The Australian economy contracted by -0.3% in the March 2020 quarter and the June quarter will see a much larger fall. Australia is now in its first economic recession since Paul Keating’s ‘recession we had to have’ in 1990-1991. Perhaps surprisingly, economic recessions have generally been good for share prices in Australia, and the stock market rose on the news of the March 2020 number.

There is widespread acceptance that the government-ordered shutdowns of activities created instant recessions and unemployment for tens of millions of workers around the world. The debate is now about how deep and how long the recessions or depressions will be.

Recession versus depression

There has not been an economic ‘depression’ since the 1930s. It was caused by collapses in commodities prices and incomes, excessive levels of debt, rising protectionism and bursting of speculative bubbles. The Australian economy contracted by -19% and lasted two years, and the US economy contracted by -33% and lasted three years. In the 1890s depression, the Australian economy contracted by -13% and lasted four years, and US economy contracted by -8% and lasted two years.

By comparison, the 2008-2009 GFC was very mild. The US economy contracted by -4% and lasted six quarters, while Australia’s economy contracted by only -0.5% and lasted for just one quarter. Yet share markets fell by more than 50%. The next most recent ‘big recession’ was in 1990-1991 which was also mild by comparison with depressions.

It is notable that the current recession may have been triggered by an unforeseeable set of events (government shutdowns to contain a virus spread) but it is also accompanied by similar underlying pre-conditions as previous deep depressions, and as well as several mere ‘recessions’. The common culprits are familiar:

- collapses in commodities prices and incomes

- contractions in credit availability

- excessive levels of debt

- rising protectionism

- potentially, the bursting of the QE-inspired asset price bubbles.

Governments have learned how to spend

This time is different. The GFC taught governments how to deficit spend and it taught central banks how to create artificial money to buy bonds from governments, companies, mortgage borrowers, car borrowers and even credit card borrowers. These ultra-loose monetary and fiscal policies are now embraced by left and right governments almost everywhere, even in Germany.

The problem is that, even after the hasty unleashing of trillions of dollars in government and central bank stimulus and support measures this time, economists are still talking about economic contractions in the order of 5-10%. This is several times worse than the GFC and the other mild contractions, and unemployment levels are heading for 20%.

It seems we are still facing contractions in overall economic activity and unemployment levels in the same league as the big depressions of the 1930s and 1890s. What the stimulus might do this time is shorten the contractions, but they are unlikely to lessen or shorten the unemployment pain.

All this talk of economic ‘recessions’ and ‘depressions’ can be depressing, but that is where the good news starts for investors.

The fear is that, since the economic contractions are only just starting now and may last for several quarters, then perhaps the February-March 2020 share market fall may not be the end of the overall share sell-off.

The good news is that while share market crashes and economic recessions and depressions are in most cases related, share prices generally fall before economic contractions start and then start rebounding while economies are still contracting.

Australian share prices in recessions and depressions

Share price falls generally precede economic recessions and share prices in Australia have actually risen during the vast majority of economic recessions. Here are the facts.

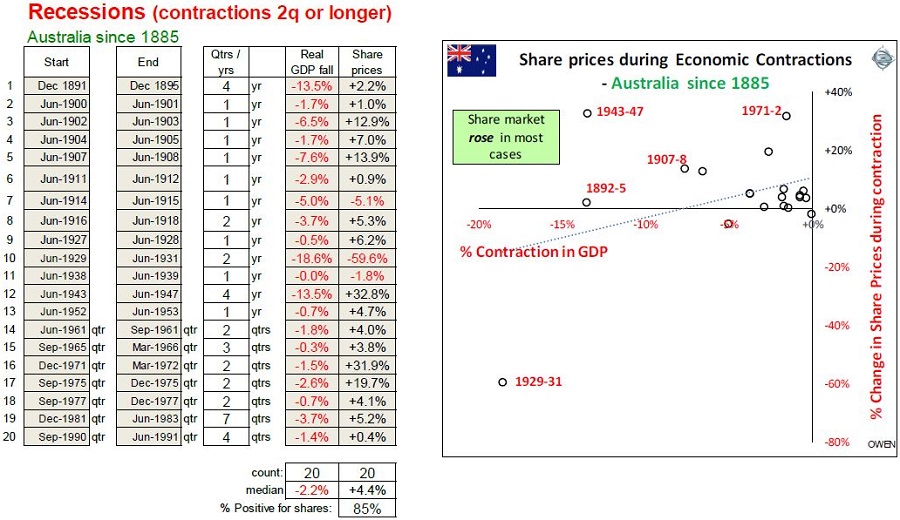

Australia has experienced 20 economic ‘recessions’ (including two ‘depressions’) since the 1880s. These are summarised below. The table sets out the dates and length of each economic contraction and what share prices did in during each period of economic contraction. The chart on the right shows the inverse (negative) relationship between economic growth and share prices.

In summary:

- Share prices rose during 17 (85%) of the 20 economic recessions in Australia in the past 150 years.

- Share prices rose during each of Australia’s last nine recessions.

- The last time a recession was accompanied by falling share prices was the 1938-39 recession (share prices fell by only -1.8%).

- Share prices rose in each of the recent well-known recent recessions – including: Keating’s 1990-91 ‘recession we had to have’, the long 1981-3 recession, the 1975 post-Whitlam dismissal recession, and the 1971-72 oil crisis recession.

The hard part for investors

Although shares prices often fell heavily at around the same time as the economic crises, in almost all cases, the share market fell before the economic contractions and then started to rebound during the contractions. As a result, most our big share market crashes were not actually during economic ‘recessions’ – not the 55% share crash in the GFC, the 50% crash in 1987, the 60% crash in 1973-4, the 39% mining crash in 1970-71, the 40% fall in 1981-82, nor most of the other big falls.

Conversely, some of the best years for Australian shares have been when the economy was contracting or still weak (albeit after big share falls earlier). For example: 1983, which was the best year ever for Australian shares (up +60%), during the 1981-1983 recession.

The hard part for investors is having the courage to buy shares when the economy is still contracting and the media headlines are full of doom and gloom about a cascade of corporate collapses, bankruptcies, and rising unemployment.

And, of course, deciding if this time really is different.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual.