The early part of each year is often a good time to review your investing strategy for the calendar year ahead and beyond.

And, with less than six months to go before 30 June, it’s also a good time to consider shorter-term opportunities. Sometimes it can be a case of use them or lose them.

Take this financial year, for example. For some Australians, there’s a concessionally taxed superannuation investment opportunity specifically hinged to the 2018-19 financial year that will expire on 30 June this year. By 1 July it will be gone.

The catch-up opportunity

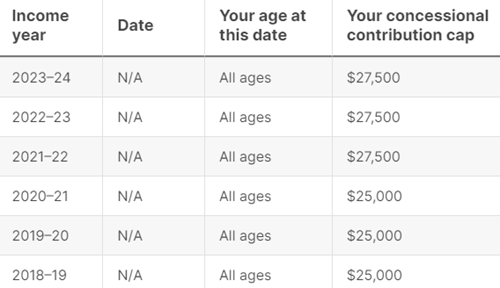

Working Australians are allowed to contribute a maximum of $27,500 into their super each financial year at a concessionally taxed rate of 15%.

It’s a capped amount that includes the mandated super payments made by your employer plus any additional personal super contributions you choose to make to your super fund. However, in any given financial year, many people are unable to take advantage of the full $27,500 concessionally taxed contributions limit.

Back in 2016-17 the then federal government announced that from the start of the 2018-19 financial year it would allow eligible Australians to carry forward any unused annual concessional contribution amounts they have for up to five financial years.

Source: ATO

As such, the deadline for taking advantage of any unused concessionally taxed entitlements from the 2018-19 financial year is the end of 2023-24.

In many respects it’s a super free kick that’s there for the taking, at least for those Australians who are legally and financially able to do so.

Eligibility requirements

There are eligibility requirements for being able to take advantage of carry forward contributions from previous financial years.

To be eligible, you must:

- have a total super balance of less than $500,000 at 30 June of the previous financial year.

- have unused concessional contributions cap amounts available.

The good news is that if you are eligible, there’s nothing you really need to do. If you have the ability to make extra super contributions this financial year above the concessionally taxed $27,500 annual limit, any carry forward concessional cap amounts from previous financial years will be automatically applied by the Australian Tax Office (ATO).

If you haven’t used them already, the ATO will first apply any amounts from the 2018-19 financial year. It will then progressively apply any unused amounts from subsequent financial years.

A carry forward example

Let’s say you are still under the $500,000 total super balance and have some accumulated savings you’re willing to put into your super fund. Maybe you’ve recently sold an asset and now have some extra cash in the bank.

In the 2018-19 financial year you made $15,000 in concessional super contributions. Because the annual concessional contributions limit back then was $25,000, you would therefore have a $10,000 unused amount from that financial year. The annual concessional contributions limit wasn’t lifted to $27,500 until the start of 2021-22.

In each subsequent financial year you made $20,000 in concessional contributions, so you also have $10,000 from both 2019-20 and 2020-21, and $7,500 from both 2021-22 and 2022-23.

That gives you a grand total of $45,000 in unused concessionally taxed contributions spanning five financial years plus this financial year’s $27,500 limit.

If you were to exceed this financial year’s $27,500 by between $1 and $10,000, the extra contributions would be deducted from your 2018-19 carry forward amount. Any amounts over $10,000 would be deducted from 2019-20, and so on.

How do I find out if I have unused amounts?

You can easily check if you have unused concessional contribution amounts online via your myGov account by linking to the ATO.

After logging in, select Super - Information - Carry forward concessional contributions, and your unused balances by financial year should be viewable.

The caveats are that you must not have made concessional contributions in the financial year that exceeded your general concessional contributions cap and, as noted, your total super balance must be below $500,000 as at 30 June of the previous financial year.

Even though we’re now only around midway through the current financial year, it’s worth considering whether you can use this super free kick before 30 June 2024.

Consider an adviser

Super and retirement planning is a complex area. Take care to understand the contribution types and limits carefully as there are significant tax penalties for exceeding the applicable contributions caps. If you’re unsure about your super options before 30 June and need some advice, consider consulting a licensed financial adviser.

Tony Kaye is a Senior Personal Finance Writer at Vanguard Australia, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.