On 21 September, the Australian Prudential Regulation Authority (APRA) posted a media release seeking feedback on improving the effectiveness of Additional Tier 1 (AT1) capital in a potential bank stress scenario. This has come about in the wake of the Credit Suisse hybrid write-off in Switzerland, as APRA is “concerned that AT1 capital instruments would not operate as originally intended due to certain design features and market practices”. APRA noted that “AT1 has not been effective in absorbing losses” before the point of failure noting that Credit Suisse continued to make discretionary hybrid distributions “despite incurring sustained losses and facing an uncertain profitability outlook”.

AT1 hybrids are perpetual and convertible bonds that pay discretionary, non-cumulative coupons to investors, designed to protect depositors and senior creditors where the bank or insurer (the issuer) experiences severe stress through conversion to equity or complete write off. These securities, as well as common equity and Tier 2 instruments, form the regulatory loss-absorbing capital of a bank. Despite the complexity of these instruments, the domestic AT1 investor base is not dominated by institutional investors and almost entirely listed on the ASX. The typical buyer, in our view, is clients of private wealth and private banking firms.

Three possible options

APRA is exploring three potential options to make AT1 capital more effective in absorbing losses:

- changing the design features to ensure AT1 capital absorbs losses earlier in a stressed scenario,

- making changes to the level or mix of regulatory capital requirements to reduce the reliance on AT1 capital, and/or

- shifting the AT1 investor base away from domestic retail investors.

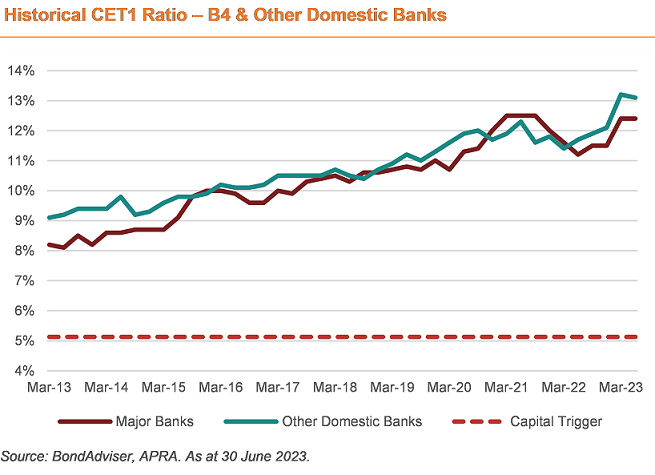

The first option would likely result in raising the capital trigger level that results in a conversion or write-off of AT1 capital, and/or limiting distributions where banks are under duress. This is currently where the Common Equity Tier 1 (CET1) ratio reaches 5.125%, in-line with international guidance and standards. Noting some countries like the United Kingdom and China have “high trigger” ratios of 7%.

Raising this capital trigger would make AT1 hybrids inherently riskier, and therefore primary issuance under this new policy would require higher credit spreads given the higher likelihood of conversion or write off. Given the major bank AT1 capital is rated BBB-, this would likely see a credit rating downgrade to sub-investment grade, which may temper demand from institutional investors.

We do not see a downgrade of the security rating as being material to the traded (current hybrids) performance, however a higher trigger will require higher spreads. Given Australian Banks have maintained CET1 ratios of greater than 8% for more than a decade, we would likely be opportunistic in allocating at higher spreads due to higher triggers.

The second potential option is reducing the reliance on AT1 capital as a proportion of total regulatory capital. This can be done by either :

- reducing the minimum amount of AT1 capital (currently 1.5% of RWA), and potentially increasing other capital requirements (CET1, or total capital via an increase in the proportion of Tier 2 capital), or

- capping the maximum amount of capital that is eligible to be counted as AT1 – with excess to effectively be very expensive senior funding. The latter seems the more rational, but it is complicated.

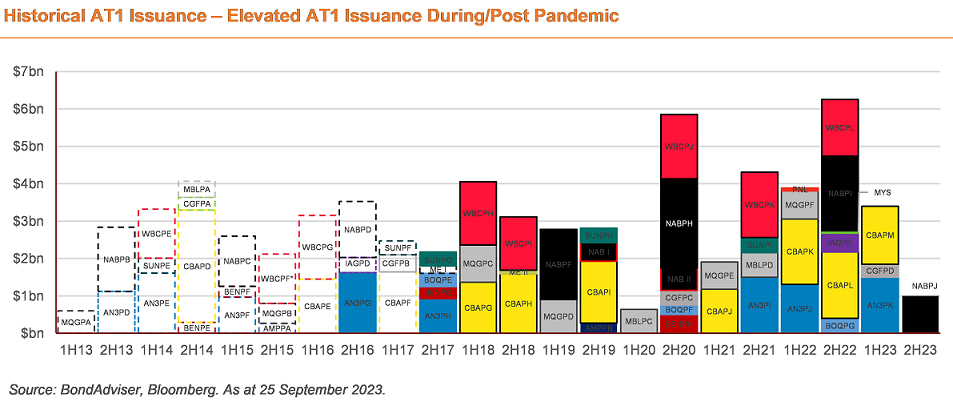

The third option proposed by APRA is to hinder access from retail investors (potentially via minimum parcel sizes), effectively limiting investment to wholesale investors. Under this option, we would expect more issuers to come to market to issue AT1 capital before any introduction of retail limitations given (1) they can capture more market demand given retail would be locked out from investment once any changes are implemented, and (2) to issue AT1 hybrids at a lower cost of funding, given domestic wholesale AT1s have historically traded with higher spreads (~50bps) to more liquid ASX-listed AT1s. Tenors would likely also be longer to lock in lower spreads.

Demand for hybrids from retail has been hot over recent years, and this demand is only growing as coupon income has materially risen (the 3mBBSW increase alone has roughly increased hybrid income by $1.7 billion p.a. to local investors) and some of that needs to be reinvested. This might see increased demand for ASX-listed bonds, as well as the secondary AT1 market, as retail investors crowd in for the last dance. This would make the perfect environment for issuers to come to market with lower spreads and longer tenors before the potential new policy is implemented.

Demand may also turn to Listed Investment Trusts (LITs) which went out of fashion after numerous domestic LITs started trading at material discounts to NAV. However, this will take time given there is still more than $40 billion locked up in current ASX-listed AT1s.

The degree of change is key

As a general comment, APRA is likely to receive responses to this consultative process that points out the reality that retail investors hold CET1 (ordinary shares) of the banks in vastly larger volumes than AT1 hybrids and so any significant event, however unlikely, that requires absorbing losses through equity will still impact materially on retail investors, and earlier than a scenario involving the absorption of AT1.

Indeed, the likelihood of an event requiring AT1 absorption has been made remarkably remote by the solid actions of APRA over its 25-year history, and particularly in the last 10 years via bolstering bank requirements in capitalisation, funding, and liquidity.

Any of the above potential outcomes are likely to change the price and volume dynamics for AT1 hybrid issues assuming one or more are implemented but the extent of these dynamics will depend ultimately on the outcome of the consultative period which ends on 15 November 2023, and APRA’s response to this process.

Charlie Callan, CFA is an Associate Director, and Ben Haseler, Ravi Reddy, and Christian Belvedere are Analysts at BondAdviser. This article is general ionformatio and does not consider the circumstances of any investor.