Charlie Munger is best known as Warren Buffett’s sidekick though he’s a formidable investor and investment thinker in his own right.

Munger first met Buffett in 1959 through a mutual friend. A doctor in their hometown of Omaha, Dr. Edwin Davis, told Buffett in 1957 that he trusted him to manage money because Buffett reminded him of someone called Charlie Munger. “Well, I don’t know who Charlie Munger is, but I like him,” Buffett responded to Davis. Two years later, Davis arranged for the pair to meet, and they hit it off right away.

Munger was originally a lawyer by trade. He started his own investment firm in 1962 and went on to crush the market over the following 13 years, compounding his portfolio at 19.8% per annum compared to the Dow Jones Industrial Average’s 5%.

In 1978, Munger became Vice Chairman of Berkshire Hathaway, a position he still holds today. Munger is credited for helping change Buffett’s investment approach from buying cheap, often low-quality companies, to purchasing great companies at reasonable prices.

Munger is 99 years of age yet retains a sharp mind and wit. Recently, he gave a rare interview to the Acquired podcast and offered some great insights on a range of investment topics.

Munger and Buffett’s investment approaches

Buffett got his first taste of investing as a young man at the racetrack. Munger was asked about this, and his response gives a key insight into the way that Buffett approaches the stock market:

“… Warren never gambled. He was only a patron of them [the racetracks]. Warren wants the odds in his favor, not somebody else. It's just so simple if you're Warren. You want to be the house, not the punter.”

There are many famous investors who started out as gamblers – Edward Thorp, Bill Gross, and Jeff Yass come to mind. Buffett is also in this bracket. He took the mindset of an expert gambler – betting when the odds are overwhelmingly in your favour - and parlayed that into investing.

On his own investment approach, Munger gave a surprising answer. Though he’s known for liking stocks that earn high returns on capital over long periods, Munger acknowledged that’s not the only way he invests:

“I only study two kinds of companies. I'm enough of a big Ben Graham follower… so if something is really cheap, even though it's a crappy company, I'm willing to consider buying it. For a while anyway. I do that occasionally. I've done it with great success a time or two, but unlike Howard Marks I’ve only done it once or twice in my lifetime for big gains, and that's it. It's not like I’ve done it a hundred times. It isn't a bit easy. A hundred times easy money is almost non-existent….

… Great brand companies, of course, are good. Getting the right price… the whole trick is getting them on a few rare occasions when they're really cheap. Buying Costco at its present price… it may work out all right but that’s… but again it's getting hard.”

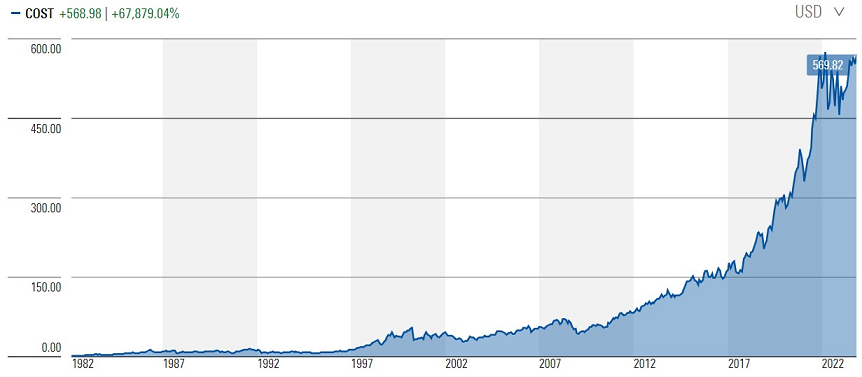

Buffett’s big Costco error

In 1997, Costco (NYSE: COST) offered Buffett a seat on the board, which he declined. Buffett suggested Costco ask Munger instead, and Munger accepted. He’s been on the board ever since.

Munger tried to convince Buffett to invest in Costco early, though it didn’t work. The reason: “Warren doesn’t like retailing”. Apparently, Buffett had seen many retailers come and go, including big department stores that once dominated, and thought it a difficult business to make money from.

Munger thought differently, and recognized early on that Costco had an incredible business model:

“They really did sell cheaper than anybody else in America and they did it in big, efficient stores. The parking spaces were 10 feet wide instead of eight or nine feet or whatever they normally are. They did it all right and they had a lot of parking spaces. They kept out of their stores. All these people didn't do big volumes, and they gave special benefits to the people who did come to the stores in the way of reward points.”

Costco share price

Source: Morningstar

What makes a great retailer

Munger says Home Depot took the Costco business model and applied it to home improvements: “They copied everything”.

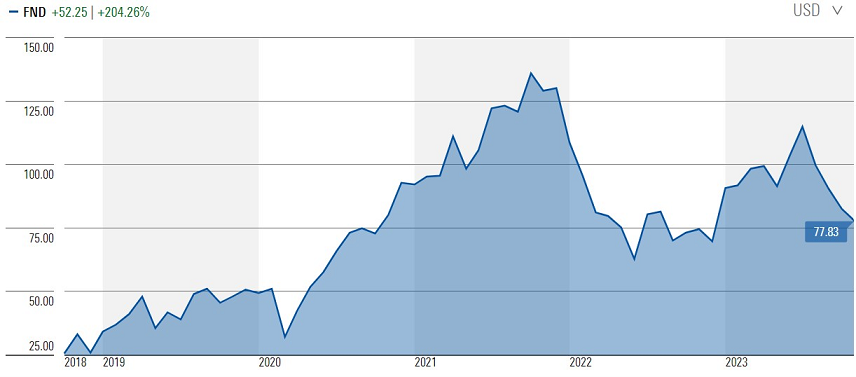

Munger believes there’s a more modern Costco imitator in a smaller company called Floor & Décor (NYSE: FND). As the name suggests, the business sells flooring, offering a huge selection via large warehouses, and with cheap prices to boot.

