Editor's introduction: Banks are the major issuers of hybrids in Australia, and each is considering the implications of DDO regulations (explained below) on hybrid distribution. For example, ANZ Bank has decided it cannot offer hybrids to the general public and some investors may find it difficult to access new issues. ANZ sent a note to holders of its Series 2 that will be replaced by Series 7, advising:

"The Offer period is expected to open on 23 February 2022. The Reinvestment Offer closes at 5.00pm AEDT on 15 March 2022 and the New Money Offer closes at 10.00am AEDT on 22 March 2022."

... but also saying any applicant must apply through a broker. When I contacted my broker on 18 February, he replied:

"Both new money and rollover applications have closed for ANZ Capital Notes 7 (ANZPE). This was open to Sophisticated Investors (must be registered as SI) from Tuesday midday until yesterday 4pm (new money) and 12pm today (rollovers). Unfortunately bids/rollover requests for these notes are closed."

As far as my broker was concerned, the whole thing was finished even before the new offer opened while ANZ said it would close on 15 March. This is a big change in distribution.

This article explains some potential implications.

***

DDO stands for Design and Distribution Obligations, and it means that certain financial products can only be sold by initial public offering or IPO to appropriate consumers. For bank hybrid IPOs, this means wholesale investors or retail investors who receive the appropriate level of financial advice. We assume there will be material negative consequences for issuers who breach the rules by issuing to inappropriate investors.

So how does this affect banks and hybrids?

From ASIC’s perspective, investors in hybrid IPOs have traditionally fallen into five categories:

- Wholesale investors

- Investors who receive a high level of financial advice

- Investors who receive a lower level of financial advice

- Investors who receive no financial advice or are unadvised

- Investors who apply after receiving a shareholder offer

The last three categories will most likely be deemed inappropriate under DDO guidelines.

Offers to shareholders/hybrid holders/unadvised Investors who elect to rollover

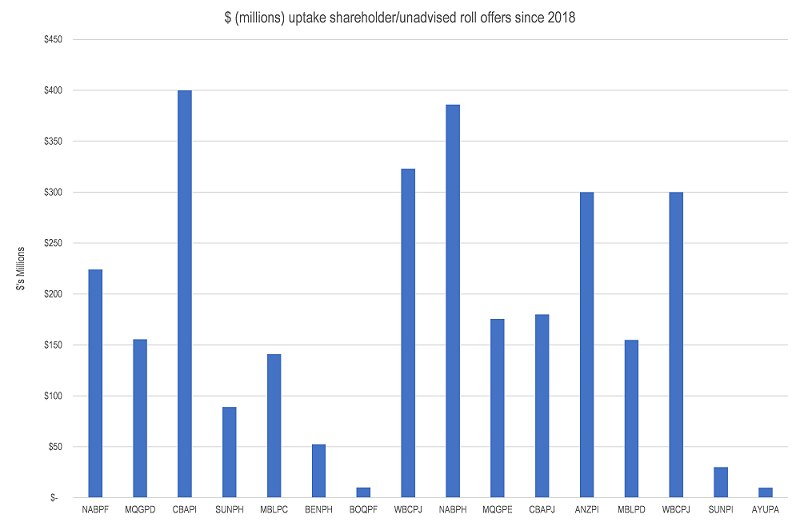

The typical bank hybrid issuance process is usually a bookbuild conducted by brokers. The investor cohort includes potential new investors and existing hybrid security holders that use an adviser and wish to roll their investment. Then there is a post bookbuild process which includes shareholders and unadvised security holders who did not participate in the bookbuild. This cohort is not immaterial. The chart below shows the level of uptake in shareholder/unadvised security holder offers since 2018.

For the average major bank issue, the shareholder/unadvised cohort constituted just over $300 million or typically 18% of the total issue size. Bank treasurers loved this method of raising money because they did not pay stamping (brokerage) fees.

It looks like this category of offer type is dead. There is no way that the issuer can determine if the hybrid is appropriate for the investor. ANZ's new issue includes no unadvised existing security holder offer.

Advised Investors with inappropriate levels of financial advice

This category is trickier to analyse. Different advisers and issuers will have different thresholds as to what is required to provide a recommendation. We understand that up to 30% of demand for hybrid issues for some advisers originates from investors who will be deemed to be not appropriate because they were not receiving the necessary level of financial advice.

