Regular readers of Firstlinks may recall I took the unusual step at the start of December 2021 of advising that I was switching some of my SMSF portfolio from equities to cash when I wrote:

“However, while I recommend anyone with a long-term investment horizon should stay substantially invested in equities, I am starting to reduce some equity exposures as I personally believe the market will experience a decent fall sometime in 2022.”

My colleagues at Morningstar had asked me to write about why I expected stockmarkets to fall in 2022. I don't normally make such announcements as I’m not a fan of timing markets. However, the frothy valuations of 2021 were due for a correction, and then conditions worsened with the war in Ukraine and higher-than-expected inflation and interest rates. An advantage of running an SMSF is this flexibility to make changes that suit personal risk appetite, or it can be a curse if the ins and outs are badly timed. In most cases, better to leave it for the long term. As legendary investor Peter Lynch famously said:

“Far more money has been lost by investors preparing for corrections, or in trying to anticipate corrections, than has been lost in corrections themselves.”

It is also difficult to decide when to restore risk towards equities, and while money is saved by selling before a fall, money is lost in not re-entering before a rise. If the market continues to rally while money sits in cash, the long-term benefits of equity investing may be lost. But unable to resist the timing temptation, the risks to the downside still seem greater than the upside at this stage.

All that involves a decent amount of guesswork, but there is one thing that is a sure-fire way to generate more income. While the money is in cash, make it work harder and earn the higher rates on offer, if other goals are not compromised.

Major banks are enjoying the ‘retail inertia’ of customers staying in lower-earning savings accounts. My SMSF’s transaction account held with CBA is not tracking increases in cash rates, paying 1% or less for under $100,000 and a top rate of 1.85% on high balances versus the current cash rate of 2.6%. On $100,000, earning 1% versus say 3% is a shortfall of $2,000 a year.

The major banks are using the rise in rates to rebuild their net interest margins, and their clients do not give the banks enough incentives to act differently (and I have sat on the Pricing Committees of three Australian banks and lagging rate increases on deposits is an extraordinary source of profits).

Guidelines for investing my cash

It’s overdue for me to find better ways to invest what might loosely be called ‘cash’ as significantly better rates are now available. I have different needs for this money, leaving me to set the following (sometimes conflicting) criteria to drive allocations:

1. Maintain liquidity for opportunistic investments

Regardless of market conditions, investment opportunities arise that may require a quick response. A bond or note issue, such as the recent hybrid offer from CBA, may open and close in a day. Term deposits are a commitment for a given maturity and banks are now pushed by the regulators not to allow easy prepayment, so some level of at-call cash is required.

2. Stagger term maturities

Some bank term deposit rates are now offering 4% to 5%, which while not generating positive real returns with inflation over 7%, at least they generate decent income on government-guaranteed deposits (subject to a maximum of $250,000 per entity per ADI under the Financial Claims Scheme). For example, AMP Bank is at 4.8% and Judo Bank is at 4.9% for five years.

But these long terms reduce flexibility and the threat of inflation and interest rates rising more than expected cannot be ruled out. Staggering maturities leaving some at call in a high-yielding cash account, plus term deposits at 3% for 6 months, 3.9% for 12 months and maybe a little longer term at around 4.5% retains more flexibility. Deposits maturing every six months allows deployment elsewhere if needed.

3. Lock some away at decent rates

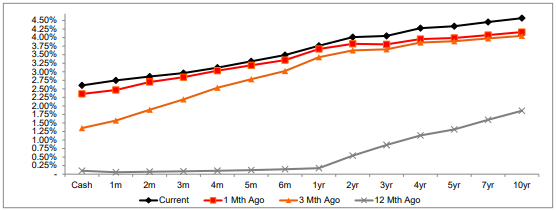

The chart below from NAB (as at 25 October 2022) shows how much the bank rate curve has increased over the last 12 months and in the last month, with cash rate futures pricing in 4.25% by September 2023. Amid all the market uncertainty, this week's Budget forecasts a return to lower inflation, down to 3.5% by 2023/2024, and there is an argument that market rates have risen too far. Yes, this is having it both ways (fix some, float some) but locking in some of today's higher rates has merit.

