With financial markets again experiencing turbulence, it is timely to take a closer look at the defensive asset classes – what they are, why you hold them, and how you can use them to both deliver on your goals and increase the reliability of your desired outcomes.

It’s fair to say eyes typically glaze over when bond markets come up in conversation. Unlike the dazzling and high-profile world of equities that tends to dominate the daily headlines, bonds are frequently cast as necessary but boring infrastructure in diversified portfolios.

But the truth is that there are a lot of nuances to defensive investing that if overlooked can deprive you of the tools necessary to solidify your portfolio and ensure it behaves as expected, particularly during more volatile periods as we have seen recently.

To return to the analogy of my previous article, bonds are akin to the foundations of a house, providing the structure upon which everything else rests, while playing multiple roles of their own in ensuring ongoing liquidity, generating income and offering defence.

So using a top-down approach, can help fine-tune your approach to the defensive part of your portfolio. The aim here is to add flexibility, while improving intended outcomes – not just in terms of returns, but in bolstering reliability, predictability and providing peace of mind.

Start with the objectives

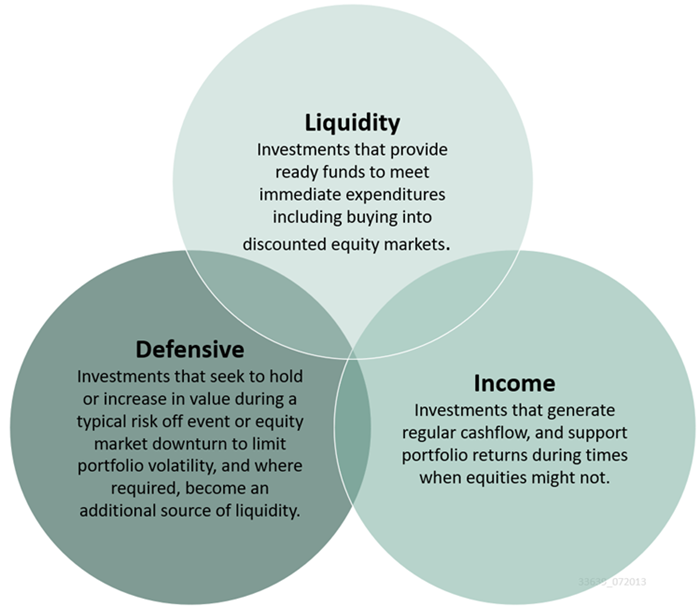

To start, lets disaggregate the defensive part of your portfolio into three objectives:

Source: Minchin Moore Private Wealth

There are a couple of points about these three objectives that can be overlooked. First, no single investment will fulfill all these roles all the time. Second, the three objectives and the investments that meet them aren’t mutually exclusive. There will be some overlap.

Just look at the options. Investors can employ a mixture of cash, term deposits, bank bills, corporate bonds, floating rate securities/hybrids, and fixed term and rate government bonds. Securities can be issued locally or offshore. As well, they can be directly held (such as hybrids and ASX-listed, Australian Commonwealth Government bonds) or via a managed fund or ETF, which is often diversified based on an indexed mix of issued securities.

