The world is on the cusp of a revolution in low-carbon technologies, and they are set to reshape many of our supply chains.

The not-so-humble battery sits at the heart of this shift. The growth of electric vehicles (EVs), and renewable power generation/storage, will increase demand for a range of raw materials. It’s estimated that the global EV stock will reach 245 million vehicles by 2030, or more than 30 times above today’s level.

Installed wind capacity is expected to rise almost fourfold in the same period, from around 700 gigawatts today to around 2000 gigawatts in 2030 [Source: IRENA, CGAU].

However, a rapid ramp-up of such technologies will require a concurrent increase in the materials used in them. Significant investments in mining and technology will be required to meet the needs of the burgeoning battery market.

This article outlines the key materials required for battery production, and their related investment opportunities.

1. Lithium

It’s the metal that everyone is talking about. Australia is extremely well positioned to supply into this market and has a number of projects across the board among large companies such as IGO and Mineral Resources, as well as a lot of smaller companies that are trying to also establish a position in this space.

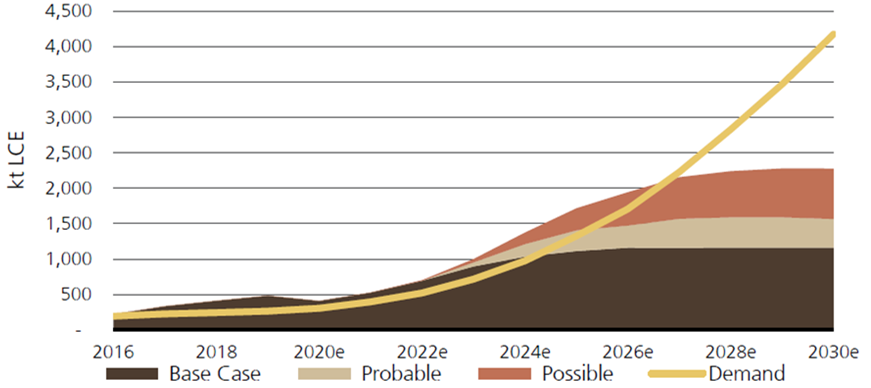

Lithium is the prerequisite metal for all batteries that are used in electric vehicles. As shown in the chart below, it is clear that future demand is massively outstripping the supply that’s coming on. Most lithium processing companies are in China, and they’ll tell you that the curve is nearing vertical in terms of the demand they are seeing.

Chart 1: Lithium supply and demand balance

Source: UBS, Battery Raw Materials, 4 March 2021.

There are two sources of supply for the lithium that goes into a battery: brine, and hard rock called spodumene.

Brines are usually found in South America, in the form of an underground salt that can be dissolved and then taken up to the surface and spread out into an evaporation pond to leave lithium chloride which is converted to lithium carbonate. Everything can go wrong, due to being an open-air chemical reaction exposed to the elements. Because of this, and due to the lesser energy density that this type of material provides, brine is not the preferred source of lithium to be used in the batteries.

Spodumene is what we have here in Australia. Spodumene is a hard rock and is found mostly where iron ore is found, for example in the Pilbara region. Spodumene is even harder than iron ore and is very difficult to break. A concentrate is formed by crushing and separating the ore, and Australia has become very good at this over the years. For example, Mineral Resources is a world leader, crushing and concentrating spodumene to 6% lithium, which is the optimal concentrate for this ore for conversion into lithium sulphate and then lithium hydroxide and lithium carbonate. Spodumene is where the supply and investment is going. The capital intensity has been coming down, and the ability to reliably concentrate it has improved dramatically.

2. Nickel

The best batteries in the world have very high nickel content. Tesla and its EV peers want the best batteries, and this is what is going to drive demand. Nickel is favourably exposed to demand from electric vehicles due to nickel use in battery cathodes, and a trend towards using more nickel and less cobalt in cathodes.

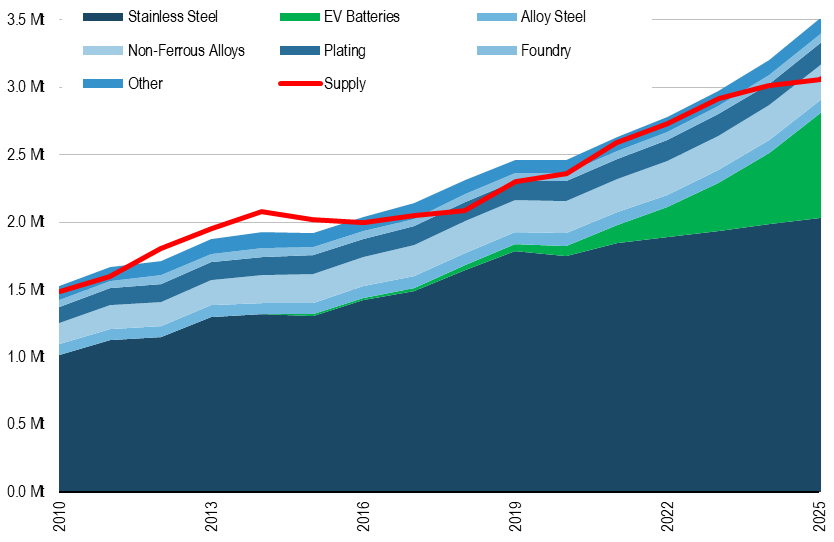

As shown in the chart below, currently nickel is predominantly used in stainless steel and other steel alloys. However demand for nickel is increasingly going to come from EV batteries.

