Our superannuation system receives almost universal praise, and rightly so. It’s served us well.

Yet, growing pains within the system are becoming apparent. For instance, there’s been rising pressure on funds to better meet the retirement needs of Australians.

I’m going to suggest that pressure may come from another source in the not-to-distant future: from mega super funds struggling to outperform their benchmarks.

Why do I say this? Because the mega funds are becoming so big that their size will almost inevitably impact their performance.

If I’m right, it’ll make it even more important to find the right fund for you.

Supersize me

A recent Morningstar report highlighted the successes of our superannuation system. Sector assets have soared from $150 billion in 1992 to more than $4 trillion today, and some forecast that number to rise to $9 trillion by 2040. The super sector is among the five largest pension pools in the world. That’s quite the feat given Australia’s population is outside the top 50 countries globally.

Super assets dwarf those of almost any sector in Australia, barring residential property. They’re 40% larger that Australia’s GDP. And they account for about 80% of local managed fund assets.

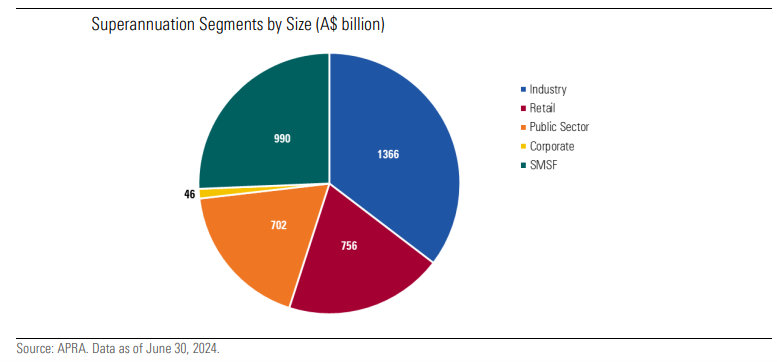

There are more than 60 licensees with a combined $2.7 trillion in assets—around 70% of sector assets— managing the super of over 90% of the population with superannuation balances.

The rise of mega funds

Normally, with the growth in assets that super has seen, you’d expect more competition and a greater number of players entering the sector. But that hasn’t been the case.

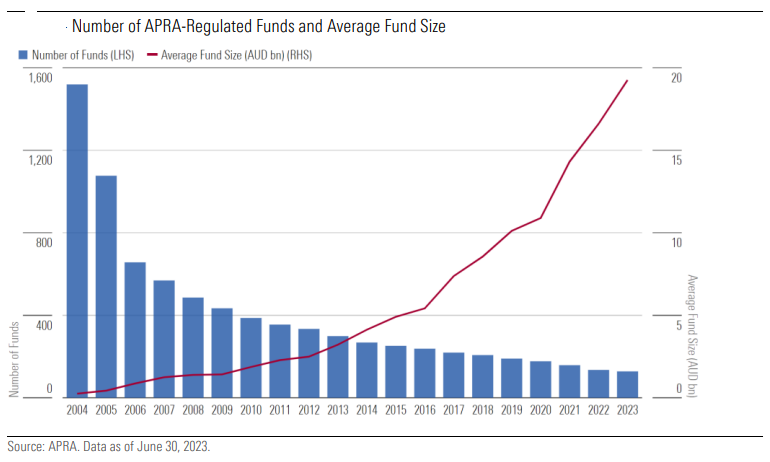

In fact, the number of APRA-regulated funds has fallen by 93% over the past 20 years. Consequently, the average fund size has rocketed from $250 million in 2004 to $19 billion now.

