On 23 March 2020, Afterpay (APT) traded at a low for the year of $8.01 and 18.8 million shares changed hands. On 3 July 2020, Afterpay hit $70, a rise of almost 800% in only three and a half months. That’s a lot of winners and losers in a short time. When the history of the amazing investing year of 2020 is written, Afterpay will be the feature stock. Co-founders Nick Molnar and Anthony Eisen both own 20.5 million shares or about 8.1% of the company, worth nearly $1.5 billion each at $70. The 30-year-old Molnar is currently Australia’s youngest self-made billionaire, pipping the 32-year-old Melanie Perkins, the co-founder of graphic design platform Canva. With a market capitalisation around $18 billion, Afterpay is an ASX Top 20 company.

Afterpay share price, 1 January to 5 July 2020

Source: Morningstar Direct

Afterpay was founded in 2014 and listed on 4 May 2016 at $1, ending its first day at $1.25. It had received $8 million in private investment prior to the float, including backing from Ron Brierley’s Guinness Peat group, where Eisen had been Chief Investment Officer. Don’t kick yourself for not buying in the float. In the first half of 2016, Afterpay had revenues of only $220,000 and underlying merchant sales were about $3 million a month with 60,000 customers. It now has almost 10 million customers and adds them at 10,000 to 20,000 a day.

The business model, called Buy Now Pay Later or BNPL, is simple. Someone can own a $200 pair of sneakers immediately by paying four fortnightly instalments of $50 with no interest or fees if they pay on time. Merchants are charged a transaction fee as a percentage plus a flat fee, but most promote the product because it increases sales and Afterpay takes the credit risk.

My investment experience and valuing Afterpay

Afterpay has taken thousands of retail investors on a ride few will experience again, leaving behind the most astute professional investors in the country. Relatively few fund managers believe in the value. On 23 June 2020, Morningstar published an article called “Buy now, regret later? How Afterpay is dividing punters and pundits” showing most fund managers are underweight.

A few weeks ago, I mentioned to a colleague that Firstlinks was publishing an article on the estimated value of Afterpay, and he said, “Don’t tell me, I hate that company.” Imagine the mood of the people who sold at $8.01 a few months ago.

How do I feel having dabbled a mere $10,000 in Afterpay in December 2017, selling most of my shares along the way, and turning it (at the moment) into a ‘profit’ of $50,000 when it could have been $130,000 if I had held on?

Here are my Afterpay transactions. You might think a profit of $50,000 is nothing to sneeze at, but it feels like a shallow win.

So two guys half my age make $3 billion and are in the process of selling 10% of their holdings for $135 million each, and thousands of other people have made small fortunes, while I make a lousy $50,000 on a 70-bagger stock (floated at $1, now $70). I realise $50,000 is better than a poke in the eye but it’s not much of a result for investing in the biggest stock market success of the decade.

I’m not a stock trader. I’m a ‘buy-and-hold’ sort of chap. I prefer the Warren Buffett guidance to 'only buy something that you’d be perfectly happy to hold if the market shut down for 10 years'. So the dalliance with Afterpay in the past couple of years is not my usual style. Normally, I couldn’t be bothered trading smallish amounts, but Afterpay is no normal stock.

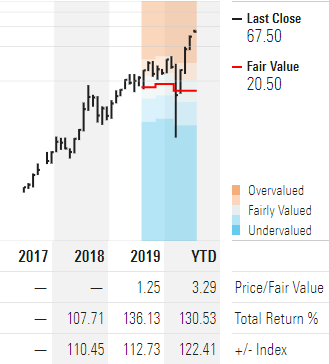

It’s not possible to value this company on normal metrics. Investors must believe the growth story. Morningstar analysts estimate a fair value of $24.10, with an uncertainty rating of ‘very high’. Citi recently upgraded its target from $27.10 to $64.25. UBS gave it a value of $17 last year then downgraded it to $13 with a ‘sell’ recommendation and more recently to $27. The bulls are Morgans at $68.58, Macquarie at $70, Bell Potter at $81.25 and as we go to press, Morgan Stanley at $101. Like, who knows? The chart below shows the rise since Morningstar initiated coverage with Afterpay heading into overvalued territory.

