Many intriguing confrontations occur behind closed doors in the world of Listed Investment Companies (LICs) and Trusts (LITs) but much of the fight between Nick Bolton’s Keybridge and Magellan is playing out in the public domain. It is an insight into the machinations caused by the closed-end structure, where issues commonly trade at a wide discount to their underlying value, opening the door for activists and competitors to exploit investor disquiet.

Background to the billions involved

On the surface initially, Nick Bolton’s move on Magellan seemed mispriced. He had acquired options (ASX:MGFO) which gave the right to acquire units in the listed Magellan Global Fund (ASX:MGF) at an exercise price of 92.5% of the estimated NAV of MGF on the date the option is exercised. They are not traditional options with a fixed dollar exercise price. The options were issued in 2021 with an expiry of 1 March 2024. But in the year to end August 2023, MGF had traded at an average discount of 18.6% with a high discount of 22.9% over five years, and a current discount of about 12%. Bolton is obviously aware of the discounts but why did he pay for the right to a 7.5% discount?

(Declaration, my SMSF holds shares in MGF).

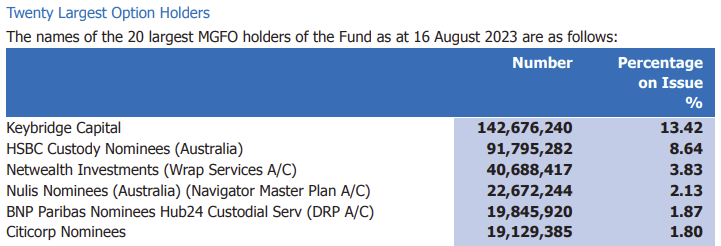

The amounts involved are huge. The Magellan Global Fund includes an open-ended class (ASX:MGOC) comprising about $7 billion and the closed-ended trust (ASX:MGF) worth about $2.8 billion. There are over 1 billion MGFO options on issue with a potential exercise value of about $1.8 billion. Whereas large shareholdings are often reported through nominee companies or trustees, Keybridge’s position is shown in the Magellan Global Fund 2023 Annual Report. Keybridge has acquired 143 million options, currently priced at about 1 cent each.

What is Bolton doing?

Nick Bolton hit the headlines in 2006 when he acquired BrisConnections options for 1 cent and forced a $4.5 million settlement after he voted against the proposal he put forward. Bolton's plan is to force Magellan to pay him the discount or change the structure of MGF to realise the NTA value. Based on the current share price of $1.68 and NTA of $1.89, Bolton could exercise into MGF at a price of $1.75 (that is, $1.89 X 92.5%) and sell for around $1.89. In other words, his 143 million options could buy $270 million worth of MGF on which 7.5% is over $20 million.

Nick Bolton has sent a note to select MGF shareholders, and here is an extract:

“With the assistance of 99 other members, we are looking to request a meeting of unitholders to consider a resolution that requires the redemption of our units at the full NAV of the fund (i.e. $1.94 at today’s value). We fundamentally believe members of the trust should be entitled to access all of their beneficial interest at any time and not just what a third party might pay for that interest from time to time on the ASX.

Importantly, if you also hold options in the fund (MGFO), then if the current trading discount persists it will cause a loss of what otherwise would be a ~15c entitlement when those options expire on 1 March 2024. In aggregate, unitholders and option holders, including yourself, are leaving some $500 million on the table as a result of the current trading discount.

We are not asking other members, at this stage, to make a decision on whether to redeem their units, we are simply looking to collectively request a meeting such that we all have that option available to us.”

If Bolton manages to convene a vote of all investors to wind up the trust, he would require the support of 75% of unitholders.

Recent media reports suggest Bolton and his associate Anthony Catalano approached Magellan offering to sell the options and drop the campaign in exchange for a payment that only Keybridge would receive, not other unitholders, although this version of events is disputed.

But therein lies the challenge for Bolton. To gain cooperation, Magellan will need convincing that anything Bolton does on his tactics is acting in the interests of all unitholders.

What has Magellan said in public?