Floor & Décor share price

Source: Morningstar

Munger was asked about whether he’d ever looked at Nike as a business, and he said he had, though he rejected it because it’s a ‘style company’. Munger didn’t elaborate on this though I suspect what he’s alluding to is that with ‘style companies’, future prospects and earnings are difficult to forecast and that is not the type of business that he likes to invest in.

Munger prefers capital-light retailers with predictable earnings and pricing power:

“… we were lucky enough to buy See’s candy for $20 million as our first acquisition. We found out fairly quickly that we could raise the price every year 10%, and nobody cared. We didn't make the volumes go up or anything like that. Just made the profits go up. We've been raising the price by 10% a year for all these 40 years or so. It's been a very satisfactory company.

It didn't require any new capital. That’s what was good about it: very little new capital. It had two big kitchens and a bunch of rental stores when we bought it, and now it's got two big kitchens and a bunch of rental stores.”

Berkshire’s investment in Apple

Buffett’s most high-profile recent investment has been in Apple (NASDAQ: AAPL). He first purchased a stake in 2016 and it’s since been a home run. Berkshire now owns 5.8% of Apple, worth around US$164 billion. Apple accounts for close to 50% of Berkshire’s stock portfolio.

Apple share price

Source: Morningstar

Munger’s take on the lessons from Berkshire’s investment is intriguing:

“What everybody has learned is that everybody needs some significant participation in the 12 companies that do better than everybody else. You need two or three of them, at least. If you have that mindset, Apple was the logical candidate to be on the list of which you’re going to select your companies. It's not very hard to come up with an idea that it may be okay.”

This seems to be a recognition that when you’re a big investor like Berkshire, you must be invested in some of these great technology companies, or risk underperformance.

As for why Berkshire picked Apple, Munger says it was valuation, as the company got down to around 10x earnings when Buffett bought in.

Buffett’s investment in Japan trading companies

Buffett’s other recent investment success has come from the unlikely place of Japan. He started investing in Japanese trading companies in 2020 and retains stakes in five of them (Mitsubishi Corp., Mitsui & Co., Itochu, Marubeni and Sumitomo Corp).

Munger implies that there was leverage involved in the purchases. He says at the time, you could borrow in Japan at 0.5% for 10 years, and these stocks had cheap assets and dividend yields of 5%, making them “no-brainer” investments:

“It took him [Buffett] forever to get $10 billion invested. It was like God just opening a chest and just pouring money. It's awfully easy money.”

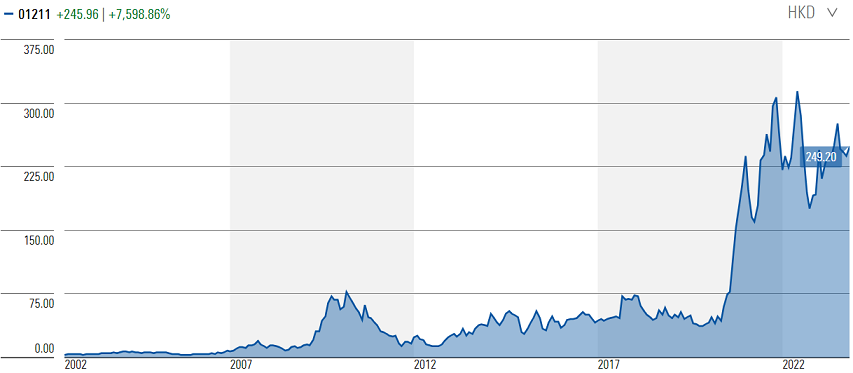

Why he likes China

Munger has been a long-time investor in China. He persuaded Buffett to invest in automaker, BYD (HKG: 1211), in 2008. Munger has since called this one of the best decisions that he’s ever made.

Munger claims the BYD founder, Wang Chuanfu, is a genius, and says he’s better at making things than Elon Musk.

BYD share price

Source: Morningstar

In the interview, Munger doesn’t address his more recent investment in Chinese online retailer, Alibaba, which hasn’t worked out so far.

On China itself, Munger remains a believer:

“My position in China has been that: (1) the Chinese economy has better future prospects over the next 20 years than almost any other big economy. That’s number one. (2) The leading companies of China are stronger and better than practically any other leading companies anywhere, and they're available at a much cheaper price.

So naturally, I'm willing to have some China risk in the Munger portfolio. How much China risk? Well, that's not a scientific subject, but I don't mind whatever it is, 18% or something.”

Choice words for John Malone and Jim Simmons

Munger is known for his blunt manner, and he doesn’t hold back on a few subjects. One is US billionaire, John Malone, who owns Formula One and the Atlanta Braves baseball team, among other things. Malone is credited with the rise of Ebitda (Earnings before interest, tax, depreciation, and amortization) as a financial term used by corporates, one that Munger has long abhorred. Munger says he’s never liked Malone’s “extreme manipulations”, including his famous methods of minimizing tax at his listed companies.

Munger also says he’s uncomfortable with investors who principally use algorithms like the famous hedge fund, Renaissance Technologies. He says these funds essentially front run investors. And Munger believes that they’re making smaller profits with more volume, and the only way that they’re still making good returns is through using greater and greater leverage, “which I would not run myself”.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au.