One of my most popular articles from last year was one entitled 16 ASX stocks to buy and hold forever. I think it sparked interest for a few reasons. First, owning stocks that can compound returns at a high rate is an attractive proposition. Second, a number of investors have very long timeframes and there isn’t much in the financial press that caters to these investors.

One year on, I thought it’d be worth revisiting the article to answer the many questions I’ve got from readers since that time, including what stocks on the list may be worth buying now and whether I’d make any changes to the list.

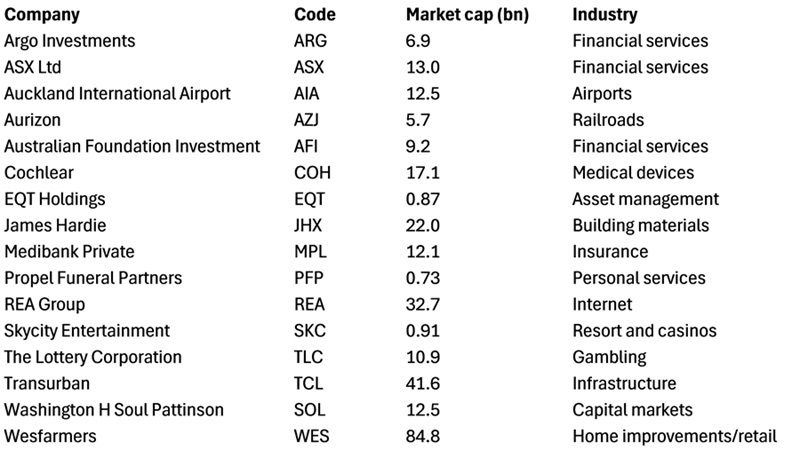

The 16 stocks I chose

Let’s quickly recap the premise of the original article. I got the idea from Warren Buffett, who had famously named several stocks that he’d like his company, Berkshire Hathway, to own forever, including Coca-Cola, American Express, Occidental Petroleum, and the Japanese trading companies.

I thought I could take that and apply it to the local share market. It wasn’t an easy task because I had to be confident that the companies could last indefinitely, and that they had enough growth opportunities to allow them to achieve shareholder returns that beat the ASX 300 index (otherwise, why own them?).

To help with the task, I created seven criteria to identify the ASX stocks that could be held indefinitely:

- Part of the ASX 300

- Long runway of growth opportunities

- Economic moats

- Good returns on capital

- Sound balance sheets

- Don’t rely on exceptional managers to succeed

- Unlikely to be disrupted

From these criteria, I chose 16 stocks that you could hold forever:

Source: Morningstar, Firstlinks

To be clear, the list wasn’t a case of buying now and holding forever. It was a wish list of potential stocks to own in future and own indefinitely.

Are there really forever stocks?

One query I got was what I meant by ‘forever’. In a follow-up interview I did with Morningstar’s Mark LaMonica, I clarified that my timeframe for forever was 50+ years.

I also got scepticism about whether any stocks really could be held indefinitely. After all, studies show the average lifespan of an S&P 500 company is around 15 years. The scepticism has merit, though it doesn’t preclude finding special companies that can buck that trend.

One year on, would I change the list?

Yes, I would. In hindsight, there are two weak links in the list. The first is Argo Investments. Put simply, its portfolio returns are continuing to disappoint. I thought it might be a temporary blip, but it has been underperforming for a long period, and there doesn’t seem to be any turnaround to that. My error was that I got caught up in its long history, stable management, and decent returns over almost 80 years. However, as a fund manager, it’s performance that matters, and on that front, its ‘glory days’ appear to be behind it. Consequently, I would eliminate this one from the list.

Some investors have also questioned the merits of Australian Foundation Investment given its recent underperformance. I’ve got more faith that management will turn it around and deliver outperformance in future.

The other stock I have on my watchlist is Aurizon. When I featured it in the list, I said that I love the railroad business. Railroads have cost advantages for bulk transportation that won’t go away. And there are long-term contracts with imbedded price increases. And though Aurizon gets 80% of its earnings from coal haulage, I’m more optimistic than most on coal volumes over the next decade, plus I’m buoyed also by the company’s gradual transition to non-coal transportation.

One thing I may have underestimated is the competition in the industry. That impacts both rate and volumes.

I’m keeping a close eye on this, but for now, I think Aurizon should remain on the list.

