Editor’s Note: A common problem for Listed Investment Companies (LICs) is their tendency to trade at a discount to their Net Asset Value. While it gives new investors the opportunity to buy into a manager at a discount, it can be frustrating for sellers wanting the realise the underlying value of their investments. In this extract from a recent discussion, Magellan explains why the discount may persist for some time despite the efforts of the manager, and why steps such as converting the LIC to an open-ended fund are not as easy as they sound. In this edited transcript, Magellan also describes its actions to address the performance disappointments in its Global Fund in 2022.

***

Frank Casarotti: In this MGF update, we acknowledge there have been concerns and frustrations around the significant trading discount to the underlying net asset value in the ASX-listed MGF, which is the closed-class version of our flagship fund, the Magellan Global Fund. We want to address this head on and share our thoughts on the discount as well as discuss the actions that we're taking to address it.

I'm joined by Magellan's new CEO, David George; our Head of Listed Funds, Jennifer Herbert; and one of the portfolio managers on the Magellan Global Fund, Nikki Thomas.

David George: The investor experience for MGF unitholders has been frustrating for both unitholders as well as brokers and advisers. We acknowledge that the discount is both persistent and significant, and we are very focused on solutions.

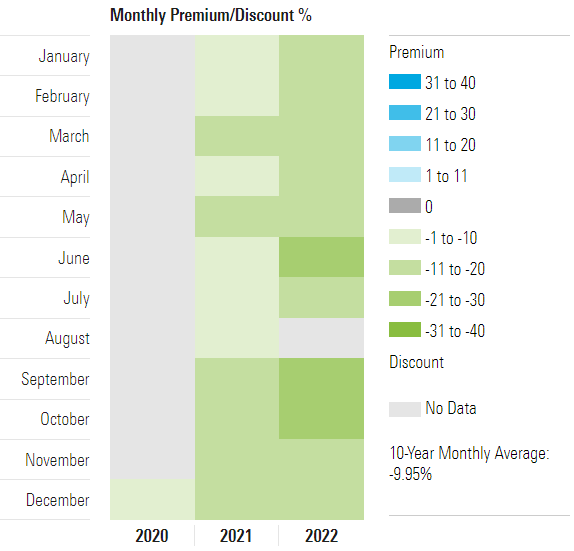

Source: Morningstar

Casarotti: Jen, there are obviously structural issues with both listed investment companies and listed investment trusts. We're not alone, are we?

Jennifer Herbert: LICs and LITs have been around for a long time. They are a very well-understood fund structure. However, they do have their limitations, particularly in difficult markets, and the recent environment of uncertainty and volatility has not been kind across the board. Currently, there are about 14 global equity LICs and LITs on the Australian market and of those 14, 13 of them are trading at discounts to their net asset value. Of those 13, more than half of them are trading at discounts of greater than 10%. We're going to do everything we can to address this issue.

Casarotti: So, David, why is the discount there and what will it take to close?

George: A discount can appear and persist in a closed-end fund because of a lack of demand from buyers of units, or if that demand is overwhelmed by additional selling pressure. In this way, they trade a lot like a listed company in that supply and demand determines the price. Now, unlike a listed company, in a closed-end fund, you are able to see what the value of the company is each day to compare that against.

So, these conditions may persist. Quite often, they appear during periods of market volatility or when markets are falling, or when an investment manager may be experiencing a period of relative underperformance. In the Magellan Global Fund, we've had a period of underperformance relative to benchmark. Despite our long-term investment horizon, we suspect that relative underperformance may be creating some additional selling pressure.

Now, ultimately, what we want to create is more demand for the MGF units, and the best way to do that is by delivering strong investment performance. We've recently announced a couple of role changes and these are particularly focused on how our analysts work and also interact with our portfolio managers.

Casarotti: Jen, is there anything else ultimately that we can do within the discount-related issue that might solve and help?

