UniSuper’s John Pearce is one of the most respected fund managers in the country. When he speaks, people listen.

In a recent update to members, he outlined his thoughts on 2024 and what lies ahead.

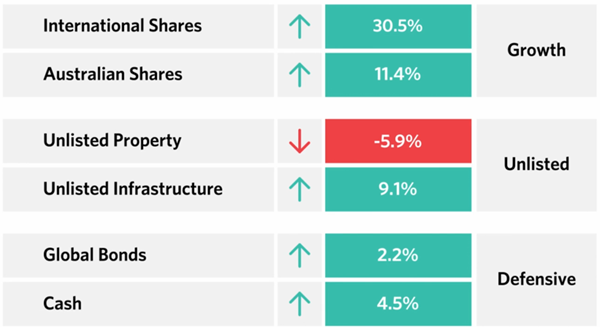

Pearce says the optimal strategy for last year would have been threefold:

- Owning growth over defensive assets

- Having international assets, especially US tech

- Favouring listed over unlisted assets.

Figure 1: 2024 market performance

12 months to 31 December 2024. Past performance is not an indicator of future performance. Source: UniSuper.

The thing that strikes your author about this chart is the underperformance of unlisted assets. We’ve heard a lot of noise about the superior performance of unlisted over listed assets, yet this wasn’t the case last year.

To his credit, Pearce had flagged in late 2023 that unlisted assets were looking pricey, and that may be part of the reason for them lagging listed assets last year.

Also to his credit, Pearce was reasonably bullish on markets at the beginning of 2024.

These calls helped UniSuper’s funds last year. Its Balanced fund performed better than the peer average, returning 11.72% for the year, while its Sustainable Balanced option was among the best in class, returning 15.25%. The reason for the latter was it overweighting listed assets, and especially US tech.

Pearce notes that index funds outperformed most super funds over the past year. Why? Pearce says that’s simple: they didn’t own unlisted assets.

He says that while index funds performed well in 2024, it’s not always the case. Over a 10-year period, UniSuper’s Balanced and Sustainable Balanced options have handily beaten all the index funds, with annual returns of 7.92% and 7.79% respectively.

What’s moving markets now?

Pearce gave his take on the two big issues moving markets right now: DeepSeek and Trump. On DeepSeek, he admitted he hadn’t heard of it until a few weeks ago.

Put simply, DeepSeek is the Chinese equivalent of ChatGPT. The big news has been that its engineers been able train DeepSeek at a cost of just US$6.5 million. That compares to ChatGPT’s US$100 billion and Meta’s equivalent, Llama, at US$500 billion.

The market freaked out because it was afraid that the big US tech companies were blowing a lot of money on Nvidia chips and data centres and the like.

Fast forward to today, and the market seems more sanguine about DeepSeek. The US tech companies have reconfirmed that they’ll be spending hundreds of billions to continue to develop AI models.

Pearce doesn’t say whether this is prudent or not, but is bullish on AI’s implications for business, as “cheaper technology is the single best way for businesses to improve their productivity.”

He suggests that while AI’s benefits are overstated in the short term, they’re understated in the long term.

Turning to Trump, Pearce says he was elected to move fast and break things, and that’s exactly what he’s doing. Despite a flurry of daily announcements, the key one that Pearce is keeping an eye on is tariffs. He says that if it ends in a trade war, “it is going to be bad for the economy, bad for business, and bad for share markets.” Pearce hopes that cooler heads prevail on the issue.

The crystal ball for 2025

To this year and Pearce jokingly says that the year of the snake has not been auspicious for markets in the past. On the other hand, the fifth year of each decade has produced the best returns through history.

