The media over the years have had a deep fascination with bubbles, but what exactly are they? Is there any way of knowing if we are in a bubble and what should we do if we are?

The 'Bitcoin bubble'

Bitcoin and other cryptocurrencies are currently in the midst of a massive speculative bubble. The market value of Bitcoin has tripled from the start of the year while other cryptocurrencies are rallying strongly.

But how should we think about bubbles more generally? And more importantly, what should we do if we find ourselves in one?

Bubbles should be viewed as part of a boom-bust cycle

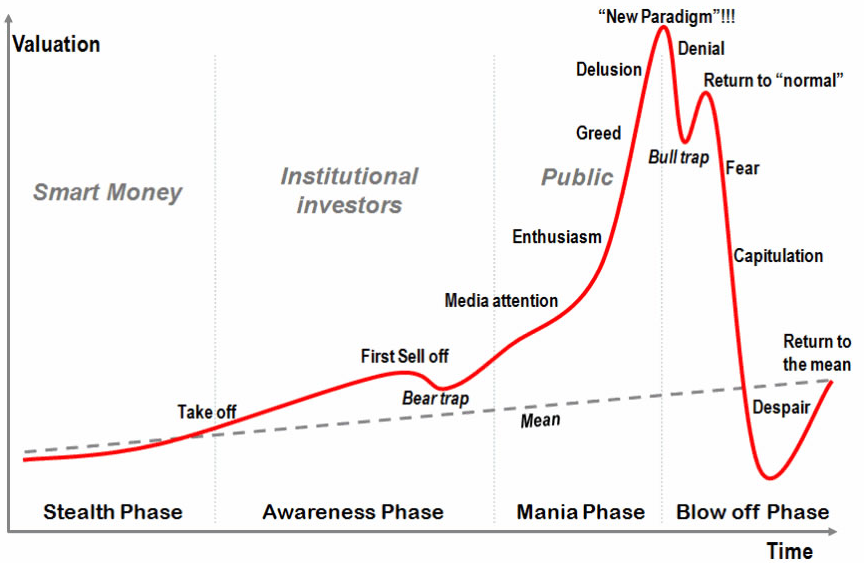

Rather than examining bubbles in isolation, they should be viewed in the wider context of cycles and the inevitable booms and busts that have played out repeatedly in history. A bubble is just another phase in this cycle.

Bubbles often begin with some element of truth. In the tech boom, a common belief was that ‘internet will change the world’. While the early stages of the boom-bust cycle is evidenced by ‘smart money’ making profits, the later and more exciting ‘bubble’ phase is characterised by a sharp rally fuelled by extreme greed. Fundamentals and valuations no longer matter and ‘this time it’s different’.

Source: realinvestmentadvice.com

Bubbles are about psychology not economics

When the powerful emotions of greed and fear are driving markets, we should exercise extreme caution. In the short-run, economics and fundamentals are out the window. Economic theory would predict that as prices rice, demand should fall. While this is true in many settings, this is not necessarily so in financial markets. People should like something less when its price rises, but in investing, they like it more. Why does this happen?

Traditional finance does not have a good answer. Instead, we should take a more behavioural perspective. At the heart of every speculative bubble is ‘bubble mentality’, a combination of greed and fear driving the actions of market participants. If the actions of market participants are no longer driven by logic and considered thought, it is no surprise that market prices deviate substantially from intrinsic value.

Bubbles are exciting. Our adrenaline is pumping. We are feeling greedy. As humans, we are fundamentally wired to have a ‘fear of missing out’. If a price of an asset rises sharply and we see those around us profiting, we want a piece of the action. Knowing full well we are in the midst of a bubble, we begin to convince ourselves that investing a small amount wouldn’t hurt.

This is contrary to fundamental logic: as prices rise, the less the future expected return. It is when we catch ourselves in this aforementioned process of irrational self-rationalisation when we should exercise the most caution.

Bubbles induce excessive risk-taking

What started out as a small ‘investment’ can quickly turn into betting the whole ranch. Ordinary investors get excited by the initial returns, they become inclined to bet more until they become heavily overleveraged. This is important. Market participants begin to take undue risks, focussing on the risk of the ‘missed opportunity’ rather than the risk of the investment itself. But there is a second important implication. The speculative game is addictive.

This is why informed investors avoid bubbles entirely. Crowded trades can be dangerous. Consensus is fallible. When we follow consensus, we become average by definition. As Buffett notes, “the less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own.” This is not simply an exercise in philosophy or ideology, this is a fundamental pillar of sustainable, long-term investing.

What should you do if you find yourself in a bubble?

Avoid them entirely. Ordinary investors think about the opportunities during a bubble, informed investors think about the opportunities after a bubble. As prices reach a point where they can no longer increase, the inevitable crash occurs. Initial denial by market participants turns into fear, which culminates in despair. At this point, informed investors who have avoided the crash entirely have the luxury of purchasing assets at distressed levels. Never be a forced seller. It is only by resisting the temptation of ‘easy money’ that informed investors are in a position of sufficient liquidity to fund large purchases.

A final word on Bitcoin

Bitcoin is similar to a long call option. There is limited downside - the most you can lose is your initial investment - with seemingly unlimited upside. However, 90% of options expire worthless and Bitcoin is no exception. With volatility fluctuating between 40% and 80% per annum, Bitcoin is not for the faint-hearted investor.

I would feel comfortable with Bitcoin valuations only if there is sound proof that it is used for transactions and especially that central banks are comfortable having a parallel currency. As long as this does not happen, Bitcoin is in a traditional bubble: an asset whose value is solely determined by what people are willing to pay for it in the future.

Wilbur Li is a final year student studying Bachelor of Commerce (Honours in Finance) at the University of Melbourne and is a Portfolio Manager with Sharewell. He has worked at Unisuper (global equities) and PwC (debt and fixed income). This article is general information that does not consider the circumstances of any individual.