The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

30 September 2022 and weekend market update

The S&P/ASX 200 fell 6.2% in the month of September 2022 giving back all the gains made in July and August and leaving the quarter up only 0.4% and the 12 months down 7.7%. Small caps fared worse for the month, with the S&P/ASX Small Ordinaries down 11.2% and 0.5% for the quarter, taking the annual loss to -22.6%.

All S&P/ASX 200 sectors dropped in September, but six out of 11 rose for the quarter with Energy up 5.9% and 26.1% for the year. Hard hit for the month were property trusts, or A-REITS, with the Real Estate sector losing 13.6% taking annual losses to 21.4%. Utilities were as bad for the month, down 13.8% but still up 13.1% for the year.The big annual sector loser was IT, down 39.3%.

Bond indexes for September show how widespread multi-asset portfolios have struggled with the S&P/ASX Australian Government Bond Index down 1.74% for the month and 13.8% for the last year. The Commodity Index lost 6.6% for the month but rose 25.3% for the year.

From AAP Netdesk: On Friday, the local share market gave back nearly all of Thursday's rally, putting a gloomy finish on its second-worst month in the past two years. The benchmark S&P/ASX200 index closed Friday down 81 points, or 1.2%, to 6,474. The September fall was the worst performance since the 8.9% decline in June. The index finished the week down 1.5% in its third straight losing week, and fifth of the past six weeks.

Every sector was lower on Friday except energy and mining, which gained ground as an ebbing US dollar makes commodities look more attractive. Rio Tinto gained 2.7%, BHP climbed 0.9% and Fortescue added 0.2%. However, all the big banks were lower ahead of the Reserve Bank's board meeting on Tuesday, where the central bank is widely expected to raise rates for a sixth consecutive month. Macquarie was down 4.2% to $152.74, its lowest in more than a year. The utilities sector fell 1.6% on Friday and the monthly loss was its worst since at least March 2000 for the traditionally defensive sector.

Industrials were the biggest drag on the market on Friday, falling 3% as Transurban dropped 5.1%, Qantas declined 4.2% and Cochlear fell 6.6% to a three-month low of $194.54. It had released no news, but could be a victim of a currency trade as the US dollar showed signs it had peaked after some strong gains. As a company that sells Australian-made devices in North America, Cochlear's sales are mostly in USD, while its expenses are mostly in AUD.

From Shane Oliver, AMP: Share markets fell sharply again over the last week in response to continuing hawkish central bank comments and rising recession fears not helped by the UK crisis. For the week US shares fell 2.9% to a new bear market low, leaving them down 25% from their January high, Eurozone shares fell 1%, Japanese shares fell 4.5% and Chinese shares fell 1.3%. September lived up to its reputation as the weakest month of the year for shares.

Shares look oversold and could still have a near-term bounce. But with the US share market falling below its June low, they are at high risk of more downside in the short term as central banks remain hawkish, recession risks are high and rising, the conflict in Ukraine looks likely to escalate with Russia annexing occupied territory, we remain in a seasonally-weak period of the year for shares out to mid-October and earnings expectations are still being revised down. While investor confidence is very negative, we are still yet to see the sort of spike in put/call ratios or VIX that signals major bottoms.

The financial market turmoil in the UK – which saw a surge in bond yields and a plunge in the pound which was triggered by the UK Government’s fiscal stimulus – would normally have been a bit of a sideshow. But it impacted global markets because it engendered a sense of crisis. The Bank of England’s intervention to calm the gilt market (which was threatening financial problems for UK pension funds) by buying bonds (ie restarting QE) has helped calm things by showing that authorities will still intervene in a crisis. Unfortunately, the return to QE may just add to inflationary pressures if it is sustained for long.

***

As I stood in the long queue at a NSW South Coast café on the weekend, waiting patiently to buy four bacon and egg rolls at $14 each and four coffees at $4.50 each, I thought back on our recent Reader Survey including whether inflationary expectations are now embedded in prices. I was about to spend $74 (ouch! no tip!) on a simple takeaway breakfast, and so were the dozen people ahead of me. This was not a café in an expensive CBD location, it was in a side street in a country town. I part-own a restaurant at Robina on the Gold Coast and we have reluctantly increased prices three times this year, and turnover is at record levels. Around the corner from where I live, the 'traiteur' and 'boulangerie' (don't call it a bakery and deli) has queues around the corner for its $25 barbeque chickens - I just checked and they are now $28 - and $13 miche loaves. After the pandemic, we are out and about and spending.

Reserve Bank Governor Philip Lowe is right to be troubled, as he told a Parliamentary Committee on 16 September 2022:

"But the general inflation psychology appears to be shifting. It is easier for firms to put their prices up and the public is more accepting of this."