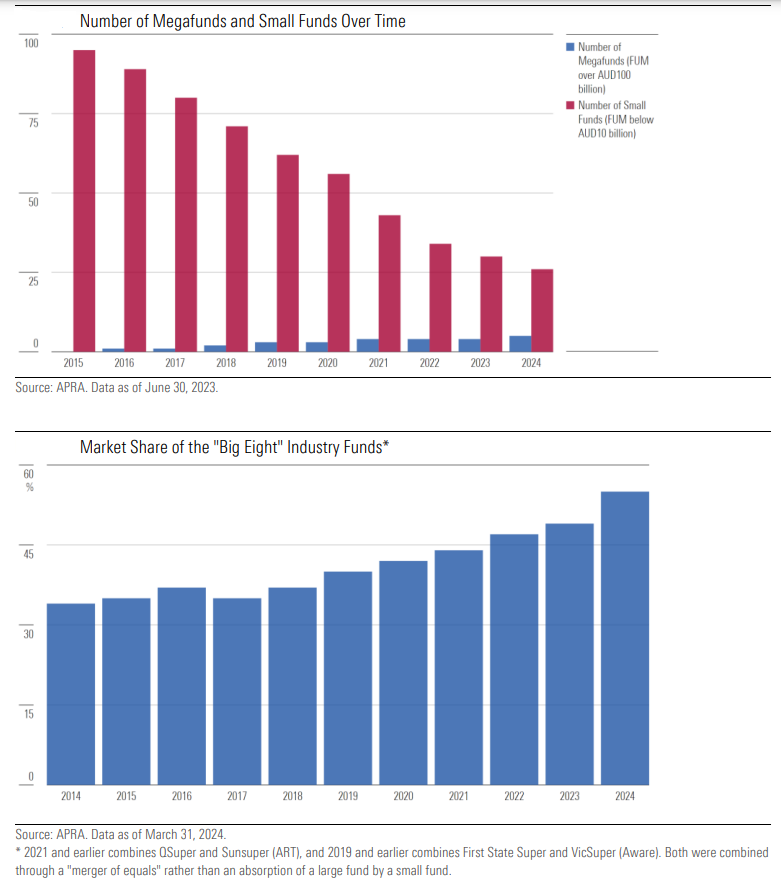

APRA has encouraged consolidation in the sector. It’s labelled funds with less than $30 billion in assets as “uncompetitive’.

That’s led to a spate of mergers, both large and small. The larger ones include First State Super and VicSuper forming Aware Super in 2020, and Sunsuper and QSuper teaming up to create the Australian Retirement Trust in 2022.

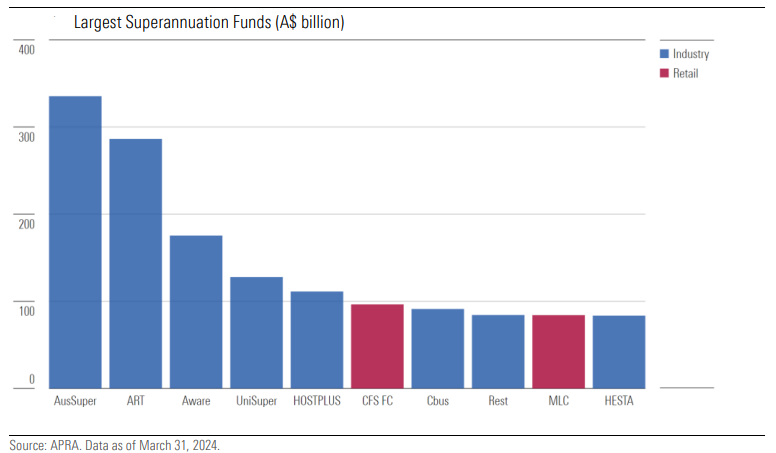

And it’s led to the rise of five so-called mega funds: Australian Super, ART, Aware Super, UniSuper, and Hostplus. Three others, in HESTA, Rest, and Cbus may join this club soon.

These eight funds control more than 50% of super assets. The largest of them, AustralianSuper and ART, hold about 25% of the sector’s assets.

Benefits of scale

As Geoff Warren and Scott Lawrence have pointed out in a previous Firstlinks article, size brings two key advantages. First, it lowers the cost per member, aka economics of scale. Mega funds can reduce costs by managing assets in-house, negotiating lower fees for external investment managers for larger mandates, and by spreading administration costs over a larger customer base.

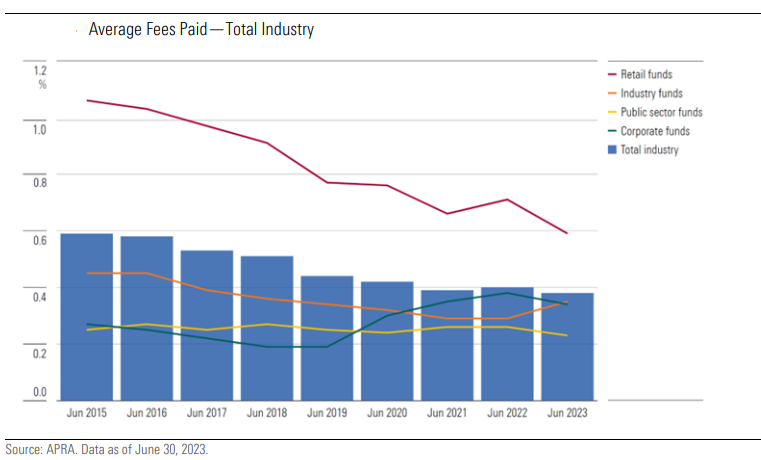

Morningstar says that the percentage of fees paid (incorporating administrative, investment, and insurance costs) across the industry has fallen by more than 20 basis points, from 0.59% to 0.37%, since 2015.

