Stop whinging about investment performance in 2022. Every market analyst starts the year with a summary of the previous 12 months, and descriptions of 2022 vary from brutal to terrible to disappointing. Among many examples, fund manager Roger Montgomery, mainly an Australian equity investor, started his first newsletter of 2023 by saying:

“Many commentators point to the 12 months to December 2022 as being one of the toughest annual periods for the performance of the share market and the bond market for several decades.”

Morningstar's Director of Personal Finance, Christine Benz, who has more of a US focus, wrote:

"This past year was likely an unnerving one for many retirees. Amid soaring inflation and rising interest rates, stocks and bonds both ended the year with double-digit losses, marking their worst simultaneous decline in more than 50 years."

Not much love there, but was it really so bad for Australian superannuation?

Expectations need a reality check

In fact, including dividends, the broad S&P/ASX200 index rose 1.9% in 2022, and many active equity managers performed well. According to the latest VanEck Australian Investor Survey, 70% of investors plan to increase their allocations to Australian equities in 2023, and what matters most to local investors is local equities.

While US investors saw their broad S&P500 index fall by 18% and the Bloomberg Aggregate index of investment-grade bonds lost 13%, there were plenty of opportunities to avoid the gloom for Australians. Chant West reported in mid-December 2022 that the median superannuation growth fund was down 4% for the year, hardly a disaster. The top five managed funds in the Morningstar database were all up over 30% in the last year.

The Standard Risk Measures for Australia show the number of annual negative periods expected over any 20-year period for major asset classes. For equities, the number is '6 or greater'. At least 30% of years should show stockmarket losses. Investors not prepared for equity market downturns once every three years are in the wrong investments.

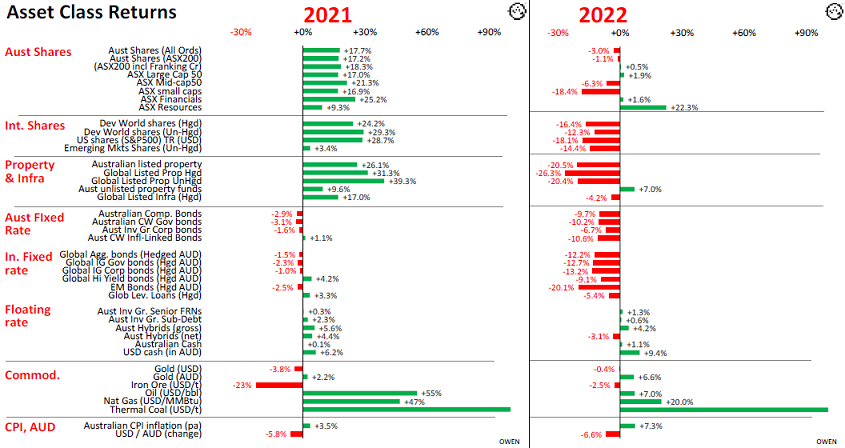

Yes, there’s a lot of red in Ashley Owen’s (of Stanford Brown) chart below for asset class performance in 2022 but look at all the green for 2021. While everyone moans about the S&P500 losing 18.1%, it was up 28.7% the year before, giving a respectable two-year return, despite everything that has hit the market.

Much of what was lost in 2022 was giving back the exuberance of 2021 and previous years. Did bond investors believe interest rates would stay at zero or negative forever? Did the valuations on tech stocks deserve to stay lofty and priced for perfection in all market conditions? While some fund managers looked like geniuses riding out the pandemic in 2020 and 2021, many then misread conditions and took little off the table as the market switched from growth to value. On another side of the same coin, plenty of fund managers outperformed as markets corrected. Check Lazard, GQG, Merlon, Allan Gray, Talaria, PM Capital and Katana among many for strong 2022 results.

