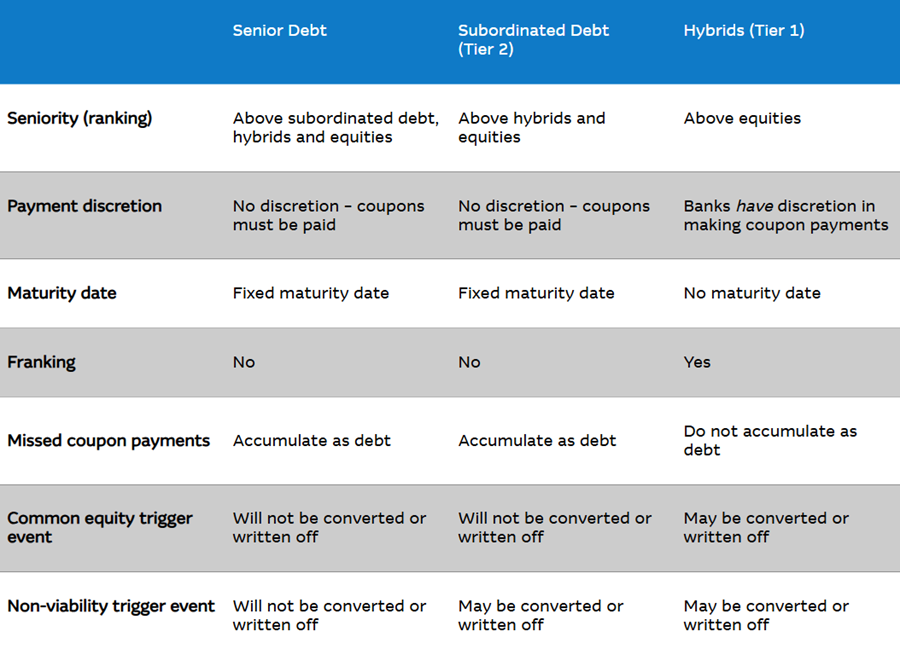

Also known as Tier 2 capital, subordinated debt securities rank below senior debt in terms of repayment priority in the event of insolvency of a company. However, subordinated debt generally takes priority claim of cash flows and assets over hybrid securities and equities in the event of a default.

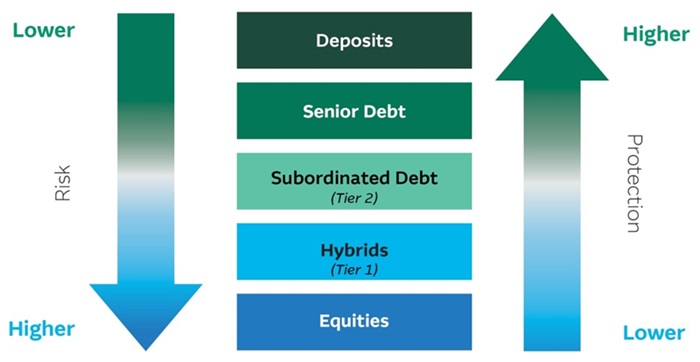

To determine the potential risk or return of any security investment, it’s important to understand where the security sits within the issuer’s capital structure. The higher a security ranks in the capital structure, the lower the risk of a default event and the higher the level of protection compared to other securities further down the capital structure.

For example, here’s a typical capital structure of a financial institution. Most banks and insurers are required to hold a certain amount of capital, which they do through a combination of equities, debt, and deposit holdings.

Subordinated bonds are typically unsecured, meaning they are not backed by specific assets. Their value is tied to the overall creditworthiness of the bond issuer.

What differentiates subordinated debt?

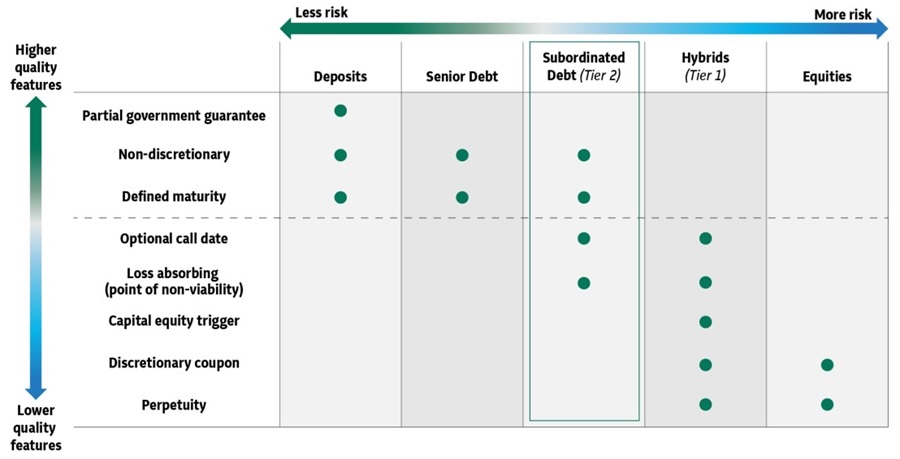

Let’s take a closer look at the different securities making up a financial institution’s capital structure.

Subordinated debt vs. senior debt

The claims of subordinated debt holders rank below that of senior bondholders or depositors. That means if the issuer were to default, subordinated bondholders will only be paid after all obligations to higher ranking creditors are paid. As a result, subordinated bonds generally pay higher interest than senior bonds.

Despite ranking lower on the capital structure hierarchy, subordinated debt has many of the same higher-quality features as senior bonds. They both offer non-discretionary coupons, so interest payments must be made, and have a clearly defined maturity date at which principal must be repaid.

