The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

“There are these two young fish swimming along and they happen to meet an older fish swimming the other way, who nods at them and says, “Morning, boys. How’s the water?”

And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, “What the hell is water?””

The late, great US novelist, David Foster Wallace, included this parable in a speech entitled, ‘This is water’ at a US college commencement address in 2005. It went viral as much for its poetry as its brutal honesty.

The point of the parable is that the most important and obvious realities are often the hardest ones to see.

Markets are missing the obvious

There’s a parallel to financial markets today as I see an obvious reality that the US tech sector is back in bubble territory again, yet few others are talking about it.

It’s odd how this has come about. Last year, everyone seemed to have recognized that the prices of many assets had become ludicrous and that their subsequent pummelling was long overdue. However, a number of these same assets have come roaring back to life this year and there’s been barely a peep.

Bitcoin hasn’t not nearly got the same attention and it’s rocketed 135% in 2023. Tech stocks in the US aren’t far behind. Tech bellwether, the NASDAQ, is up a blistering 45% year-to-date. Of the S&P 500, seven stocks aka ‘The Magnificent Seven’ have risen 68% this year, while the remaining 493 stocks in the index are just 2.5% higher.

Here are ‘The Magnificent Seven’ total returns this year:

- Nvidia (NVDA) +230%

- Microsoft (MSFT) +55%

- Apple (AAPL) +44%

- Meta (META) +171%

- Alphabet (GOOGL) +50%

- Amazon (AMZN) +70%

- Tesla (TSLA) +74%

At first glance, what’s staggering is how much the prices of these mega-cap companies have moved in one year. Apple and Microsoft are worth US$2.9 trillion and US2.7 trillion, and they’re up 44% and 55% respectively this year. For Microsoft, the market believes that the company is worth around US$950 billion more now than it was at the start of the year. Even with the hype around artificial intelligence, business values moving around this much are difficult to fathom.

Though, perhaps not. Let’s look at the trailing price-to-earnings (PER) multiples of the seven stocks, based on Morningstar estimates:

- Nvidia 117x

- Microsoft 36x

- Apple 30x

- Meta 29x

- Alphabet 25x

- Amazon 75x

- Tesla 72x

- Simple average 55x

The simple average multiple of 55x compares to the S&P 500’s 24x, a premium of 129%.

Of course, some of the stocks above are set for stellar growth over the next few years. Nvidia, riding the AI boom, is a standout here.

Yet other stocks with high multiples attached are struggling to grow. Apple is one. Another is Tesla where Morningstar expects earnings to shrink this year as competition heats up in the electric vehicle space. And Alphabet faces a serious structural threat to its dominant search engine business from AI.

Have earnings driven stellar tech returns?

I thought it would be a worthwhile exercise to look at how much earnings growth has contributed to the rise in share prices for some of these stocks. For instance, Microsoft’s stock has risen by 861% over the past decade. That’s excluding dividends. Including those, and the stock has compounded at 26% per annum. A stellar performance.

How much of that performance was driven by earnings? Well, earnings per share over that period increased at a compound annual growth rate (CAGR) of 14% on revenue which grew at an 11% CAGR clip. In simple terms, earnings accounted for a little over 50% of the Microsoft’s price rise over the 10 years. The remaining 50% or so came from expansion in the multiple attached to the stock.

Back in 2013, Microsoft was considered a stodgy dinosaur and it was valued as such, bottoming with a trailing PER of 13x. How times have changed.

Source: Morningstar

Apple is another case study. Over the past 10 years, the stock is up 896%. Including dividends, it’s compounded at 26% per annum, the same as Microsoft.

Earnings per share over that period have compounded at 15.8% per annum. A big chunk of that return has come from share buybacks as operating earnings were up only 8.8% a year over the decade.

Earnings accounted for around 61% of the total return over 10 years, with the remainder attributable to an increase in the earnings multiple applied to the stock.

Source: Morningstar

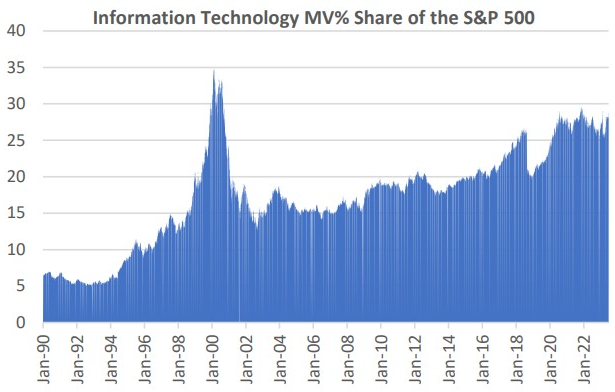

S&P 500 tech weighting also flashes warning sign

It’s not only the prices of large cap tech stocks that should concern investors. IT’s weighting in the S&P 500 provides further evidence of irrational exuberance in the sector.

On the face of it, the tech sector’s weighting of 28% in the S&P 500 looks high.

