Australian investors' love affair with exchange-traded funds (ETFs) intensified this year as fund inflows rose a staggering 25% in six months.

Funds under management for the Australian ETF industry now stands at $60 billion.

Providers have long spruiked the benefits of ETFs. They trade like a share and offer instant diversification—and investors have clearly caught on.

But the love affair hasn't been without its losers. As more money flows, so fees drop, and some providers are feeling the heat of that competition. One firm on the wrong side of the fee war is State Street Global Advisors (SSGA).

SSGA is the asset management business of US financial services firm State Street Corporation, and the manager of SPDR ETF funds (pronounced "spider").

SSGA is known as a pioneer in the industry, having created the first US-listed ETF in 1993—the SPDR S&P 500 ETF. SSGA listed the first ETFs in Australia on 27 August 2001, the SPDR S&P/ASX 200 (ASX:STW) and the SPDR S&P/ASX 50 funds (ASX:SFY). Back then STW charged a management fee of 0.286%.

Over the ensuing 18 years, SSGA has launched 16 products on the ASX, and today holds $6.3 billion in assets under management. First-mover advantage has helped the firm reach these heights, alongside strong global brand recognition.

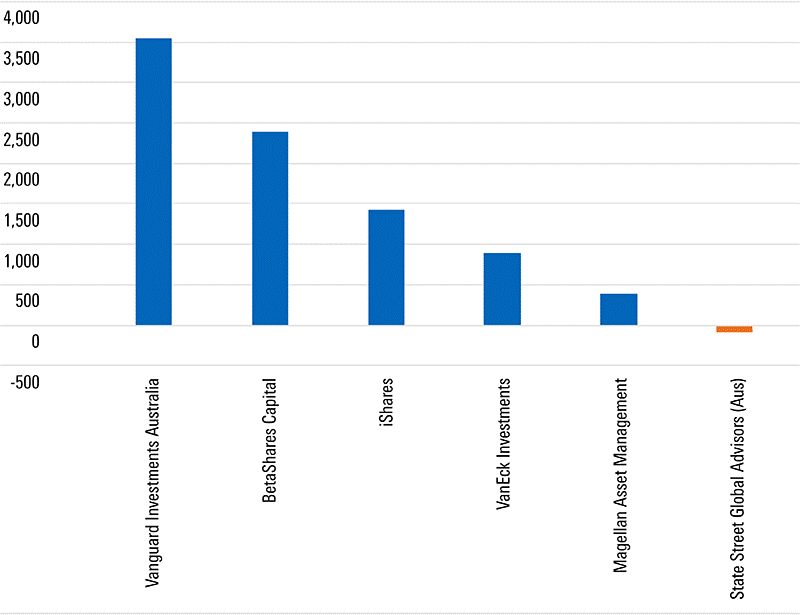

But things have started to turn sour for SSGA. This year, $93 million was pulled from its funds Morningstar data shows. By comparison, Vanguard's funds captured net inflows of $3.5 billion, BetaShares $2.3 billion, and iShares $1.4 billion.

Fund families, estimated net flow (Mil), YTD effective 31 October 2019

Source: Morningstar Direct, Asset Flows

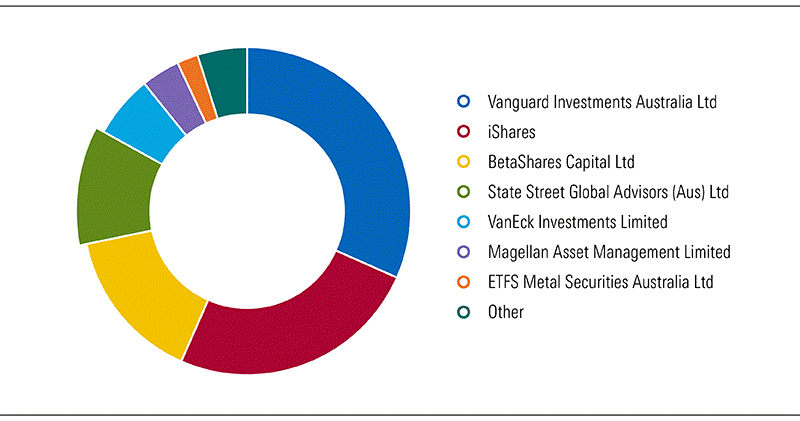

SSGA remains the fourth largest ETF provider in Australia by total net assets under management. But, it fell behind home-grown rival BetaShares for the first time this year in total net assets, dropping from third place.