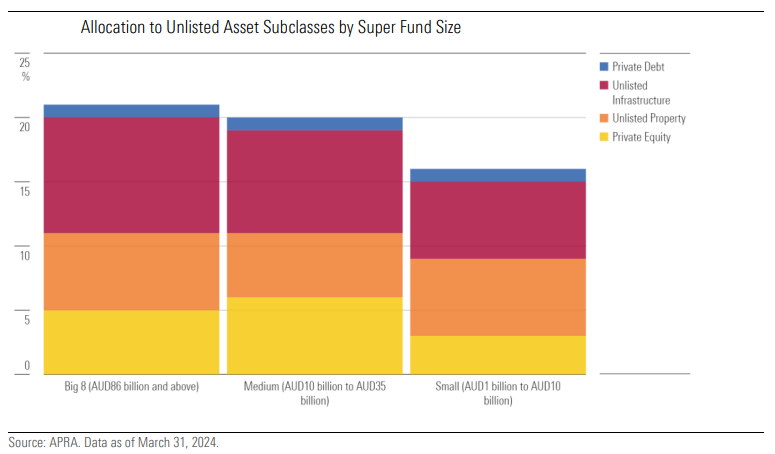

The second advantage of size is on the investment side. Scale allows mega funds to invest in larger assets that smaller funds can’t touch. The funds have been investors in infrastructure projects, for instance. And they’ve also ramped up investments in other private assets over the past decade.

Size limitations

Size also brings disadvantages. It inevitably makes the funds more complex and bureaucratic. We’re already seeing some evidence of this with their attempts to cater to the growing retirement needs of their members.

The second disadvantage is that size limits where mega funds can invest. Consider that AustralianSuper is aiming to increase assets from $341 billion to $500 billion by 2028. Investing that amount of money on a daily, monthly, and yearly basis will be challenging to say the least.

The size factor may partly explain why the funds have moved so aggressively into international and private assets. A number of the funds have said that the moves are due to these assets offering more opportunities and greater returns. However, I think there’s also been an element of ‘force’ at play. Australian assets, including equities, have become too small for many of these funds and that’s forced them to look elsewhere for returns.

Studies show size reduces returns

The investment disadvantages of size haven’t received the attention they should. That’s largely explained by the impressive historical performance of the super funds.

I suggest that outperformance from the mega funds will become more difficult going forwards.

Why do I say this? First, because numerous academic studies have concluded that size impacts the performance of funds.

A 2015 paper by Lubos Pastor and colleagues for the Journal of Financial Economics found that as the size of the active mutual fund industry increases, a fund’s ability to outperform passive benchmarks decreases.

A 2018 study by Ping McLemore detailed how fund mergers resulted in deteriorating performance of the acquiring funds, and liquidity played an important role in the negative relationship between size and performance.

A 2020 paper by Pastor and colleagues studied tradeoffs among active managers and found “diseconomies of scale” among these managers.

There is other evidence of scale impacting performance. Look no further than one of the world’s greatest ever investors, Warren Buffett. His company, Berkshire Hathaway has returned 19.8% since 1965, compared to the 10.2% of the S&P 500. That outperformance of almost 10% is superb, yet deceptive.

As Ashley Owen has pointed out, most of the outperformance came from 1965-1990, and it’s been downhill since. Berkshire outperformed the index by 27% per annum (p.a.) in the 1960s, 16% p.a. in the 1970s, and 21% p.a. in the 1980s. However, it has only performed roughly in line with the index since 2002.

What explains the steep fall in Buffett’s outperformance? It’s likely to be less about skill and more about size. Consider that Buffett is currently sitting on a cash pile of about US$325 billion, which is larger than the market capitalisations of 477 of the 500 companies in the S&P 500. He’s having a harder and harder time investing the enormous cash that Berkshire is generating.

Pick your fund wisely

This is not to say that all mega funds will suffer. The main point is that the funds have enjoyed the fruits of scale up to now, as have their members. Yet, the downsides of scale are just starting to show, and are likely to become more apparent in future. Some funds will handle these challenges, while others won’t.

Monitoring fund performance, portfolio composition, and risks will become even more critical for superannuants.

James Gruber is Editor at Firstlinks.