Source: Bloomberg

But that doesn’t tell the full story. There are companies that should be part of the tech sector but aren’t. For example, Amazon and Tesla are classified as consumer discretionary when they’re arguably not. Amazon’s cloud business generates 107% of operating profits, which should make it an IT company. In case you’re wondering, Amazon’s online retail business doesn’t make any money (those deliveries are loss makers, after all). Netflix, Alphabet, and Meta are classified as communication companies when they clearly shouldn’t be.

If you include these companies in the tech sector, the true weighting of IT in the S&P 500 is closer to 41%, which is well above the peak of 35% reached in 2000.

Source: Bloomberg

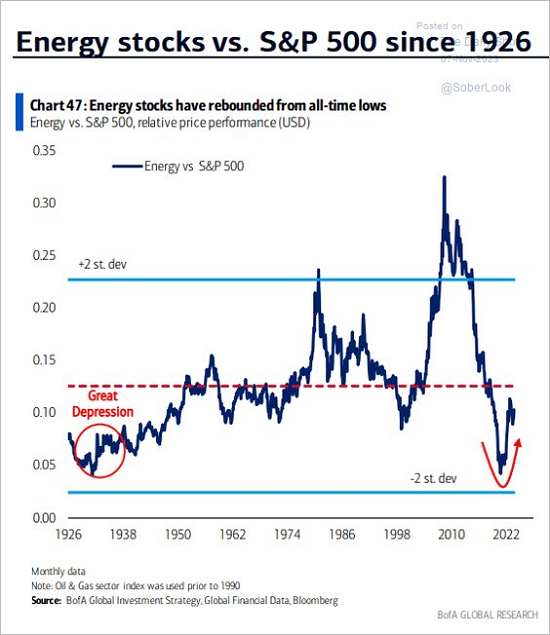

Crowding into tech has created opportunities in other sectors

Like in 2000, an extraordinary amount of money has found its way into the tech sector at the expense of the rest of the market, leaving some sectors looking cheap. And like back then, these sectors may perform well even if tech stocks pull back hard.

The energy sector appears the standout in this regard. In the US, the sector is down 2% versus the S&P 500’s 18% gain this year. And energy looks inexpensive on almost every valuation metric.

Energy stocks have the potential to be what tobacco stocks were over the past century. The tobacco sector in the US outperformed all other sectors over the past century. On the face of it, this seems strange. After all, tobacco has been a dying industry for decades. That’s only been part of the story, though.

Increased regulations, tax hikes, and numerous lawsuits have driven companies out of the sector, leaving only a few large players left. With this consolidation has come immense pricing power for those companies which remain. Increased tobacco pricing has been able to offset reduced product demand.

Throw in almost perpetually low valuations for the tobacco sector providing opportunities to buy back stock at cheap prices, and that’s led to incredible long-term returns for shareholders.

The energy sector has similar dynamics to the tobacco sector. Oil and coal demand will likely decline in coming decades. That’s led to large cuts in investment, which is reducing supply. The question is whether supply cuts will outrun demand cuts, and I suspect they will.

There’s also pressure on investors to not invest in oil and coal stocks. Many of these investors are essentially forced sellers of these stocks. That’s making many shares in the sector cheap. Yes, they could be forever cheap, though like tobacco, that paves the way for stock buybacks at inexpensive prices.

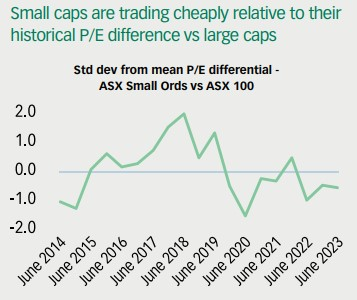

The other opportunity may be in small caps. In the US, small caps are at their lowest level compared to large caps since December 2000.

It’s similar in Australia.

If the US tech sector does stumble at some stage, these types of opportunities may finally get some love from investors.

James Gruber

In this week's edition...

Charlie Munger is best known as Warren Buffett’s sidekick though he’s a formidable investor and thinker in his own right. In a rare interview, Munger sheds light on what makes Buffett a great investor, why Costco is the world’s best retailer, and the reasons behind Berkshire Hathaway’s investments in Apple, Japan, and China. James Gruber reports.

Magellan Financial Group has been under the pump of late with investors exiting funds and a management reshuffle resulting in further falls in the share price. That’s made it potential takeover fodder. East 72’s Andrew Brown says it would be wrong to sell the company now and there’s still significant value outside of the funds management business, especially with Magellan's stake in investment bank, Barrenjoey.

Former RBA Governor Ian Macfarlane says Australia’s economy has held up incredibly well given the sharp spike in interest rates. Yet he thinks that economic strength plus high inflation mean rates are more likely to go higher than lower in 2024.

Meg Heffron is back, this time to address the issue of whether binding death benefit nominations make sense for SMSFs. She describes her own journey in deciding on the issue after weighing up the pros and cons.

