I’ve been getting many questions from income investors about what to do with their money now that term deposit rates are falling, and bank hybrids are being phased out.

Here I’m going to run through the various options, and their pluses and minuses.

Term deposits

With the RBA cutting interest rates last month and potentially more cuts on the way, it seems the days of +5% fixed term deposit rates are largely behind us.

The biggest bank, CBA, has 12-month deposit rates of 4.2%, with 6- and 3-month rates at up to 3.4% and 3% respectively. It has a current ‘special offer’ of 4.6% for a 10-month deposit.

My favoured term deposit institution, Judo Bank, offers higher rates than CBA, at up to 4.85% for 3 months, and 4.7% for 12 months.

There are others that are also more competitive than CBA, such as UBank, ING, and Macquarie, though all come with conditions attached ie. spending and saving certain amounts to qualify for higher rates.

The current term deposit rates still seem a reasonable proposition given they remain well above the official inflation rate of 2.4%.

Cash ETFs are an alternative for those investors who don’t want to be locked into three-month plus term deposits. These ETFs invest in cash products and deposit accounts that are offered by reputable banks with distributions (ie. interest payments) that are typically paid out on a monthly basis.

The most popular cash ETF is Betashares Australian High Interest Cash ETF (ASX:AAA). It offers a current interest rate of 4.18%.

Government bonds

Government bonds have been in the doghouse for four years now. Despite the more attractive yields on offer, both institutional and retail investors have been reluctant to wade back into bonds.

Australian 10-year Government bond yields peaked above 4.8% in October last year and now sit at 4.46%.

Figure 1: Australia 10-year Government bond yield

Source: Trading economics

That yield seems ok given the circumstances. Unlike cash and term deposits, bonds offer protection for investors in the event of a slowing economy or recession.

The risk with bonds is if inflation ticks up again.

I’ve previously been vocal in suggesting that bond cycles usually last decades not years, and that the current bear market in bonds is likely to continue for some time. That said, Government bonds do still have a role to play in income portfolios.

You can buy Government bonds directly or via ETFs, the most popular being iShares Core Composite Bond (ASX:IAF) and Vanguard’s Australian Fixed Interest ETF (ASX:VAF).

Subordinated bonds

With hybrids being phased out from 2027, banks and issuers are likely to replace hybrids with other forms of capital like subordinated debt.

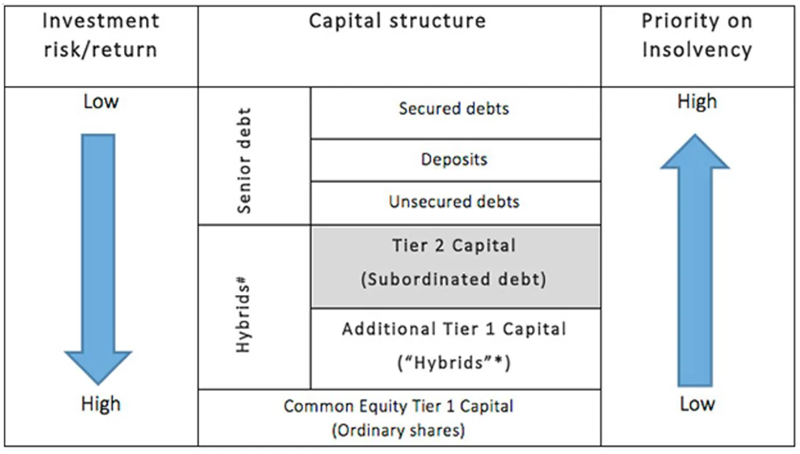

For context, there are different levels of debt in companies. The lowest risk is senior secured bonds, followed by senior unsecured bonds, and then subordinated bonds, otherwise known as junior bonds or lower Tier 2 debt.

Banks and insurance companies issue subordinated debt and Tier 1 hybrids as regulatory capital instruments. Their principal purpose is not as a source of funding but rather to add to the capital position of a bank or insurance company which can be used to absorb losses in a crisis scenario. These securities add to capital ratios that are monitored by regulators as an indication of risk.

Figure 2: Simplified capital structure of a financial institution

Source: ASIC

Betashares offers an Australian Major Bank Subordinated Debt ETF (ASX:BSUB) that has a current running yield above 6%. And Macquarie has just launched a Subordinated Debt Active ETF (ASX:MQSD).

The yields on subordinated debt are very reasonable, particularly given the quality of the major banks and insurers issuing the debt.

