Most economists expect the RBA to cut rates by 25 basis points this month. They also expect that this will fuel renewed demand for housing, and lead to a bounce in home prices.

I get frustrated by the almost universal forecasts for house prices to increase by 8-10% annually, like they’ve done in the past. It’s extrapolation and it’s lazy. For instance, it doesn’t consider how expensive current housing is. My valuations indicate housing in Australia is about 40% overvalued.

The forecasts are lazy also because they don’t look at the implications of rising prices and what it will mean for affordability. In other words, whether people will be able to afford more expensive homes.

Some context

House prices across Australia rose 4.9% last year, and in capital cities, they were up 4.5%. Including rents, prices were 8.3% higher in 2024.

Over the past 10 years, ‘hedonic’ house values (including rental income) increased 133%, at a compound annual rate of 8.8%, according to CoreLogic.

It’s been a stellar decade for the property market and it’s continued an almost uninterrupted 35 years of prices rising in the high single digits annually on average.

The median house is now valued at $986,000 (this includes apartments, townhouses as well as houses).

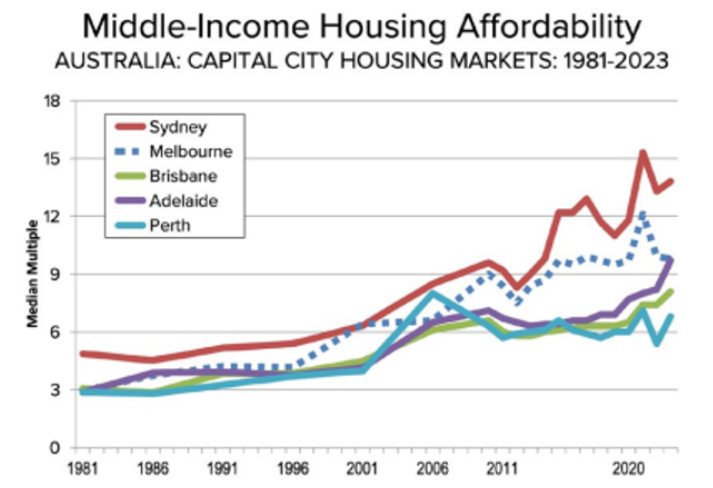

International consultants, Demographia, say Australia’s median price-to-income ratio of 9.7x puts it among the most expensive housing markets in the world. They categorise our five major capital cities, excluding Canberra, Hobart, and Darwin, as either severely unaffordable, or impossibly unaffordable.

Despite being arguably expensive, many economists, along with most Australians it would seem, expect houses to replicate the returns of recent decades moving forward.

Here I crunch the numbers to see if that’s plausible.

