This is an edited transcript of John Pearce’s interview with Graham Hand on Morningstar’s Wealth of Experience podcast.

John Pearce is Chief Investment Officer at UniSuper, Australia’s fourth largest superannuation fund by assets, managing about $130 billion for about 615,000 members.

John Pearce: Thanks for having me, Graham. It's going to be very unusual and exciting to be interviewed by my old boss.

Graham Hand: It's particularly good to have John on because we go a long way back. I'm proud to say that John once reported to me, although unfortunately for him, I probably learned a lot more from him than he did from me.

Pearce: Not true.

Hand: If we can start on some big picture issues, I know you're an admirer of JPMorgan CEO Jamie Dimon, and he said recently that now may be the most dangerous time the world has seen in decades. So, how are geopolitics and global economics affecting your investing at the moment?

Pearce: First, you're right. I'm a huge admirer of Jamie Dimon. He is arguably the preeminent bank executive and CEO of our generation.

But as far as Jamie Dimon's grip on financial markets, I don't know if he's got any greater insights than many other people. And if you look back in our time, what was the riskiest time for world global financial markets? It was a month before Lehman collapsed. It was the riskiest time because nobody actually saw the risk apart from a few hedge fund managers that made a lot of money. But the reality is that the riskiest times are the times when risk is not priced. Arguably, just before COVID, it was the riskiest time when that risk was also not priced.

What do we know about these current times? Everyone is talking about risk. It is at the forefront of everyone's thinking. We're all worried about what's happening in geopolitics. Bond markets are taking fright because of inflation. So, I actually think that the pricing of risk now is such that you're at least getting rewarded for taking that risk.

Hand: So, the US 10-year Treasury at around 5% is better for investing than the US 10-year at 0.5%.

Pearce: It absolutely is. The problem is the speed at which it's got here. Now, we can argue whether 5% or 4% is the right number. I think we'd all prefer close to 4%. I certainly do not want it back at a 0.5% or 1% or to the ludicrous situations we still have in Japan where you've got still negative yields. So, to me, the world is getting back to some semblance of normality. So, hopefully, we have a pause here and we can stabilize at these levels or slightly below. But whether it's 4% or 4.5%, that doesn't particularly concern me.

Hand: Managing $130 billion, even only 1% of that is still $1.3 billion. Does that make it more difficult to move the needle to find meaningful investments?

Pearce: I bring it back to what's happening in the bond markets. If you asked me this question in December 2020 when bond yields were 1% in Australia and 0.5% in the U.S., I'd have said, absolutely. There was a big problem because the power really was with the originators. They had people lining up, and we had to overpay for assets. We had to accept certain fee structures. We had to accept certain governance rights. That world has now changed for us. The power is 180-degree changed where it's now with the asset allocators.

Hand: You made an interesting comment that when rates were close to zero, the optimal allocation for a retiree wasn't that much different in the accumulation stage and the decumulation or the spending stage. But that's now changed.

Pearce: Well, if you recall that we had that acronym, TINA, and it was kind of right.

Hand: As in you had to be in equities.

Pearce: You had to be in equities or risk assets of some description because 1%, and we'll add a credit margin, it just didn't cut it for anyone. Why did Australians avoid annuities for so long? Because rationally, it just wasn't the right decision to make. But now as a retiree, you can actually go pretty well down the risk spectrum. And we're not talking about just cash, just some sort of cash enhancement. You can get these bank bonds, top-quality corporate bonds, and get a decent return. So, this notion of 60-40 being dead, I think the opposite. I think the time has come for 60-40 or 70-30 but it was a stupid idea when bond yields were 1%. But why not now?

Hand: So, in your allocation of money, UniSuper is well known these days for your in-house management, and you also appoint active managers, and you also do some index. How do you decide between those three?

Pearce: It starts with a philosophical position and, as you know, my background has always been in investment management, so I've always been comfortable with managing money in-house and that was pretty much my mandate from the day I joined UniSuper. So, philosophically, if we believe that we can do a job as equally as good as external managers, the default will be in-house.

Hand: It's your starting point.