Fund families, total net assets share, effective 31 October 2019

Source: Morningstar Direct, Asset Flows

Local provider escalates fee war

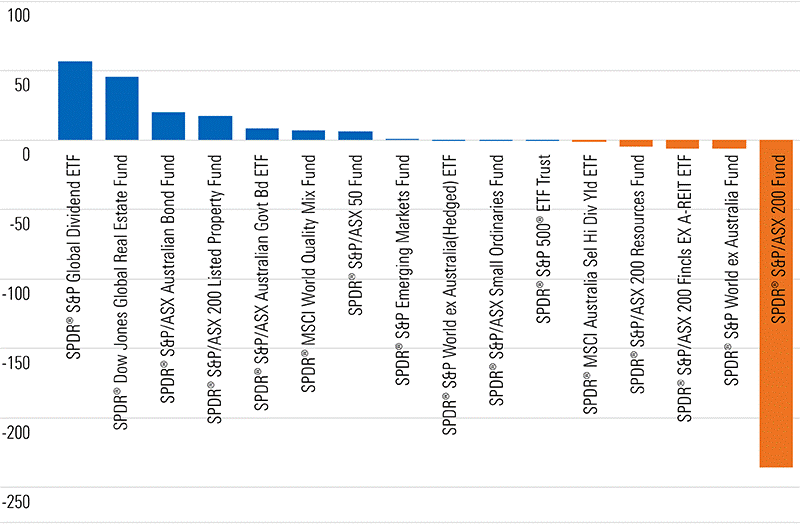

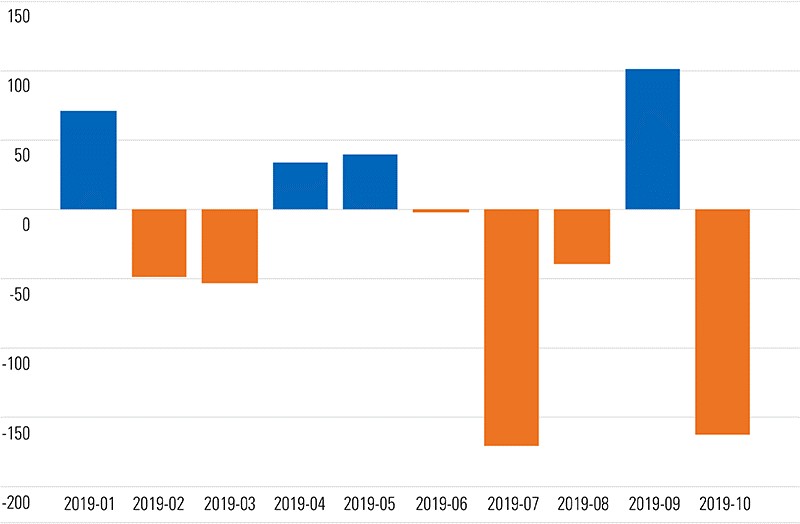

Why is this global behemoth struggling to keep pace? If we look across inflows and outflows for SSGA's product suite over the last year, the majority of outflows came from one product—STW.

STW tracks the performance of the S&P/ASX 200 Index—a free-float-adjusted, market-cap-weighted index.