The current state of play

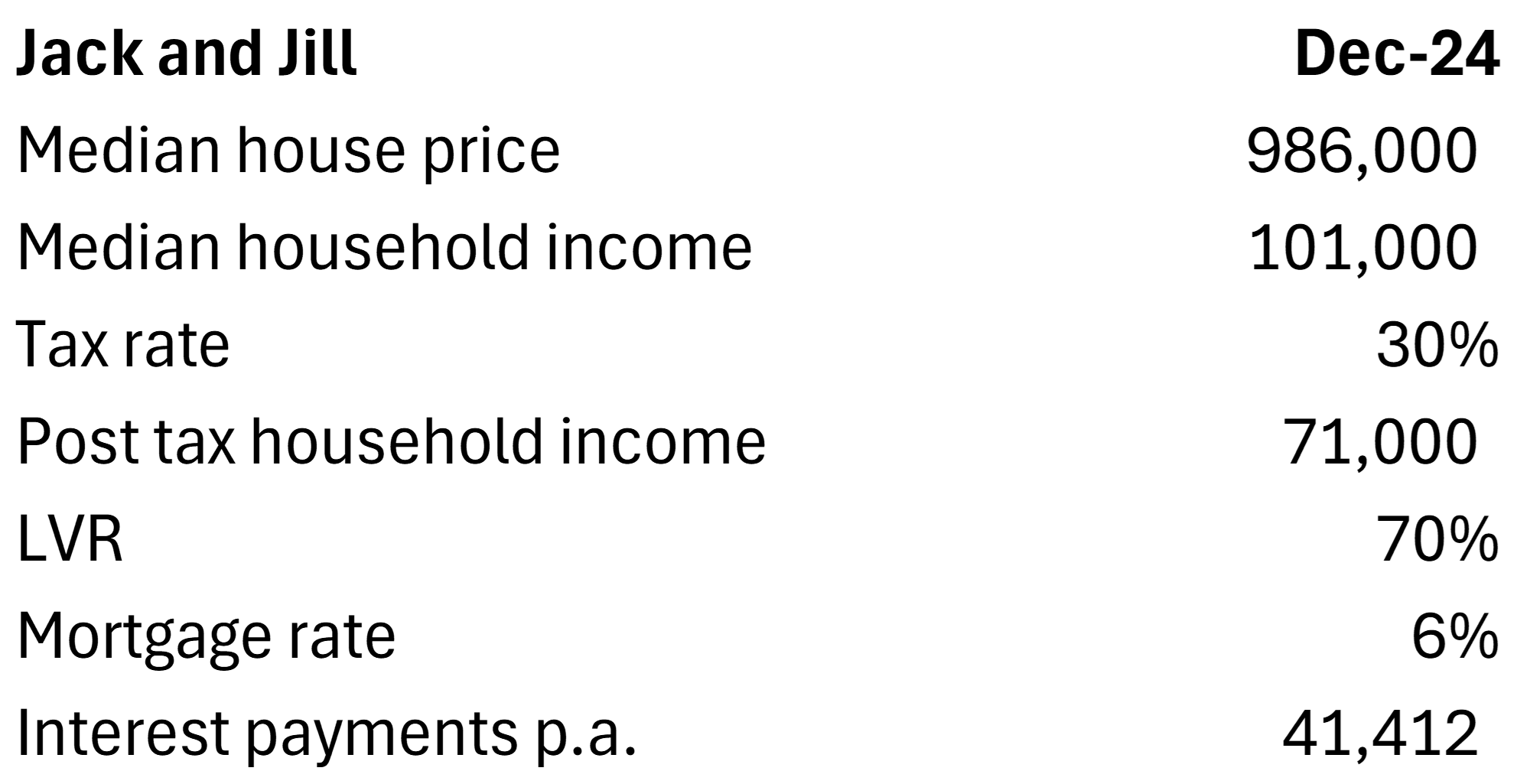

Let’s first try to calculate how affordable current housing is. Imagine a couple, Jack and Jill, who are looking to buy a home in Brisbane’s outer northern suburbs. They’re in their mid-30s, childless, and Jack has a full-time government job while Jill works part-time. Together, they have combined salaries of $101,000. After taxes, their household income is $71,000 (applying a 30% tax rate).

The house they have their eyes on is valued at $986,000. Jack and Jill have saved up for a deposit and can get a loan from the bank with a loan to value ratio (LVR) of 70%, at a rate of 6%.

That means interest payments will be $41,412 each year. With net household income of $71,000, before accounting for everyday expenses, it’s not hard to see how challenging it will be for Jack and Jill to be able to afford the home they want. Remember, those annual interest payments don’t include possible loan principal payments each year.

Jack and Jill’s situation isn’t unusual. In fact, they represent the typical Australian household. Their household income is identical to the median household income across the country. And the house they want to buy is in line with the median national house price.

Source: Firstlinks, ABS

Given these figures, some of you may wonder how the average family can afford a home at all. The median numbers don’t factor in that Jack and Jill are entering their prime salary earning years and therefore may have a higher household income than the norm. Also, they may not be on the 30% tax rate applied above. They could have saved up enough to have money to put towards future interest payments. Or they could possibly have the Bank of Mum and Dad to help them out.