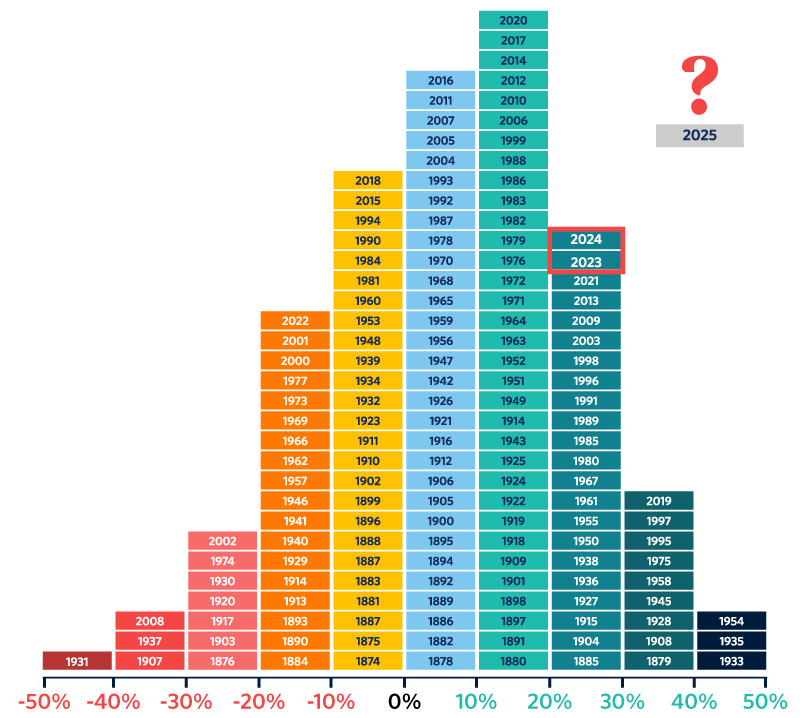

More seriously, he notes that two years in a row of +20% returns for the S&P 500 is rare, and a third year of such returns is rarer still.

Figure 2: 151 years of S&P500 returns

Source: Global Forecast Series, Unisuper

In fact, three consecutive years of +20% returns have happened just once – when the US economy was recovering from a deep recession in the 1990s.

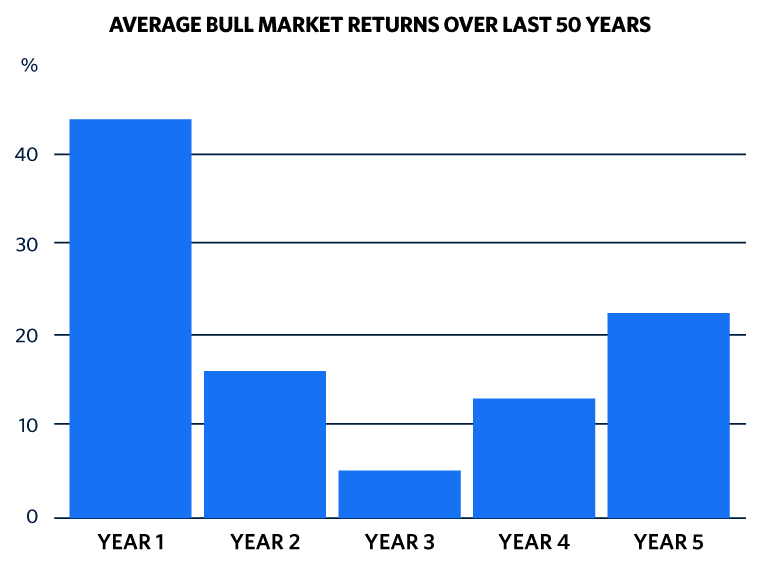

Pearce says that the third year of bull markets have historically delivered subdued returns, and he predicts a flat year for stocks in 2025.

Figure 3: Bull market third-year returns have been the lowest

Source: BMO Capital Markets Investment Strategy Group, Factset, Unisuper

He believes markets are expensive without being in bubble territory. The US market is at about a 20% premium on a price-to-earnings ratio basis. Meanwhile, Australia is at a 10% premium.