Pearce: Starting point. But we're also very well aware of our limitations. I don't see any merit in us building a team to look at U.S. high-yields or Asian small caps or Australian small caps for example. So, we understand our limitations and that's where we look for outsourcing partners. Indexing, once again philosophically, we do believe in active management, but indexing can be a very efficient way of accessing markets when you're looking at tilts, and quite often our index position will be a holding pattern until we can find good active strategies.

Hand: What do you describe as a tilt? Some theme in the market that you want to invest in?

Pearce: Yeah, what's the last major tilt? We had put a decent chunk of money in US banks, for example. It's pretty easy to get an index position in the US bank sector.

Hand: We've seen a lot of debate, particularly around the industry funds about listed and unlisted assets and how well they've done in the unlisted. Is the glory days of doing that in the past?

Pearce: Maybe. I don't know the answer, but there's a feeling. The conventional wisdom is that unlisted assets have outperformed listed because of this illiquidity premium. But that's not true. There has not been an illiquidity premium. As a matter of fact, based on our pricing and valuation, the market has been paying a premium to buy illiquid assets. We've stuck with traditionally listed assets because the unlisted equivalents always seem to be trading on higher multiples. Now what has happened over the past two decades is we've seen the massive fall in interest rates. And guess where most of the unlisted assets have been? They've been in infrastructure and property, et cetera, massive beneficiaries of this huge rally in interest rates.

Hand: Like the bond proxy sort of assets.

Pearce: Exactly. We know that that era is gone. So, unless you are genuinely harvesting an illiquidity premium rather than paying one, I think the jury's out.

Hand: In your own case with your position, say, in Transurban and Sydney Airport both in the listed space, that was because of your feeling about the lack of being paid enough to be unlisted.

Pearce: Yeah. Sydney Airport of course is now unlisted, but let me give you a classic real-life example. During COVID, we owned half of Adelaide Airport, unlisted. Sydney Airport was listed at the time. During COVID, Sydney Airport was off 43%.

Hand: Still as a listed entity?

Pearce: As a listed entity. You had pretty much all the unlisted airports being marked down. Now call me biased because I'm from Sydney, but let me tell you Sydney Airport is the best airport in Australia by some stretch.

Hand: Until you have to drive 80 kilometres to another one.

Pearce: That's for you.

Hand: Okay. So, it didn't deserve to be off that much in the listed market.

Pearce: That's right, and that's where you get these opportunities in listed markets.

Hand: A lot of your members go into the balanced option. It's sort of your default 'set and forget' option. But that requires you to allocate across equities and properties. How do you do that sort of allocation process and do your allocations change very much?

Pearce: At the high level, we are not that dissimilar to most of the big funds. So, your typical balanced option in Australia is 70% roughly growth assets, 30% roughly defensive assets or thereabouts. Where we differ from other funds is firstly our exposure to unlisted assets has traditionally been a lot lower than other large funds.

Within our growth allocation, we tend to take sector-specific bets such as we would have large overweight on the tech sector, we'd overweight to Asia or Japan at the moment or India, country-specific bets. That's where we tend to differ. And in defensive, we probably have less in these what we call alternative defensives and more in what we like to pick up a yield for example via at the moment Tier 2 major bank bonds.

Hand: And those big allocation decisions, do they change much?

Pearce: We're pretty active. Post COVID and some sort of normality, our biggest position has been in these Tier 2 bonds. So, if you looked at our portfolio a couple of years ago, you've hardly see any of them. In our unlisted because of Sydney Airport, because we've actually had more opportunities at the pricing we like, we've lifted that unlisted exposure from 6% to about 18% in that balanced option.

Hand: You gave a talk recently where you said that governments are a bigger problem than central banks. What were you talking about?

Pearce: Well, if we believe as I do, that the single biggest problem facing financial markets right now is inflation and the economy, well, what's the root cause of inflation? We all point our fingers at central banks that kept rates too low for too long. That is absolutely true. But if you look at some sort of controlled experiment such as Japan or if you even look at that period in most developed markets between the GFC and COVID where rates were close to zero where there was quantitative easing, what was CPI doing? It was hardly doing anything. So, there was very little consumer price inflation. There was asset price inflation but hardly any consumer price inflation. We were still talking about the problems of potentially more deflation than inflation.

