Friday next week, 1 July 2022, is the 30th anniversary of the introduction of the Superannuation Guarantee (SG), initially set at 3%, which lifted forever the importance of Australia's retirement savings. It required employers to make contributions into a super fund for their employees. At the time, the total super system held about $148 billion from prior schemes, and the SG rate rose to 9% within a decade. On the 30th anniversary, SG rises to 10.5% on its way to 12% by 2025.

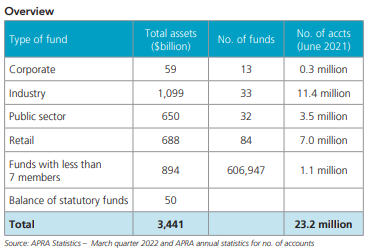

As the table shows, super balances have reached $3.4 trillion, with industry funds holding the largest segment at about $1.1 trillion. Next are the 1.1 million SMSF trustees with about $900 billion.

Let's mark the 30th anniversary of SG by taking a closer look at what SMSF trustees are doing.

Former Prime Minister and Treasurer, Paul Keating, wrote in an article in 2013:

"When we laid the foundations for the current superannuation system in the 1991 Budget, I never expected Self Managed Super Funds (SMSFs) to become the largest segment of super. They were almost an afterthought added to the legislation as a replacement for defined benefit schemes."

A surge in new SMSF establishments

SMSFs have come a long way, although it has not been straight line. New establishments peaked at 43,000 in 2012 and seemed to be falling steadily each year to reach a nadir in 2019 of barely 21,000. However, in the last couple of years, some fascinating changes suggest a resurgence in SMSFs.

Not only are fewer SMSFs being wound up (10,000 in 2021 versus 23,000 in 2017), but a cohort of younger and more engaged trustees are choosing SMSFs with confidence in their own investment decisions.

The Vanguard/Investment Trends 2022 SMSF Report was conducted between March and April 2022. The main reason for establishing an SMSF remains constant – the desire for more control over investments – but the average age at establishment has fallen from 51 years between 2006 and 2014 to 46 years between 2020 and 2022.

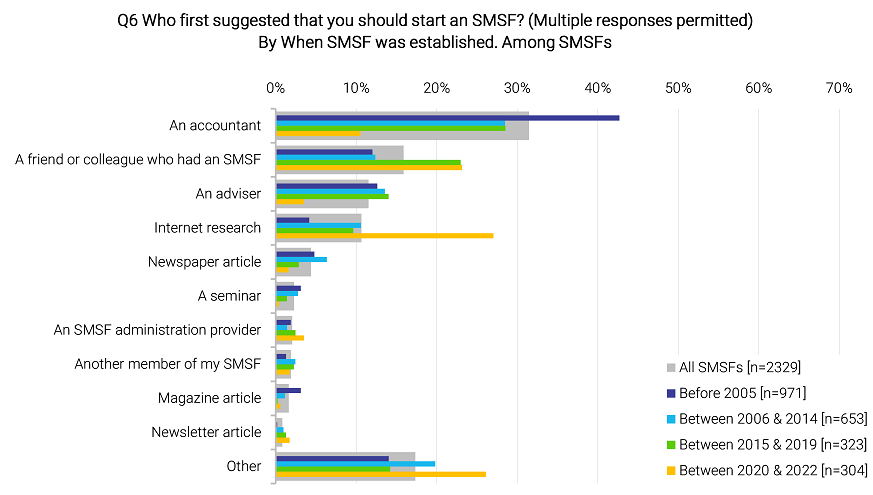

There has been a dramatic decline in people relying on their accountant to suggest an SMSF, and a rapid rise in word-of-mouth (friend or colleague), internet research or self-initiated. We know thousands of new investors made their first stock trades during the pandemic, and many also set up an SMSF.

'Buy and hold' versus trading

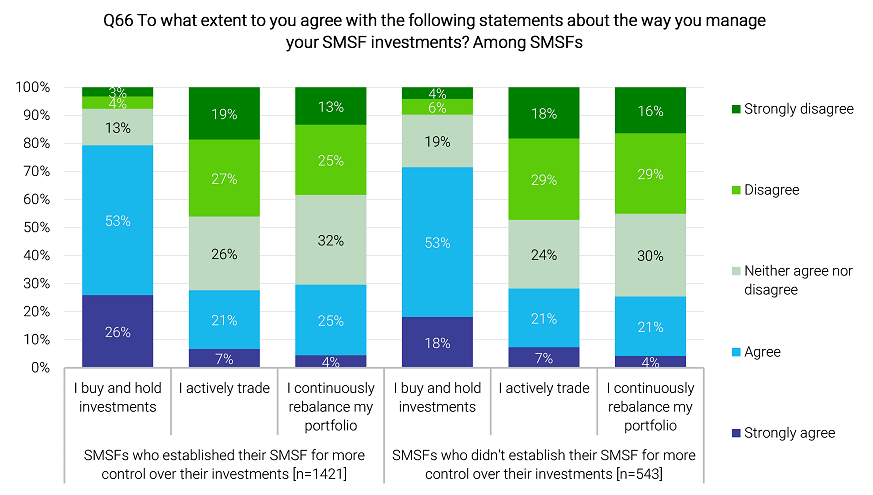

Even among SMSF trustees who say their main motivation is control of their investments, a high 79% either agree or strongly agree that they take a ‘buy and hold’ approach to investing. Only about 28% agree or strongly agree that they trade actively, while only 29% agree or strongly agree that they continuously rebalance their portfolios.