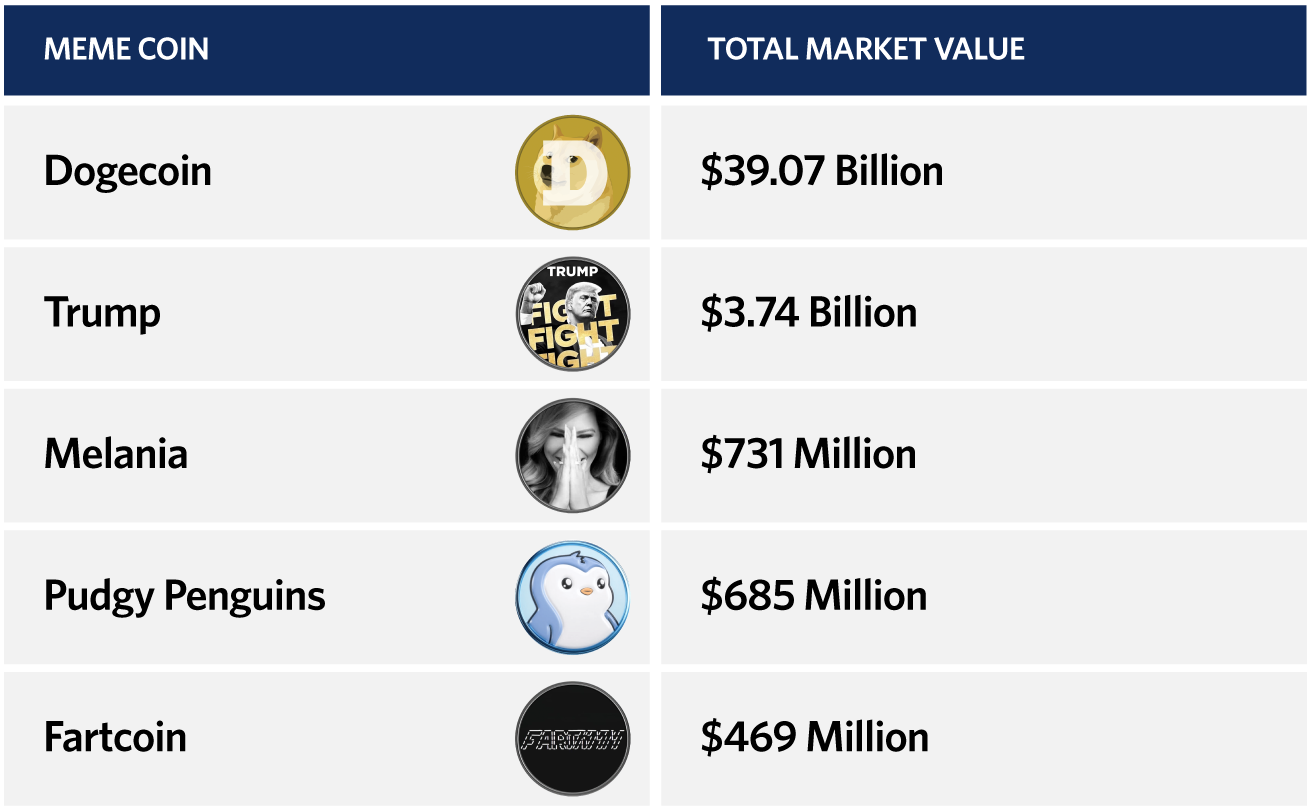

Where he does see some irrational exuberance is in cryptocurrency. He points out that Dogecoin, now valued at US$40 billion, was set up as a joke by its founders.

He views the broader crypto market as a joke gone too far, and “our members' life savings will not be going anywhere near cryptocurrency investments.”

Figure 4: Cryptocurrencies' irrational exuberance

As of 7 February 2025. Source: UniSuper

Pearce says that while he expects a flat year, he won’t discount the possibility of a correction in markets of 10% or more. However, he invests for the long term, and on this basis, he remains optimistic given the growth in the global economy, subdued inflation, strong employment, and the tech revolution:

“… if we do get that correction, UniSuper will be using it as a buying opportunity. We've got plenty of cash, and we intend to load up on assets when the price is right.”

* You can read John Pearce’s full investment update here.

** Disclosure: UniSuper is a Firstlinks sponsor.

James Gruber is Editor of Firstlinks.