There is no doubt the intentions of Australia’s financial regulator are honourable in the Design and Distribution Obligations (DDO) imposed on product providers. Putting aside the reality that 99% of investors never read these documents and a further level of red tape has been created, DDO is a good step in protecting unsophisticated investors.

But the balance is wrong. Issuers are wary of the rules and unwilling to offer rollovers to investors who have held assets for many years, and wholesale investors who know the risks are denied access to some issues.

It's a yin and yang of a regulation. In Chinese culture, opposing forces should complement each other, but if yin is too strong, yang is weaker. In cracking down on the yin (still, dark, negative) of financial products sold to the wrong people, the yang (energy, bright, positive) of efficient investing and open distribution is compromised. The balance of yin and yang exists in everything, and it needs fixing in these rules.

Background to ASIC’s demands

The Australian Securities and Investments Commission (ASIC) regulates financial services and consumer credit, and is responsible for “promoting a fair, transparent and efficient financial system for all.” Under Regulatory Guide RG274, the DDO requires issuers and distributors to take ‘reasonable steps’ to ensure consumers are receiving products that are likely to be consistent with their objectives, financial situations and needs.

Issuers must provide a Target Market Determination (TMD) and ensure products are consistent with the descriptions in the document. A simple example is that an unsophisticated 90-year-old should not be sold a 10-year derivative exposed to leveraged market volatility. DDO generally covers insurance, asset management, superannuation and derivatives but not MySuper.

ASIC requires products identified as 'complex' to carry a higher level of disclosure in offer documents than traditional products which are more readily understood.

How could reducing the yin of inappropriate products not be a good thing? It's an independent regulator protecting investors, and heaven knows, there are plenty of examples of shysters separating unsuspecting people from their hard-earned savings. So what’s the imbalance between yin and yang?

The downside example of distributing a convertible bond

The most common example where retail investors have suffered from ASIC's policy is the rollover of bank hybrids, which have been commonly held for years by an army of retail investors. ASIC will argue that hybrid structures are complicated and should only be bought by ‘sophisticated’ investors or with financial advice. Banks have decided they cannot offer new hybrids to the general public, even when the issuer is rolling over an existing hybrid that may have been held for five years or more. Retail investors are forced to buy on the ASX after the issue is completed.

A specific example of the heavy hand of ASIC has surfaced during the rollover of a CVC bond which demonstrates the wider implications.

a) Brief background on the transaction

CVC Limited (ASX:CVC) is a listed investment company that deploys capital into real estate, listed and unlisted companies and funds. In 2018, CVC issued a five-year listed convertible note (ASX:CVCG) which is maturing soon, on 22 June 2023. The full terms are described in the 2018 Prospectus in detail but major features are:

- Pays a quarterly floating rate margin of 3.75% over 90-day bank bill rate

- Converts at investor option to CVC shares at $3.40, a 30% premium to the CVC share price at the time of issue

- Ranks unsecured but ahead of shareholders

- Protected by a gearing covenant preventing the Gearing Ratio (Liabilities/Liabilities + Equity) exceeding 40%.

I have held this investment in my SMSF for five years. While this is not a recommendation, the two main reasons I was comfortable with it are:

- The gearing covenant, with $2.50 of assets for every $1 of debt (including the convertible note) and rights to the assets for CVCG holders rank above shareholders but behind secured debt.

- The floating rate exposure and decent margin, currently paying around 7.3%.

I did not place any value on the share conversion option, but it was a potential bonus.

While the transaction came with a long offer document, and no doubt the intricacies would be essential in the event of a default, I was satisfied with a modest exposure. I am not attempting to review the full document here, just using this example.

Clearly, the structure is not as simple as, say, a bank term deposit, and investors are paid for the added risk.

On 29 March 2023, CVC announced the successful completion of a bookbuild arranged by E&P Corporate Advisory for a replacement transaction, $31.1 million of CVC Notes 2 (ASX:CVCHA) with a margin set at 4.75% per annum and a new maturity date of 31 March 2026. CVCHA will replace CVCG.

b) ASIC changes the target market appropriately

ASIC issued an interim stop order on 30 March 2023 preventing the distribution of CVC Notes 2. After the target market was significantly narrowed, the order was lifted on 4 April 2023 to allow the transaction to proceed. ASIC felt that the target market in the original TMD was too broad for higher-risk unsecured debt. ASIC said:

“For example, the original TMD indicated that retail investors intending to use CVC Notes 2 as core component (25-75% of investable assets) were potentially in the target market. This has been reduced to 3% in the revised TMD. The original TMD also indicated that retail investors with a ‘medium’ risk profile were potentially in the target market. These investors are now excluded from the target market.

The original TMD defined the target market based on features that CVC Notes 2 does not provide. For example, the original TMD indicated that retail investors needing to withdraw money frequently were in the target market despite CVC Notes 2 not providing redemption rights for approximately three years. It also indicated that retail investors seeking a capital preservation product were in the target market. CVC has revised the TMD to exclude these investors from the target market.”