Hybrids

Hybrids are part equity and part debt instruments. They’ve been exceedingly popular with both banks and investors.

But with hybrids slowing disappearing, it will mean billions of additional subordinated bond issuance and potentially some widening margin pressure for new issues if demand growth doesn’t match supply growth.

That could result in tighter margins for hybrids, and higher prices. So, there may still be an opportunity for 6-7% returns in this space.

The easiest way to get hybrids exposure is via Betashares Australian Major Bank Hybrids Index ETF (ASX:BHYB).

If you want an expert in this area, Elstree Investment Management is well regarded and has a listed ETF, The Elstree Hybrid Fund Active ETF (Cboe:EHF1).

Another ogood ption is the Schroder Australian High Yielding Credit Fund (Cboe: HIGH).

Dividend ETFs

If cash is the least risky investment, and bonds are second, then equities are riskier still, but they offer higher potential returns in the form or capital gain and income. An advantage for the income investor is that dividends offer tax advantages that cash and bonds don’t, through franking credits.

The largest ASX dividend ETF is Vanguard’s Australian Share High Yield ETF (ASX:VHY). It sports a current dividend yield of 5%, or a grossed up yield close to 6.5%.

It’s worth noting that VHY has struggled to grow its dividend over the past decade because of its heavy exposure to financial and commodity stocks (73% of the portfolio). Financials, especially banks, haven’t been able to lift dividends much given limited earnings growth, while mining company earnings and dividends have suffered given the recent falls in many commodity prices.

Listed investment companies

Listed investment companies or LICs may be an option for those seeking high and growing dividend income.

Australian Foundation Investment Company (ASX:AFI) is one of the oldest and most reputable LICs. It currently offers a yield of 3.7%, or 5.3% grossed up.

A good alternative is Plato Income Maximiser (ASX:PL8) which has a current yield of 5.2% fully franked and has achieved 9.8% total returns including franking credits since it was launched in 2017.

The recently listed Whitefield Income (ASX:WHI) is also worth a look, as is Wilson Asset Management’s WAM Income Maximiser Limited (ASX:WMX), which is raising money for the fund to invest in both equity and debt, with the aim of delivering gross income returns of 6% per annum.

Equities

With the recent dip in share prices, it potentially offers more opportunities to buy companies at cheaper prices and better yields.

For steady, high dividend yielding stocks, here are three ideas:

Charter Hall Retail REIT (ASX:CQR). With rates more likely to dip than climb, property asset values are starting to stabilize after a rocky 24 months. CQR has $4.5 billion in neighbourhood retail assets plus some petrol stations. A lot of the assets are suburban sites with a supermarket and 5-10 retailers around that supermarket. Property occupancy remains high at almost 99%, and the average tenancy expires in seven years. CQR offers a healthy 7.3% net yield and trades well below its net asset value.

NIB Holdings (ASX:NHF) With an ageing population and increasing need for medical care, the long-term prospects for health insurers are favourable. NIB is the fourth largest health insurer behind Medibank Private, BUPA and HCF. While pricing is set by government, growing demand for private healthcare should ensure increasing earnings and dividends for many years. NIB offers a forecast net dividend yield of 4%.

Origin Energy (ASX:ORG) Origin is Australia’s largest electricity and gas supplier. Low wholesale electricity and carbon credit prices are going to make it tough for them to grow earnings over the next few years, though the company has defensive qualities that should make its dividend safe. Origin offers investors a 5.1% yield with reasonable valuations.

If you’re after growing dividends, then here are two stocks to consider:

Woolworths (ASX:WOW). I think it might be time to buy this supermarket giant. It’s had a terrible time of it lately – being trounced by Coles, having a change in management, plus the Government breathing down its neck, effectively capping grocery pricing. It’s left Woolies at less than a 20x price-to-earnings ratio, with earnings depressed because of the recent events. With a 3.4% forecast yield, I expect a comeback for this blue-chip stock.

Washington H. Soul Pattinson (ASX:SOL). A personal favourite of mine. The company has raised dividends in each of the past 24 years, by 10% per annum. A great track record and though the boss, Rob Millner, isn’t getting younger, the future still appears bright for the conglomerate. Soul Patts has a forecast 2.9% dividend yield.

* Note that Vanguard, Charter Hall, Schroders, and Macquarie Asset Management are sponsors of Firstlinks.

James Gruber is Editor at Firstlinks.