The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

As industry heavyweights go, there aren't much larger than Rob Arnott, who chairs the US-based Research Affiliates, a US$132bn asset management behemoth. His views are widely respected and widely read.

Today, Arnott and colleague Omid Shakernia look at the history of inflation. The conclusions are sobering for those who believe inflation growth rates will fall quickly from here. History suggests once inflation peaks above 8%, as the US and much of Europe did this year, it takes between 6 and 20 years - with a median 10 years - to get the rate back to a politically acceptable 3%.

On the other side of the fence sits Peter Zeihan, a noted strategist. He's more in the deflationary camp. Zeihan thinks the Federal Reserve rate hikes will crunch demand from businesses and consumers in the US. But their greatest impact will be on other countries that will be starved of capital when they most need it. He's particularly concerned for Germany.

One factor that will influence future inflation is demographics. This week, the world reached a milestone with the global population officially hitting 8 billion. Australia has played its small part. New figures from the Australian Bureau of Statistics (ABS) show life expectancy in Australia actually increased during the COVID-19 pandemic. From 2019-2021, life expectancy for both men and women lifted by 0.1 years to 81.3 and 85.4 years respectively, compared to the 2018-2020 period.

Australia was one of the few countries that showed increases in life expectancy during the pandemic and has the third highest life expectancy in the world, according to United Nations' estimates.

Life expectancy in Australia is almost 12 years longer for men, and 11 years longer for women, compared to the world average.

Broken down by state, the ACT has the highest life expectancy, while the Northern Territory has the lowest. Victoria was the only state where life expectancy decreased during the pandemic.

It might not be the whole story

The ABS figures raise some questions: how did the life expectancy go up? Was it because of the lockdowns? What about vaccines? Did Australia's distance from the rest of the world play a part? Were masks helpful? Did the closure of schools have an impact? The ABS doesn't answer these questions, as it's not really its expertise.

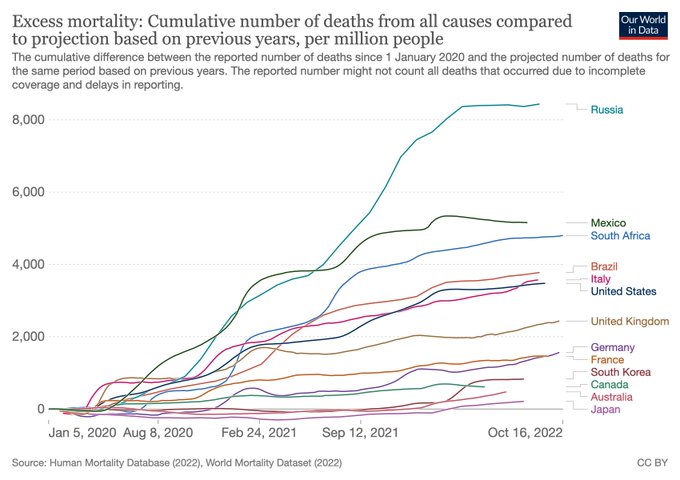

Another question: why isn't 2022 included? After all, Covid is still with us this year, even if less virulent. Figures on excess mortality - the cumulative number of deaths compared to previous years - suggest Australia has had an uptick in 2022. This might result in marginally lower life expectancy figures when the ABS reports next.

Whichever figures are used, and there are all kinds of methodologies used to measure the pandemic's impact on human life, Australia looks to have come out the worst of COVID-19 in decent shape compared to other nations. We've been the lucky country once again.

Fear and loathing

I was in two minds about presenting the figures above given the virus is a lightning rod for many people. I'm not sure about you, but I find talking about the pandemic with almost anyone a difficult exercise these days. It's almost as if there's a collective silence in Australia about what we went through. It's understandable: people went through a lot.

Fear and uncertainty were pervasive during the pandemic. Interestingly enough, both of those things form the basis for many types of anxiety and depression. Perhaps the heightened anxiety from that period hasn't full dissipated, which explains some of the collective silence around the issue today.

Isn't now though the time to look back and see what Australia got right during the pandemic, what it got wrong and what it can learn for the next crisis, pandemic or otherwise?

What can we learn for next time?

I get that most people want to forget about the pandemic. What I don't get is why governments and others in authority aren't rigorously analysing Australia's response to COVID-19. Largely, there's been radio silence from our politicians and the public service (perhaps reports from the latter may not have seen the light of day). We had a royal commission into the banking industry, why not one into our COVID-19 response?

One of the few reports into the issue that I've seen came from an independent panel, funded by philanthropic foundations, and led by former senior public servant, Peter Shergold. The report found government missteps and was especially critical of the closure of schools, arguing the costs of that move outweighed the benefits.

In contrast to Australia, the UK is up to its third investigation into the pandemic. Recently, it announced an inquiry into the impact of the pandemic on healthcare in the country.

Inquiry Chair, Baroness Heather Hallett, said:

"The pandemic had an unprecedented impact on health systems across the UK. The Inquiry will investigate and analyse the healthcare decisions made during the pandemic, the reasons for them and their impact, so that lessons can be learned and recommendations made for the future."

Here's to hoping that the ABS statistics, and others like it, can be used one day as part of a broad-ranging investigation into how Australia can best prepare for the next crisis that comes our way. It's time to put politics aside and have a sensible discussion on the issue.

