In March 2013, I wrote an article for Cuffelinks called ‘Facing the daunting prospect of residential aged care’ in which I summarised the complex fees and charges involved in moving to aged care accommodation.

It is timely to revisit this topic as major reforms to the aged care system are set to kick in on 1 July 2014. The financing arrangements have been revised, and will affect those who enter residential aged care on or after this date. Those who enter before that date will continue under their existing arrangements.

There is no point reproducing the new rules here - that would make for a very complex and tedious read. Instead, I will list the key points to give you enough to decide whether it’s time to get advice if a family member is close to requiring residential aged care.

- There will no longer be ‘low level care’ or ‘high level care’, there will only be one type of approval for residential aged care with all post 1 July 2014 residents subject to the same fee structure.

- The basic daily care fee remains unchanged from the current rules.

- The Accommodation Bond and Accommodation Charge will be replaced by an ’Accommodation Payment’ which will be determined by a resident’s assessable income AND assets. The Accommodation Payment will be able to be paid as a refundable accommodation deposit (RAD), a daily accommodation payment (DAP) or a combination of both.

- Facilities will be required to publish accommodation prices. Currently, the accommodation bond is, in theory, negotiated with the facility. In practice, there isn't a lot of room for negotiation, as most facilities have a set bond that they charge. They just don’t have to publish it.

- The ‘Income-Tested Fee’ will be replaced by the ‘Means-Tested Care Fee’ which will be determined by a resident’s assessable income and assets.

- Those on the full rate age pension will not pay a means-tested care fee.

- The means-tested care fee will have an annual indexed cap of $25,000 and a lifetime indexed cap of $60,000 and cannot exceed the resident’s cost of care.

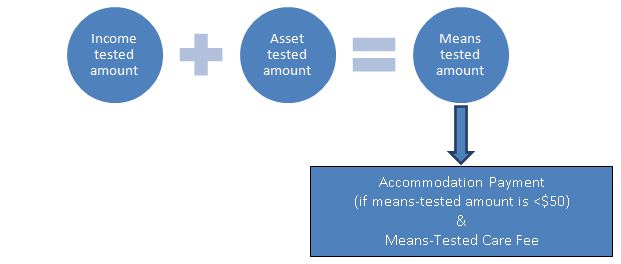

- Both a resident’s assets AND income will be used to determine their ‘means-tested amount’. This is calculated by working out an asset-tested amount and an income-tested amount and adding them together.

- The income-tested amount will be calculated in a similar way to the current income-tested fee.

- The asset-tested amount will be calculated as a percentage of assessable assets at increasing thresholds:

- 17.5% of assets between $40,500 and 144,500

- 1% of assets between $144,501 and $353,500

- 2% of assets above $353,500

- In calculating the asset-tested amount’, the former home up to a cap of $144,500 will be assessed as an asset if unoccupied by a spouse (or relative in some circumstances).

- if a person’s only asset is their unoccupied house, their asset-tested amount would be 17.5% x ($144,500 – $40,500) = $18,200.

- divide that by 364 and you get $50.

- Whilst accommodation deposit amounts are published by the facility, if the means-tested amount comes to less than $50, the accommodation payment is subject to a maximum. If the means-tested amount comes to $50 or more, the accommodation payment is the published amount.This is a confusing but important point. The outcome is that those entering care from 1 July 2014 could be hit with higher accommodation costs than if they entered under the current rules.

- The means-tested amount will determine how much a resident pays for both their accommodation payment and their means-tested care fee.

If you followed any of that, you are doing well. As I said in the beginning, I’m reluctant to go into any more details as it requires a lot of numbers and will be a tough read.

The upshot from all this is:

- If a family member needs to go to residential aged care this year, it is worthwhile getting advice to determine if they will be better off (financially) going in under the current rules prior to 1 July 2014. Of course, this isn't just a financial decision, but in many cases in-going residents will pay higher costs under the new rules.

- The decision whether to keep the family home or sell it has always been a difficult one. In terms of the new means-tested care fee, the scales are tilted towards keeping it. This is because only a portion of it is assessed ($144,500) as an asset as opposed to all of the proceeds if it is sold.

- I haven’t decided if these rules are more complex than the current ones. They seem to be, but that could just be because I’m not familiar with them yet. What I do know is that costs will be higher for those with ‘greater means’.

- Getting advice will make a real difference to the outcome. An adviser experienced in aged care matters can determine investment strategies that give the best outcome in terms of fees, structuring the accommodation payment to optimise Centrelink and DVA benefits, and investment of funds.

- Give yourself plenty of time if you want to make the move prior to 1 July 2014. Now is the time to act as it can take time to get assessed, find a place, sell your home, get advice and move in.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on any information posted, you should assess your own circumstances or seek advice from a financial planner and seek tax advice from a registered tax agent. Information is current at the date of issue and may change.

Alex Denham was Head of Technical Services at Challenger Financial Services and is now Senior Adviser at Dartnall Advisers.