Fund families, SSGA, estimated net flow ($m), YTD effective 2019-10-31

Source: Morningstar Direct, Asset Flows

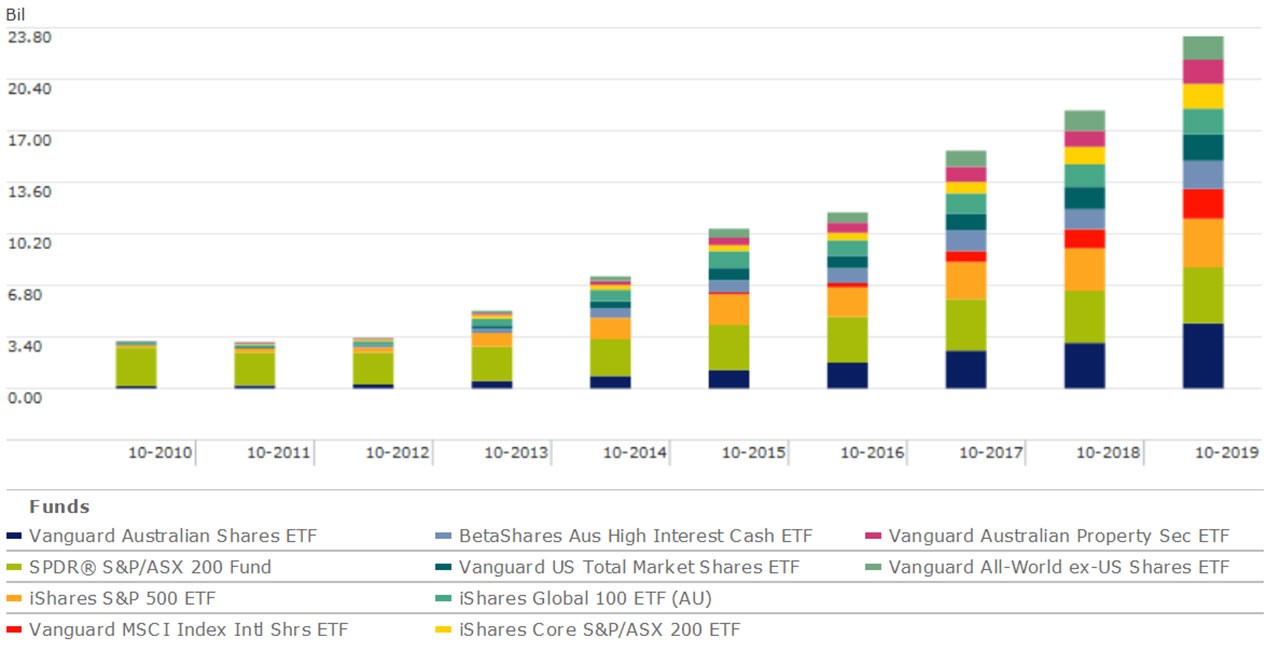

Until this year, STW was the largest ETF trading on the ASX. However, in August it slipped to second place behind the Vanguard Australian Shares ETF (ASX:VAS). STW today trades with $3.6 billion under management.

Australian ETFs, largest funds by total net assets, 10 years, effective date 2019-10-31

Source: Morningstar Direct, Asset Flows

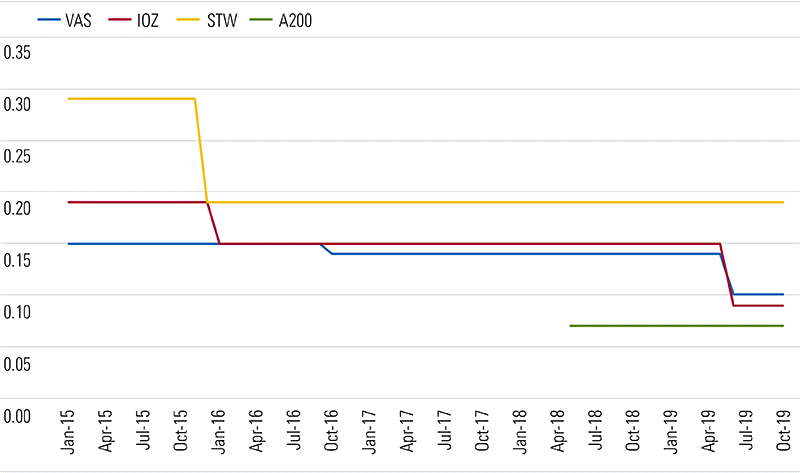

One reason for outflows could be fierce competition in the market, driven by fee compression. In May 2018, BetaShares rocked the market with the launch of its Solactive Australia 200 Index tracking ETF—the BetaShares Australia 200 ETF (ASX:A200). A200 charges an annual fee of 0.07%, half the cost of its nearest Australian equity index rival.

A year later and after $500 million flowed into the BetaShares product, several of the largest product providers slashed their fees. First off the blocks, BlackRock Australia almost halved the fee for its ETF, the iShares Core S&P/ASX 200 ETF (ASX:IOZ), from 0.15% to 0.09% in June.

Vanguard followed a day later, lowering its fees on the Vanguard Australian Shares Index ETF (ASX:VAS) from 0.14% to 0.10%.

STW slashed its price in 2015 from 0.29% to 0.19% but has since kept it on hold. This makes it the most expensive of the four products.

Fee race to the bottom, management fee %

Source: Morningstar DatAnalysis, ASX Announcements

Source: Morningstar DatAnalysis, ASX Announcements

Both providers said their respective scale benefits made the fee reductions possible.

"This change is part of the regular review of our pricing strategy, reflecting our continued growth and ability to leverage our scale for the benefit of clients,” Christian Obrist, head of BlackRock's iShares business in Australia, said.