Morningstar Price versus Fair Value Chart for APT, as at 5 July 2020

Social media is alive with frustrated investors who cannot accept what has happened, and an equal number of true believers.

What are the lessons from this experience?

I’m not a stock analyst but here are some lessons to ponder:

1. Watch your anchoring biases

‘Anchoring’ is a major tenet of behavioural finance whereby an investor places too much emphasis on some prior information or number. I remember thinking when I first sold 500 shares that it would pay for the initial 2,000 shares, covering me for whatever happened in future. The $14.87 sale in March 2020 was influenced by the $8 price a few days earlier, and the $49.45 sale was based on a notion of a $50 ceiling. Even professional investors have arbitrary rules for selling but a stock like Afterpay brings out behavioural biases when there’s not much else to cling to.

2. Discover an information edge

When a stock trades between $8 and $70 in a few months, it shows the market is far from an efficient pricing machine. However, there are times when you might discover something about a company that may not be fully factored into the price, or at least give you more confidence. During my Christmas shopping in December 2017, I was amazed how many stores had an Afterpay sign next to the cash register. 'Afterpay it' seemed more common than Amex or Visa. Some stores, such as Rebel Sports, included an Afterpay promotion on every display unit throughout the shop. I asked a friend who was a senior executive in a top-end sneaker business whether Afterpay was popular, and he said about one-third of buyers used Afterpay. One third! I’m not saying the market was unaware of Afterpay’s rapid growth by December 2017, but did it fully allow for younger generations embracing the BNPL idea?

3. Look for companies that customers love

Successful investors look for unique data sources, and scouring the internet for customer feedback is a good measure of repeat business potential. One such source is Trustpilot, and here is a summary of their Afterpay user reviews plus a typical comment (putting aside the merit of people buying things they cannot afford).

4. Check what is happening on Google Trends

Another non-traditional data point is Google Trends. This is available to anyone, and its use should not be confined to professionals doing thorough research.

Here are the results over the past five years for the word ‘Afterpay’. It has been surprisingly steady for a couple of years but a close watch would have revealed it coming to prominence over 2017.

5. Find companies that other businesses promote

This is a variation on a ‘network effect’, where the more people who use a product, the more valuable a business becomes. As Afterpay adds users, more retailers are compelled to join as customers are attracted to the payment method. Over the last year, merchant numbers have increased from 32,300 to 55,400.

Thousands of retailers not only allow Afterpay, but openly sing its praises, which leads to new customers, and more praise, and on it goes. Consider this from a US retailer, Outerknown:

“Afterpay is a service that allows us to offer our customers the ability to make purchases now and pay for them in four equal installments, made every 2 weeks, without any interest.

Just shop Outerknown.com and checkout as usual. At checkout, choose Afterpay as your payment method. You will be directed to the Afterpay website to register and provide payment details (Visa or Mastercard). If you’ve used Afterpay before, just log into your Afterpay account. Then complete your order -- it’s that easy.”

Wow. “It’s that easy.” Free promotions like this are better than paid advertisements.

6. Check when a company is embedded in another's process

Afterpay is now embedded into the payment processes of thousands of businesses, in the same way it took Visa and Amex decades to achieve. The move to more buying online is another positive. The Afterpay purchase process is tempting to users about to pay for $200 when on the payment page, they are asked if they would rather pay $50 now and $50 a fortnight, at no added cost.

Similarly, when a company embeds an IT system or platform into its own processes, it is often a major exercise to unravel and change to another supplier. Inertia and routine are powerful ways to retain business.

7. ’You never go broke taking a profit’ is poor advice

Most listed companies are not successful over time, either disappearing or underperforming the index. Ashley Owen's article, '99% of listed companies disappear worthless' is a stark reminder that investors need strong winners to make up for inevitable failures. A better saying might be ‘Let your winners run’, although there are many examples of companies which have won in the short term and crashed over time. For example, a former market darling, Axsesstoday (AXL) rose strongly in 2018 from $1.50 to $2.50 then quickly went into voluntary administration, leaving the shares worthless and paying bondholders less than 30 cents in the dollar.

