There is a lot of noise in markets. What's going to happen with Donald Trump? Is he going to win the next election? What's going to happen with interest rates, inflation, geopolitical conflict? Part of our job is to cut through that noise to try and understand what true tangible changes are taking place in industries, sectors and markets that we can take advantage of as investors. Let’s have a look at three examples.

Cyclical change – Coming out ahead at the grocery store

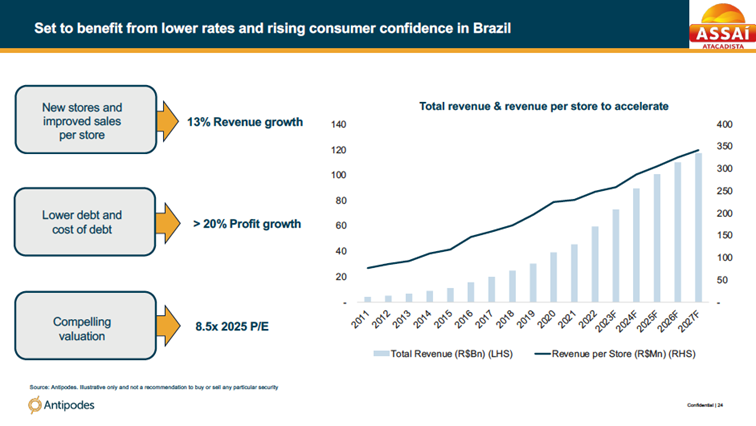

We have 18% exposure to emerging markets in our global portfolios. This includes Brazil, which has had a volatile economy, and been through all sorts of cyclical ups and downs. Yet, interest rates are starting to come down, consumer confidence is rising, unemployment is declining, while people's ability to borrow is increasing. That's leading to a real consumer recovery in Brazil. It's a cyclical change we want to be a part of, and we are taking advantage of that through Sendas Distribudora (BVMF:ASAI3).

This is a Brazilian cash and carry grocery store that’s popular among the well off. This business bought one of its competitors at an unfortunate time, when interest rates really started to accelerate, and they took on debt. Now what they're doing is rolling out stores at a rapid pace. They're refurbishing those stores that they bought and opening them at three times the rate of sales that they had before. So you're getting this really nice double digit revenue growth rate. Then you've got the cashflow coming out of these new stores and you've got interest rates coming down.

That means that they're now growing earnings at 20% per annum. And yet this grocery retailer is trading at just eight and a half times PE. We can compare that to a developed market equivalent of Costco, but to buy Costco, it will cost you a 40x earnings multiple.

Structural change – AI, but the boring bits

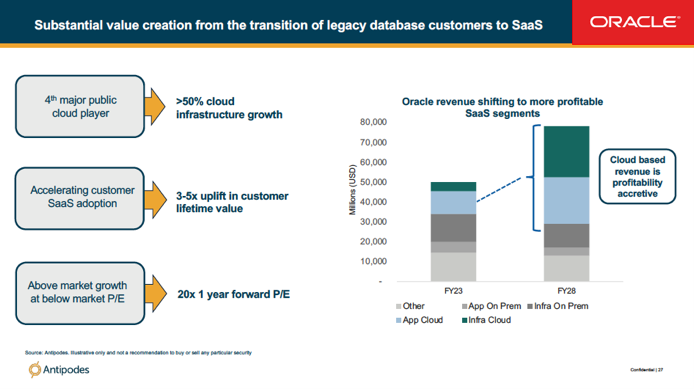

A lot of the structural shift that's taken place with AI has been on the consumer facing side. With the likes of Netflix, Apple Music, Microsoft apps on the cloud etc.

A big shift is about to happen on the less exciting end of things, with back-office databases and the infrastructure as a service element of this cloud transition. And as that shift takes place, we are going to continue to have 15 to 20% organic migration growth coming from that growth in the usage of cloud. It'll come from new products, and AI will be a real way for this growth to be augmented over time.

And the pragmatic value way that we are playing that trend is through Oracle (NYSE:ORCL). This is a business that was written off by the market about 10 years ago. The CEO famously said that he thought cloud was a fad. Therefore, the company was slow to move on the 'fad' and paid the price. Now, it's a different story.

You can see that with those gray bars, Oracle's on-premise ERP stuff is declining. It's being replaced by cloud infrastructure revenue that is growing at 50% per annum. And as they augment that infrastructure as a service with platform and with software, they're actually getting three to five times the customer value out of those business.

Oracle is trading at 20x earnings and growing at 10-15% per annum. So it's growing faster than the market and it's trading at a cheaper multiple.

Energy transition as socio/macroeconomic change

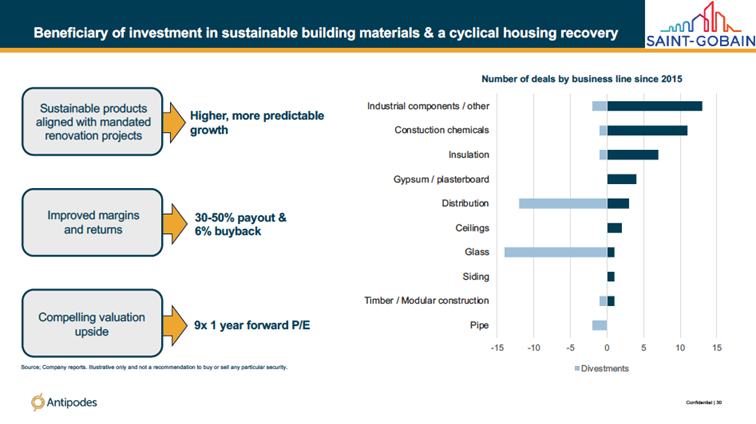

Socio/macroeconomic change is now achievable and in lots of different ways. One of the least exciting is through efficiency. That means things like using insulation, reusing materials, having more energy efficient air conditioning in your home. Efficiency is quite a broad-based investment opportunity within this broader circle of socio/macro change and the way that we're participating in this is through French multinational building materials company Saint-Gobain (EPA: SGO). This is a business that has really re-engineered itself towards sustainability.

75% of the products and services that they sell now are sustainability focused. This is leading to higher and more predictable growth. To give you an example of Europe, 90% of buildings actually need to be retrofitted with things like insulation. It's going to triple the renovation rate in Europe. So this is a business that's getting higher growth than it used to. It's getting better profitability, it's getting better return on its capital employed and it's getting better cashflow.

They've actually increased their dividend. They're paying back 6% of their stock. And this is a business that's trading on a single digit multiple. This is a multiple that is at a 10 to 15 year low for a business that has better forward-looking economics than in the past. And the reason for that is because people are worried about the mortgage cycle and they're worried about what's going to happen with new builds, when the reality is this is a story that is about sustainability and the market is missing the point when it comes to the future of this business.

Vihari Ross is a Portfolio Manager at Antipodes Partners, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.