Evan Reedman, head of product and marketing for Vanguard, said the company "takes a lot of pride in being able to pass along the benefits of increasing scale in our funds and driving costs down over time for our investors”.

The falling fees came at a time when US ETF giant Fidelity Investments launched two zero-fee index funds, signalling a new chapter in the US passive investing price war.

The relatively high price of STW could be playing a role in the erosion of its market share, particularly at a time when both VAS and A200 are seeing strong inflows. In a highly commoditised product such as an index-tracking Australian shares ETF, where there is little to separate the providers beyond index and liquidity advantage, price is arguably the most important distinguishing factor for investors.

Investors placed “low cost” as their second highest consideration behind diversification when asked why they use ETFs in the latest BetaShares/Investment Trends ETF report shows.

Robo advisers are also taking notice of SSGA's inaction. In October, Stockspot investment associate Marc Jocum wrote the online investment adviser and fund manager "continues to favour VAS", with its low expense ratio a key consideration. However, other robo advisers and micro-investing apps, including Six Park and Raiz, favour STW. The loss of an institutional mandate could also be playing a role in outflows.

Responding to questions from Morningstar, Meaghan Victor, head of SPDR ETFs, Australia and Singapore, SSGA acknowledged the fierce competition in the Australian ETF market and put STW's flows in part down to movements in institutional holdings.

"As with any other market where there is fierce competition, from time to time the market will experience a swing. These swings can be accentuated when there is a strong institutional holding, as is the case with STW," she said.

Victor said investors were focused on smart beta ETFs, "as they look to generate income in this low interest environment". This year, SSGA's strongest inflows came from its smart beta SPDR S&P Global Dividend ETF (ASX:WDIV), Morningstar data shows.

Look beyond fees

Victor did not say whether SSGA would consider dropping this to be in line with rivals such as VAS, which charges 0.10%. However, when assessing total cost, she says there are aspects for investors to consider in addition to the management fee.

"Investors need to look beyond the ETF’s expense ratio to assess a fund’s total cost of ownership in conjunction with the liquidity profile of the fund and index which it tracks," she says.

"Because ETFs trade like stocks on exchanges, trading costs also contribute to the total cost of owning an ETF. And these costs can fluctuate significantly."

Former Morningstar associate director, manager research, Alexander Prineas says incumbent providers in this competitive environment face a tough decision. To follow with their own fee reductions to entice inflows, and risk sacrificing some profit on the existing book of funds under management; or, maintain fees and profits, but potentially sacrifice new inflows.

"That’s a particularly tough choice for SPDR because STW is such a large and long-running ETF in Australia," Prineas said in June.

"It also remains one of the most liquid ETFs thanks to its size and large trading volume, and the fact that it tracks the most widely-used benchmark, the S&P/ASX 200 index. But STW is now priced notably above other rivals."

It's clear that SSGA has decided to sit out the price war. For them, cutting the fee on STW to make it comparable to VAS and IOZ would be a multi-million-dollar decision.

But being relatively cheap compared with active management simply doesn't cut it.

Victor is confident that STW, as the first Australian ETF, and licensee of the S&P/ASX 200 Accumulation Index—one of the most important financial benchmarks in Australia, will "continue to be a staple investment for many institutions, intermediaries and retail investors".

"We have always sought feedback from our clients to ensure we are offering the best possible outcomes while remaining competitive in the market," she says.

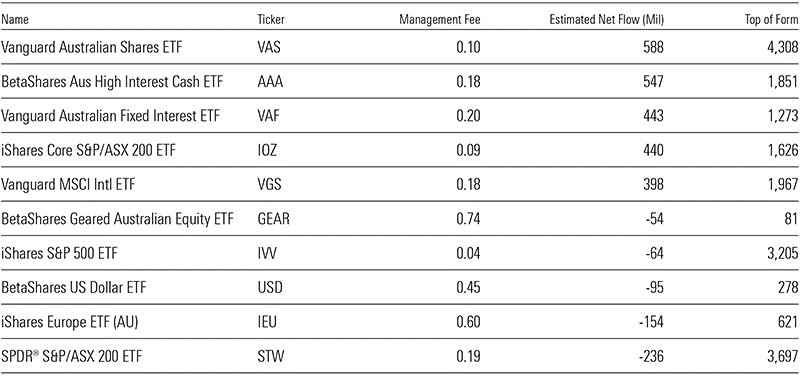

ETFs with the highest inflows and outflows for the year include:

Source: Morningstar Direct, Eff date, 2019-10-31

Source: Morningstar Direct, Eff date, 2019-10-31

Where are my franking credits?