The other company that may raise eyebrows is SkyCity. It’s had a horror run, with regulatory crackdowns, a New Zealand economy that’s been in recession, and a broader casino industry that’s been on the nose.

Yet, I’m still a believer in the long-term future of the company given its long-dated and exclusive licences in Auckland and Adelaide. It remains a keeper.

In saying that, the biggest lesson that I’ve learned over the past 12 months is that sometimes the biggest competitive advantage for a company can also be its largest risk. That’s especially the case for companies that have government licences and contracts.

For SkyCity, its economic moat comes from its exclusive casino licences. But we’ve seen increased regulatory scrutiny in New Zealand of late. And in Australia, Crown and Star have encountered the wrath of Governments after decades of friendly regulatory oversight.

We’ve also seen that with another stock on the list: Transurban. Pressure continues for it to renegotiate toll road contracts after a review recommending as such. This is another one to keep a close watch on, though I remain confident that any change to contracts will be adequately compensated and that there are still ample growth opportunities ahead for the company.

What other stocks could be considered for the list?

There are four stocks that were unlucky not to make the original list:

- Brambles (ASX: BXB). Wooden pallets are an old technology but it doesn’t look like being replaced any time soon. Brambles is a leader in the industry, operating in 60 countries. Demand for its products should continue to grow given most of its business comes from fast-moving consumer goods.

- ARB (ASX: ARB). This company has grown from a local bull bar manufacturer to become a global automotive accessory leader. It’s accelerating its push into the US, recently increasing its stake in Off Road Warehouse, the largest 4x4 accessory retailer in America. Lots of growth opportunities, great returns on capital, and a proven management team make ARB a potential keeper for the long-term.

- Goodman Group (ASX: GMG). Greg Goodman is a smart guy who knows how to scale a business and make a buck (or billions of bucks). His pivot into data centres seems well timed and should pay off given the increasing commoditisation of AI should drive greater demand for AI and data centres. Meanwhile, the industrial property business remains well-placed given the rise and rise of e-commerce.

- Aristocrat Leisure (ASX: ALL). Aristocrat’s gaming machine business operates in a mature industry but with licencing requirements that limit new players coming into the market. In recent years, it’s expanded into the fast-growing mobile gaming market. This move should drive growth for the company, which has become one of Australia’s biggest overseas success stories.

I mentioned above that I would eliminate Argo from the list of stocks to own forever. In its place, I would choose either Brambles or ARB.

What stocks on the list are worth buying now?

There are six ‘forever’ stocks that I believe are potentially worth buying now:

- ASX Ltd

- Aurizon

- SkyCity

- Medibank Private

- The Lottery Corporation

- Washington H Soul Pattinson

The top three stocks here have all encountered what I consider temporary setbacks. I wrote of Aurizon and SkyCity above. On ASX, it has proven my point in the original article that you want to own companies that don’t rely on exceptional managers to succeed. Because leaders of ASX have failed at a lot of things, and yet the quality of the company is undiminished. Of all the companies, ASX Ltd is my strongest buy idea.

The remaining three companies that I think are potential buys are high quality businesses offering reasonable value. Medibank Private continues to show its strength in an industry that should continue to grow for decades to come. The Lottery Corporation is a great company. Yes, it has regulatory licences, though it seems highly unlikely that Governments will undermine the company’s monopolies in markets. Washington H Soul Pattinson is a proven, canny investor. One wonders if Perpetual or parts of it may be in play for Soul Patts at some stage.

Which of the stocks are overvalued now?

Of the 16 stocks on the list, which are the ones to avoid right now? I would name three:

All three companies are high quality, and all are priced for perfection, and beyond.

I considered REA incredibly expensive at this time last year, and the stock is up 33% since! It’s now trading at 18x sales and 53x earnings. The move by Costar on REA rival, Domain, may be the catalyst for a reality check in the REA share price. CoStar is a proven operator with deep pockets and investors may soon fret about the potential implications for REA.

Cochlear’s share price has taken a hit over the past 12 months, yet at 46x earnings, it still seems very overpriced. I think the company can grow profits by high single digits over the next few decades, but there’s no way I’d pay a 46x multiple for that.

Wesfarmers is another that seems overpriced. Again, though, I thought the same thing last year, and it’s performed ok since.

James Gruber is Editor of Firstlinks.