What happened during COVID? It wasn't the fact that central banks cut rates to zero. They've been doing that for a long time. It's the fact that governments started putting cash in people's pockets.

Hand: That's what we're recovering from now.

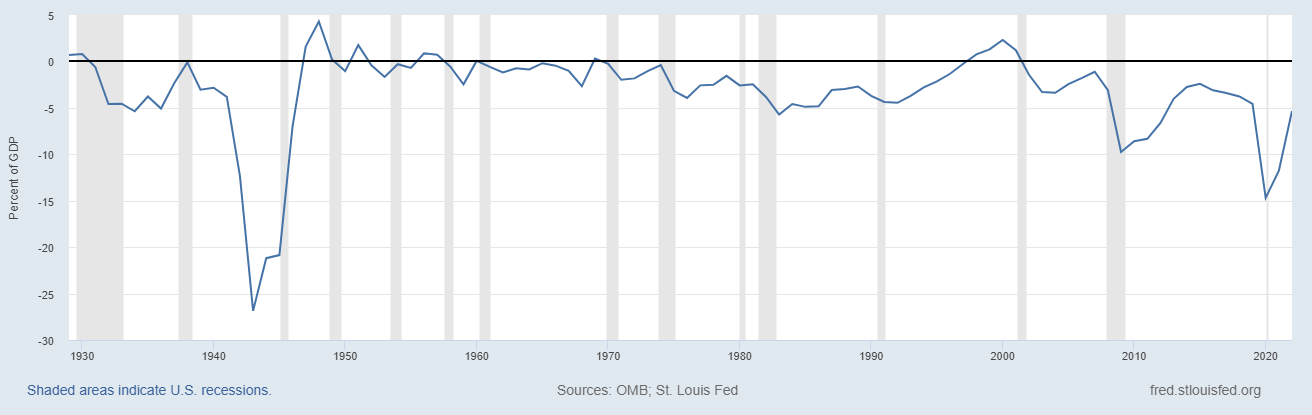

Pearce: That's what we're recovering from now. Central banks have at least realised the errors of their ways. And now they're tightening. We're going through the fastest tightening cycle in history. What's happening with government expenditure? Have a look at what's happening in the US. This is peace time in the U.S. This is boom times in terms of the economy in the US The US is still putting massive deficits. Therein lies the problem. It's not the Fed Reserve. It's the US government.

US budget surplus/deficit as % of GDP

Hand: So, it's almost impossible, isn't it, for someone to run for US President and say the platform is increased taxes, lower spending?

Pearce: It's not going to happen. And if you look at something like the Inflation Reduction Act, have you ever heard of such a silly name? This is just outright inflationary.

Hand: So, as an investor, you have to study history. Are you finding any historical presidents that can guide us in current market because there's a lot to worry about?

Pearce: I think it's very dangerous to look at any period of history. Not only have you got so many variables in terms of economic and financial variables, you've also got the political construct, the institutional construct around it. We were able to escape a depression after GFC because the central bankers like Ben Bernanke studied the Great Depression. So, we avoided the Great Depression because we studied the Great Depression. So, the whole institution concept …

Hand: So, we knew what to do by then?

Pearce: Exactly right. So, I don't like the term but, call it, reaction function, has changed. So, I think looking at history is problematic. If you look what's happened since 1978 when the Fed has paused the interest rate cycle, the bond market has always rallied.

Hand: And the reverse has just happened.

Pearce: Yes, if you were waiting for a Fed pause to buy bonds because that's what's always happened, you've just been run over.

Hand: John, it's been great to see you again, to have a good chat. We had a lot of fun back in the old banking days. Thanks very much for coming on the Wealth of Experience podcast.

Pearce: Thanks very much, Graham. It's been a pleasure.

This is an edited transcript of John Pearce’s interview with Graham Hand on Morningstar’s Wealth of Experience podcast.

John Pearce is Chief Investment Officer at UniSuper, Australia’s fourth largest superannuation fund by assets.

Please note that past performance is not a reliable indicator of future performance. The information above is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Comments on the companies mentioned aren't intended as a recommendation of those companies for inclusion in personal portfolios.