The age pension has been a staple of retirement income for Australians since the early 1900s. Despite much public debate in recent years around reducing its benefits, and the latest changes introduced in early 2017, the age pension remains a relatively attractive, low risk source of cash flow for the majority of Australian retirees. If you consider its true value, you could say it is the world’s greatest annuity.

And yet, despite its importance, investors often overlook it when they make asset allocation decisions for their retirement portfolios.

Similar to an exceptional insurance company-issued annuity

Thinking of the full age pension as a life insurance company-issued annuity, its product features would look something like this:

- Yearly income of around $34,382 per homeowner couple

- Indexed twice yearly (to at least CPI, if not wages)

- Payments guaranteed for life

- Spouse reversionary

- Issued by an AAA-rated entity

- Government guaranteed.

How much would the average retiree couple be willing to pay upfront at age 65 for an income stream such as this? $200,000? $400,000? $600,000? The answer is, probably more.

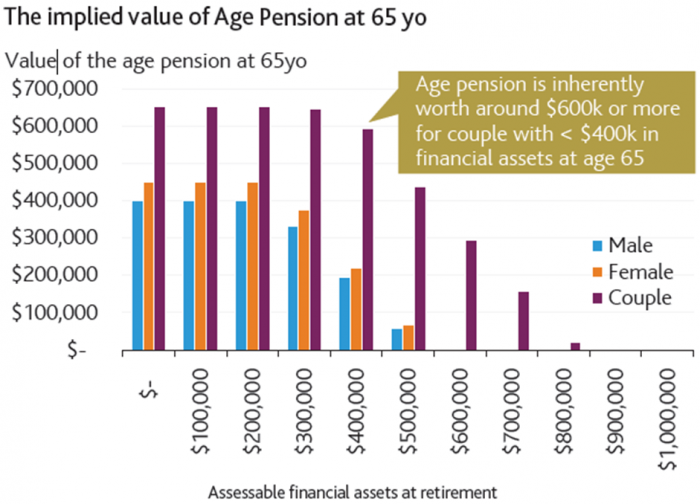

Looking at an estimated net present value (NPV) of the yearly payments of $34,382 for an average male and female at age 65 on a full age pension gives a guide. From Aberdeen’s estimates (based on constant value of assets during retirement) for a couple, it works out to be around:

- $653,787 for a couple

- $451,375 for a single female

- $398,698 for a single male.

The higher amount for a single female is based on an additional three years’ worth of payments due to longer life expectancy.

These figures assume the recipients are on the full age pension. However, even for retirees eligible for a reduced pension, due to their assessable financial assets under the ‘assets test’, the value of the age pension remains substantial. For an average 65-year-old couple with $400,000 in combined financial assets, the age pension still has an estimated NPV of around $592,687.

This is a large sum, particularly compared to the average superannuation balance of $430,650 for the same couple at or near retirement age (60-64 years old). For a single male of this age, the average superannuation account balance is $292,500 and for a female it is $138,150 (according to ASFA ‘Super account balances by age and gender’, December 2015).

More than 55% of wealth is in the age pension

The average Australian couple at retirement effectively has $430,650 in accumulated super and, based on that super balance, also has $545,398 worth of future age pension payments (in NPV terms). Considered another way, more than 55% of the average retiree couple’s financial wealth is in the form of the age pension.

Yet some investors, when determining the most appropriate asset allocation for their retirement portfolios, focus solely on accumulated superannuation balances, without taking into account the inherent value of the age pension. They fail to recognise that the age pension, which accounts for a significant portion of their total financial wealth (55% in the example used here), is a 100% defensive low risk asset. The implication of this is that the average investor can afford to be more growth asset-oriented with the remaining 45% (accumulated super balance) when constructing their investment portfolio.

Let’s consider what this means for our couple above who has:

Accumulated super at retirement: $430,650

Estimated NPV of age pension: $545,398

Total assets effectively worth: $976,048

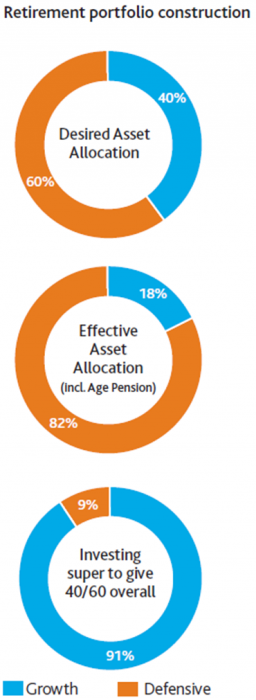

Applying the traditional approach, this couple would invest the $430,650 in super in a 40/60 portfolio. This would include 40% in growth assets like equities and property, and 60% ($258,390) in defensive assets like annuities and term deposits.

Including the age pension as a defensive asset

However, if we were to include the age pension as an asset in this mix (counting it as defensive), their effective asset allocation would be 82% exposure to defensive assets, and 18% to growth assets. At the overall level, the couple may be $218,000 (or 22%) over-exposed to defensive assets like term deposits and annuities. Such a mismatch between their risk profile and investment portfolio could severely compromise their ability to meet their retirement objectives.

For most retirees receiving a part pension, the inclusion of investments such as term deposits and annuities in their broader portfolio arguably offers similar exposure to the defensiveness offered by their pension, and therefore make less sense from a diversification perspective. Remember that a basic tenet of diversification is that incremental assets included in a portfolio should bring different characteristics and therefore add to the overall diversification benefit of the portfolio.

It can make sense, when considering a retiree’s asset allocation, to include the age pension within the asset mix. If we were to do this for the couple in our example, and then invest the accumulated super balance to achieve an overall portfolio mix of 40/60, then 91% of the super portfolio would be invested in growth assets to give an overall 40/60 mix. It may sound extreme but the diversification means such a portfolio is likely to deliver a more optimal outcome over the long term than the portfolio over-exposed to defensive assets.

The age pension provides an important source of income for many Australian retirees. The average retiree who doesn’t take into account the inherent value of the age pension is almost certainly over-exposed to similar assets with a defensive set of characteristics, namely term deposits and annuities.

Retirees should take a more holistic approach to their wealth and financial exposures by considering investments that complement the age pension, rather than looking at their superannuation in isolation.

Josh Hall is Investment Specialist at Aberdeen Standard Investments. This article is general information and does not consider the circumstances of any individual.