stocks collapsed. The only exception was poor returns in the 1973-4 crash, but that was recovered big time in the late 1970s and 1980s.

True to form, Buffett was also vocal in avoiding the most recent 2020-21 Covid stimulus tech bubble, and the share price lagged the market (orange dash line below zero) as expected. There were also some poor deals in the recent cycle – notably Kraft-Heinz, and the disastrous Airline bets in 2020.

In the rebound over the past year, performance has improved, thanks to huge bets on Apple and oil/gas.

Reasons for performance fade

Buffett and Munger certainly have not succumbed to the problems that afflict many older fund managers, such as selling out, no longer lean and hungry, family problems or diversions, buying football teams, hubris, ego, etc, etc.

In their case, there are probably two reasons:

- Berkshire has become too large and they cannot deploy the huge sums effectively without moving markets.

- It has too much cash, which is largely the result of the first problem.

Am I a seller? Probably not until my SMSF is in tax-free pension mode, so I avoid CGT on sale!

Same pattern of fading out-performance

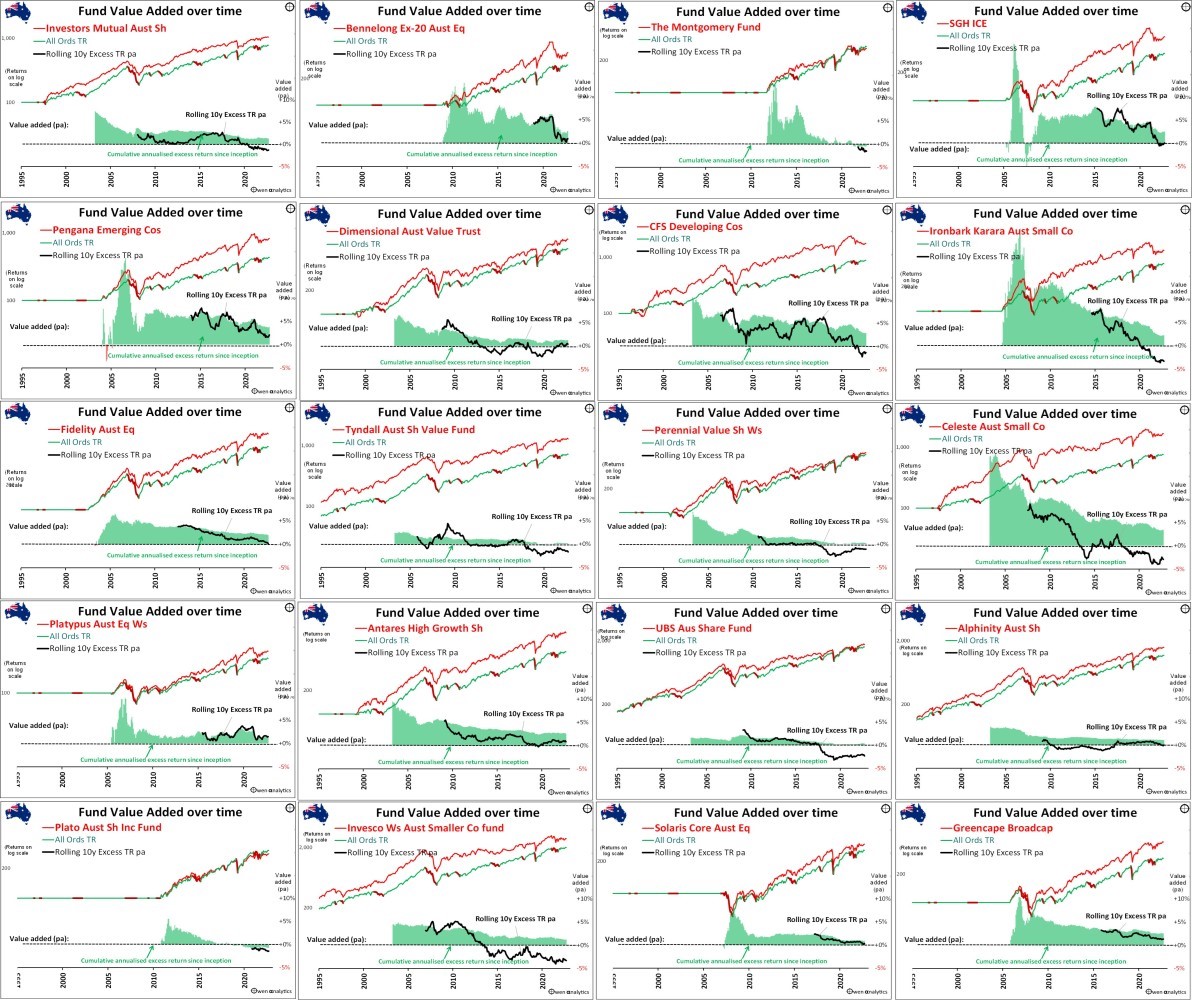

For reference, here is a copy of the charts on 20 ‘value-adding’ Australian share funds. Just as with Berkshire Hathaway, the general pattern is the same. Excess returns (green bars) start out with a bang early in the fund’s life, but then fade over time in every case.

The difference is of course that Buffett and Munger added a lot more value for a lot longer than anyone else.

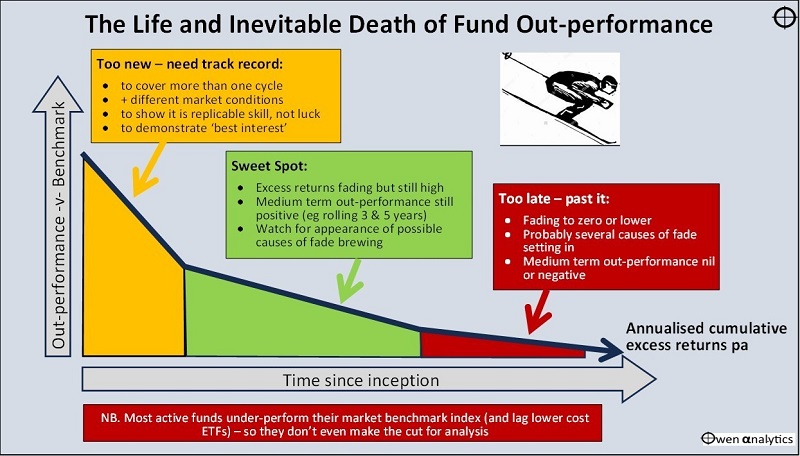

Three stages of out-performing fund managers

Here is the chart from my last article, outlining the three stages in the life of an out-performing fund:

Berkshire Hathaway was in the Sweet Spot for decades but has probably been in Stage 3 since the early 1990s. The orange 3-year value-add line on the main chart shows there are certainly some short-term opportunities through the cycles, but as a long-term investor, the black 10-year value-add line has flat-lined.

(1) OwenAnalytics Newsletter is currently published on LinkedIn. ‘Few active fund managers add value, but even value-adding managers almost always fade over time.'

Ashley Owen, CFA is Founder and Principal of OwenAnalytics. Ashley is a well-known Australian market commentator with over 40 years’ experience. This article is for general information purposes only and does not consider the circumstances of any individual.