In other words, the numbers are approximate and are meant to give a rough guide on the affordability of houses for the typical Australian family.

Scenario 1: Jack and Jill buy later

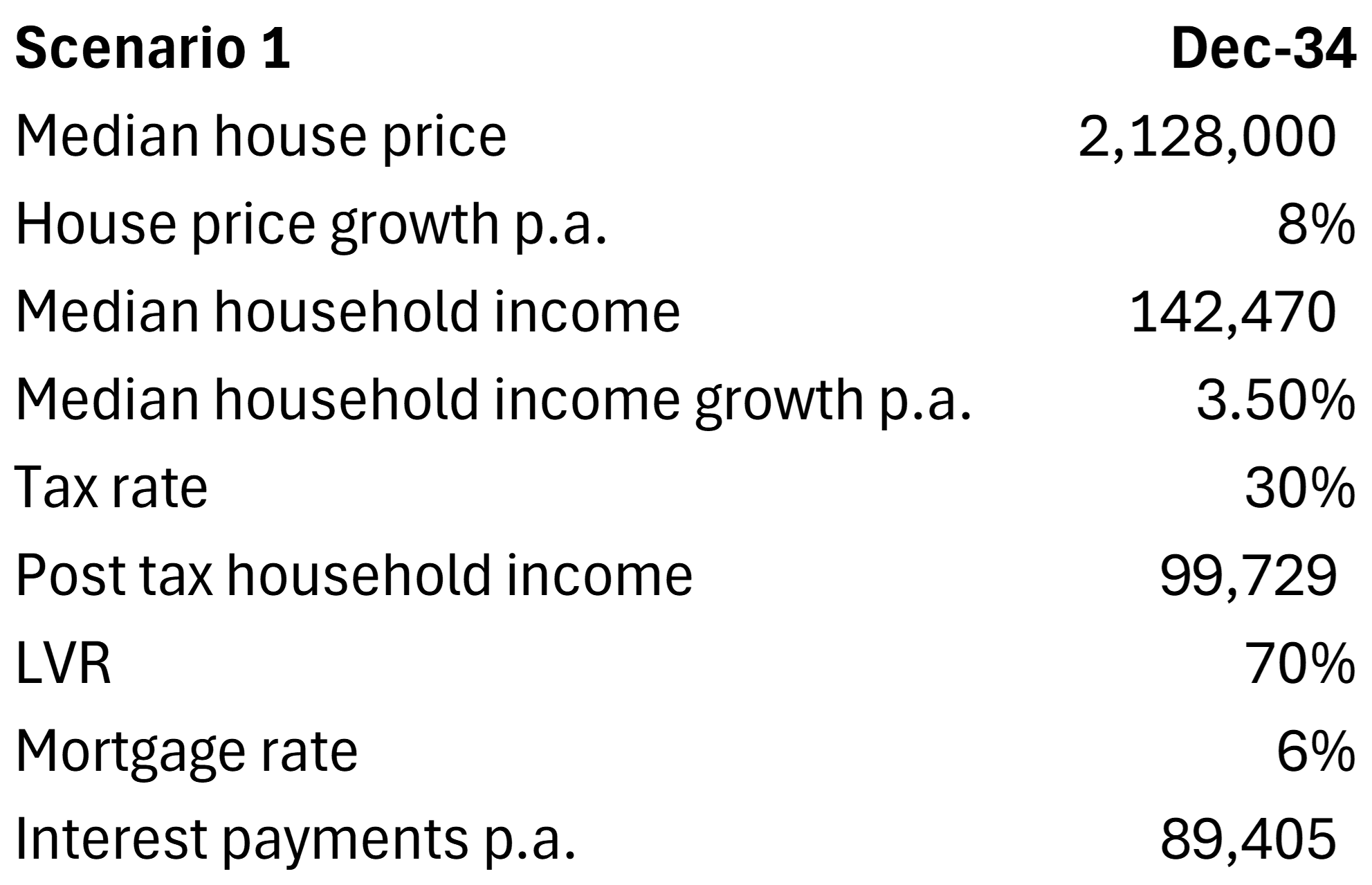

Let’s say Jack and Jill hold off buying now. Instead, they look to purchase a property in 10 years’ time. Let’s assume that house prices rise by 8% per annum over the next decade, largely in line with what they’ve done in recent decades. Let’s also assume that salaries grow at 3.5% each year, in line with recent wage rises. Finally, let’s also assume that the mortgage rate remains at 6%.

How do the numbers stack up for Jack and Jill by the end of 2034? The median house price will have risen to $2.13 million, from $986,000. Their household income, in line with the Australian median, will have grown to $142,470 and, assuming a 30% tax rate, post-tax income will be just under $100k.

How affordable will a mortgage be, then? At a 70% LVR and 6% interest rate, annual interest payments would be more than $89,000.

In this scenario, the annual interest payments would take up about 90% of Jack and Jill’s post tax income. Remember, that income doesn’t include everyday expenses incurred each year. And the scenario excludes any loan principle that may need repaying.

It’s easy to see that if the prospect of Jack and Jill buying a house is difficult now, then it would be impossible in 10 years’ time in this example.

Zooming out, 8% annual property price increases alongside 3.5% annual wage rises would result in the median price to income ratio expanding from around 9.8x now to 15x in 2034.

Scenario 2: Lowering interest rates

I can foresee that some of you may push back, suggesting that mortgage rates I applied in the above examples are too high. Actually, 6% rates aren’t high versus history; they’re only high when compared to the past decade.