Chart 2: Nickel demand forecast (kpta)

Source: UBS, Battery Raw Materials, 4 March 2021.

There are two nickel ore types: laterite ores and sulphide ores. Demand for nickel sulphide is going to be very high, compared to laterite ores, because a sulphide can be converted to a nickel sulphate for batteries at a relatively low financial and environmental cost. To meet future high demand, nickel sulphide is going to be the precursor material that is going to go into batteries.

3. Copper

Copper supply is declining. It is becoming increasingly difficult to mine, with new discoveries typically being lower grade, deeper underground, or in regions such as the Democratic Republic of Congo which, from an ESG perspective, are unviable. These factors combine to make copper one of the few commodities that are increasingly rare to find in the earth’s crust in an economic way.

EVs rely on the movement of electrons, and there is no material known that is better than transmitting electrons than copper. Therefore EVs are going to have a lot more copper, along with the charging stations and the electricity grids which support them. Therefore copper demand for EVs and supporting infrastructure, along with the copper price, is expected to be very strong.

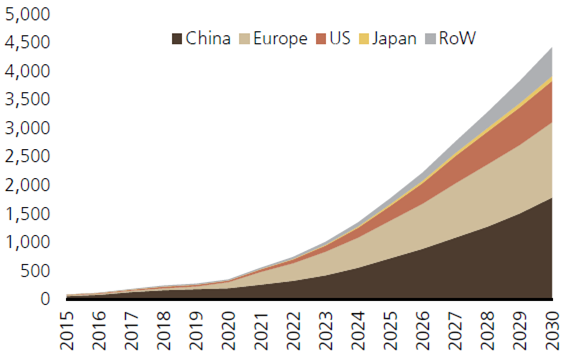

As shown in the chart below, by 2030 copper consumption in electric vehicles is expected to represent 4.4Mt of copper or approximately 13% of total demand. At face value, this is modest demand growth compared to the markets of lithium, nickel, rare earths or graphite. But EVs serve to accelerate demand growth towards around 3% p.a., which is above the long-term historic trend of 2.4% CAGR (1976-2019) [Source: Wood Mackenzie, Company Filings, UBSe, August 2021].

Chart 3: Copper demand from Electric Vehicles (ktpa)

Source: UBS, Battery Raw Materials, 4 March 2021.

4. Rare Earths

Rare Earths (RE) refers to a group of transition metals that have magnetic, nuclear and electrical properties. Their name refers to their rare occurrence in economically viable concentrations, rather than scarcity. Neodymium (Nd) and Praseodymium (Pr), or NdPr, are two rare earth elements that face a step change in demand from forecast EV sales because they are the strongest type of permanent magnet, used in high performance applications such as electric motors and wind turbine generators. Currently, permanent magnets represent the largest end-use for rare earth elements, at around 30% of demand.

China has the best deposit in the world, with the second largest deposit in the world being in Australia; a highly strategic asset owned by ASX-listed Lynas Rare Earths Ltd.

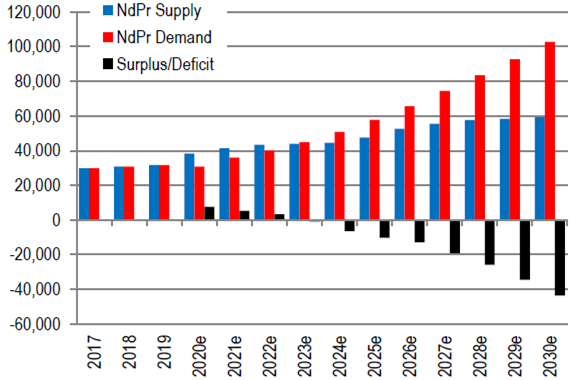

Current demand for NdPr is less than 40,000 tonnes per year, but this is forecast to reach over 100,000 tonnes by 2030. Supply projections suggest producers will be unable to keep up with this demand [Source: UBSe, Company Filings].

Chart 4: NdPr demand and supply projections (tpa)

Source: UBS, Battery Raw Materials, 4 March 2021.

Investment opportunities in Australia

We believe that Australian companies are well-placed to benefit from the growing demand for batteries and EVs, with a number of established companies already operating in the sector, including:

The Federal Government is focused on fostering a resilient commodity supply chain and has developed a roadmap for critical minerals processing and manufacturing, with the goal of becoming a regional hub for the sector over the coming decade.

The Australian Small and Mid Cap Companies team continues to monitor the opportunities in this sector, in particular leading companies that are positioned to benefit from the fundamental changes the next decade will bring as a result of the growing demand for electric motors and battery technology.

Dawn Kanelleas is Head of Australian Small and Mid-Cap Companies at First Sentier Investors, a sponsor of Firstlinks. This article is for general information only and is not a substitute for tailored financial advice. Any stock mentioned does not constitute any offer or inducement to enter into any investment activity.

For more articles and papers from First Sentier Investors, please click here.