In an update on MGF by Magellan in January 2023, reported in Firstlinks, CEO David George and Head of Listed Funds, Jennifer Herbert, spent considerable time explaining how Magellan planned to handle the MGF discount. Herbert was asked why Magellan did not convert MGF to open-ended active ETF, and she said:

“It's actually not that simple unfortunately. Firstly, MGF is a class within the greater Magellan Global Fund, it's not a standalone fund. And secondly, we have over a billion options out on issue. So, the option holders are a class of members within the Global Fund and Magellan as the responsible entity of the fund has a duty to treat those option holders fairly. So, unfortunately, we can't just wrap up the LIT to an active ETF while those options exist …”

There’s a clue: “While those options exist”. Then David George was asked if Magellan delivers on its performance objectives, but the discount persists, what might he do?

“Well, delivering on the objectives should support a narrowing of the discount and the fund can continue to engage in the buyback. But if the options expire in March 2024, that may provide us with other avenues to explore.”

In the 2023 Annual Report for the Global Fund, Magellan references the work that had already been done to narrow the discount:

“While it is pleasing that the discount has narrowed considerably since our update in November 2022 from 22.6% on 9 November 2022 to 12% on 17 August 2023, we believe there is more that can be done.”

Showing their commitment to the buyback, Magellan has now spent $465 million of MGF money buying MGF units, probably the largest LIC/LIT buyback programme in history.

Some factors determining the outcome

There’s a lot at stake in a $10 billion combined fund, and here are some factors influencing the outcome over the next five months or so:

1. The options were issued when MGF was restructured in December 2020, designed as a pro-rata bonus at a rate of one option for every two closed-class units held on the record date. Magellan said:

“We believe this is an attractive bonus issue and provides Eligible Unitholders with the opportunity to increase their investment in Magellan Global Fund, over a three year period, at a discount to net asset value.”

If MGF had continued to trade around its NTA, the options would have carried decent value and Magellan would have raised a large amount of additional funds. Magellan needs to bear in mind what it said to investors in the original option PDS.

2. Magellan did not offer the option out of the goodness of its heart, although it may have expected a win-win. The annual management fee is a healthy 1.35% plus a performance fee. Assuming Magellan would earn fees of say 1.5% a year, the 7.5% discount would be covered in five years. MGF is a closed-end fund and investors cannot redeem, and Magellan decided the NPV of future fees would exceed the discount.

3. Which leads to a crucial feature of the discount. It is funded by the Magellan Group, not the Global Fund (closed or open). And the NPV calculation only works for a closed-end fund from which investors cannot withdraw. Magellan will not want to fund the 7.5% discount and then convert to an open-ended fund if they expect investors to withdraw.

Magellan would be paying from its own shareholders’ funds the $20 million on Keybridge’s $270 million position. The options may also have value if the discount narrows to less than 7.5%, which is not impossible but unlikely.

4. Does Magellan have an incentive with 1 billion options on issue to encourage investment of around $1.8 billion of new money? While this might have been conceivable at the height of the fund-raising powers of Hamish Douglass and Magellan, it is unlikely investors will commit billions of new money, even at a 7.5% discount. They did not respond much when the discount was over 20% and most of the push in the discount back to the current 12% is buyback demand. Nevertheless, Magellan may argue it is motivated to reduce the discount so the options are exercised, adding billions to its funds.

My expectation

I expect Magellan to tough it out and refuse to change MGF until well after the options expire. If the discount narrows towards zero (and it has already moved from about 18% to 11% in 2023), it may raise money through the exercise of MGFO.

At some stage, with the options expired and better performance, but faced with the ongoing discount problem of many LIC/LIT issuers, I believe Magellan will convert MGF holders to the open-ended unit class (ASX:MGOC).

But Nick Bolton will find 100 like-minded investors, giving him the right to request a meeting of unitholders, and he will not go away easily.

The clock is ticking and the alarm will ring on 1 March 2024.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor. Graham's SMSF holds units in ASX:MGF and Magellan is a sponsor of Firstlinks. This analysis should not be relied upon for any transaction and financial advice should be sought.