The ATO has released all the superannuation rates and thresholds that will apply from 1 July 2024. This article outlines what’s changing and what’s not. It also explains some key considerations and opportunities in the lead up to 30 June and beyond.

Transfer balance cap

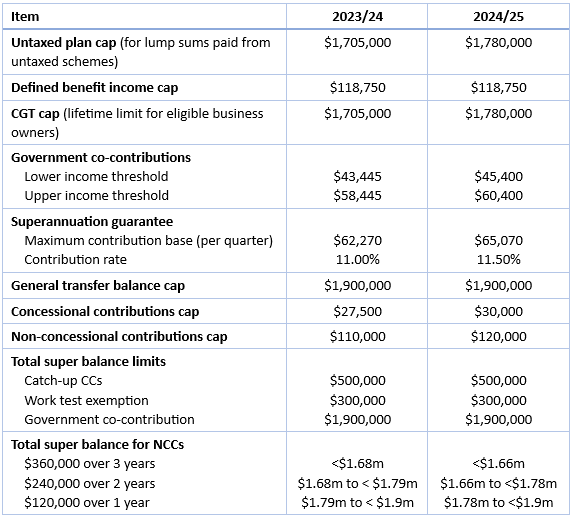

The transfer balance cap limits the amount of superannuation that can be used to start a pension, where the investment returns are generally tax free. The transfer balance cap was introduced from 1 July 2017 at $1.6 million and is indexed periodically to the consumer price index (CPI) in $100,000 increments. From 1 July 2021, it increased to $1.7 million and to $1.9 million from 1 July 2023. The transfer balance cap will remain at $1.9 million from 1 July 2024.

Contributions

Some key thresholds that impact contribution planning will increase from 1 July 2024, while others will be unchanged.

Total super balance

The value of the general transfer balance cap is used to determine the total super balance threshold which impacts eligibility for making non-concessional contributions and spouse contributions, as well as receiving Government co-contributions. This will remain at $1.9 million from 1 July 2024.

When determining eligibility for contributions, the total super balance is measured at the previous 30 June, not at the time a contribution is made.

Concessional contributions

The concessional contributions cap is indexed to average weekly ordinary times earnings (AWOTE) in $2,500 increments. The concessional contributions cap will be indexed from $27,500 to $30,000 from 1 July 2024.

This also impacts the concessional contributions that can be made under the five-year carry forward rules by individuals who have a total super balance at the previous 30 June of less than $500,000. The five-year carry forward total super balance threshold is not indexed.

Individuals who have a total super balance at 30 June 2024 below $500,000 will have a concessional contribution cap of up to $135,000 in 2024/25. This includes a maximum of $25,000 for 2019/20 and 2020/21, as well as $27,500 for 2021/22 and 2022/23.

Based on the five-year carry forward rules, from 1 July 2024, any unused concessional contributions from 2018/19 will no longer be available to use. This means that 2023/24 is the last year that individuals can use any unused concessional contribution cap from 2018/19.

Non-concessional contributions

The non-concessional contributions cap is calculated as four times the concessional contributions cap. So from 1 July 2024 the non-concessional contributions cap will be $120,000.

The two- and three-year bring forward limit will also increase to $240,000 and $360,000 respectively from 1 July 2024.

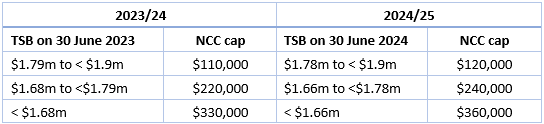

The total super balance thresholds for determining eligibility to make non-concessional contributions will change, as outlined in the table below:

Importantly the three-year bring forward maximum contribution is based on the non-concessional contributions cap at the time the three year bring forward is triggered. There is no benefit from indexation for individuals who have triggered a bring forward prior to 1 July 2024.

Example

Shamal triggered the three-year bring forward in 2023/24 by making a $150,000 non-concessional contribution. Shamal can contribute a further $180,000 prior to 30 June 2026; they don’t benefit from indexation of the non-concessional contributions cap during this time.

Thresholds not indexed

In addition to the threshold for accessing the five-year concessional contributions carry forward, the $300,000 total super balance threshold for determining eligibility for the work test exemption is not indexed.

Summary of rates and thresholds

The table below summarises the key rates and thresholds recently released by the ATO:

Superannuation guarantee contributions

Although not subject to indexation, from 1 July 2024 the superannuation guarantee rate is increasing from 11% to 11.5%. Individuals who make personal concessional contributions or have salary sacrifice contributions made by their employer may need to factor the increase into their arrangements.

Preservation age

From 1 July 2024, the preservation age will be age 60. This means that all individuals who are eligible to commence a pension or take a lump sum payment will not pay PAYG tax on their benefits.

Summary

The superannuation rules changed dramatically in 2017 and introduced a variety of thresholds that determine eligibility for certain tax concessions and the ability to make contributions. The indexation of the thresholds adds an additional layer of complexity from 1 July 2024. Understanding the additional complexities will assist individuals to maximise the opportunities available within super in both 2023/24 and 2024/25.

Julie Steed a Senior Technical Services Manager at Insignia Financial.