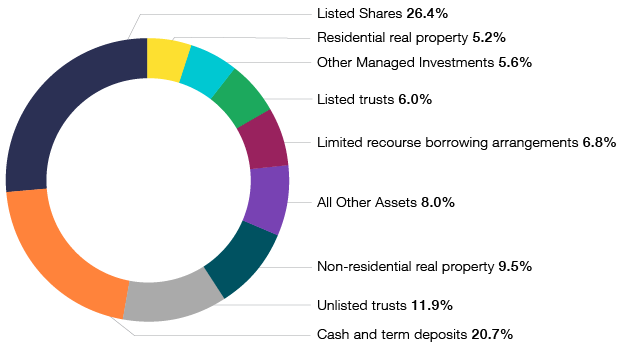

Limits to fixed rate bond losses in SMSFs

In the portfolios of SMSFs, long-term fixed rate bonds do not feature prominently, and it’s unlikely bond losses were significant. The latest SMSF asset allocation data from the ATO (produced with a lag and dated 30 June 2020) shows cash and term deposits comprised about 21% of assets, and income from these rose significantly over 2022. Property gave some of the 2021 gains back in 2022 but depending on who was managing the equities and the domestic/global mix, it may have been a decent year. SMSFs are overweight Australian equities relative to global.

Investors who bought into crypto and NFTs on the back of celebrities like Matt Damon telling them that ‘Fortune Favours the Brave’ have experienced a reality check. Here are the words of Damon's Crypto.com commercial:

“And in these moments of truth, these men and women, these mere mortals - just like you and me - as they peer over the edge, they calm their minds and steel their nerves with four simple words that have been whispered by the intrepid since the time of the Romans: Fortune favors the brave.”

Investing rubbish. I’m looking forward to the new ad: ‘Fortune Favours the Diversified.’

Market timing versus risk management

There is a difference between hopeful market timing and considered risk management. Any number of studies show investors struggle to identify market entry and exit points, and as Vanguard’s Jack Bogle said:

“The idea that a bell rings to signal when to get into and out of the stock market is simply not credible. After nearly 50 years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

And Peter Lynch, who as manager of the Magellan Fund at Fidelity Investments in the US for 13 years from 1977 delivered double the returns from the S&P500, said:

“Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply … and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.”

While I agree with these thought leaders, every person needs to set up a portfolio which suits them personally, to meet their goals and to marry with their appetite for risk. When I signalled to Firstlinks readers at the end of 2021 that I was reducing my exposure to equities, it was less a market timing exercise than a desire to preserve capital. I turned 65 a few weeks ago, and while I might live another two or three decades, my focus heading into 2022 was hanging onto my SMSF’s assets rather than stretching for another year like 2020 and 2021. On 8 December 2021, I wrote:

“I am starting to reduce some equity exposures as I personally believe the market will experience a decent fall sometime in 2022.”

So just as the market legends eschew market timing, so they also encourage investors to adopt a plan and a discipline and not take risks that might compromise their goals. The father of value investing and mentor to Buffett and Munger, Benjamin Graham wrote:

“The best way to measure your investing success is not by whether you’re beating the market but whether you’ve put in place a financial plan and a behavioural discipline that are likely to get you where you want to go.”

A phrase adopted by Nobel Laureate, Daniel Kahneman, is that the key to good investing is having “a well-calibrated sense of your future regret”.

These words provide a context for reviewing 2022.

Delving into my SMSF performance for 2022

No decision made now can change past returns, and the only thing that matters for the future are the buy, hold or sell investments made from this day forward. But looking at the past for lessons can inform the future, both for investment decisions and risk appetite.

Despite no new contributions into our SMSF and drawing the minimum pensions for me and my wife, the total balance in our SMSF increased over 2022. Let’s take a quick look at a few of our investments.

The Good

When switching some money out of equities in late 2021, the investment choices were not exciting. The Reserve Bank of Australia did not start increasing cash rates until 4 May 2022, a poor judgement by Governor Philip Lowe who was at least six months late in moving to control inflation. The cash rate was only 1.35% by July 2022.

Bank hybrids and corporate floating rate notes paying a margin above BBSW offered better defensive appeal. Not only did they generate some cash flow, but the income would rise with the cash rate. Hybrids were purchased at varying margins around 3% depending on price opportunities over many months. Money was also allocated into a range of unlisted hybrids and notes, a senior bank debt fund (ASX:QPON), a subordinated debt fund (ASX:SUBD) and various listed corporate floating rate notes (such as Centuria's ASX:C2FHA and CVC's ASX:CVCG).

