Warren Buffett is widely considered the greatest investor of all time so it’s no wonder that his every move is closely followed by markets. On August 3, Buffett made waves by revealing he’d sold 49% of his stake in Apple shares, worth US$88 billion, in the second quarter. After a smaller sell-down of the stock in the first quarter, it means Buffett has reduced his stake in Apple by nearly 56% in 2024. While the second quarter sale of Apple shares wasn’t a total surprise, the extent of it certainly was.

Naturally, Buffett’s move has generated many questions from investors. About the future of Apple, about whether Buffett is calling a peak for technology stocks, and about whether he’s worried that the broader market is looking toppy. That the revelation happened during a dip in markets put investors further on edge.

Here, I’m going to explore the likely reasons for Buffett’s sale, why he’s changed his mind on Apple, and some of the key lessons for investors.

Details of the sale that shook markets

In its second quarter earnings release, Buffett’s conglomerate, Berkshire Hathaway, announced that it’d sold about 390 million Apples shares in the quarter, on top of the 115 million shares it offloaded from January to March. Berkshire said it still owned around 400 million shares, worth US$84 billion as of June 30.

Apple remains Berkshire’s largest stock holding. It’s close to 30% of the stock portfolio, more than double the second largest holding, Bank of America – which it’s also been selling. At its peak, Apple was more than 50% of the stock portfolio.

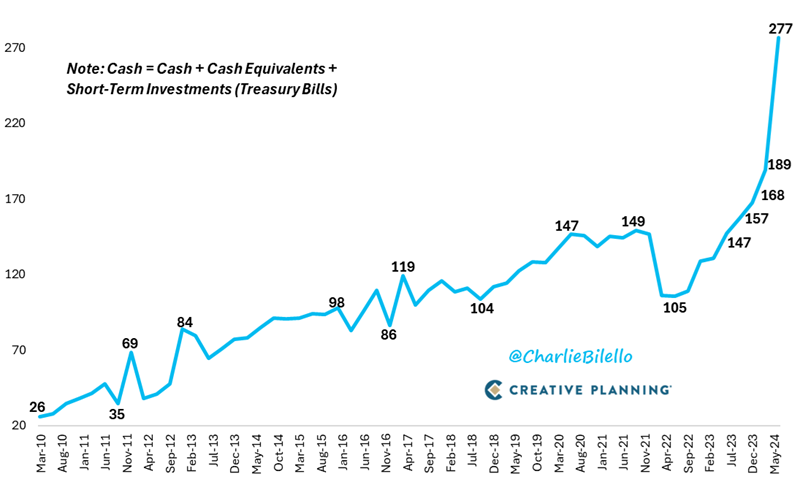

The sale means Buffett’s company is gushing with cash, totalling US$277 billion. Berkshire is holding 25% of its assets in cash, the highest percentage since 2004. The average cash position versus assets across its history is 14%.

Figure 1: Berkshire Hathaway’s Cash Pile (billions)

A large chunk of the cash is in Treasuries. The company held US$235 billion in short-term US Treasury Bills at the end of the second quarter, up 81% from the end of last year. Staggeringly, Berkshire now owns more Treasury Bills than the US Federal Reserve.

From effusive praise to selling

Buffett’s sale of Apple caught investors off-guard for two reasons:

- Buffett has said he likes to buy stocks and hold them forever. The share sale runs counter to that.

- Buffett has praised Apple on numerous occasions since owning a stake in the company.

On the first point, it’s intriguing that Buffett has previously named stocks he’d like to hold “indefinitely” – and Apple hasn’t been among them. Instead, he’s nominated Coca-Cola, American Express, and Occidental Petroleum as companies that he wants to own forever.

That said, Buffett has gone out of his way to talk up Apple since first purchasing the stock in 2016. After the initial purchase, he said he liked the stock and the company’s “sticky” product, although he didn’t use it.

In 2018, Buffett said Apple users are “very, very, very locked in, at least psychologically and mentally” to the product and the ecosystem.

“Apple has an extraordinary consumer franchise,” he said.

Last year, when asked how Berkshire can defend having Apple make up so much of its public portfolio, Buffett said, “It just happens to be a better business than any we own.” He also hailed CEO Tim Cook as one of the “best managers in the world.”

One of the reasons that Buffett has liked Cook’s management is that Apple has been consistent buyer of its own shares.

“When I buy Apple, I know that Apple is going to repurchase a lot of shares,” Buffett said in 2018.

And he’s noted how buybacks result in getting a bigger stake in the company without buying more shares.