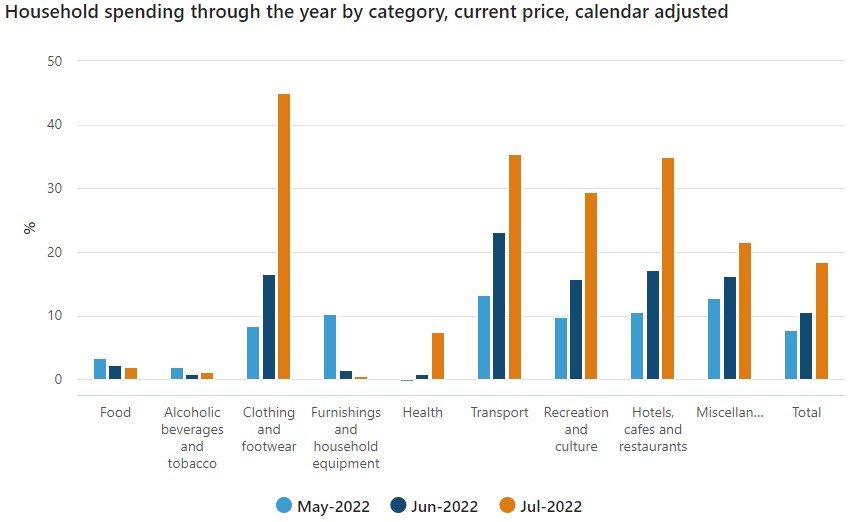

We are paying up despite some prices rising 30% or more. While all the inflation talk is about global energy prices, blocked supply chains and labour shortages, it is the public's ready acceptance of higher consumer goods prices that is a major factor. There's far more spending than complaining as the latest ABS data shows.

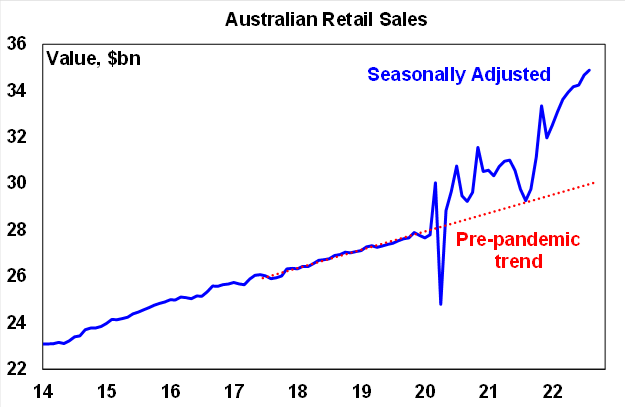

In numbers released on Wednesday this week by the ABS, August 2022 retail sales rose another 0.6% month-on-month and 19.2% compared with August 2021.

Source: AMP and ABS

Source: AMP and ABS

Acceptance of inflation, what Lowe calls our "mindset", is a "broken spell" says Ross Gittins, writing in The Sydney Morning Herald:

"Suddenly, some big price rises are announced, the dam bursts and everyone - from big business to corner milk bars - starts putting up their prices. The spell has broken, and I doubt we'll go back to the weird world we were in."

The old "weird world" was a reluctance of businesses to increase prices, and that's gone. Unfortunately, the consequence is that central banks will probably need to increase rates to shake consumers from their complacency. The cash futures rate in Australia is now about 4.3% for mid-2023 which would take variable rate mortgages to around 7%, an unaffordable level for many borrowers coming off 2% fixed rates.

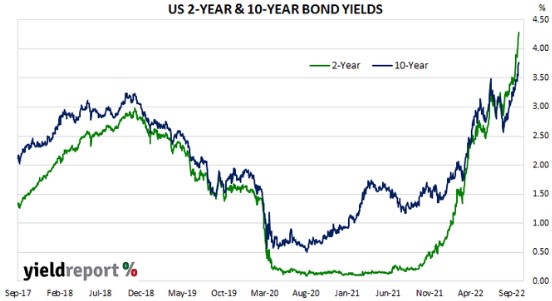

The dramatic increase in US bond yields as shown below, however, holds an underlying message, with the two-year rate above the 10-year. The market expects short-term rates to rise but long term, the central banks will bring inflation under some level of control.

The US 10-year Treasury yield briefly reached 4% during the week and closed firmer at 3.8% but it was only 3.2% at the start of September. How long it takes for the US Fed to reduce inflation, nobody knows. Here is a sobering chart quoted in Bloomberg from Bank of America, showing that since 1980, whenever inflation exceeds 5%, it has taken on average 10 years to bring it down to 2%, the bottom of the Reserve Bank desired range.

On a more optimistic note, Capital Economics in the US produces an index of product shortages. It suggests a fall in inflation is coming, based on reducing fuel prices, easing global supply constraints, cheaper travel costs and lower food prices.

Which gives an outlook of higher inflation in the short term, lower inflation in the medium term, and plenty of mortgage rate pain in the meantime.

