Aged 94, Warren Buffett is understandably slowing down. In his 48th letter to Berkshire Hathaway shareholders last weekend, he reveals that he now uses a cane. He jokingly refers to how his regular Sunday phone calls with his sister, Bertie, cover exciting topics such as the relative merits of canes. And in his case, “the utility is limited to the avoidance of falling flat on my face.”

The revelations follow a recent interview where he said that he could no longer play his favourite hobby of bridge as he once did.

Buffett’s age may be why his annual letters are getting notably shorter. This year’s spanned 13 pages. A decade ago, it was more than twice that length. He’s also planning to cut down on his speaking time at the upcoming Berkshire annual meeting in his hometown, Omaha.

In this year’s letter, he acknowledges that, “it won’t be long before Greg Abel replaces me as CEO and will be writing the annual letters.”

Buffett’s thoughts on his own mortality may explain his reticence on key topics in his latest letter. He seems to go out of his way not to court controversy.

But that may be the point: at this stage, he’d rather remain above the fray and be remembered simply as one of the world’s greatest-ever investors.

That said, there’s still a lot of value in Buffett’s letter, if you read between the lines. Because it’s as much about what he doesn’t say as what he does.

Like a magician who’s performing a trick with his right hand, it’s meant to be a distraction to what’s really going on in his left hand.

The Berkshire result

First, let’s run through the Berkshire result. Buffett says that Berkshire’s fourth-quarter profit rose 71% to US$14.53 billion, and excluding currency gains totalled US$13.38 billion.

Full-year operating profit increased 27% to US$47.44 billion, a record-high.

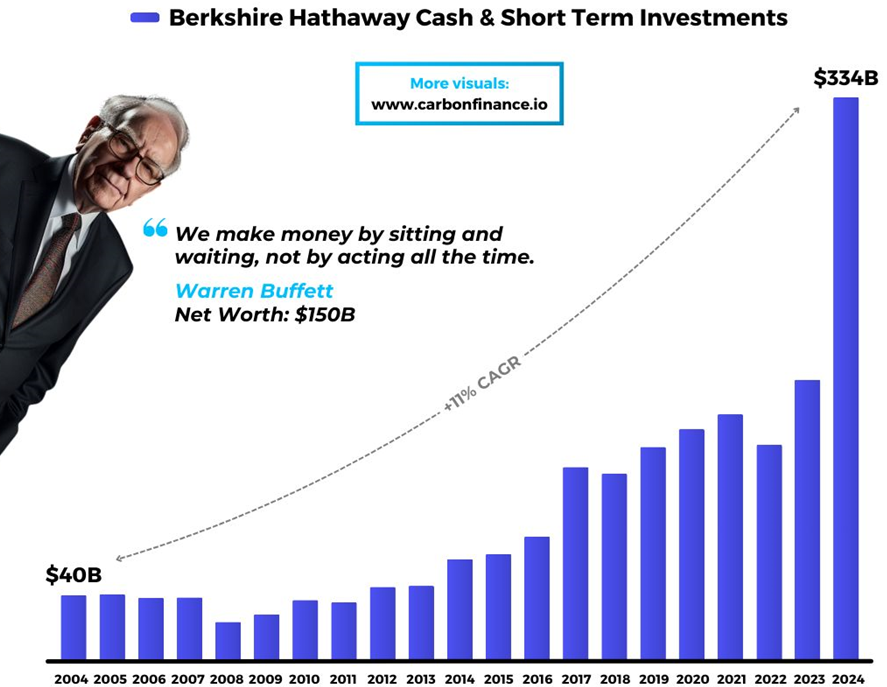

That was helped by more income from $334.2 billion of cash and equivalents, invested mostly in U.S. Treasury bills.

Cash doubled in 2024 as Berkshire reduced its stake in Apple (NYSE: AAPL). Net income, including gains and losses from stocks, totalled US$89 billion.

Buffett did find a few things to use the cash from last year by spending US$3.9 billion to buy the rest of its utility business and another US$2.6 billion to purchase the remainder of the Pilot truck stop chain it didn’t already own.

