Warren Buffett has described his ‘Rule of 20 Punches’ when speaking to graduation classes:

"I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches representing all the investments that you got to make in a lifetime. And once you'd punched through the card, you couldn't make any more investments at all. Under those rules, you'd really think carefully about what you did, and you'd be forced to load up on what you'd really thought about. So you'd do so much better."

Of the hundreds of Buffett investment lessons, this one goes under the radar but is among the most powerful. Many portfolios include a foundation of long-term mainstays but there's a rabble of other acquisitions due to rumours, quick-fire opportunities or hot tips. The tiddlers are often more trouble than they are worth, they need to be watched regularly and then punted when they fall or pay off. Buffett would have no place for them on his punch card.

Trading, investing or something to do?

Some people enjoy the regular activity but it’s more akin to trading than long-term investing.

A retired friend told me recently that he spends a couple of hours a day on his SMSF portfolio, worth about $2 million and it includes over 200 holdings, all listed. It’s become his hobby. I'm far more of a 'buy and hold', but my own portfolio includes too many small positions which have a negligible impact on the total performance. But there are other investments which I have held for decades which follow the discipline of Buffett’s 20 punches in a lifetime.

When I present at conferences or webcasts, I am often asked for a stockmarket forecast. It is a disappointment when I say I have no better insight into what the market might do next month or next year than a taxi driver who has overheard a passenger.

It's always 'time for caution'

I dislike articles which give a list of reasons the market will fall, another list of reasons it will rise, and then conclude with “It’s a time for caution.” Or how about "The market will be volatile." Really? Well, that covers everything. If the market falls, I told you to be cautious. If the market rises, I told you not to sell. Let me know when it’s a time for all-out aggression.

There are reasons markets are expensive – central bank stimulus, low interest rates, strong earnings – or markets are cheap – low growth, rising rates, slump in earnings. (There, I just gave you two short lists – happy now?). But few people want to sell when markets are expensive in case they miss the next leg up, nor buy when markets are cheap because they are not sure where the bottom is.

But here's the thing. Regardless of whether I think markets will rise or fall in the short to medium term, I have a large SMSF and it must be invested in something other than term deposits at 1%.

Most people are tempted into tactical asset allocation

Chris Cuffe wrote in an article in 2014 called “Why can’t we resist tactical asset allocation?”:

“Like many people who manage their own portfolios, I actively engage in tactical asset allocation (TAA), despite evidence that it’s a waste of effort.”

I'm the same, and the need to make new investments is constant. Most portfolios throw off cash flow that must be reinvested, unless it is money to live on or left to rollover in term deposits. Even a defensive bond portfolio delivers regular coupons and maturities, and equities pay dividends and sometimes the proceeds of share buybacks. The cash flow requires a conscious decision to buy something, perhaps to reinvest in the same asset class.

Some institutions operate the discipline of a strategic asset allocation but they utilise ranges to make decisions at the margin based on forecasts or expectations.

I have some stocks and funds I never expect to sell. However, while I recommend anyone with a long-term investment horizon should stay substantially invested in equities, I am starting to reduce some equity exposures as I personally believe the market will experience a decent fall sometime in 2022. There, the forecast you make when you're not making a forecast ... and here are my brief explanations:

1. Central banks have delivered too much stimulus

OECD governments have spent about US$20 trillion on COVID support measures. With such massive business and personal stimulus, company earnings have recovered strongly and asset values have surged. In Australia alone, the value of residential property has increased by $2 trillion in a year to almost $10 trillion. The Reserve Bank lent nearly $200 billion fixed for three years at 0.1% for Australian banks to fuel a housing boom.

For many sectors of the economy, the cost of borrowing was close to zero, as central banks bought trillions of dollars of bonds and other securities. Awash with liquidity, markets entered a massive ‘risk on’ where asset values were pushed up in the buying spree.

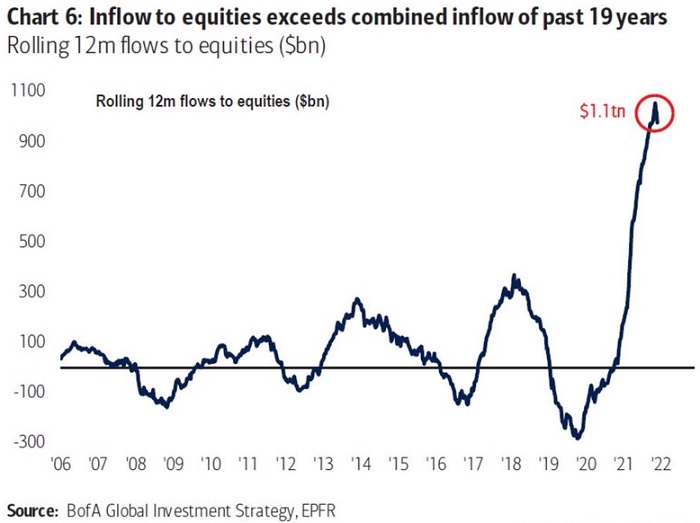

Common valuation measures in the US such as the Shiller P/E, the Crestmont P/E and the Buffett Indicator set new records in 2021, and as the chart below shows, flows to equities were unprecedented. In the nine months to September 2021, the value of US stocks rose US$8 trillion from US$41 trillion to US$49 trillion, making a lot of wealthy people even wealthier.

But 2022 will be the year that central banks and government take away the punch bowl.

2. Interest rates will start to rise

It's only a few weeks ago when the RBA Governor, Philip Lowe, was still saying:

"Our judgement is that this condition for a lift in the cash rate will not be met before 2024."

But even he changed his tune this week, removing the reference to a date, opening the door to an earlier move. It's a significant development as there has not been a cash rate rise for a decade.