Less flattering, a listed fund that invests in floating rate bank capital instruments, ASX:GCAP, produced good income but our investment shows a small capital loss. Our average entry price was $9.27 and it is now trading at $9.05 after a recent recovery.

Source: Morningstar

Three-month BBR is currently around 3.3% (and heading higher) and with margins above that, the income is far higher than anything seen for years. Of course, inflation is also higher and real returns are flat.

These investments down the bank capital structure come with more risk than deposits, but there is reward for risk in a strong Australian banking system. In the deposit market, to increase returns on cash, investments were placed in ASX:BILL and higher-yielding cash accounts.

Listed infrastructure has also held ground despite rising rates, including positions in Argo's ASX:ALI and to a lesser extent, Magellan's ASX:MCSI.

Source: Morningstar

As we moved beyond the first quarter of 2022, with demand for resources looking strong, exposure to Mineral Resources (ASX:MIN) looked worthwhile given its stake in iron ore and lithium, and industry stalwart ASX:BHP offered potential. Two resource LICs, Tribeca’s ASX:TGF and Lion’s ASX:LSX, were both trading at a large discount to NTA which seemed to offer added upside potential.

The Bad

While I was generally lightening the load on equities, I still wanted exposure to the growth and dividend potential of good companies. I like the concept of a core/satellite portfolio - where cost is minimised in index (or near index) funds, such as ASX:A200 (with a cost of only 7 basis points, or 0.07%) and a broad LIC available at a discount such as the Djerriwarrh ASX:DJW – while backing some active managers for potential outperformance. For reasons described in the next section where I exited direct holdings in many tech companies, I decided to build a position with a few equity growth managers.

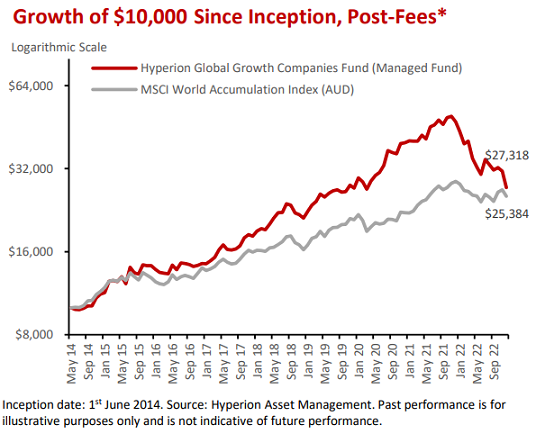

These managers included listed vehicles from Hyperion (ASX:HYGG), Munro (ASX:MAET), Loftus Peak (ASX:LPGD) and Hearts & Minds (ASX:HM1). Presentations by these managers were impressive. For example, Hyperion was Morningstar’s Fund Manager of the Year in 2021 with outstanding long-term results. Hearts & Minds is a ‘fund of funds’ with experienced people selecting quality managers, with a philanthropic angle. I also thought buying Magellan’s closed-end LIC, ASX:MGF, at a discount to NTA around 20%, was taking advantage of the market loss of appetite for the brand despite the quality underlying companies.

My new satellites took a hard landing when returning to earth over 2022. Yes, I went into this with my eyes open but it was disappointing that the funds did not bank more of their successes in 2020 and 2021. They are all global managers exposed to tech and investors should know what to expect of them. HM1 added fuel to the fire in late 2021 by updating its managers to include up-and-coming tech and growth managers, which were hit in 2022. Hyperion maintains great confidence in Tesla, down 65% in the last year, and 35% of the main portfolio is in three stocks: Tesla, Microsoft and Amazon. All great companies, but the chart shows Hyperion has given back nearly all the outperformance it took eight years to achieve since 2014. Ironically, perhaps the lesson is not to invest with managers after a long and successful run, and wait until they have given some back.

Hyperion Asset Management Global Growth performance since inception

My ‘index’ Australian equity positions were steady. While intuitively, I believe it should be possible to identify active managers who can deliver over time, it’s a long way back since the start of 2022 for some of these growth positions. Fortunately, the build of these active allocations had only started when tech problems hit.