4. Minimise the pain and time involved in paperwork

We all feel differently about the effort of investing. I have a low pain threshold. For example, I started filling out what looked like a decent online application process by Judo Bank. It is, after all, a new online bank without legacy systems. But I became bogged down in identifying myself, the company trustee and the super fund, and for some reason, it requires unique email addresses for the trustee company and the directors. Judo Bank then advised me by email:

“I do thank you in advance for the feedback during our ‘pilot program’. Can you please send through a screen shot of the sections you have mentioned in your email?”

What! Their SMSF application process is a pilot program? Don’t release it to the public, then.

Similarly, I thought I was going well with account opening at Gateway Bank, sending in by email the lengthy application form and various copies of ID, only to receive this reply:

“Please find attached the following documents required to set up a Self-Managed Super Fund with Gateway:

-ID for each signatory (Medicare Card and Driver’s licence/Passport – certification not required; a copy is fine)

-Each signatory must sign the membership form

-The membership application – trust is for the superfund itself

We also need:

-A certificate of registration (showing the ABN)

-1st page of the deed that shows the legal name of the fund and page where it shows the number of beneficiaries and Settlors details if any.

-Table of contents

-The last pages of the deed that show the signatories signatures and the confirmation that it has been witnessed.

If the company is involved as a trustee for the super fund, we would need additional documents for the company:

-The membership application – Company

-A certificate of registration (showing the ABN or ACN) /ASIC certificate.

-All the above documents should to be certified and forwarded to us via email or mail. Unless the members can visit the branch with the original documents, and we can certify it here.”

Really. I had already provided some of this. Life’s too short for all this signing and gathering and certifying, plus who's the Settlor?

Anyway, after more email exchanges, we all gave up on each other. You might have a difference experience or be happier filling in forms.

I finally set up up a TD using a smoother process with Macquarie Bank. Not sure why they did not require a certified copy of my SMSF’s Trust Deed but they made the application easy.

5. Consider listed cash (money market) ETFs

The range of Exchange-Traded Funds (ETFs) continues to expand and give opportunities across many asset classes which were previously only available in unlisted funds.

There are three ‘cash’ ETFs and many bond, note and private credit funds which are worth considering, but sticking to the cash comparison gives the following choices.

|

ASX code

|

Base fee

|

Buy/sell spread

|

Current rate

|

|

AAA (BetaShares)

|

0.18%

|

0.02%

|

2.72%

|

|

BILL (iShares)

|

0.07%

|

0.03%

|

2.89%

|

|

ISEC (iShares)

|

0.12%

|

0.03%

|

3.04%

|

Sources: Issuer websites as at 25 October 2022

AAA is the market leader and by far the biggest and offers the best liquidity and tightest spreads. It has become a popular place to leave cash with better rates than bank deposits. For a relatively quick in and out, it’s the best choice. But it’s also the most expensive on fees, making the others more attractive if money may be left in cash for a while. Note that ISEC carries somewhat more risk than the others as it can hold up to 20% in floating rate notes.

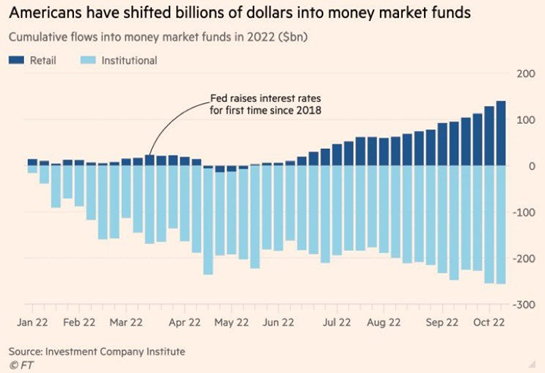

Listed cash funds have become popular globally, as this chart of US retail flows shows (the institutional outflows are due to financing redemptions from other funds). Retail investors are looking for a safer home in the face of equity and bonds funds crashing.

6. Don’t compromise on risk in search of returns

A common investment technique to drive better returns during 2020 and 2021 as cash rates were held at 0.1% was move up the risk curve in search of yield. This may include lower tiers of the bank capital structure, such as subordinated debt or hybrids, or high-yield credit, such as non-investment grade company debt.

