Investors do not need to look too closely at a Listed Investment Company (LIC) report in our Education Centre to see that the majority trade at a discount to the value of their Net Tangible Assets (NTA). This is disappointing for existing investors who cannot realise the market value of their investment but it’s potentially an opportunity for a new buyer.

While it's not a good look for LICs generally, it also reflects poorly on the market’s opinion of the fund manager when there is little appetite for their investment skills even when available at a 15% discount. For members of the board of a LIC, as I have been in the past, the discount dominates board meetings with much time spent on near-fruitless attempts to remove the discount. If the manager also runs a large unlisted business, why would anyone invest at NTA in an open-ended fund when the struggling closed-end LIC is much cheaper?

It’s also problematic to grow the fund by issuing new shares at a discount because existing holders are diluted when buyers come in at a lower price. Loyal investors are already disadvantaged when their outlay at NTA is now worth 15% less than if they had gone into an equivalent unlisted fund at initial issue of the LIC.

Fund managers often start off loving the LIC structure because it locks in funds and fees with no potential for redemption and outflow, but they underestimate the work involved in managing a listed company and coping with the flak if performance is poor. When I was on the board of 452 Capital, the small LIC took as much management time as the multi-billion dollar unlisted portfolio. Many fund managers, such as Simon Shields at Monash, Sam Shepherd at Bennelong and Bill Pridham at Ellerston have exited the closed-end LIC structure to focus on other funds.

Why are investors reluctant to buy discounted LICs?

If boards, fund managers and existing holders are vexed, one group of stakeholders which can benefit is new buyers. As the dominant spokesperson and promoter of LICs, Geoff Wilson, loves to say, the best feature of LICs is buying $1 for 80 cents. He criticises other fund manager for not knowing how to nurture a LIC investor base and relying too much on the committed capital to retain their funds.

It sounds straightforward to buy a $1 worth of assets for 80 cents but investors may be reluctant because:

- They are not confident the fund manager (or perhaps any active manager) can deliver consistently strong performance in future, at least matching an index.

- There is often poor liquidity in the smaller LICs, and buying or selling a decent quantity can take time.

- The bid/offer spreads may be wide, and a loss of some percentage points may occur simply in the buying and selling process.

- The active fees are high in a world with ETF and index competition. It is common for LIC annual management fees to be 1% or more with an additional performance fee. Some academic work suggests the discount is the present value of the future cost of the active fee.

- Some LICs are poorly supported by their managers, committing little effort to marketing such as regular webinars and writing for newsletters to raise their profile.

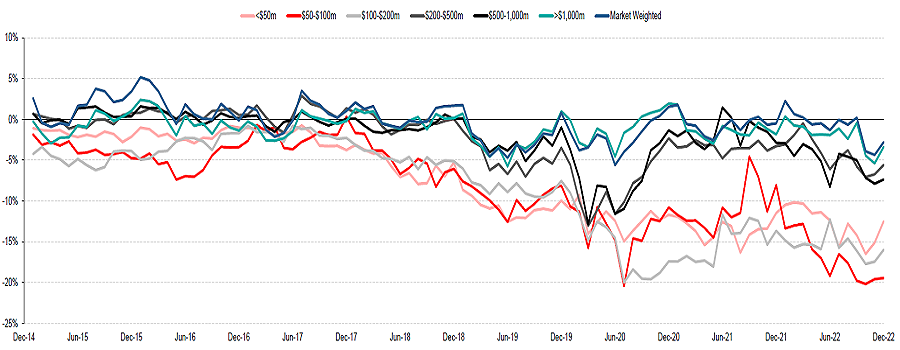

- The discount may widen. The chart below on premiums and discounts since 2014 shows they are volatile and there are examples of 10% discounts moving to 20%, making what was a 10% ‘saving’ look expensive.

Premium/Discount by Market Capitalisation Band

Source: IRESS, Company Data, Bell Potter Estimates

When is it worth discount harvesting?

Given these drawbacks, what are the circumstances where a LIC might be more worthy of support?

1. Use a buy-and-hold strategy

The starting point, regardless of the discount, is to find a good fund manager.

Investing into any equity fund is a long-term decision, at least five years and preferably 10. Investing should be contrasted with trading, where a short-term view is taken based on a perceived anomaly or near-term opportunity. As part of a long-term portfolio, investors must accept that markets rise and fall, fund managers have good and bad years, investment styles ebb and flow.

This is even more so with LICs versus unlisted funds. At least with a managed fund or ETF, the investor can be confident of entry and exit at NTA, plus or minus a small spread.

One way to mitigate the risk or loss on sale due to the discount deteriorating further is to commit not to sell, or to hold for a long time. It also matters less if liquidity is poor or trading spreads are wide if an investor considers the LIC a core part of a portfolio. With no desire to sell, the benefits of the large discount can accrue.