I also held some long-term bond positions, such as in listed bonds, Australian Unity’s ASX:AYUPA paying 5% pa, ECP Fund’s ASX:ECPGA at 5.5% pa and Mercantile’s ASX:MVTHA at 4.8% pa. At the beginning of 2022, selling these would have reduced cash flow from over 5% to around zero, and (like everyone else including the Reserve Bank Governor), I did not expect rates to rise quickly. I decided to take the ongoing income which was likely to be better than cash, notwithstanding the greater (but I judged acceptable for the reward) credit risk.

These three listed securities are now ‘trading’ at about $88, no bid and $94. Not the end of the world but large capital losses on the defensive part of my portfolio were not part of the plan. Liquidity in these small, corporate bond issues is poor despite public listing. Spreads were wide and I sat on the offer for many weeks to reduce these bond positions at a decent price.

Listed property is delivering good income but with varying capital losses depending on the sector exposure. I thought staying away from offices and discretionary retail would protect the portfolio, but the downside on a fund like Charter Hall’s ASX:CLW has surprised. I expected its focus on industrial property, its long leases (average 12 years) to top-quality names (99% blue-chip), 6.8% distribution yield with half of the leases on the 549 properties linked to CPI (and therefore rising rapidly), plus low gearing (29.9% and most leases ‘triple-net’) were compelling. The market may be doubting the NTA at June 2022 of $6.26 because the share price is languishing at about $4.60, and it's the same with many property trusts. Rising rates weigh on cap values and the market is worried about independent valuations. Our average entry price is $4.80.

Source: Morningstar

The Lucky

US author Joe Wiggins focusses on the role of luck in investing, especially 'outcomes bias' where we judge the quality of the investment process by the result:

"From the unique life experience of a star fund manager to the early morning ice bath routine of a successful entrepreneur, we cannot help drawing a causal link between an individual’s success and their past actions. Yet so often the outcomes we see are nothing more than a mix of luck and survivorship bias, this is particularly true in the field of fund management."

Every diversified portfolio includes strokes of luck. In my desire for floating rate exposure, I am overweight bank hybrids, and if that sector struggles, my portfolio will take a mark-to-market hit. Then if a bank such as CBA or Macquarie fails to meet its obligations, or is forced to convert its hybrids to equity, I’ll end up with a large bank share position. Sometimes an investment looks good … until it doesn’t.

A big piece of luck came at the end of 2021 when Deutsche Bank advised Chi-X, the alternative exchange competitor to the ASX, that it was discontinuing its Transferable Custody Receipts (TraCRs) business in February 2022. I liked this product because it allowed investments in wonderful US companies such as Apple, Microsoft, Tesla, Berkshire Hathaway, Amazon and Alphabet (Google) on the Australian market with currency covered, including conversion of dividends. I felt these great companies deserved a place in most portfolios, and having built a TraCR position over 2020 and 2021, I planned to hold them for the long term. Chi-X gave various choices to holders, but I avoided the complications by selling at the end of 2021. It was an administration decision, not motivated by investment outcomes, but I missed most of the losses in these companies over 2022. I gave some back in smaller positions in growth fund managers described above.

What about the future?

My SMSF portfolio probably will not suit you. It is designed for my personality, family, age, goals, risk appetite, experience and outlook. No doubt my overweight in floating rate notes and underweight equities will seem wrong to some readers.

Investors who reduce equity exposure are faced with another timing decision on when to return to the market. For anyone who can hold a portfolio for the long term and not worry about capital fluctuations, the best outcome is likely to come from an equity-heavy portfolio throwing off rising dividends from quality companies, with steady capital growth.

Our SMSF is generating plenty of cash, and since it is in a mix of pension and accumulation mode, tax rates are low (yes, I’m one of those bastards who has contributed heavily to super for 30 years and now benefits from the attractive tax concessions). Hybrids and bonds are also regularly repaid and reinvestment of cash is a challenge. I have started directing some of this to equities, despite no great confidence we have seen the bottom. I feel the market is too confident about small falls in inflation and the expectation of central banks ‘pausing’, and the Fed will want to show that its work controlling inflation is still underway, even at a cost to economic growth. This is moving more into the realm of market timing rather than risk management, and no doubt luck will play a part.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any other investor, and is not a recommendation for any of the investments. The securities mentioned are listed securities given the ease of access for all readers, but 'wholesale' investors have many other opportunities, especially in bonds.