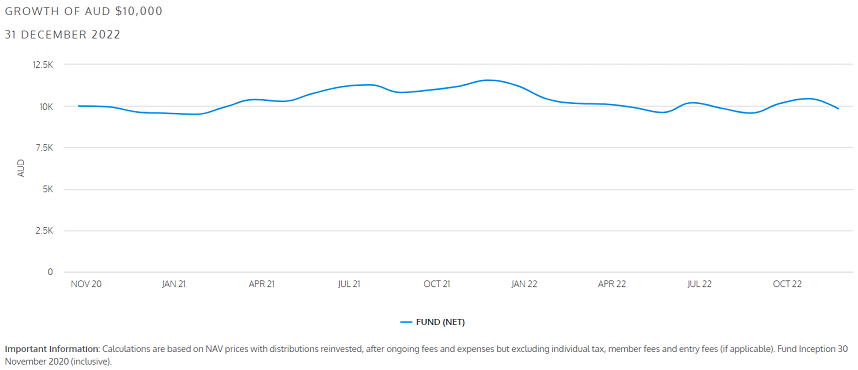

Herbert: Sure. A tool commonly used by managers when discounts persist is a share buyback, and in our case, that would be a unit buyback, where the fund itself steps in and buys units over the trading day, and then those units are cancelled. And the buyback has two benefits. Firstly, it provides additional liquidity for investors. And secondly, when the buyback is executed at prices lower than the net asset value as it is in the case of MGF, then it's accretive to the NAV and therefore a benefit to unitholders. Now, we're currently engaged in a very aggressive buyback and have been since November 2020, and so far, we've brought back over 200 million units, and that equates to around 17% of total units on issue.

Casarotti: Jen, we often get asked why we don't simply convert MGF to an open-class active ETF like we did with the High Conviction Fund.

Herbert: It's actually not that simple unfortunately. Firstly, MGF is a class within the greater Magellan Global Fund, it's not a standalone fund. And secondly, we have over a billion options out on issue. So, the option holders are a class of members within the Global Fund and Magellan as the responsible entity of the fund has a duty to treat those option holders fairly. So, unfortunately, we can't just wrap up the LIT to an active ETF while those options exist, and they have value.

Casarotti: Jen, what about other structural solutions?

Herbert: It's a very complex issue. Any solution needs to factor in the unitholders in both the classes of the Global Fund but also MGF option holders. And each of these groups is likely to consider this issue from a different angle, and Magellan must act and consider the best interests of all of these groups.

And the solution must be simple and straightforward enough for advisers and investors to understand and process. You can imagine that if we come out with something extremely complex and labour-intensive, it will not be well received by the market.

Casarotti: Nikki, as one of the portfolio managers on the Global strategy, maybe you could reinforce the objectives and how we're placed to achieve those objectives.

Nikki Thomas: The objectives for the Global strategy have been unchanged for 15 years, and they're quite simple – to minimise the risk of a permanent capital loss and to deliver an absolute compound return, minimum 9% objective, through the cycle. That's what we're trying to do.

The macro environment has been very challenging this year, but global markets are generally down around 20% in 2022 and that gives you better opportunity to buy at better prices. We look at achieving those objectives through thinking about high-quality world-class companies. Those are the companies that come through difficult periods like this and actually don't just survive but they thrive. They tend to see their competitive advantages increase.

As we look at the sort of companies that we own in the portfolio, it's exciting as an investor. I am able to buy wonderful businesses like Microsoft or McDonald's or Visa or Mastercard at prices that have become compelling. And I see a forward return prospect for this portfolio that's well ahead of our objective from current prices. I can't tell you that the market wouldn't go down further from here, but if you're thinking about a long-term return objective of compound returns approaching that double digit, I think we're well placed.

Casarotti: So, David, what if the fund actually does deliver on its objectives and absolute returns and relative returns and yet, we're still seeing this persistent discount, what then?

George: Well, delivering on the objectives should support a narrowing of the discount and the fund can continue to engage in the buyback. But if the options expire in March 2024, that may provide us with other avenues to explore. In the meantime, we'll be looking at fund disclosures and client engagement plans to make sure that we're communicating frequently and transparently.

Casarotti: So, Nikki, any closing thoughts?

Thomas: I see Magellan closed class as an opportunity to buy a world-class group of companies at about a 20% discount at the moment, and potentially that discount closes. Anyone investing in a global strategy like ours should be thinking three- to five-year horizons for investing, and you don't want to think that this could happen overnight with the difficult times we're living in.

Source: Magellan

David George is CEO, Jennifer Herbert is Head of Listed Funds, Nikki Thomas is a portfolio manager and Frank Casarotti is General Manager of Distribution and Marketing at Magellan, a sponsor of Firstlinks. This article is for general information purposes only, not investment advice. The full video is here.

For more articles and papers from Magellan, please click here.