“The math of repurchases grinds away slowly, but can be powerful over time,” Buffett said in 2021.

Buffett’s kind words for Apple even extended to May this year at Berkshire’s annual meeting. He declared that two of his long-time prized investments, Coca-Cola and American Express, were "wonderful" businesses, but lauded Apple as "an even better one."

At the same meeting, when asked why he’d sold some Apple stock during the first quarter, Buffett alluded to tax rates as a reason to take profits. He said selling now would benefit Berkshire shareholders should the U.S. raise capital gains taxes in the future “to plug a climbing fiscal deficit.”

Why has Buffett changed his mind?

The big question is: why is Buffett selling Apple now? The’s been much commentary about how the move indicates that Buffett is calling a market top. In effect, that markets are expensive and it’s time to bail.

Yet, this seems unlikely given Buffett has repeatedly said that he doesn’t believe in timing markets. He’s always focused on stocks, not markets.

Yet his reference to taxes as a reason to sell also doesn’t make sense. While it may have been a small part in the decision, it surely couldn’t have played a major role. More likely, it was to give as an explanation, so he didn’t have to reveal the true reasons for the sale.

What were the real reasons, then? I think there are four probable factors behind the decision:

1. Apple is expensive

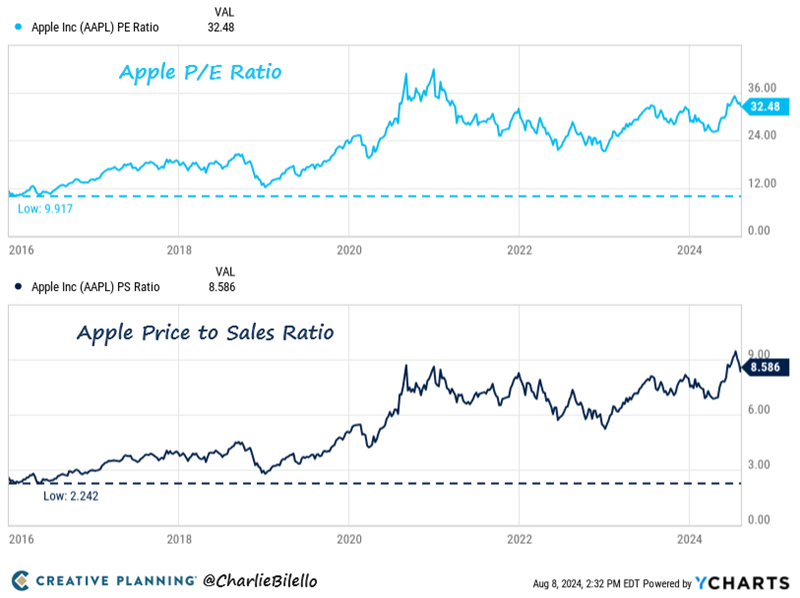

By any measure, Apple is priced for perfection. It trades at 32x earnings, compared to 10x when Buffett started buying it in 2016. The price to sales ratio has also moved from 2x to 9x – the highest in the company’s history.

Figure 2: Apple Inc. Price to Earnings and Price to Sales Ratios

Buffett remains a value investor and a believer in purchasing stocks at a price that offers a “margin of safety”. Perhaps, Apple no longer offers that margin of safety.

And perhaps, Buffett has learned his lesson from not selling another of his beloved shares, Coca-Cola, in 1998. Back then, Coke’s stock reached more than 50x earnings and 11x sales as the market exploded higher. As markets came back to earth, the shares didn’t reach their 1998 highs again until 16 years later.

Buffett has since said that he regrets not selling Coca-Cola in 1998.

“Coca Cola is a fabulous company that was selling at a silly price… You can definitely fault me for not selling the stock. I always thought it was a wonderful business, but clearly at 50 times earnings it was a silly price.” - Buffett, 2006 annual meeting

2. No growth

While valuations may have been one reason for Buffett’s selling, a deterioration in Apple’s earnings power may have been another. Between 2010 and 2020, Apple revenue grew at a 15.5% average annual rate. During the pandemic, Apple enjoyed a surge in revenue — growing at a nearly 20% annual rate in 2021 and 2022. However, between 2022 and March 2024, Apple’s revenue declined almost every quarter. Apple’s revenue broke that run by rising 5% in the June-2024 ending quarter – still anemic by most measures. Unless AI can kickstart growth, Apple pricey stock doesn’t make a lot of sense.

