It is well known that any money withdrawn from superannuation after age 60 is tax-free. Less well known is the arrangement that allows a couple over the age of 67 to earn up to $57,948 per year and a single person up to $32,279 per year outside super and pay no tax.

This is because of the operation of two tax offsets which together eliminate all the tax payable. It is important to note a tax deduction reduces the income on which tax is payable, a tax offset reduces the tax payable on that income.

The current tax-free threshold is $18,200. For low-income earners, there is also a Low-Income Tax Offset (LITO). It effectively allows working Australians to earn up to $21,884 per year before they need to pay any income tax or Medicare Levy.

In addition to the LITO, people who have reached pension age are entitled to use another tax offset called the Senior Australians and Pensioners Tax Offset (SAPTO). The important element here is not that the person receives the age pension, but that they have reached pension age.

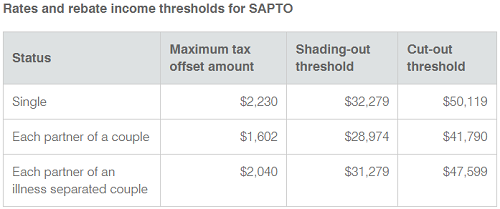

SAPTO works in tandem with LITO. This means that a single person over age 67 can earn $32,279 before they pay any tax as the LITO and the SAPTO together offset the tax payable. The SAPTO for each member of a couple means they can each earn $28,974, or $57,948 together, tax-free. There is also no Medicare levy payable for taxpayers eligible for SAPTO.

Source: Australian Taxation Office

Just as the LITO is tapered as income exceeds the threshold, the same applies with SAPTO but the taper rate is much more severe. The SAPTO is reduced by 12.5 cents per dollar of income so there is no SAPTO available when income reaches $50,119 for a single person or $83,580 combined income for a couple.

Implications of the two working together

Thanks to the LITO and SAPTO, a couple with a taxable income below $57,984 pay no tax. In that case, their tax position is the same as if their income was drawn from super. If we assume that these assets were generating an income yield of 6%, it would mean that this couple could hold over $900,000 in assets outside super and have the same tax-free income as if those assets were held inside super, assuming no other taxable income. A single person could have over $500,000 invested in their own name and still pay no tax.

For some seniors over the age of 67 this may encourage them to close their SMSF with its fees and regulations. By holding those assets in their own name, they would have to go back to completing a tax return, particularly if they wanted a refund of their unused franking credits.

It also means that, in addition to tax-free income derived from investments held inside super, seniors over the age of 67 can also hold substantial assets outside super with no income tax to pay. Withdrawals from a super fund are tax-exempt, after age 60, and are not declared on a tax return and as shown, SAPTO allows substantial tax-free income from assets outside super.

Risks of moving money out of super

If the assets are held outside super and as the income grows over time, some tax may become payable if the income progressively exceeds the tax-free threshold, which is not indexed.

Similarly, capital gains are taxable income in the year the asset is sold. Outside super, any capital gains on assets sold may trigger a tax liability whereas that is not be the case in a super fund paying a pension.

If one member of a couple survives the other, their effective tax-free threshold is reduced from the couple rate of $57,984 to the single rate of $32,279. If the surviving spouse continues to hold all the assets in their own name, the income produced could trigger a tax problem which may not arise inside a super fund. Holding assets in their own name requires different estate planning and asset protection arrangements from those who hold assets in a super fund.

Assets transferred out of a super fund to benefit from SAPTO are difficult to put back into super because of the contribution caps. Removal of the work test makes this somewhat easier for those under age 75, but this decision is almost irreversible.

SAPTO is another example of seniors paying less tax than the working population and is often suggested for removal as a way of improving taxation equity. There is a legislative risk that it may be removed in future, although that would affect mainly age pensioners and seems unlikely.

SMSFs are considered by many to be the investment platform of choice because of the tax concessions they offer, but they are not cheap, particularly for retirees with modest investment balances. SAPTO may provide people with modest investment balances the same tax-free income as a super pension with none of the fees or regulations.

Important to note

This article is not meant as financial or tax advice as I am not qualified to offer either. It is important to stress that any decision to close down a SMSF has enormous implications for future tax liabilities and should not be taken without sound advice from a qualified accountant and/or financial adviser who can consider individual circumstances.

Jon Kalkman is a former Director of the Australian Investors Association. This article is for general information purposes only and does not consider the circumstances of any investor. This article is based on an understanding of the rules at the time of writing and anyone considering changing their circumstances should consult a financial adviser.