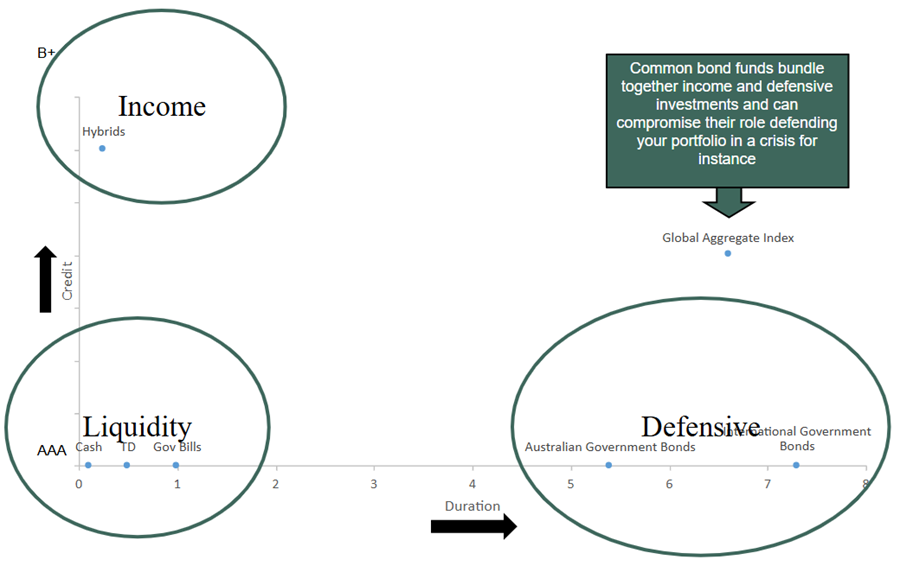

Let’s map the three core objectives to specific investments:

- Defensive – government bonds (Australian and international)

- Income – hybrids and short duration, floating rate credit

- Liquidity – cash and term deposits

Using this framework, you can enable targeted and controlled exposure to the three objectives via each component of the ‘debt investment’ universe. In contrast, a standard diversified, bundled mix such as the global aggregate bond index may not deliver as intended during different market cycles.

Source: Minchin Moore Private Wealth

The problems with bundles

While convenient, bundled bond investments combine both higher yield securities (e.g. less defensive corporate bonds) with more defensive securities (e.g. lower yielding government-issued bonds) in mixes that evolve with issuance.

Further, the characteristics of bonds in the index vary greatly in terms of issuer credit quality, term to maturity, coupon level, and interest type (fixed or floating). The frequent result here is a portfolio whose behaviour changes markedly depending on market conditions and macroeconomic drivers.

This can create some challenges. In an equity downturn, government bonds are often more sought after, while corporate bonds can be less likely to increase in value. Holding these different types of bonds together in a pooled fund can therefore mute the defensive role of the asset class.

Investing in an index also means you lose control of composition. The mix of government and corporate bonds on issue changes over time, as does the interest rate duration of the index.

The equity vs bond correlation debate

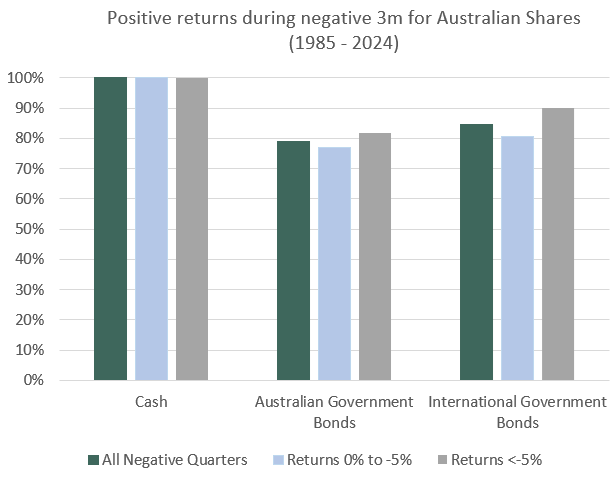

Since 2022 – a year when equities and bonds both experienced negative returns – there has been debate about whether bonds remain an effective defence against equity market volatility. Some observers have even read the last rites for the traditional 60/40 balanced portfolio.

We don’t agree. The fact is special circumstances combined in 2022, including the inflation breakout post-COVID and subsequent aggressive interest rate increases from central banks. In fact, our research shows that over the last 30 years, government bonds have demonstrated positive returns approximately 80% of the time when Australian shares have been down over a three-month period (a period long enough to spark investor angst). Not perfect, sure, and there will be outliers like 2022, but most of the time such as in the current environment, bonds play their role.