2. Enjoy the larger income or dividend flow

Once the discount fear is removed, the appreciation can start. If a portfolio of underlying assets is paying 5% net income on a $100 investment, that’s worth 6.25% if bought for $80. LICs are companies which pay tax, and dividends are decided by the board, with the ability to smooth the payments and create a more consistent income flow. This contrasts with ETFs and unlisted funds where income and capital gains must be paid out each year. LICs disclose in their accounts the amount in their Profit Reserve and Franking Account Balance as a sign of ability to sustain future dividends.

Managers such as Wilson's Leaders (ASX:WLE) and Plato (ASX:PL8) have realised that retirees want income and have focussed their LICs on yield, so convincingly that they both trade at premiums of around 12% (despite availability of Plato's unlisted fund at NTA). Clime (ASX:CAM) has embarked on the same income strategy but it is still available at a discount of about 6%. If the latest quarterly fully franked dividend of 1.32 cents is sustained for a year to give 5.28 cents on the current price of 86 cents, that's a healthy 6.1% fully franked or 8.7% grossed up.

Some LICs are fixed interest which hold debt instruments rather than relying on share dividends, and again, these interest payments are grossed up for the discount. For example, Neuberger Berman (ASX:NBI) and KKR (ASX:KKC) are at discounts of 15% and 17% respectively.

3. Find a size sweet spot

The chart above of premiums and discounts shows the largest discounts to NTA are in the smaller LICs worth less than $200 million. The large, traditional LICs valued at over $1 billion, such as AFIC, Argo, Djerriwarrh and BKI offer high liquidity, good trading volumes and decent support, and usually trade around their NTA. WAM Capital is large with similar support. However, at the other extreme, tiny LICs of less than $50 million do not have the resources to market actively, and suffer from fixed costs as a high percentage of their FUM. Although still small and therefore often suffering poor liquidity, those between $50 million and $200 million may be in a sweeter spot of large enough to cover costs but available at a decent discount.

Katana (ASX:KAT) is a manager with a strong long-term track record and a LIC at a 10% discount, but its small size means it does not receive much broker coverage and supply is limited.

4. Identify a potential recovery story or turnaround

To remove the discount, a manager needs at least two things: sustained good performance and the ability to promote their story. Investors who see a fund manager perform well while the LIC stays at a discount could move ahead of the recovery. There is sometimes a delay in the share price realising the NTA has improved.

Everyone has different views on particular fund managers, and some well-known fund managers do not have well-supported LICs. These vehicles are unusual animals that respond strangely to market vagaries. Perhaps a seller owns a large parcel that must be liquidated, and they hit bids hard and push down the price. It may be that a long-established manager has hit a rough sport and gone out of style for a while. Perhaps there are options overhanging the price, or a high-profile portfolio manager has departed recently. There are many reasons the market ignores a LIC.

Rob Luciano’s VGI Partners Global Investments (ASX:VG1) holds around $540 million in assets but trades at a hefty discount around 16% due to poor recent performance (down 22% in 2022). However, the business was recently acquired by Regal and Phil King is the new manager of the sister Asian Fund (ASX:RG8) and he should have more supporters to reduce its 15% discount.

Magellan’s Global Fund (ASX:MGF) Closed Class is also at a considerable discount around 17%, while billions rest in the unlisted fund around NTA. There is an instant arbitrage opportunity for thousands of investors. It is well known that Magellan’s conservative positioning in 2021 left its relative performance struggling, but it holds a high-quality portfolio of leading global companies. Other well-known funds or portfolios include Pengana (ASX:PIA) at 16% discount, Hearts and Minds (ASX:HM1) at 19% off and Alex Waislitz’s Thorney Technologies (ASX:TEK) at a whopping 36% discount. A recovery of popularity of any of these names may produce a windfall return. HM1 recently changed many of its managers in an attempt to reduce its discount.

Other high-profile managers such as Anton Tagliaferro's IML and its listed fund, QV Equities (ASX:QVE) and Perpetual's equity fund (ASX:PIC), are available at more modest discounts. Platinum Global (ASX:PMC) once dominated international equities and prices at a 13% discount, while Spheria Emerging Markets (ASX:SEC) at 16% off was previously more popular.

5. Potential to convert from LIC to open-ended fund

When a fund manager converts a closed-end LIC to an open-ended fund, investors enjoy the benefit of the discount removal, less some transaction costs. One downside is the conversion takes a lot of work, up to a year, subject to shareholder approval.