Also in this week's edition ...

We review a book called What to do when I get stupid, which suggests our financial abilities peak at the age of 53. Given this, it's wise for us to take financial decision-making out of our hands while we still have the mental capacity to do so. Planning is critical to guarantee we'll have enough income coming in each month for the rest of our lives.

High Dive gives us his bank reporting season scorecard. With Covid largely behind us, low unemployment and minimal bad debts, bank results were mostly positive. He argues for a benign loan loss cycle in coming years and for bank share prices to be re-rated higher.

Shane Woldendorp of Orbis Investments has the audacity to suggest that investors don't forecast well (c'mon, Shane). Rather than that being bad news though, he believes it can create opportunities for those investors that are prepared to think differently.

As markets whipsaw, the risk that volatility might undermine investors’ ability to achieve their return objectives looms large. Roy Maslen asks, what can investors do to mitigate that risk and avoid falling short of their goals?

For international investors, it's not just market volatility that needs to be considered, but currency volatility too. Alice Shen runs the numbers of how much currency movements impact the performance of international portfolios and finds that they make minimal difference in the long-term. The short-term is a different story, however.

In the weekend update by Morningstar, Christine St Anne suggests that while Australian retailers confront a challenged outlook, one business is expected to reignite its sales growth, and Jon Mills explains why Australian miners should benefit from changes in the Chinese property sector.

This week's White Paper comes from Capital Group which recently surveyed over 1,100 global professionals - including advisors, consultants and intermediaries - to get their latest views on ESG.

***

Weekend market update

On Friday in the US, stocks fluttered higher to wrap up a low voltage week that saw the S&P 500 finish virtually unchanged. US Treasurys came under modest pressure with two-year yields rising eight basis points to 4.51% while the long bond settled at 3.92%, below the 3.93% on offer for one-month bills. WTI continued its retreat, settling at $80 per barrel, gold pulled back to $1,751 an ounce and the VIX slipped to 23.

From AAP Netdesk: Australian shares held on to a slender lead by close on Friday despite a cautious mood among investors over prospects of continued monetary tightening that could drag major economies into a recession. The benchmark S&P/ASX200 index closed 16.1 points, or 0.23% higher, at 7151.8 in Friday's session. The broader All Ordinaries ended up 15.7 points, or 0.21%, at 7354.7. But the benchmark was down 0.1% for the week, its first loss after three straight weeks of gains.

Local traders on Friday took their cue from choppy trading on Wall Street after hawkish remarks from US Federal Reserve officials about interest rates fed nagging concerns over the looming slowdown in global growth.

The trend in the local market reflected the mixed mood, with interest-rate sensitive financial stocks performing well but the gains offset by losses in energy and mining.

Each of the Big four banks closed in positive territory with investors seemingly reconciled to higher rates in coming months that will help the lenders expand their margins. Insurers IAG, QBE and Suncorp also saw robust trading, climbing between 1-2%.

Energy and mining shares were subdued, as oil prices are on track for a steep weekly decline over concerns about weakening Chinese demand and further US interest rate hikes. Woodside shares ended nearly 1.0% lower while Santos and Whitehaven Coal edged higher to close in positive territory.

Those same growth concerns weighed over mining stocks, with lithium and gold bearing most of the brunt. Shares in BHP ended 0.3% higher at $43.94 as investors cheered its revised $9.6 billion takeover offer for OZ Minerals that could give the world's biggest miner more exposure to battery minerals and add to its pipeline of growth options. OZ shares also jumped 4% to $27.34 after coming out of a trading halt but are still trading below the new offer price.

From Shane Oliver, AMP: US shares pulled back a bit after their post US CPI surge, with various Fed officials noting that there is still more work to do on inflation. This left US shares down 0.7% for the week and Japanese shares down 1.3%, but European shares rose 0.8% and Chinese shares rose 0.4%. Bond yields were little changed in the US and Japan but fell in Europe and Australia. Oil and metal prices fell sharply on growth concerns but the iron ore price rose. The $A fell back a bit as the $US rose but is still around $US0.67.

While share markets ran a bit ahead of themselves after the lower-than-expected October US CPI and we could see more volatility in the short term, there have been more positive developments over the past week:

- US producer price and import price inflation for October slowed more than expected adding to signs that we have seen peak inflation in the US.

- While numerous Fed speakers over the last week indicated the Fed has more work to do as inflation remains too high, most noted the importance of lags in the way monetary policy impacts and indicated an openness to slowing the pace of rate hikes. The Fed seems to be moving to get off the hamster wheel of 0.75% hikes as monetary policy is now tight and there are signs of slowing growth & easing inflation pressures. This is a positive sign for investment markets.

- Of course, various countries inflation rates (including in the UK with 11.1% inflation in October, and in Australia) are lagging the US, central banks are still hawkish, the risk of a hard landing globally and in Australia remains high (with US yield curves now more firmly inverted) and geopolitical risks remain high so the ride for shares is likely to remain choppy and new short-term lows can’t be ruled out. However, increasing evidence of a peak in US inflation – which led inflation in other countries including Australia - and less hawkish central banks help provide confidence that shares will be higher on a 12-month horizon.

James Gruber

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website