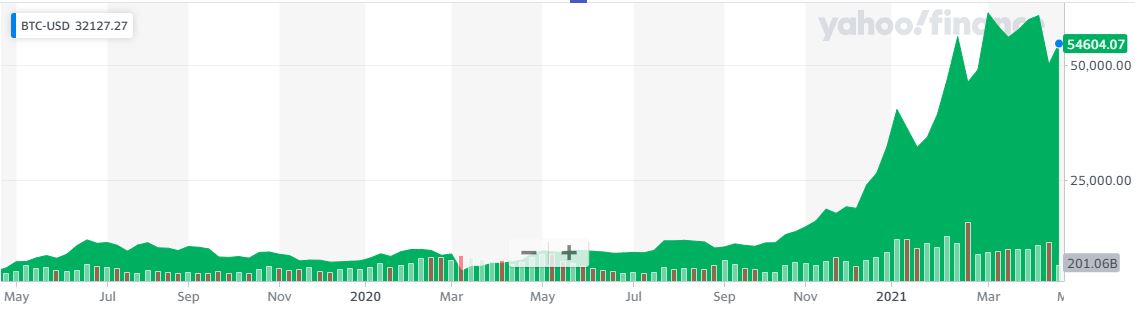

In 2014 Bitcoin was a relatively unknown five-year-old digital currency with a market value of just $US6.2 billion. Skip forward to February 2021 and Bitcoin's market capitalisation is now $US1 trillion with an ecosystem around it that includes crypto exchanges and banks, and new offerings into savings, lending and borrowing.

The biggest change with Bitcoin over that time is the shift from it being primarily a retail-focused endeavor to something that looks attractive for institutional investors. In a search for yield and alternative assets, investors are drawn to Bitcoin's inflation hedging properties and it is recognised as a source of 'digital gold' due to its finite supply.

Specific enhancements to exchanges, trading, data, and custody services are increasing and being revamped to accommodate the requirements of institutional investors.

(Here is a two-year price chart of Bitcoin, sourced from yahoo!finance).

10 observations on risks and opportunities

There are a host of risks and obstacles that stand in the way of Bitcoin progress. But weighing these potential hurdles against the opportunities leads to the conclusion that Bitcoin is at a tipping point, and we could be at the start of massive transformation of cryptocurrency into the mainstream.

Here are 10 observations:

1. Bitcoin has become increasingly mainstream and has spurred the creation of a widening ecosystem around cryptocurrency. Growing acceptance on major consumer-focused platforms like PayPal indicate Bitcoin and other cryptocurrencies are expanding their presence in the real world.

2. Perceptions on Bitcoin have evolved from a focus on (1) its ethos-oriented roots as a payment system, (2) to an alternative currency that is both resistant to censorship or interference and stores value to protect purchasing power, (3) to a form of digital gold due to its finite supply (only 21 million Bitcoins can be created). A focus on global reach and neutrality could position Bitcoin to become an international trade currency in the future.

3. Once the domain of retail investors, Bitcoin is increasingly attracting institutional investors searching for yield and eyeing inflation on the horizon. Bitcoin offers institutional investors an inflationary hedge, a portfolio diversifier, and a safe haven alternative to government bonds. In particular, Bitcoin’s value proposition as a form of digital gold fills a niche for both risk assets and inflation hedges in an investment landscape remade by the COVID-19 pandemic.

4. Enhancements to data, exchange and trading, and custody services are emerging to meet the needs of institutional investors. These include the development of Bitcoin derivative contracts and over-the-counter (OTC) crypto desks.

5. Open interest in the Chicago Mercantile Exchange’s (CME’s) Bitcoin futures, a benchmark for institutional activity, surged by over 250% between October 2020 and January 2021.

6. Bitcoin is driving interest and investment into other digital currencies. As such, Bitcoin is becoming the de facto 'North Star' of the digital asset space, with its trajectory being seen as a compass for the evolution of the broader ecosystem.

7. New innovations including the announcement of fiat-backed stablecoins used within private networks, such as the Diem (formerly Libra) initiative, may build pressure for central banks to consider issuing their own digital currencies. China is already experimenting with the use of a digital Yuan.

8. If efforts progress to the actual issuance of central bank-backed digital currency, blockchain would become a mainstream offering. Individuals and businesses would have digital wallets holding a variety of cryptocurrencies, stablecoins, and central bank digital coins (CBDCs) just like they today have checking, savings, and treasury accounts. Connectivity between the traditional fiat currency economy, public cryptocurrency networks, and private stablecoin communities would become fully enabled.

9. In this scenario, Bitcoin may be optimally positioned to become the preferred currency for global trade. It is immune from both fiscal and monetary policy, avoids the need for cross-border foreign exchange (FX) transactions, enables near instantaneous payments, and eliminates concerns about defaults or cancellations as the coins must be in the payer’s wallet before the transaction is initiated.

10. Various concerns over capital efficiency, a lack of protections, and security against hacks and illicit activity, among others, limit the widespread adoption of cryptocurrencies. While security issues have occurred, just 0.3% of the activity in the cryptocurrency space was linked to illicit activity in 2020.

Sandy Kaul is the Global Head of Citi Business Advisory Services and Rich Webley is Head of Citi Global Data Insights. Citi Australia is a sponsor of Firstlinks. This information is not advice and has been prepared without taking account of the objectives, situations or needs of any particular individuals.

For more Citi articles and papers, please click here.