Berkshire also increased its investment in five major Japanese conglomerates, and Buffett says he’ll likely invest more in them because those companies have agreed to let the company increase its ownership beyond 10%. Berkshire has now spent US$13.8 billion over the past six years on the Japanese investments that are now worth US$23.5 billion.

On that cash pile

Berkshire has amassed the greatest cash position of any company in history, so it’s understandable that it’s grabbed media headlines. Of the cash, Buffett is almost defensive in his letter to shareholders:

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change.”

And:

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance. Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

So, Buffett is saying that most of the company’s money is in equities and his preference is to own equities rather than cash or bonds.

What doesn’t that tell us? A few things.

First, why has Buffett been a net seller of stocks? Why did he cut his holding in Apple by 70% in 2024?

To put the stock sales in context, the US$127 billion in net sales last year resulted in a US$97 billion realizable tax gain for Berkshire – that gain is larger than all the cumulative realized net gains over the past three decades (of US$85 billion), according to investor, Christopher Bloomstan.

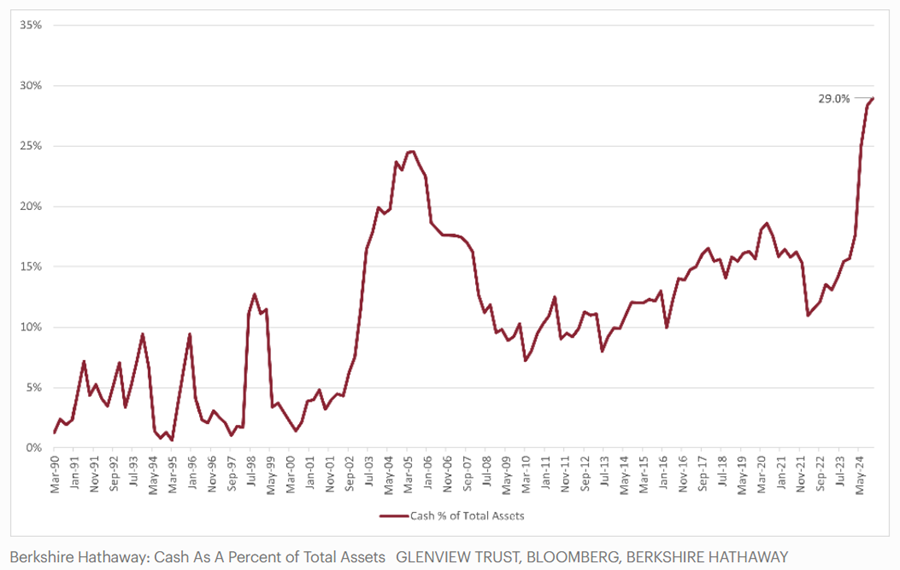

Also, the cash balance at Berkshire has reached 29% of assets. That compares to the 13% average of the past 25 years.

Berkshire Hathaway cash as % of assets

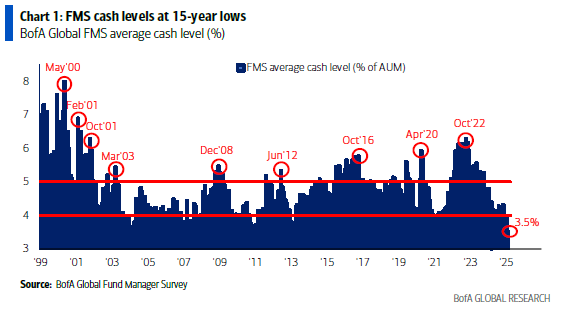

Berkshire’s record-high cash pile stands in stark contrast to the cash levels of global fund managers, which are at 15-year lows.

