Weekend market update: On Friday, both the S&P500 and NASDAQ in the US posted modest gains of around 0.4%, and that latest bellwether (??) stock, GameStop, finished at $63.77, down 80% for the week. But it was a strong five days elsewhere, with the broad US market up 4.7% to a record high and Europe adding 4.6%. The S&P/ASX200 index closed up 1.1% on Friday taking the gains for the week to 3.5% led by the banks pushed higher by the Reserve Bank announcement that it would buy a further $100 billion in government bonds.

***

Regardless of the many theories floating about on the impact of the extraordinary events around GameStop (GME) trading, there is one market fact: you never know who is on the other side of your trade. The Reddit tribe is portraying a victory against a few hedge funds as the little guy gaining revenge over Wall Street, but many 'suits' are enjoying the ride.

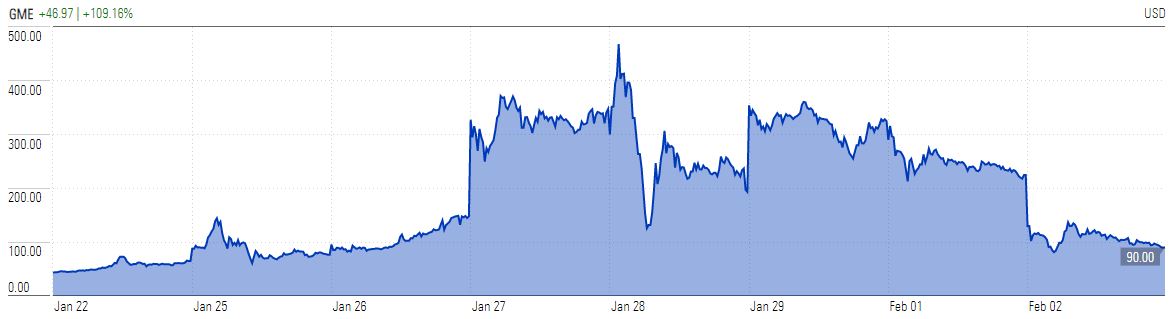

It's conjecture whether there are enough individuals with 'diamond hands' to hold out against hedge funds and other professionals in concerted attacks. In the parlance of subreddit group r/wallstreetbets, diamond hands are where investors are hard and committed enough to sustain a position despite the potential risks and losses. The opposite are 'paper hands', where holders are weaker and fold early. GameStop shares have already fallen from US$500 to below US$100. The memes come out as the Reddit group implores members to be diamonds.

Regardless, many large players on Wall Street are winners anyway. For example, Fidelity and BlackRock each own more than 10% of GameStop shares. The owners of Reddit and Robinhood (which undertook a multi-billion dollar equity raising) have seen the value of their businesses rise as millions of new users subscribe to their services. The r/wallstreetbets group had 2.8 million members at the start of this saga and it is now close to 10 million.

Many fund managers, both longs and shorts, jumped aboard the trading when GameStop pushed towards US$500 (but the share price closed the week at US$64). The likes of Goldman Sachs are mandated to manage a public offer of Robinhood with spectacular fees attached. While we can categorise the Reddit members as a sub-group of renegades fighting the system, and some hedge funds were indeed caught out, Wall Street in general is far from defeated.

Reading the Reddit posts, a lot of individual users seem to think this is a game, with people saying GME is going to US$1,000. Apparently, holding the stock of a struggling retailer is a way to finance their education or buy their parents a car. Well, investing is not that easy and this was always going to end badly for many.

The popular view that Robinhood is democratising investing by making trading free overlooks the fact that someone has to pay for it. Robinhood makes most of its revenue on 'payment for order flow' (PFOF) where trades are directed to market makers not immediately to exchanges. These professional traders make money from knowing the order flow, so the Robinhood users are helping the very people on Wall Street they think they are punishing. Citadel Securities, Wolverine Securities and Two Sigma hedge funds exploit the retail trades while Reddit users jump on social media claiming they just fooled the big guys.