There are of course other possible reasons for STW's fall from first place. For instance, investors were baffled earlier this year when for the first time in its history of operation, STW failed to distribute franking credits with its end of year distributions. Its decision emanates from a confusing series of ATO rules. As SSGA company secretary Peter Hocking explained to investors in an ASX update:

"…STW received franked dividends from its holdings in S&P/ASX 200 stocks at very close to index levels. However … the Fund cannot automatically pass these franking credits on to its investors. It must first pass the ‘holding period’ test in the tax law," he wrote.

To pass the test, providers must pass either the "45-day rule" or the "benchmark rule":

- 45-day rule: "if a fund has held a share for at least 45 days within a specified period around the ex-dividend date it can distribute any franking credits attached to that dividend."

- Benchmark rule: "The ATO publishes a ‘benchmark’ level of franking and the fund tests its franking credits against this benchmark. The fund can distribute this benchmark level of franking credits plus an extra 20% without any other restrictions applying."

STW selected the benchmark test when it first listed. In June 2019, the testing showed that "the franking credits already distributed exceeded the franking credits permitted under the benchmark rule”. As a result, STW was unable to distribute franking credits for the June quarter.

The ATO has since granted STW’s request to permanently switch from the benchmark rule to the 45-day rule, and allowed STW to retrospectively apply the 45-day rule to the June 2019 distribution. This resulted in investors receiving a commensurate amount of franking credits for the June quarter. Coincidently, STW suffered its strongest outflows the same month, bleeding $170 million.

STW, estimated net flows, YTD effective 2019-10-31

Source: Morningstar Direct, Asset Flows

Source: Morningstar Direct, Asset Flows

New millennium spurs ETF growth

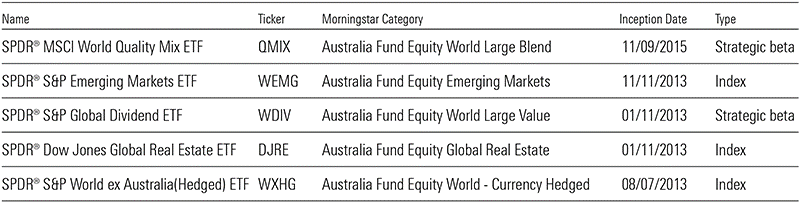

After going through a period of product innovation between 2011 and 2013, bringing 10 products to market, SSGA's last product launch was in September 2015—the SPDR MSCI World Quality Mix ETF (ASX:QMIX).

By comparison, since September 2015, BetaShares have launched more than 35 products, Vanguard 17, iShares 11, and VanEck 10. Between 2001 (when SSGA launched in Australia) and 2010, there were around five major providers in the ETF market. Today, there are over 15, Morningstar data shows.

SSGA has launched a new suite of ETF model portfolios this year, available to financial advisers via investment platforms.

SPDR five latest product launches, by inception date

Source: Morningstar Direct

Source: Morningstar Direct

This is not to suggest that more products equal better offerings. Morningstar has warned investors about the dangers of niche and thematic ETFs, and with the US ETF industry burying its 1,000th ETF product this year, it shows how volatile the market is.

The recent reluctance to innovate can be viewed as SSGA focussing on existing products and clients. But it's hard to deny the impact that new product launches and product innovation have on consumer brand awareness and affiliation, particularly in an industry where 43% of all new entrants into the ETF market within the past two years are millennials.

Diversified listed products such as Vanguard's Diversified Investments range also provide an avenue for flows to funds.

Morningstar analyst, manager research, Ksenia Zaychuk expects the ETF fee war to continue into 2020. However, she says it's unlikely to be as rapid as the US market.

"The Australian ETF market is still small relative to the US and lags behind it. Investors are becoming more cost-aware so we expect to see fee reduction in the products that don’t offer much differentiation, for example, traditional index tracking Australian equities," she says.

STW holds a Bronze rating from Morningstar fund analysts.

Emma Rapaport is the editor of Morningstar.com.au

Try Morningstar Premium for free

© 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This information is to be used for personal, non-commercial purposes only. No reproduction is permitted without the prior written consent of Morningstar. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), or its Authorised Representatives, and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Please refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a licensed financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782. The article is current as at date of publication.