ASIC has done a good job here, and such directions to issuers are common. ASIC has now issued 28 stop orders due to its perception of deficiencies in TMDs, 23 of which have been lifted after suitable changes.

While many ‘retail’ investors would not find these notes difficult to understand, they should certainly not represent up to 75% of a ‘core component’. Investors should assume there is little or no liquidity and there is no guarantee of capital. CVC and its advisers overstepped the mark with these claims, and ASIC acted appropriately.

c) What are the distribution problems?

Despite the prospectus for the new issue describing at length the reinvestment opportunity, many existing investors were effectively ruled out of the rollover. Here is the chain of events:

1. On 16 March 2023, CVC launched its ‘CVC Notes 2 Offer and CVCG Reinvestment Offer’ including emailing all existing investors in CVCG. It said:

“The Offer under the Prospectus is comprised of a Reinvestment Offer, under which Eligible CVCG Holders, may elect to exchange their CVCG for CVC Notes 2 and a New Money Offer, which will allow clients of Brokers to apply to make a new investment in CVC Notes 2.”

Under ‘How to apply’, existing holders were informed:

“All Applications must be submitted through a Broker and you should contact your Broker for instructions on how to apply once the Offer opens.”

The Reinvestment Offer stated that any existing CVCG Holders were invited to request some or all their CVCG Notes be exchanged for CVC Notes 2.

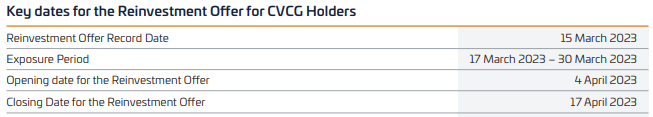

Under the Replacement Prospectus issued as a result of the ASIC delay, the Opening Date for the Reinvestment Offer was 4 April 2023 and Closing Date 17 April 2023.

2. On 5 April 2023, I contacted my main broker, CommSec, where I am qualified as a Wholesale Investor and serviced by their CommSec One team for premium clients. Despite the instructions clearly saying to submit applications via a broker, CommSec advised:

“Unfortunately Commsec was not a participant of this deal and as such we are unable to accept your interest in the offer.”

3. I rang the Arranger at E&P immediately and was informed that the transaction had already been completed. I told him that the Reinvestment Offer had only opened the day before and the offer documents said it ran to 17 April, almost two more weeks. He said the opening and closing dates were in the prospectus as a formality and the issue was placed and closed.

Despite the facts that:

- I had held the maturing investment, CVCG, for five years and was offered the opportunity to reinvest in writing.

- I followed the instructions by contacting my broker the day after the offer opened.

- I qualify as a wholesale investor.

… I am not able to participate in this offer and the person at E&P offered no alternative access method.

As notes such as CVCG trade infrequently and liquidity is poor, it’s likely that many existing investors are buy-and-hold and simply treating the investment as a long-term bond. The offer structure allowed E&P to restrict distribution to its own clients. Is this what ASIC wants?

Many people have similar experiences with hybrids. For example, in 2022, when ANZ Bank replaced its Series 2 with Series 7, it advised:

"The Offer period is expected to open on 23 February 2022. The Reinvestment Offer closes at 5.00pm AEDT on 15 March 2022 and the New Money Offer closes at 10.00am AEDT on 22 March 2022."

But then ANZ required every investor to apply through a broker, who advised even before the offer was open:

"Both new money and rollover applications have closed for ANZ Capital Notes 7 (ANZPE).”

The warning for any investor receiving these documents is that the timetable does not mean what it says.

Freedom to invest via the ASX

Where a note, fund, bond or similar is listed on the ASX, issuers are required to produce a TMD but there is no obligation to check whether anyone has read it or received financial advice. In fact, even if the TMD becomes inappropriate, the issuer does nothing to check if transactions are consistent with the TMD (although in theory, they should monitor the conduct of brokers but that’s almost impossible).

So the investors who are effectively barred from participating in a reinvestment can wait until the day of listing or any other trading day, and buy on market with no further checks. It no longer matters how complicated or suitable the note is, all the checks are waived through.

The consequence is no less risk for the investor but higher costs through brokerage and a premium now in the price.

What does this mean for investors?

ASIC has created an imbalance in the yin and yang despite the laudable desire to protect unsophisticated investors.

Whereas the rules were designed so that retail investors without a financial adviser cannot be targeted for new or rollover transactions, the operation of RG274 closes rollovers even for existing wholesale investors without a direct relationship with the sponsoring broker or arranger.

And then as if the protections no long matter, anyone can buy the same investments on market without consulting anyone and without checks.

It’s difficult to see what this achieves other than allowing an arranger to control the distribution of a reinvestment. ASIC should consider:

1. An exception from DDO for existing investors to facilitate rollovers. Until DDO was introduced, rolling an existing investment into its replacement was a simple matter of responding to an online offer by the issuer.

2. Where a product is listed that has been subject to an ASIC stop order due to its complexity, brokers should give new investors a warning (online or in person).

Graham Hand is Editor-at-Large for Firstlinks. This article is general information based on an understanding of the regulations and not a recommendation for any product. Investors should take financial advice before considering any investment described in this article.