In fact, many fund managers on Wall Street don't even like hedge funds, especially those who have been victims of short selling attacks on shares they own. While there's a strong case that selling a stock that is overvalued is as legitimate a way to make money as buying an undervalued stock, some tactics used by hedge funds are less defensible, such as when they write reports specifically to drive prices down. Hedge funds certainly have their enemies, and there's little sympathy evident in our interview today with a prominent CIO.

And finally, many pension funds globally, including super funds in Australia, are themselves investors in hedge funds. Our own Future Fund is a major allocator. It is possible that the Reddit conspirators caused losses in hedge funds managing the retirement savings of their parents.

So yes, it was a clever attack at a vulnerable part of the market, where closing short positions involved buying shares which exacerbated the price rise, and forced index funds to buy shares. But the media characterising it as the revenge of the 99% on the 1% or akin to 'Occupy Wall Street' are not thinking about who is on the other side of the trade. And let's face it, the motivation of most Reddit users is to make money, not campaign for equality. They are not parents struggling to put food on the table and pay the rent, and cheap access to call options is not what the 99% was crusading for.

The Peridot Capital Management newsletter quotes another example of a stock targetted by the Reddit army, AMC, a struggling movie theatre chain, and how the rise in share price benefitted a large holder:

"Silver Lake Partners, a large, well known private equity firm held $600 million of AMC convertible debt due in 2024, which was in a dicey spot with the convert price well into the double digits. Well, they acted fast last week, converting the debt into 44 million shares of equity as the stock surged into the high teens, and selling every single share the same day the stock peaked. That’s right, they go from being one of the largest AMC worrying creditors to being completely out at nice profit in a matter of days. Note to Redditers: that’s how you ring the register!"

Yes, there are legitimate comparisons to the disenfranchised who voted for Donald Trump, as nobody was punished for the excesses of the GFC and central bank liquidity has pushed the stockmarket to record levels while others suffer from slow economic growth and unemployment. Those with assets have increased their wealth while wages have stagnated. It is inequitable. Cheap money, free trading apps and social media have opened the door for a coordinated attack which has surprised professionals, and many are enjoying seeing parts of Wall Street suffer.

Either way, let's record this moment in financial history where the shares in a struggling video retailer rose from US$3 to over US$500 in a year without any improvement in the fundamentals of the company. Here's a screenshot from Robinhood on five-day GameStop prices.

In other articles in this packed edition ...

Active fund managers are looking for the long-term winners from the pandemic, especially if they are marked down now. In this exclusive interview, the CIO of MFS Investment Management, Ted Maloney, asks whether it's possible for 10 years growth to be compressed into one.

There has been an extraordinary turnaround in six months in economists' expectations on residential property prices, and Tim Lawless charts the change and show prices reaching new records.

For example, NAB's Chief Economist, Alan Oster, said in the middle of 2020:

“We’re basically expecting peak-to-trough to fall somewhere about 15%. Think about another year of 1% falls a month.”

Then this week, he told Domain he expected an increase of 10% over the year in most capitals, with Sydney at 7% and Melbourne 7.5%.

Many retirees are finding the income they need when they are no longer working is elusive without taking on extra market risk. Richard Dinham's survey show much more than the pandemic is worrying investors pre- and post-retirement.

It seems everyone has a view on the merits on WFH versus returning to the office, but as Steve Bennett explains, employers want to see their staff in the office for a range of reasons from culture to training to building team morale. Post-COVID, a balance will be needed but employees should not expect WFH to dominate as it did in 2020.

Investing markets are offering stretched equity values but negligible fixed interest returns, and Shane Oliver highlights seven charts worth watching in 2021 to navigate these difficult waters.

Thomas Rice manages an innovation fund but he is fascinated by the amazing ways the world in changing, as tech drives AI, health, mobility and almost everything we do in life. Here is his update of latest trends.

(For the weekend edition, we have updated the editorial on GameStop in this article).

This week's White Paper is timely as investors struggle for yield. AMP Capital has provided an outlook for real assets, such as infrastructure and real estate, both listed and unlisted. Worth considering as an alternative to equities with hopefully better defensive characteristics.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website