Reporting season can often be a messy affair. When you overlay an economic turning point that changes the importance of ‘what has been’ versus ‘what is to come’ and add a fragile global political backdrop, that by itself is causing significant volatility across financial assets, and it becomes even harder than normal to navigate.

Results were within expectations

In isolation, the reporting season has been pretty much as expected. Expectations were relatively conservative coming into these results which fit with a patchy economic growth backdrop where there were clear areas of strength (the consumer) offset by areas of weakness (housing, construction, mining). Margins had been under pressure from elevated input costs and wage pressures, but it looked like we had already passed the worse and the market was looking for confirmation of this. The A$ was expected to provide some solid translation gains, but a desynchronised global growth backdrop meant that the tailwind from international earnings was going to be a mixed.

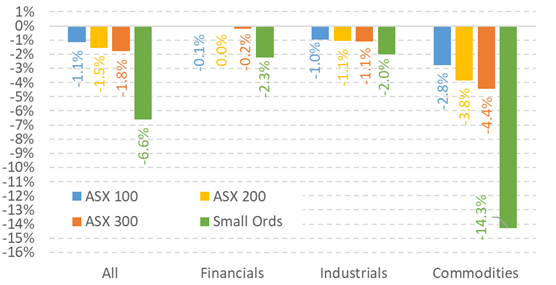

Figure 1: EPS revisions during reporting season

Source: Hasan Tevfik, MST Marquee

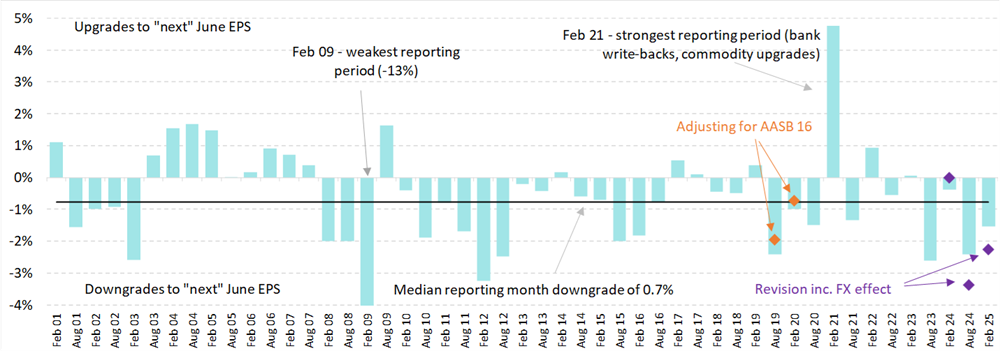

Figure 2: Post result revisions gave been more negative than usual

Source: Hasan Tevfik, MST Marquee

If it is possible to generalise, we would say that revenue lines were slightly better than expected with price over volume the culprit. It was margins that appeared to disappoint with costs coming in higher than anticipated albeit not dramatically so. We did not see much evidence of a broad increase in interest costs, or financial engineering (which tends to happen when the quality of results weakens). Small stocks tended to disappoint a little more than large caps, but post result revisions were slight better. All in all, another messy affair but there was enough positive commentary and post result upgrades to give us comfort that we have past the nadir for corporate earnings.

Share price reactions were all over the place

The real challenge was in adapting to how the market priced companies that reported results. Traditionally a bad result would be treated negatively and a good result positively. What’s more, there would usually be legs to these trades – in other words longevity to short term relative price performance. But, when the economic and profit cycle is turning, the willingness to look through a bad result on the basis that the next one will be better came through loud and clear. This meant that for a lot of stocks, not matter how bad the result, if the outlook was better, they were often bid up strongly (particularly for stocks where there was high short interest).

On the other hand, it didn’t matter how good the results were for stocks that had performed well in recent times and were trading on elevated multiples versus their peer group because at turning points, there is a rotation out of expensive stocks and into cheap stocks, supported by the notion that the next set of results will be better than the last. This was a sharp case of valuation convergence which is the exact opposite of valuation dispersion that had opened up as the economic cycle weakened and the strong (quality) was a safe haven.

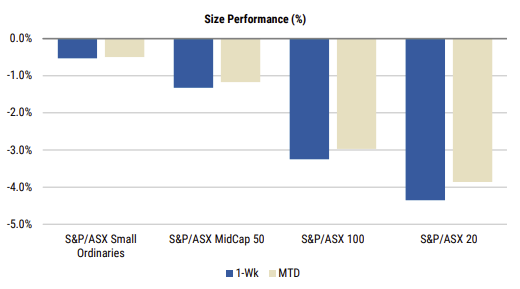

Figure 3: The shares prices of leading stocks have suffered most

Source: Chris Nicol, Morgan Stanley

Let’s look at a few examples. Guzman & Gomez (ASX: GYG) reported an incredible strong result with even stronger trading update in its Australia division which bucked the trend of the weaker fast-food category. But, instead of great share price print, the share price was down 14% on the day. Pinnacle (ASX: PNI) is another example of a stronger result with poor share price performance, almost 10% since the result.

On the other hand, poorer results such as Audinate Group (ASX: AD8) has had the opposite effect. The company reported continued weakness with current hardware sales, and probably will continue to be borderline cash flow breakeven, and yet the share price was up more than 38% at one stage. Domino (ASX: DMP) is another interesting example that when the company first updated its earnings ahead of the result, its share price rallied over 20% and caused the short seller community grief, then when the result was finally reported two weeks later, management couldn’t even put the whole story together and the share price has subsequently lost most, if not all of its gains.

Banks are an interesting one to touch on. After stellar performance in 2024 exceeding all expectations, we finally saw some weakness during this reporting season except for Commbank (ASX: CBA), as most banks share prices fell closer to double digits, with regional bank Bendigo really surprised on the downside. This weakness did not last very long, and the entire sector rebounded nicely at the expense of the tech and consumer sectors.

The most interesting reporting season in my career

This is probably the most interesting reporting season in my 20 odd years of looking at the market, as share price meaningfully diverged from earnings and prospects. It’s reflected all the greed and fear of investor behaviour in short bursts.

Turning points take time to become embedded in economic data and investor expectations. And before they do, sentiment can oscillate wildly. This means a strong stomach is needed until the recovery becomes entrenched and price action less volatile. But the market is not the economy and there are substantial tailwinds that should drive strong equity performance throughout 2025. At Ten Cap, we think bullish signs are there even if they are not yet fully transparent.

Jun Bei Liu is a co-Founder and Lead Portfolio Manager at Ten Cap. Jun Bei is also a popular media personality and a highly sought after public speaker about her investment views. This information is intended for general use only. The information presented does not take into account the investment objectives, financial situation or advisory needs of any particular person.