While there is some room in portfolios for higher risk, they are not direct substitutes for the security of cash and bank term deposits. For example, this week, CBA issued a new hybrid offering a margin of 2.85% over the Bank Bill Swap Rate (BBSW, the rate that closely follows the Reserve Bank cash rate). At current rates, this pays about 5.8%, and if BBSW goes to the predicated 4.2%, then CBA will pay a healthy 7% plus. Not bad for a bank credit of such quality, and the transaction was swamped and closed in a little over a day. Then Bank of Queensland issued at a better margin, indicated at between 3.4% and 3.6% above BBSW, or over 6% for a solid regional bank. But even when issued by quality banks, hybrids carry some equity-like risks.

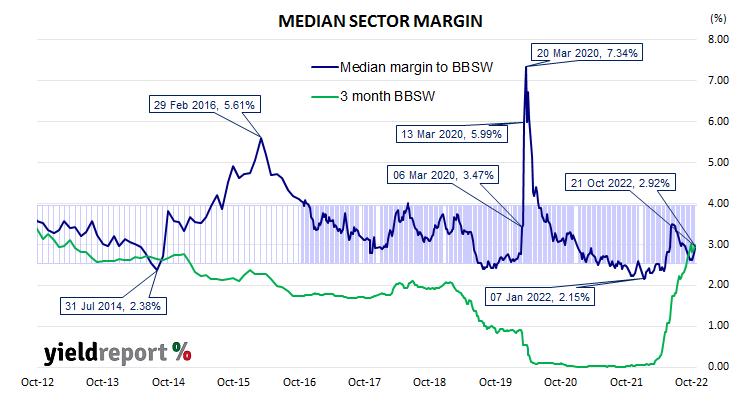

The following chart from YieldReport shows how margins on hybrids can widen in times of market distress, driving prices lower for anyone who needs to sell. While the current margin on hybrids across the range of transactions is 2.92%, it rose to a remarkable 7.34% in March 2020 at the height of the pandemic when investors were worried about bank loan quality. Another spike hit in 2016. So while the green line, the 3 month BBSW, has risen handsomely for investors, margins are highly variable and at some time in the life of today’s new hybrids, there may be better spreads available.

For those brave enough to buy in March 2020 at a margin of 7.34%, if BBSW goes to 4.2%, that’s 11.5% on a quality bank name.

So what did I do?

I am not claiming I have surveyed every bank, security and opportunity, and I’m willing to forego returns for ease of execution. The following identifies specific investments I made as a guide to the diversity available but it is not exhaustive.

- Switch some cash to a High Interest Cash account with nabtrade paying 2.75% on the full balance. My SMSF already holds an account with nabtrade, so no account opening was necessary, just a funds transfer.

- Open a new term deposit with Macquarie Bank, 12 months paying 3.9%. As above, I found the application process easier than with others.

- Invest in a couple of listed cash ETFs, BILL and ISEC, where the fees are lower than the market leader, AAA. Unlike cash bank accounts and term deposits, however, there are costs of brokerage and crossing the spread.

- Invest in some hybrids, accepting that these are not like-for-like risk versus cash, but a floating rate exposure in a rising rate environment has a place in my portfolio. Knowing that the CBA issue will face heavy scale back but they are repaying a large investment I have in the existing CBAPD, I bought two hybrids on market, Macquarie’s MQGPF set to yield about 8% to maturity and ANZ’s ANZPI at about 7.4%. There are also hybrid ETFs available which leave selection to experts for a fee. I know that hybrids in Australia are paying lower rates than banks in offshore markets. I am willing to accept this cost as I do not want more currency exposure and I am more confident about Australian banks than European names. I already hold an investment in the VanEck Bentham ETF (ASX:CGAP) which holds foreign bank capital instruments.

- Plus a couple of modest equity investments in listed companies that I have wanted to own for many years and where the price has fallen to what seems an attractive level.

That will suffice for now with some cash left in my CBA transaction account, provided they fix the rate paid.

I welcome feedback and suggestions on how to manage cash if others have seen better opportunities.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any other investor. These investments may not suit other people and financial advice should be obtained by each investor.