Now that Jerome Powell, the Chairman of the US Federal Reserve, is re-elected for another term, he has already indicated he will spoil the stimulus party. Initially, bond purchases will be tapered, and then the market will experience the first increases in the Fed funds rate to control inflation and take the steam out of asset price inflation.

3. Inflation expectations are rising

Despite US inflation around 6%, the market’s main interest rate, the 10-year Treasury, remains about 1.5%-1.7%. Few bond investors have experienced such a large negative real rate, when it had been around plus 2% since the GFC. As inflation takes hold and the economy recovers, the 10-year may rise above 2%, which will fundamentally change the discount rate on earnings of many of the darlings which drove market values in 2020 and 2021.

For example, CBA Economics wrote this week:

"Inflation pressures look to be broad-based. We see inflation in the top half of the RBA's target band around the middle of next year, prompting the RBA to start their hiking cycle in November 2022 ... A key upside risk to inflation in 2022 is that global factors such as supply chain disruptions affect tradable goods prices by more than expected. Another is that the massive pile of excess savings accumulated by households will buoy spending and demand, providing a strong tailwind to prices growth, including for services."

4. New viruses, perhaps 'more contagious and lethal'

The scientific community delivered extraordinary protection from COVID in record time, but almost two years later, the world is still experiencing travel restrictions and lockdowns. Professor Dame Sarah Roberts, the co-creator of the AstraZeneca vaccine, warned this week that future pandemics could be more contagious and lethal than COVID:

“We cannot allow a situation where we have gone through all we have gone through, and then find that the enormous economic losses we have sustained mean that there is still no funding for pandemic preparedness. The advances we have made, and the knowledge we have gained, must not be lost ...

This pandemic is not done with us.”

Forecasts are set up for failure

There are always reasons to sell, and there is plenty of evidence against trying to pick tops and bottoms. Some analysts have predicted six of the last two collapses, and guessing a market change is not much practical use without nominating the timing, the amount and the market’s reaction. Much of what is said about rate rises is already built into forward pricing, so even if a forecast is correct, there is no market gain. The more assumptions in a forecast, the more likely it will be wrong.

Look at the litany of recent failures. Nobody expected negative interest rates, we had never heard of Modern Monetary Theory until a few years ago, the experts were seeing a fall in house prices of up to 30% in 2020/21 and governments expected budget surpluses. Contrary to my personal view, Morningstar analysts expect global equities to deliver 9% per annum for the next five years.

So how should I invest? At some point, monetary and fiscal policy must return to a semblance of normal, but regardless of my expectations, I must remain in the market to a reasonable extent.

About 20 punches on my card

Taking a lead from Buffett, here are around 20 investments that I expect to hold for many years. It’s not that I will ignore the outlook for these businesses or funds, but I am happy to live with the swings. I also have large embedded capital gains which I prefer not to realise for tax reasons.

However, I accept that history is full of great companies – Kodak, Blockbuster, Nokia – which looked like long-term holds until bad decisions or better competitors wiped them out. Who would have thought Nokia with its one billion customers could fail so quickly?

I am not a stock analyst, and I am not recommending these investments. I’m showing that regardless of what I think about the equity market, there are some pillars in my portfolio. Some investments are in funds where I accept the superior ability of the manager to access and assess opportunities in particular sectors.

- CBA (ASX:CBA) – rock-solid balance sheet of home loans, leading banking platform, strong capital position, big deposit base.

- Wesfarmers (ASX:WES) – diverse business operating Bunnings, Officeworks, Kmart, various industrial and resources interests.

- Transurban (ASX:TCL) – dominant toll road operator with significant pricing power, I enjoy that 'ding' when I am charged $8.48 to use the Eastern Distributor which once cost only $3.50.

- Macquarie Group (ASX:MQG) – global investment bank specialising in infrastructure, now a leading position in mortgage lending, clean energy and funds management.

- Argo Infrastructure (ASX:ALI) – one of the few ways to access listed global infrastructure assets at a discount to Net Tangible Asset (current NTA $2.40 versus share price of $2.28).

- Mineral Resources (ASX:MIN) – a more recent addition with an entry price enabled by the selloff reaction to the falling iron ore price while overlooking lithium potential.

- Charter Hall Long WALE (ASX:CLW) – 468 properties worth $5.6 billion leased to governments and corporates with weighted average lease expiry (WALE) of 13.2 years on 'triple net lease' terms.

- Djerriwarrh Investments (ASX:DJW) – old-style LIC offering diverse exposure to Australian equities with low fees and opportunities to pick up at discount to NTA.

- My three A’s of Apple, Amazon and Alphabet (Google) are some of the greatest companies we have ever seen, and I’ve made the mistake of not picking up Microsoft along the way (except in funds).

- Generation Investment Management – a fund introduced to Australia by me in 2007 while working at Colonial First State, fronted by Al Gore but with a bunch of smart fund managers for global equity exposure.

There are also sector investments in ETFs, LICs or unlisted funds including hybrids, corporate bonds, debt funds and equity specialists such as Loftus Peak, Munro Partners, 1851 Capital, Partners Group, Pengana Private Equity, Magellan Core Series (via Chi-X), Hearts & Minds and Ausbil.

That's about 20 punches in total, give or take. Some of my super is with UniSuper because CIO John Pearce is one of the best. So while I will play with asset allocations and I don’t know what the future will bring, I will leave these investments for the long term. As Daniel Kahneman, Nobel Prize Winner, wrote in his excellent book, Thinking, Fast and Slow:

“We cannot suppress the powerful intuition that what makes sense in hindsight today was predictable yesterday. The illusion that we understand the past fosters overconfidence in our ability to predict the future.”

I will resist the urge to say it’s time for caution and next year will be volatile, but rather, think about your portfolio as if you only had 20 punches for the long term.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.