Central banks created too much stimulus in 2021, and the Reserve Bank is rightly taking criticism for its rate predictions, which even the Governor calls "embarrassing". I realise it is easy for commentators to take pot shots at central bankers. Conceding I am falling for the same trap, I want to make one point where the Governor is ingenuous. He continues to justify the four-pronged stimulus programme - the bond purchase package (BPP), the Term Funding facility (TFF), forward guidance and low cash rates - as insurance against a calamity. He has repeated this point many times, and most recently on 16 September 2022, before the Standing Committee on Economics:

"At the RBA, we did this to provide a financial bridge to the day when the virus was contained and to provide some insurance against the possibility of very bad economic outcomes. As we sit here in Canberra today, it can be easy to forget how dire the outlook was in 2020 ... But in those dark days of the pandemic, the Reserve Bank Board judged that the bigger policy mistake would have been to do too little, rather than too much."

But note the time scale here: "how dire the outlook was in 2020" and the "dark days of the pandemic". No argument about 2020, but there was little attempt to rein in the stimulus until much later, into 2022.

Recently, another speech by the Deputy Governor, Michelle Bullock, on 21 September 2022, on the operations of the BPP, explained the timing:

"The BPP was introduced in November 2020 ... (it) was extended several times: first, a further $100 billion from April to September 2021 at a rate of $5 billion a week; then, from September to November 2021 at a rate of $4 billion a week; and finally, purchases of $4 billion a week until mid-February 2022, at which point the programme ceased. All up, the BPP resulted in the purchase of $281 billion of Australian, state and territory government bonds."

The Reserve Bank was still buying bonds to inject liquidity into the banking system as recently as February 2022, long after the drop in unemployment and rise in inflation, as shown in the charts below. The US CPI was up 6.8% in the year to November 2021 but cash rates were not increased in Australia until May 2022.

Philip Lowe remained steadfast in his resolve, saying as late as 2 November 2021:

"In our central scenario, underlying inflation reaches the midpoint of the 2 to 3% range only in late 2023. Having underlying inflation reach the midpoint of the target range for the first time in seven years does not, by itself, warrant an increase in the cash rate."

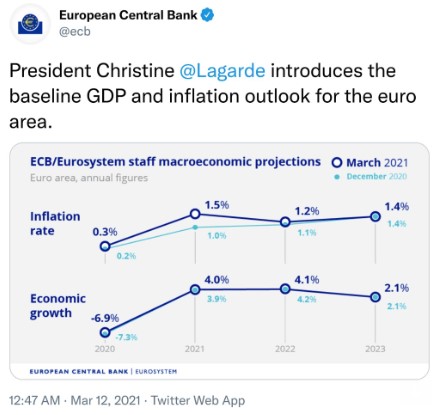

The Reserve Bank was part of a cohort, including the US Federal Reserve and the European Central Bank (ECB), that miscalculated the inflationary consequences of their actions. Here is the March 2021 ECB inflation forecasts out to 2023 issued by their army of analysts and quants. No inflation above 1.5% for four years.

In this week's edition ...

We develop some of these themes plus many more useful topics.

At a time when the new Government of UK Prime Minister Liz Truss has embarked on a massive experiment in giving A$100 billion of tax cuts to wealthy people, causing the pound to collapse and the IMF to question the 'trickle-down economics', the Bank of England is raising interest rates to slow the economy. Go figure, but then Australia has its own version with the Stage 3 tax cuts from 2024. Given many readers do not go back to read comments, we have selected 10 highlights from each of the seven questions to show what people are thinking about the challenges facing our Government.

Last week, Michelle Bullock gave the fullest explanation yet of the transition from liquidity stimulus to withdrawal, including why the bank bought $280 billion of bonds. It is timely for former actuary, Tony Dillon, to explain exactly how this worked and the extent to which it has pushed up inflation.

Robert Dinham of Fidelity reports on a survey of 1,500 people either in or approaching retirement on what makes them happy, and money is not top of the list. There are hints here on planning for retirement but also a few warnings.

Then two investment articles explaining important terms which many people might be unsure about, 'smart beta' and 'index rebalancing'. Arian Neiron of VanEck describes how and why smart beta funds are winning market flows, while Duncan Burns of Vanguard shows how index rebalancing works and why it's not an easy trade to get ahead of the professional rebalancers forced to buy and sell particular companies.

The current market selloff is not simply a correction to lower valuations but the market grappling with profound changes in inflation and perhaps stagflation. Guido Baltussen and colleagues at Robeco say periods of stagflation can be poor for equities but some investment factors may hold up better.

James Gard then reflects on investment lessons following the death of Queen Elizabeth II, that despite nobody knowing the total period they are investing for, a multi-decade plan should stand the test of time.

This week's White Paper is from GSFM specialist investment manager Man Group which presents eight things investors can no longer rely on, starting with the commonly known and ending with the more esoteric.

In two additional articles for the weekend from Morningstar. Annika Bradley says it's a good time for a financial health check as 2022 delivers a reminder of the risks in investing. Then Antje Schiffler gives a brief summary of the opening prices of the Porsche IPO, spun out of VW for a fast and curvy US$14 billion.

Graham Hand

Latest updates

PDF version of Firstlinks Newsletter

Morningstar Investment Conference for Individual Investors is on Thursday 13 October 2022. Register here for in-person or digital attendance. Use the code MICII_FL for an 80%+ discount for Firstlinks readers.

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website