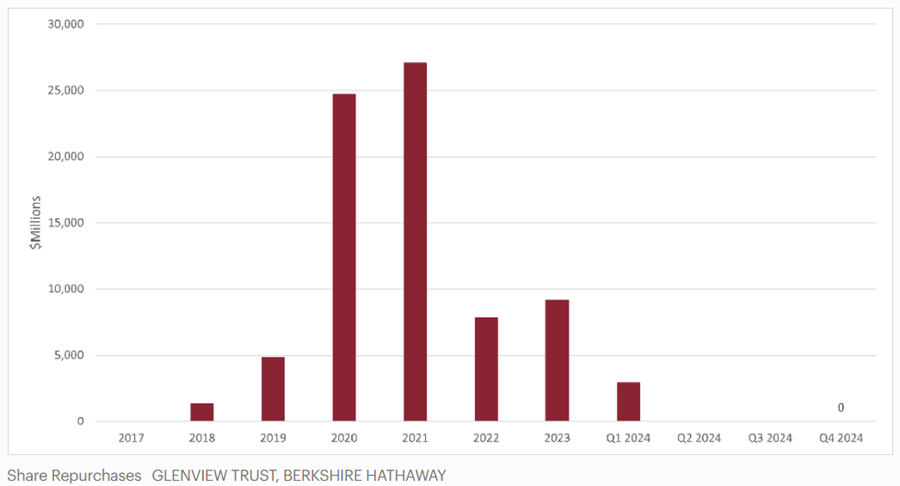

Berkshire also hasn’t been a buyer of its own shares since the first quarter of last year, signalling that Buffett doesn’t consider his company shares to be undervalued.

Berkshire share repurchases

We have this seeming contradiction: Buffett prefers to own equities over cash, but he’s been an aggressive net seller of stocks over the past year.

How to reconcile this? It’s likely that Buffett would love to own more stocks, but not at current prices. In plain English, he thinks the current US market is expensive and he’s holding dry powder for when stocks get cheaper.

On Apple

Buffett didn’t address Apple in his letter, but it really was the big news for Berkshire over the past year. Along with Bank of America, Buffett aggressively cut his stake in Apple. He sold US$100 billion in Apple in the first three quarters of last year, or more than two-thirds of his stake in the company. Interestingly, he didn’t sell more in the fourth quarter.

Some commentators suggest that this is Buffett being prudent. That Apple being 50% of his equities portfolio was too much, and his recent cuts get the stake back to a sensible level (it’s now 25% of the portfolio and remains the largest stock holding).

I don’t buy this because Buffett isn’t normally afraid to hold large positions in stocks. He’s always preferred concentration over diversification.

Other commentators believe that Buffett is readying the portfolio for his CEO successor, Greg Abel. He doesn’t want Abel having such a large Apple position, the theory goes. It may be fine for Buffett, but not for Abel.

This could have some merit. However, I think it’s more probable that priced at 39x current earnings and with single digit earnings growth, Buffett sees Apple as very overpriced.

Perhaps, Buffett doesn’t want to repeat a previous mistake of his in not selling Coca-Cola when it reached a P/E ratio in the high 40s in 1998 (it took 16 years for Coke to get back to break even).

Also, I’m speculating that Buffett may not appreciate some of Apple CEO, Tim Cook’s, recent decision making. Specifically, his preference to buy back Apple shares last year.

On this, I wrote in August:

“One reason for Buffett selling that I haven’t seen in any commentary is that he may have lost faith in Apple’s CEO. Buffett has said that he looks closely at leaders and how they allocate capital. Previously, he’s lambasted CEOs who’ve bought back company stock when the shares were expensive.

While Buffett has applauded Apple’s large buybacks in the past, he’s probably less happy with continued buybacks now. Why? Because buying back shares when the company was cheap made sense. With the company now expensive, it makes much less sense.”

On taxes and currency

Buffett is less subtle when it comes to issues of tax and currency.

In his letter, he notes that Berkshire last year made four tax payments totalling US$26.8 billion. He says this is far more in corporate income tax than the US Government has ever received from any company – even larger than the tech titans with market caps far larger than Berkshire’s.

And his message to the Government is clear:

“Someday your nieces and nephews at Berkshire hope to send you even larger payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better. And never forget that we need you to maintain a stable currency and that result requires wisdom and vigilance on your part.”

Preparing for the next bear market

Over 60 years, Buffett has compounded shareholder returns at almost 20% and turned Berkshire Hathaway into a sprawling conglomerate with a market cap of more than $1 trillion.

Though showing signs of slowing down, Buffett seems to be preparing Berkshire for the next bear market and laying the groundwork for when he's no longer around.

James Gruber is Editor of Firstlinks.