Novak Djokovic is widely regarded as the greatest tennis player of all time and the secret to his success isn’t so much from the winners he hits, but from how few mistakes he makes compared to his opponents. Investors Mutual’s Daniel Moore thinks it’s like investing - that avoiding losers is as important as making gains. And he goes through how to best protect the downside on investments.

In the Wealth of Experience podcast this week, special guest Matt Williams from Airlie Funds Management talks through recent investments in ‘fallen angels’ such ResMed and Orora. Our other special guest, Joe Cavatoni from the World Gold Council, explains the key drivers behind gold prices and the rise of digital gold. Meanwhile, Morningstar’s Peter Warnes suggests investors are complacent and possibly ‘in fairyland’ given current market risks.

Morningstar’s Steven Le investigates the performance of passive and active funds in A-REITs and G-REITs. He finds that though passive outperforms, it’s not by much, especially in A-REITs. He runs through his best picks for both active and passive REIT funds.

Two extra articles from Morningstar for the weekend. Shaun Ler sees opportunities in beaten down asset managers, while Susan Dziubinski looks at Warren Buffett's latest buys and sells.

Finally, in this week's whitepaper, Epoch, a GSFM affilate, looks at what AI means for work, the economy, and markets.

***

Weekend market update

On Friday in the US, stocks inched higher, finishing with a third straight week of gains for all three major indexes. Markets were buoyed this week by cooling inflation and bets that the US Federal Reserve may achieve a 'soft landing' for the economy. The S&P 500 and Nasdaq both finished up 0.2%. Brent crude rebounded, ending 4.3% higher at US$80.73 a barrel. Spot gold was relatively flat and the VIX dropped 3.9%.

From AAP Netdesk:

The local share market on Friday closed slightly lower amid a big drop in oil prices overnight, but gained for the week and finished comfortably above the make-or-break 7,000 level. The benchmark S&P/ASX200 index on Friday finished nine points lower at 7,049.4, a drop of 0.13%, while the broader All Ordinaries was down 8.5 points, or 0.12%, to 7,261.0. For the week the ASX200 gained 1.05%, after rising 2.2 per cent across Tuesday and Wednesday. Last week it was flat.

The ASX's energy sector was the worst performing on Friday, dropping 1.6% as Woodside fell 2.3% to an eight-month low of $31.40.

The Big Four banks were mostly lower, with ANZ down 0.5% to $24.07, Westpac dipping 0.2% to $21.10 and NAB edging 0.1% lower at $27.73. CBA was the outlier, adding 0.2% to $102.47.

In the heavyweight mining sector, Rio Tinto added 0.4% to $125.62, while BHP and Fortescue had both crept 0.1% higher to $46.61 and $25.22, respectively.

Goldminers enjoyed stronger gains as the price of the precious metal rose to a week-and-a-half high of $US1,984 an ounce. Newmont climbed 1.2%, Evolution rose 4.2% higher and Northern Star added 3.9%.

Elsewhere, Accent Group sunk 8.3% to a two-week low of $1.935 as chairman David Gordon told the footwear retailer's annual general meeting that like-for-like sales were down 2% for the first 19 weeks of 2023/24.

Lendlease gained 2.2% to $6.85 as the construction and real estate company's chairman and CEO told shareholders that they shared their disappointment after Lendlease's $232 million loss last financial year.

Looking forward, next week minutes from both the Reserve Bank and Federal Reserve will be released, providing a clue on both central banks' thoughts on the direction of interest rates.

From Shane Oliver, AMP:

Global share markets mostly rose again over the last week helped in particular by good US news on inflation adding to confidence that interest rates have peaked. For the week US shares rose 2.2%, Eurozone shares gained 3.3% and Japanese shares rose 3.1%. Chinese shares fell 0.5% with ongoing concerns about the Chinese property market. The continuing global rebound also helped push up Australian shares which rose 1% led by IT, property, material and health stocks. 10-year bond yields fell by 15-20 basis points on optimism major central banks have finished raising rates. Oil prices fell with rising inventories. Metal and iron ore prices and the $A rose as the $US fell.

More good news. The past week has seen more good news that has helped push shares higher and bond yields lower: inflation has continued to surprise on the downside - this time from the US and UK - supporting the view that rates have peaked; US economic data has been consistent with a soft landing; US profit results continue to surprise on the upside making it the best reporting season in two years; policy uncertainty diminished a bit with the US and China looking to ease tensions and the US Congress averting a shutdown with temporary funding; the war in Israel has not widened to include major oil producers and oil prices are well below their level of prior to Hamas’ attacks; and in Australia wages and jobs data came in marginally stronger but roughly in line with RBA forecasts suggesting for now at least that a rate hike in December is unlikely. All of this is combining with a positive seasonal pattern that sees strength from around now until around May in the US (or July in Australia). And so far, the breadth of the rally in shares has been broad based which is positive from a technical perspective.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

Quarterly ETFInvestor (ETF Market Data) from Morningstar

Monthly Bond and Hybrid updates from ASX

Monthly Investment Products update from ASX

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website