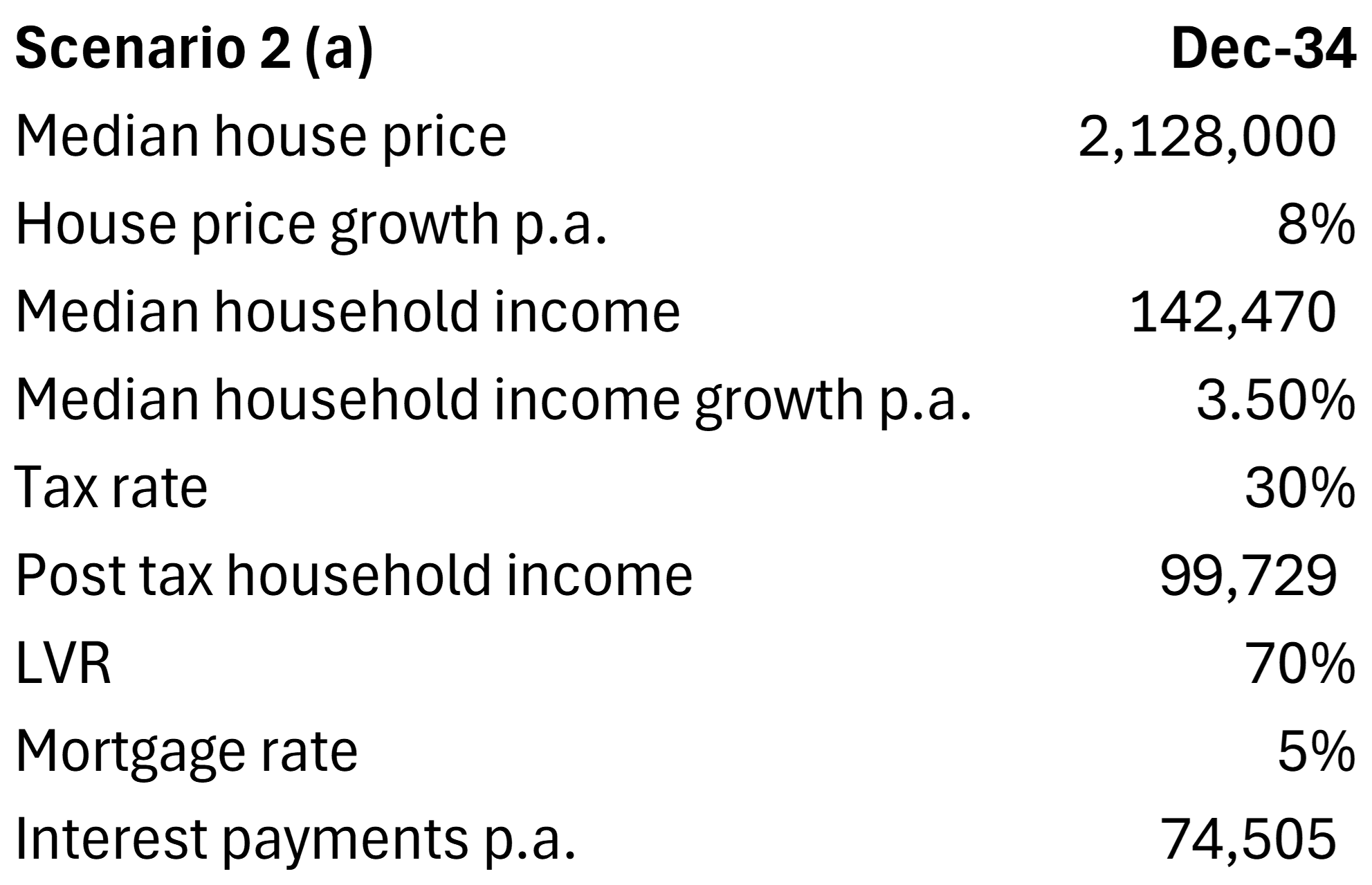

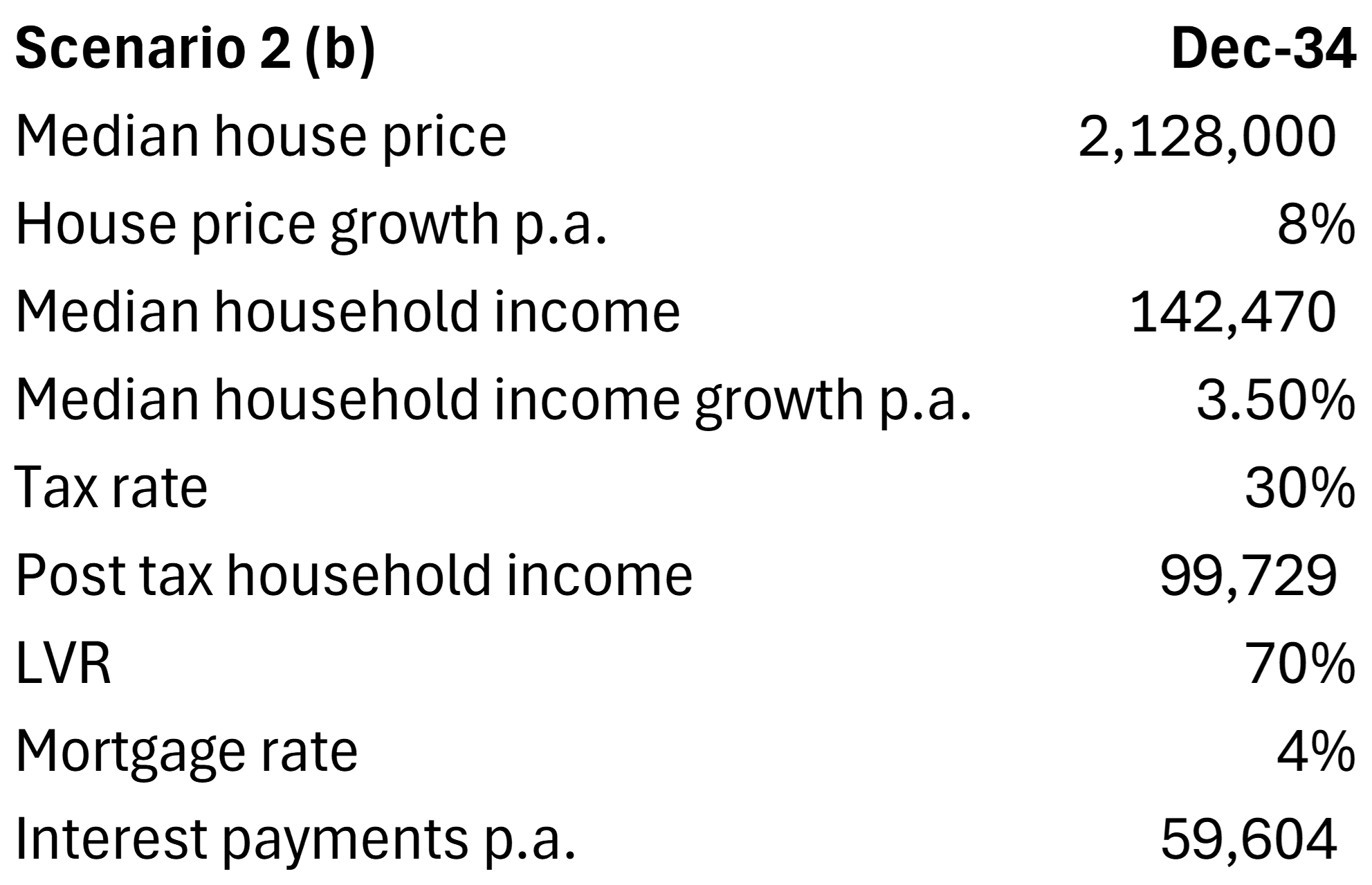

However, the RBA may lower rates soon, and perhaps they could stay low for some time. Let’s then assume a 5% mortgage rate for Jack and Jill in 2034. Would it make buying a home more affordable for them?

Not really. Assuming the same property price rises and a 70% LVR, it would result in annual interest payments of $74,505, compared to post-tax household income of $100k. That won’t work.

What about with 4% mortgage rates? With the same assumptions for prices and LVRs, it would equate to annual interest payments of $59,603. This might be affordable on an interest only mortgage, but barely. For a principal and interest loan, forget about it.

Scenario 3: Lower property prices

Instead of lower rates, let’s assume that house prices don’t increase as much as 8% annually over the next decade.

