What a daunting prospect it must be for anyone for whom moving a loved one to residential aged care looms on the horizon.

I’ve watched clients go through it. There’s the guilt: Are they ready? Am I being selfish? Should I, could I keep caring for him at home?

There’s the logistics: Where should she go? When? What will we do with the house, the furniture, the dog?

And then there’s the financial side. Anyone who has tried to research the fees and charges themselves would know how complex it is. I have been educating and advising on aged care costs for over 10 years, so I feel I’ve pretty much got a handle on it, although it took a while. It was years before I felt confident in my understanding of the system, and I still come across questions that I don’t immediately know the answer to.

Back when I first started trying to understand the fees and charges and how they interact with the age pension, there was very little written about it, and certainly nothing user-friendly. There’s now some good information available, and the Department of Health and Ageing’s website is a good start at www.myagedcare.gov.au.

The truth is there’s no simple way to explain everything, so I’ll summarise for the purposes of this article and hope it goes a little of the way to demystify it all.

Paying for the accommodation

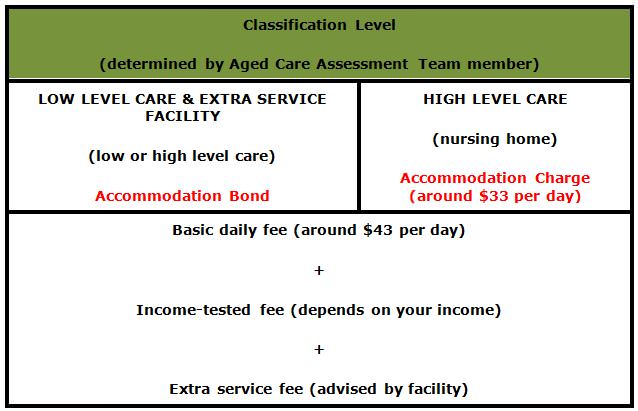

The table below provides a good summary of the fees, borrowed from Challenger:

As shown above, the main components to the cost of residential aged care are the up front accommodation bond, the ongoing accommodation charge and the daily care fees and expenses.

Accommodation bond

The accommodation bond or charge is the first thing you will have to deal with. This is an amount agreed up front to pay for costs relating to your accommodation in a facility, such as capital expenditure and infrastructure.

Once agreed, the bond or charge amount does not change during the resident’s stay. In calculating a residual value for the bond in the event of death or leaving, the facility owner will deduct an ‘annual retention amount’ each year, currently about $4000 per annum for the first five years. The balance is refundable without interest.

The level of bond paid is set by the facility and depends on several factors such as where the facility is located and the level of the resident’s assets. The facility must leave the resident with at least $41,500 in assets after paying the bond.

Assets are assessed by Centrelink (or Department of Veterans’ Affairs (DVA) where relevant), who will advise if the resident is eligible to be a supported resident for accommodation costs. This advice will also include an itemised list of assets and an indication of how long this assessment will be current.

Here are some special tips relating to accommodation bonds:

- It is not always necessary to have assets formally assessed. In fact, it can even be detrimental in some cases. Let’s say assessable assets come to $1 million in total. That means the facility can charge up to $958,500 in bond. However, very few would charge that in reality – they would have a standard bond amount probably in the range of $200,000 to $500,000 depending on where the facility is located. I have heard of places that actually charge over their standard amount once they know the level of assets the resident has. Alternatively, let’s say that a facility has a standard rate of $250,000 bond for those who can afford it. The person with assets of $291,500 or less might benefit from having their assets assessed as they might pay less.

- Be careful with strategies to reduce assessable assets as they can backfire. In a place in demand where beds are scarce, the management will take the person who can pay the higher bond. Divesting yourself of assets could land you in an inferior place.

- There are circumstances where it is beneficial to voluntarily pay more bond than the facility is asking. This is because the bond is not subject to Centrelink’s income or asset test, so by paying more bond, you can end up getting more age pension and reducing your income-tested fees. You need to do the numbers though as there is an opportunity cost involved here in lost investment earnings. Check with your adviser on this one before signing anything.

Accommodation charge

If assets come to over $109,640, the maximum charge of $32.76 a day applies and the assets assessment is unnecessary. An asset assessment will be needed if assets are below this amount, as then the resident will be classified as ‘supported’ and pay a lesser amount.

Living expenses and care fees

Residents will also contribute towards the accommodation costs and living expenses such as meals, cleaning, laundry, heating and cooling. There are two types of care fees: the basic daily care fee and the income-tested fee.

With regard to the basic daily care fee, most residents will pay the standard rate of $43.22 per day which is 85% of the single rate age pension.

That is all full-pensioners pay, however part-pensioners and non-pensioners can also pay an income-tested fee. Each quarter, Centrelink (or DVA where applicable) assesses the resident’s income and advise the aged care facility. The facility uses that to determine how much income- tested fee the resident should pay for the next quarter.

The maximum income-tested fee is currently set at $68.65 per day ($25,000 a year), and to be charged that a resident must have assessable income of around $83,000 per annum (single) or $165,000 per annum (couple combined). To put it in perspective, a single person would need around $1.85 million in financial investments to pay the maximum daily income tested fee and a couple around $3.69 million, based on the deemed earning rates used in the calculations. In other words, assets need to be considerable before this maximum of $25,000 a year is paid.

Here are some special tips on income-tested fees:

- As assessment is quarterly, it is never too late to put strategies in place to reduce your income tested fees. This often goes hand in hand with an improvement in age pension benefits.

- The income assessed is NOT taxable income, as Centrelink have their own, often more generous income test. Take deeming for instance. Financial investments are deemed to earn a maximum of 4%. A portfolio of high-yielding defensive Australian shares could be yielding far more than that.

We have a client moving into a nursing home who has a portfolio of shares valued at $900,000. In five months, it has grown in value by 15% (36% annualised) and yielded dividends in excess of 5% (over 10% annualised) before franking credits. Let’s say total annualised return is 40% (it’s been an exceptional five months), Centrelink will deem it at 4% for her income-tested fee calculation.

- Income streams such as annuities are also favourably treated for both Centrelink and taxation purposes. It is well worth looking into annuities with your financial adviser, and there have been some good product developments in this area in the last 12 months.

- A strategy that gets bandied around amongst advisers in this field involves setting up a family trust, transferring cash into it and buying an insurance bond. As an insurance bond does not pay income, and therefore the family trust doesn’t pay income, no income is assessed and the income-tested fees reduce. On a technical level this strategy has merit, but I’ve never actually put one in place. It is just too complicated to explain, and there are better or as good alternatives available in my opinion.

This article just scratches the surface of the financial side of moving into residential aged care. It seems to be an area where many people think they are on their own having to work it out, but there are advisers who know a lot about this stuff and can make a real difference. One small change in the strategy can make a massive financial difference.

Alex Denham was Head of Technical Services at Challenger Financial Services and is now Senior Adviser at Dartnall Advisers.