We estimate that the 'roll' portion of bookbuilds is around 30%-50% of the new issue and unless these investors are receiving personal advice, they won’t be able to take part in the new issue.

That's 20% shortfall plus up to 30% shortfall ... maybe 50% of previous investors are cut out of IPOs? No one actually knows as this is new ground for everybody, but there will certainly be a smaller pool of investors who can buy new issues.

What does the demand/supply outlook look like?

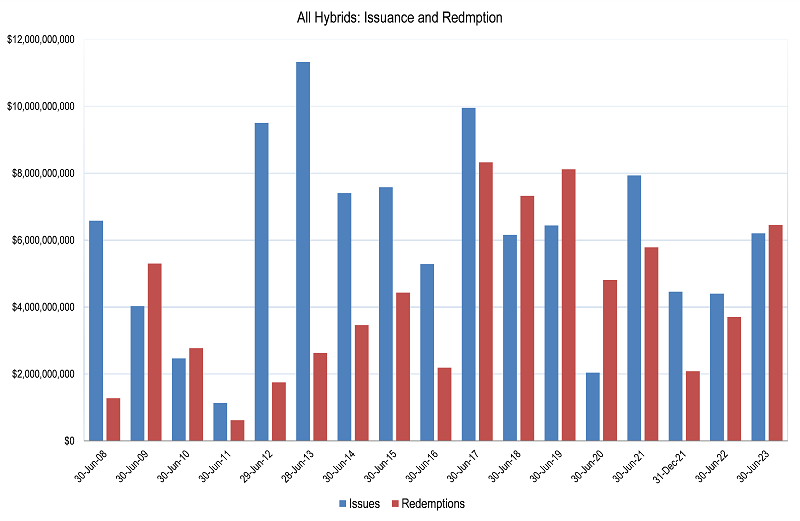

The chart below shows issuance and maturities for the market in aggregate (which we calculate by considering the banks' current and targeted AT1/hybrid ratios and issuance/redemptions). We’ve also assumed in our 2022 and 2023 forecasts growth in risk weighted assets or RWA which will result in increased AT1 issuance (last year RWA grew by $100 billion resulting in a pro forma $2 billion of additional AT1 issuance).

Prima facie, it's not a big year of net demand for either the remainder of this year or next year, but it’s still a chunky gross amount to issue given that up to 50% of the market may have disappeared.

Why this might not be as bad as these numbers suggest

There are some potential mitigating factors:

- Maybe some of the investors who do not receive personal advice or are investor in the shareholder/non-advised rollover categories are classified as wholesale investors (it’s relatively easy nowadays to be a wholesale investor) in which case they can invest as long as the qualification is held by the broker.

- Typically, issues are heavily oversubscribed and that might be enough to fill any shortfalls. We’re sceptical about this as most oversubscription is an attempt to gain higher allocations.

- All investors, including those locked out of the IPO process, can buy the same hybrid in the secondary market on the first day of trading. This may encourage ‘wholesalers’ who buy at IPO (if the yield is sufficiently good enough) and sell on the secondary market for a profit on day one. Of course, the secondary yield is unlikely to be as good as primary.

So, what happens now?

Our inclination is that banks will need to issue at a higher margin than they did prior to DDO, either to ensure sufficient demand from qualified investors or to encourage ‘wholesalers’.

We'll soon find out. ANZ and CBA both have around $1.6 billion in issues to refinance in March 2022 and both don’t have a lot of slack in terms of their capital positions. Neither bank is positioned to abandon the issues should there be insufficient demand.

Overall, we think hybrids at IPO will be cheaper. Spread margins and return outcomes will be determined by long-run supply and demand but there may be issuance spikes.

What does this mean for investors?

For some, nothing at all. They can still bid in IPOs and elect to roll existing issues. For others, it’s a big deal. They won’t be able to roll existing investments or buy new issues. There are alternatives. They can buy on the secondary market or (sales plug following) invest in a managed fund which provides a diversified and managed exposure to hybrids. Or they can wait for the redemption amount and invest in cash or other investments.

Norman Derham is Executive Director of Elstree Investment Management, a boutique fixed income fund manager. This article is general information and does not consider the circumstances of any individual investor. Elstree's listed hybrid fund trades under ticker EHF1.