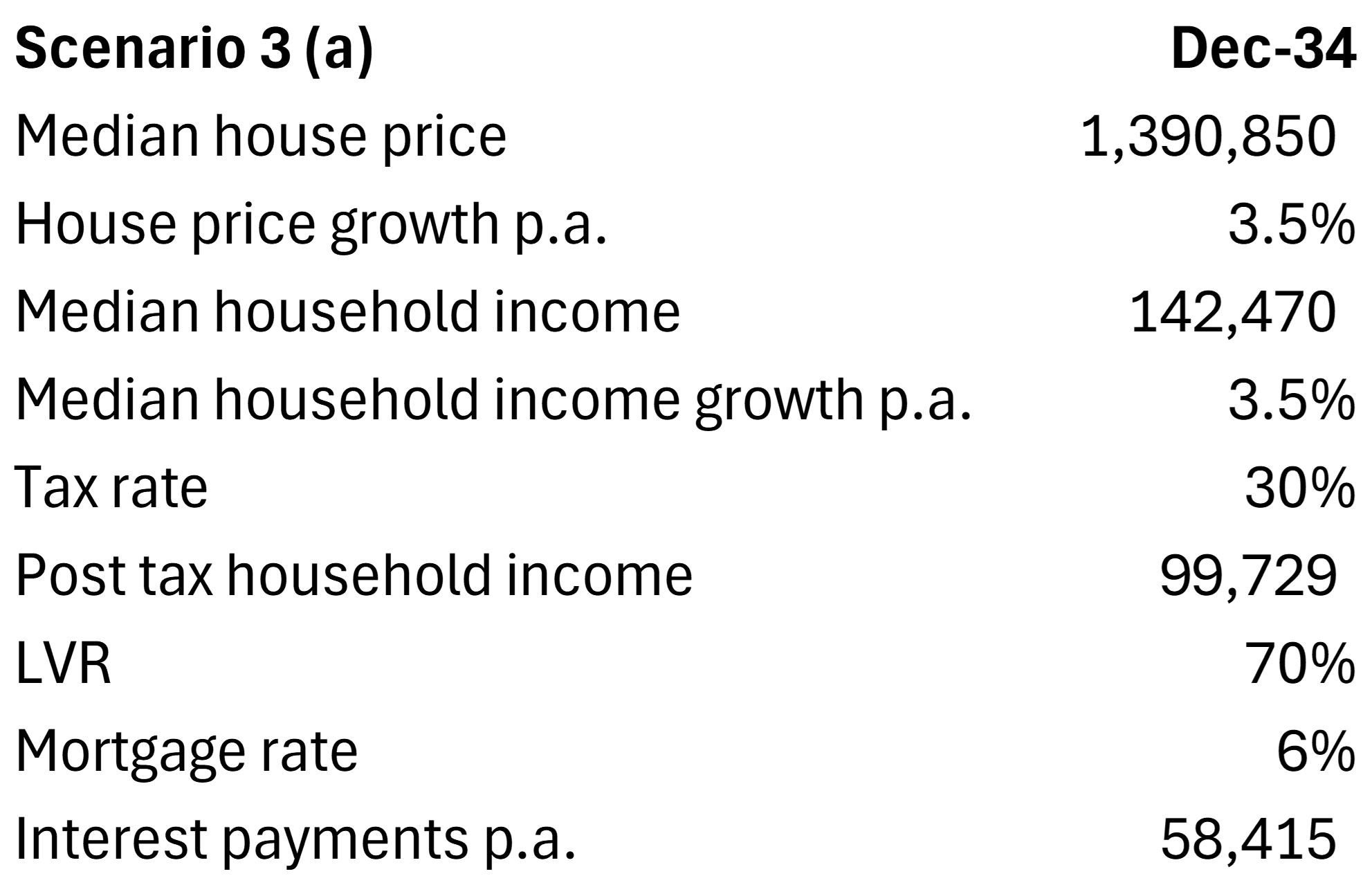

What if prices only rose 3.5% per annum? Would that make property more affordable for Jack and Jill? Assuming the same 3.5% annual wage growth and 6% mortgage rate as per scenarios 1, then affordability for them would be the same in 2034 as it is now. And at a broader level, the price to income ratio would remain the same at 9.8x.