Why not just use cash? Because while cash holds it value 100% of the time, its expected returns over a long horizon are lower than for credit and bonds. Furthermore, the expected returns from bonds during periods of equity market drawdowns is higher than cash because bonds have the potential to increase in value whereas cash does not. Of course, you should have a cash allocation (for reasons tied to the liquidity objective), but there is an opportunity cost to holding too much.

Source: Minchin Moore Private Wealth

The case for going direct

For those with larger portfolios and willing to be more hands-on in managing them, holding securities directly can provide additional benefits in the form of lower costs, increased flexibility and more reliable income. Owning domestic securities directly, rather than in a pooled vehicle gives you that control, while avoiding issues related to fund accounting treatments.

With their benefit of yield and franking credits, hybrids are still favoured by many retail investors to meet their income objectives. While it looks almost certain APRA will phase out hybrids, there will be alternatives such as subordinated debt and corporate bonds. No doubt product providers are working in the background to make them more accessible.

For the defensive objective, ASX-listed, Australian Commonwealth Government bonds are available today. Owning a portfolio of these bonds gives you the flexibility to control for duration and tailor this defensive exposure to your needs.

As always, the usual rules of portfolio management apply – have a clear investment program and objective, be well-diversified (including international exposure via a managed investment) and systematically rebalance periodically to keep your portfolio aligned with your program.

As always, the usual rules of portfolio management apply – have a clear investment program and objective, be well-diversified (including international exposure via a managed investment) and systematically rebalance periodically to keep your portfolio aligned with your program.

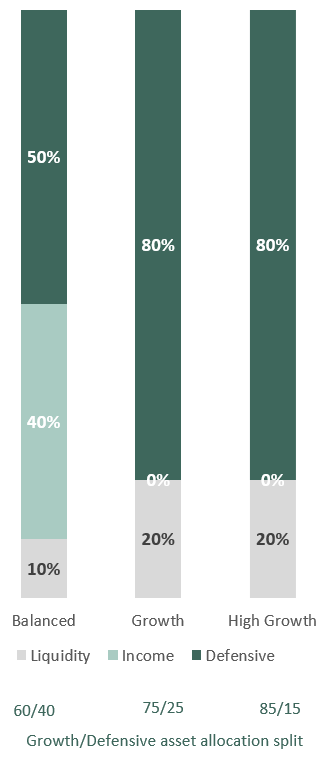

Tailoring allocations to objectives

Combining these objectives in your portfolio should be tailored to reflect your priorities. This graph provides an example of the percentage to allocate to each of the three objectives - for a balanced, growth or high-growth portfolio.

For the 60/40 portfolio, typically held by more risk-averse investors and those relying on cashflow, a blend of defence and income is prioritised.

For investors with 75%+ in growth assets, in contrast, the defensive role in periods of market stress becomes the priority. The composition of these portfolios prioritises compound growth and a longer time-horizon, with less need for cashflow. Liquidity/cash provides additional protection and flexibility when it comes to portfolio rebalancing and investing in equity market downturns.

Summary: The benefits of tailoring

If cash and debt investments play multiple roles, it makes sense to deploy a tailored, flexible approach that maximises your control in this part of your portfolio.

If anything, recent market volatility reminds us of the importance of paying attention to these nuances to optimise your portfolio and outcomes.

To recap, the benefits of this tailored and nuanced approach include:

- Design flexibility, enabling you to better balance the sometimes-competing objectives of liquidity provision, income generation and ensuring a defensive cushion in an equity downturn.

- Taking a disaggregated approach will allow you to more directly control your exposure to key factors, including credit and duration.

- Shifting to direct investing will provide a closer connection to income, increase reliability of cashflows and cut fees. Given the lower expected returns from defensive assets, it is even more important to save every possible basis point.

- More effective and efficient rebalancing of portfolios, particularly during periods of volatility. Rebalancing is critical in ensuring your portfolio doesn’t drift and expose you to greater risk and volatility than what you originally intended.

Jamie Wickham, CFA is a Partner at Minchin Moore Private Wealth and former managing director, Morningstar Australia.