In something of a disconnect, a lower proportion at 71% of those trustees who did not establish their SMSF for greater control either agree or strongly agree that they 'buy and hold'. Either way, actively trading and continuously rebalancing is a minority of trustees. Perhaps they have understood the message about taking a long-term view to asset allocation.

In reporting the results, Balaji Gopal of Vanguard said:

“It is normal to want an investment portfolio to consistently deliver better outcomes than the market averages, but as history tells us, it is much harder than we think. Over time what we see is that those who choose to invest in a well-diversified portfolio, using the time-tested principle of investing to capture market gains over the long term are the ones who are more likely to achieve their financial goals without needing to adopt a riskier investment strategy in this low yield environment.”

Asset allocation, inside and outside their SMSF

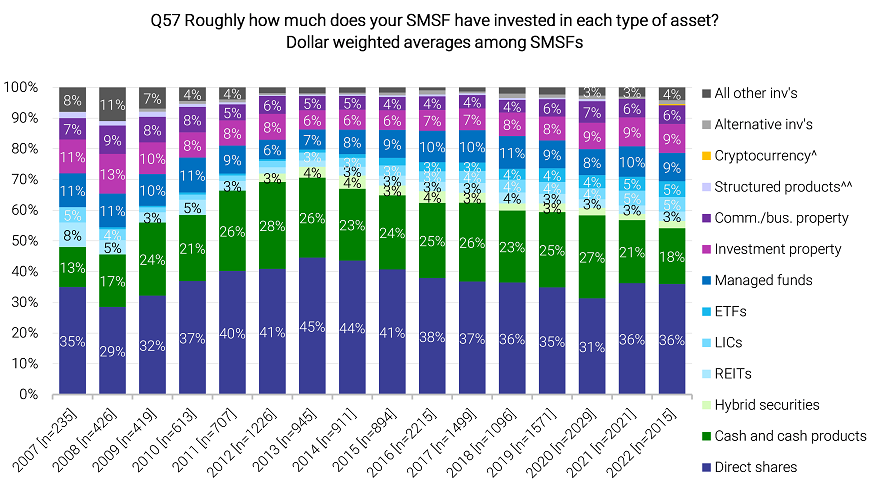

Consistent with surveys in previous years, SMSFs allocate more than half of their portfolio to direct shares and cash, with the number of direct shares increasing according to age. Trustees who are 65 and over hold a median of 19 companies in their SMSF portfolio while those aged 44 and under hold only seven.

Although market commentary places significant emphasis on the growth of Exchange Traded Fund (ETFs), they comprise only about 5% of total SMSF balances, a percentage which has not changed much over time. Managed funds remain consistently higher at about 10%.

Showing the popularity of holding business premises in the SMSF by professions such as doctors and dentists, commercial and business property comprise about 6% of assets, while residential commands around 9%.

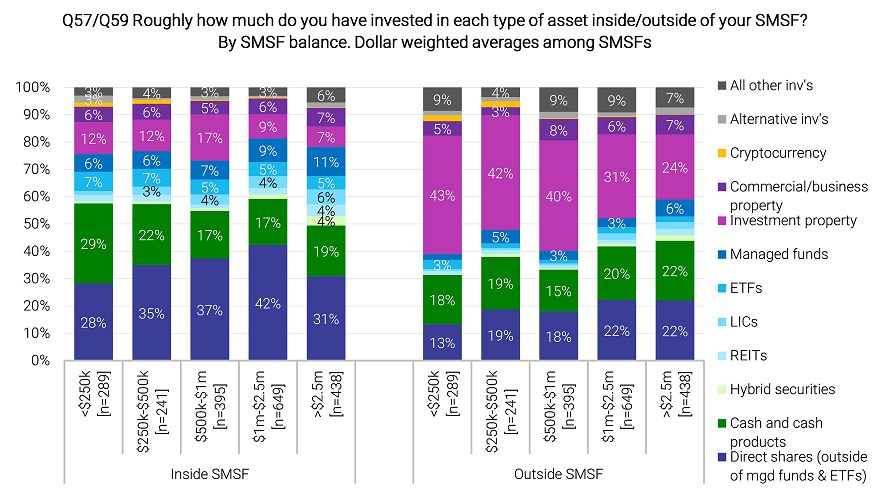

Here is the most striking difference between investments held inside and outside super. This survey was the first to ask SMSF trustees about investments outside their SMSF, and the chart below shows inside SMSF on the left-hand side and outside SMSF on the right-hand side, based on the size of the investments.

It shows the high extent to which investment property is held outside the SMSF structure. This is probably motivated by easier borrowing conditions for individuals versus SMSFs, and a desire to negatively gear against higher personal marginal tax rates than in super.

The future for SMSFs is bright

Over 30 years, SMSFs have gone from a seemingly inconsequential stoke of Paul Keating's fountain pen to the mainstay of retirement planning for over one million Australians. Far from becoming a relic of older generations, SMSFs are actively used by younger people who are confident taking control of their own superannuation.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor. The charts are reproduced with the permission of Investment Trends and Vanguard.

Vanguard Australia is a sponsor of Firstlinks. For more articles and papers by Vanguard, please click here.