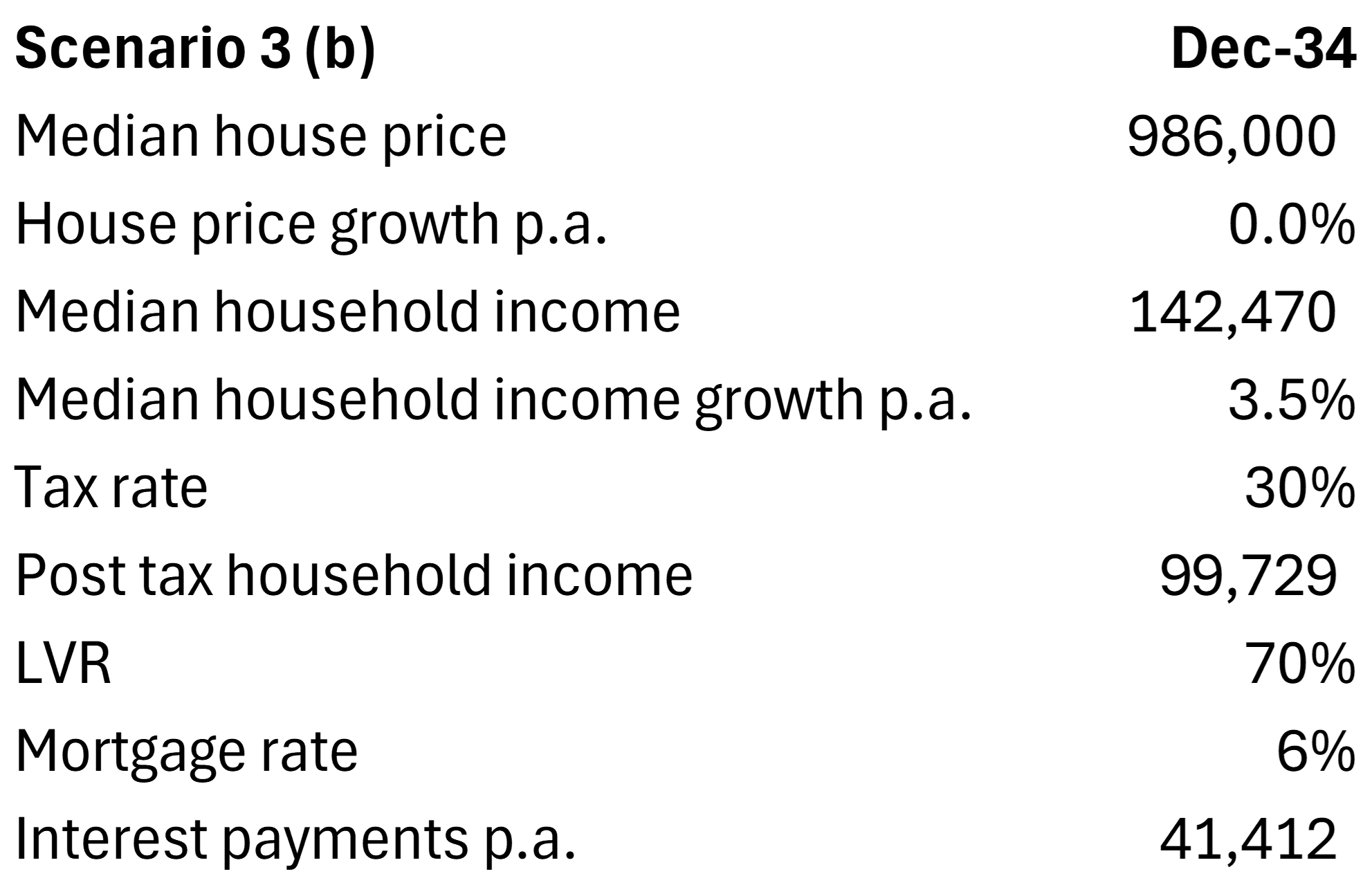

What if house prices didn’t rise at all out to 2034? Assuming the same 3.5% annual wage growth and 6% mortgage rate as per scenarios 1, then affordability for Jack and Jill would improve markedly. The median property price would remain at $986,000, but their household income would swell from $101k now to $142k in 10 years. Post-tax household income would be $100k in 2034. Meanwhile, interest payments would be $41,412 each year.

A decade of stagnant house prices starts to make property a much more affordable option for Jack and Jill.

The problem is house prices

The above scenarios indicate that the key problem for housing affordability isn’t interest rates. It isn’t credit availability. It isn’t wages. The biggest swing factor is house prices.

If property prices continue to rise as they have done in the past, then housing will go from very expensive now to impossibly unaffordable for most Australians in a decade’s time.

Because of that, it’s my view that affordability issues cap house price growth going forward.

Some caveats

The above scenarios are necessarily simplistic. I realise that they are rough numbers and are based on median house prices and incomes. I also realise that there are a host of other things that can influence the price of property - from supply, to taxes, to inherited wealth, to immigration etc. This article has deliberately on one critical factor – affordability.

James Gruber is Editor of Firstlinks.