These trading rules are dragged out when they work and ignored when they don’t, but simply 'taking a profit' is not a reason to sell a good investment.

8. You don’t need to like the product to invest in the company

I will never use Afterpay and most of my Baby Boomer generation will ignore it, but we're not the target market, so nobody cares. It’s not simply that my financial circumstances do not require me to pay for items in instalments. At no time in my life if I could not afford $200 sneakers would it make a difference to pay them off over four lots of $50.

I am not keen that a product like BNPL facilitates young people buying things they cannot afford. The Afterpay slogan, 'Shop Now. Enjoy Now. Pay Later.' encourages buying using debt. Customers are experiencing near-term gratification when they should live within their means in the same way they should not take on credit card debt. At least the Afterpay debt is required to be paid off quickly, whereas credit card debt is often permanent.

9. Retail Share Purchase Plans are inequitable

The February 2020 Share Purchase Plan allocation of 85 shares costing $1,955 was the most given to any retail investor who applied for $15,000 worth. The retail raising was originally capped at $30 million although they accepted $33 million. At the time of the announcement of the plan, Afterpay advised it “was intended to follow shortly after the successful placement of shares to institutional and professional investors (Placement Shares) which raised $317.2 million (Placement).” That’s 10 times as much for professionals as retail.

10. You don’t need to value a company to invest in it

What’s Afterpay worth? Could be $10, could be $100. Here is Morningstar’s opinion. Arguments about the value of companies fly around fund manager offices every day, but normally, an analyst will produce a detailed spreadsheet with future revenues and costs and a discounted cash flow calculation. Amazon was considered a crazy Jeff Bezos business model for 20 years. Tesla cars rate poorly for quality control but the company is now the most valuable car maker in the world. Valuing is more art than science.

Sometimes, an investor must back their personal judgement, buy into the dream and the growth story and overlook the near-term losses. Venture capitalists and private equity are built on this idea because businesses like Tesla, Canva and Afterpay are not valued on Price to Earnings ratios. Of course, we conveniently overlook that there are far more start-up failures than successes when we swoon over these winning companies.

11. A simple, replicable business is not necessarily a bad business

To the outsider, it seems easy for the PayPals, Mastercards and Visas of the world to introduce a similar model. It’s just a variation on the old lay-by, so why don’t major retailers replicate it? Afterpay doesn’t appear to have much of a 'moat' beyond its brand and market penetration, something which many professional buyers look for to protect a quality company.

But when anybody says, “I’ll Google it” or “Get me a rum and Coke” or “Let’s Zoom” or “Whatsapp me” or “We’ll Afterpay it", you know a business has gone beyond a brand.

Where to from here?

I don’t know what Afterpay is worth. Half my ‘profit’ is on paper and it could disappear or double. I could be writing an article in a year about why analysts' low valuations should have been heeded.

Of course, there are risks. When a stock is priced for perfection, it’s easier for the halo to slip. The looming economic cliff may lead to a significant increase in unemployment and compromise Afterpay’s strong credit record. Somehow, they have kept bad debts below 1% without thorough credit checks.

At some point, there will be a rotation out of growth stocks into value, and we may look back on tech valuations and shake our heads. But this is not like the tech-wreck of 2000. Tech companies such as Microsoft, Alphabet, Facebook and Apple are quality companies with serious earnings. Clearly, Afterpay is not in their league, but as a Top 20 company in Australia, it’s hard to ignore.

Anyone buying Afterpay at $70 is in for a wild ride, but to date, those who sold after a fall have missed the next run. Those buying into a growth story like this should mentally prepare to hang in for the long haul. For a little diversity, the BNPL theme can be backed in other names such as Sezzle, Zip and Splitit, but they are all part of the same bubble. Splitit listed in January 2019 at 20 cents and traded this week at $1.48.

I’m not even sure what to do with my paltry 385 shares. At least they give me the right to participate in the new Share Purchase Plan announced this week, priced at $66. Any fundamental number crunching is little help at this level. You either believe the growth story, or you don’t.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor. An investment in Afterpay carries a high risk of loss and this article is not a recommendation to buy or sell. Every investor should do their own additional research.