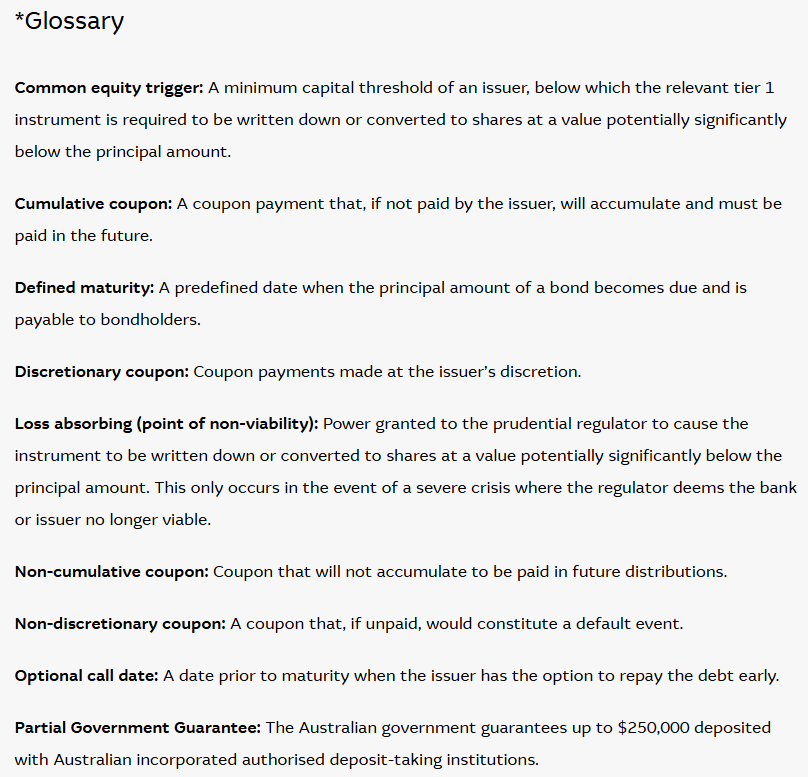

What differentiates subordinated bonds is their ‘loss absorbing’ feature. Subordinated bonds form part of the regulatory capital that banks are required to hold to protect depositors and policyholders from unexpected losses. This means in the event of severe crisis, which the regulator deems a bank to no longer be viable, interest and capital payments owing to subordinated bondholders can be delayed, converted to equity potentially at a significantly lower value than the principal amount or in the worst case written off. To compensate for this risk, subordinated debt can offer a higher yield than senior debt and deposits.

Subordinated debt vs. hybrids

As subordinated bonds rank higher in the capital structure, they provide more protection and lower capital risk than hybrids and equities. They are more akin to debt: interest payments must be met, and the principal repaid at maturity.

Investors have used hybrid securities for decades as a way to access regular floating rate income payments and franking credits.

Both subordinated debt and hybrids have a ‘loss absorbing’ feature as describe above, however in addition to this, hybrid securities also have a capital trigger. This trigger defines a minimum capital threshold of the bond issuer below which these instruments will be immediately written down or converted to equity, resulting in greater capital risk.

Hybrid securities are also listed, making them more accessible for advised and retail investors. However, this doesn’t always translate into greater liquidity, as few institutional players invest in hybrid markets.

With APRA’s requirement to phase out the new issuance of hybrids (or additional tier 1 instruments) by January 2027, banks and issuers are likely to replace hybrids with other forms of capital – like subordinated debt.

Subordinated debt is a liquid investment, but has been harder to access for most investors, outside of institutional investors. Now, investors can gain easier exposure to actively managed subordinated debt via exchange traded funds on stock exchanges, like the ASX.

Why do banks issue subordinated debt?

APRA requires major Australian banks to hold a certain amount of regulatory capital to protect depositors from unforeseen losses. This also limits the potential need for taxpayer money to bail out a failing institution, as we saw in the US and Europe during the global financial crisis. Subordinated debt acts as this buffer. It can absorb potential losses in the event of financial stress, by converting to equities and thereby lowering the debt burden of the company.

Recent regulatory changes requiring hybrids to be phased out will see subordinated debt form an increasingly significant part of the Australian fixed income universe. While it generally offers a higher yield than senior debt or cash, it will become the lowest ranked debt instrument in the capital structure.

So… why invest in subordinated debt?

For investors with holdings of cash, deposits and senior bonds who are willing to take more credit risk, subordinated debt issued by well-known and well capitalised Australian financial institutions can provide access to potentially higher yielding opportunities.

On the other hand, for investors with holdings in high-yielding hybrids or shares who are seeking to reduce credit risk, subordinated debt can play an important defensive role in a diversified portfolio.

Blair Hannon is Head of ETFs, ANZ at Macquarie Asset Management, a sponsor of Firstlinks. This is general information only and does not take account of investment objectives, financial situation or needs of any person and before acting on this information, you should consider whether this information is appropriate for you.

Macquarie offers a Subordinated Debt Active ETF (ASX: MQSD). You can learn more about it here.

Important Information (click to expand): The Target Market Determination (TMD), available at macquarie.com/mam/tmd, includes a description of the class of consumers for whom the Fund is likely to be consistent with their objectives, financial situation and needs.

The Fund(s) mentioned above may have multiple classes of units on issue. A separate class of units is not a separate managed investment scheme.

This information has been prepared by Macquarie Investment Management Australia Limited (ABN 55 092 552 611 AFSL 238321) the issuer and responsible entity of the Fund(s) referred to above. This is general information only and does not take account of investment objectives, financial situation or needs of any person and before acting on this information, you should consider whether this information is appropriate for you. In deciding whether to acquire or continue to hold an investment in a Fund, an investor should consider the product disclosure statement for the relevant class of units in a Fund, if any, and the Website Disclosure Information available at macquarie.com/mam or by contacting us on 1800 814 523.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.