3. Lost faith in management

One reason for Buffett selling that I haven’t seen in any commentary is that he may have lost faith in Apple’s CEO. Buffett has said that he looks closely at leaders and how they allocate capital. Previously, he’s lambasted CEOs who’ve bought back company stock when the shares were expensive.

While Buffett has applauded Apple’s large buybacks in the past, he’s probably less happy with continued buybacks now. Why? Because buying back shares when the company was cheap made sense. With the company now expensive, it makes much less sense.

4. Money is safer in Treasuries

It’s clear that Buffett assesses the value of stocks against other asset classes. By buying a gargantuan amount of Treasury Bills yielding more than 5%, he clearly believes that these Bills offer the prospect of a better risk-adjusted return than Apple stock.

Where it leaves Berkshire Hathaway

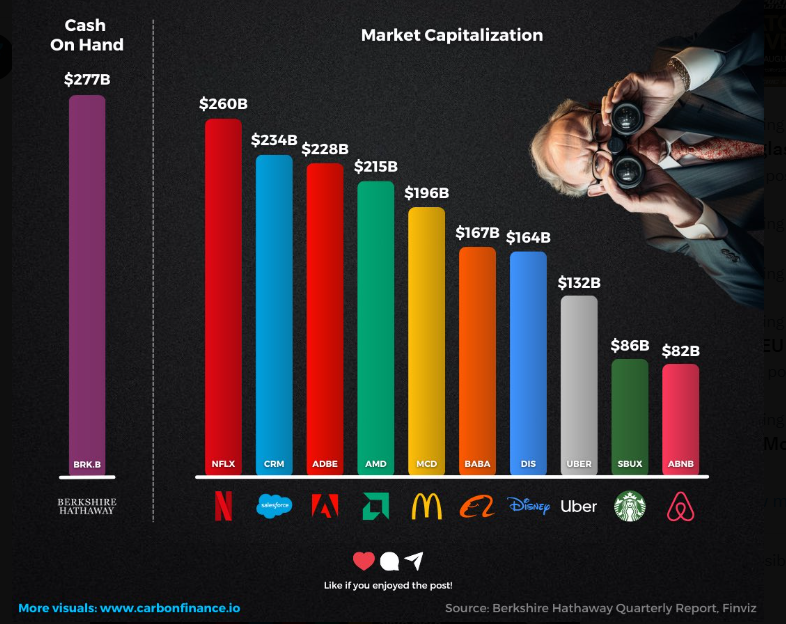

Intrigue has already started into what Buffett will eventually do with his US$277 billion cash pile. The below chart puts it into context.

Figure 3: Warren Buffet’s $277 billion Cash Pile

Buffett has said for many years that he’s seeking an “elephant” of a deal to put Berkshire’s cash to work. That need is greater after the Apple sale.

Taking over a whole company is an obvious prospect. Taking minority positions in stocks is becoming much harder.

Buffett has warned Berkshire shareholders that the size of the company will limit outperformance going forward. Firstlinks contributor, Ashley Owen, wrote a fabulous article last year on how Buffett lost his edge 20 years ago for the following reasons:

- Berkshire has become too large, and it can’t deploy the huge sums effectively without moving markets.

- It has too much cash, which is largely the result of the first problem.

Ashley has a point.

Buybacks are an option for Buffett, though at these prices, it’s less attractive.

As for the possibility of dividends, it seems doubtful. Buffett probably believes keeping the money in Treasury Bills inside the company is better than giving it to shareholders who may turn around, after the government has taxed their dividends, and invest it in Treasuries anyway, or worse, in an overvalued share market.

Takeaways for investors

Here are the five lessons that I think investors can take away from Buffett’s sale of Apple shares:

- It’s ok to change your mind. Think about how hard it must have been for Buffett to lavishly praise a stock and then later start selling it. Most people when taking a strong stand initially would dig in and find reasons to keep the stock, even if valuations got out of hand. To his credit, Buffett didn’t.

- Price matters, always. In a market like today’s, there are plenty of people who are “buy quality stocks no matter what the price” type investors. Buffett has stayed true to his value investing roots. For him, price always matters.

- Focus on stocks, not the market. Buffett doesn’t get caught up in the noise of markets. He focuses on stocks and their fundamentals, and that’s it.

- Weigh stocks against values of other asset classes. The return versus risk of stocks should always be assessed against other assets. Buffett thinks Treasuries offering 5% yield are better value than Apple stock.

- Be patient. Buffett has been sitting on a lot of cash for a while now, and he’s endlessly patient, waiting for the right investment opportunity.

James Gruber is the Editor of Firstlinks.