Reports from large fund managers whose LICs trade at a discount sometimes reveal a restructure is a possibility, flagged well in advance. Based on a comment in a recent interview, Magellan may be a candidate although the committed capital of a LIC is especially valuable as their other funds are in outflow. Here is a short extracts from a discussion between Head of Distribution, Frank Casarotti, CEO David George and Portfolio Manager, Nikki Thomas:

“Casarotti: So, David, what if the fund actually does deliver on its objectives and absolute returns and relative returns and yet, we're still seeing this persistent discount, what then?

George: Well, delivering on the objectives should support a narrowing of the discount and the fund can continue to engage in the buyback. But if the options expire in March 2024, that may provide us with other avenues to explore. In the meantime, we'll be looking at fund disclosures and client engagement plans to make sure that we're communicating frequently and transparently.

Casarotti: So, Nikki, any closing thoughts?

Thomas: I see Magellan closed class as an opportunity to buy a world-class group of companies at about a 20% discount at the moment, and potentially that discount closes. Anyone investing in a global strategy like ours should be thinking three- to five-year horizons for investing, and you don't want to think that this could happen overnight with the difficult times we're living in.”

No special insights known but Magellan needs to address this.

6. Asset classes without broad support

LICs cover many asset classes which may fall in and out of favour, and once at significant discounts, price improvement is an ongoing problem. Bailador Technology (ASX:BTI) has produced impressive results over time, including converting many of its positions to cash in recent years, yet its discount approaches 30%. Tribeca Resources (ASX:TGF) seems well positioned in a sector with growing demand and supply shortages, and yet it cannot shed its significant 13% discount. In the fixed income space, Neuberger Berman (ASX:NBI) and KKR (ASX:KKC) probably suffer from holding lower-rated corporate paper with a threat on the horizon of a US recession.

Or perhaps investors do not like what is in the portfolio. An example is Carlton Investments (ASX:CIN) which is a large fund of $850 million, suggesting liquidity and strong support, yet it trades at a 22% discount. A closer look at the portfolio reveals about 40% is in one asset, EVT (formerly Event Hospitality and Entertainment), so any holder needs to like that company.

In contrast, a specialist LIC such as Global Value Fund (ASX:GVF) holds assets which are not available in other funds, and it has developed a following based on its steady performance and strong marketing effort. It trades well at around NTA, although its market cap of around $200 million is not among the big boys. The market has rewarded its consistency.

Take a view and sit on it

Warren Buffett was talking about finding cheap companies, but the same can apply to LICs:

“It is extraordinary to me that the idea of buying dollar bills for 40c takes immediately with people or it doesn’t take at all. It’s like an inoculation. If it doesn’t grab a person right away, I find you can talk to him for years, and show him records, and it just doesn’t make any difference. They just don’t seem able to grasp the concept, simple as it is … I’ve never seen anyone who became a gradual convert over a 10-year period to this approach."

Nothing beats good performance, but it is elusive for investors to identify future returns. Some of the problems faced by LICs in trading at a discount can be turned into an advantage if the investor is not worried about liquidity, a wider discount or fees. Investing in assets at 20% below their underlying value can be an attractive buy-and-hold opportunity, as the income or dividend will be 20% higher regardless of share price performance. But if it's a dog, leave it to the fleas.

Some final comments from Peter Thornhill

Many readers of Firstlinks will see similarities between the buy-and-hold in this article and author Peter Thornhill’s preference for buying LICs and holding them for decades. However, Peter likes the large LICs without worrying about harvesting discounts. I asked him why. He prefers the consistency of a long-term proven investment process and:

“I have never bothered with discount or premium with the LIC's. I have begun to unwind my direct shareholdings where possible and moving the cash into a small handful of LIC's, about 6. As I started with the LIC's some time ago, the bulk are the old ones and I have been adding to them steadily so the holdings are substantial. To be honest, I'm too lazy to go digging for a few bits here and there. As I tell audiences, I have better things to do with my life than spending time on the computer.”

Yes, it can take a lot of time and effort to harvest dividends, and each investor needs to decide if it worth the effort. At least with buy-and-hold, once the job is done, there is nothing more involved except enjoying the enhanced income flow.

*For consistency in this article, prices and NTA are taken from the latest Bell Potter Report in our Education Centre, where other details can be checked by readers. Discounts are based on pre-tax NTA, in line with the buy-and-hold message in the article. The indicative NTA has been adjusted for dividends. Dividends are removed from the NTA once the security goes ex-date and until the receipt of the new cum-dividend NTA. In some cases, Bell Potter has been unable to verify the Indicative NTA within a reasonable level of accuracy. There is no dilution due to unexercised options. See notes in their table.

Graham Hand is Editor-at-Large at Firstlinks, and he owns many of the investments mentioned in this article. This content is not personal advice and does not consider the circumstances of any investor. The prices and discounts quoted are as at 3 February 2023 and change regularly.