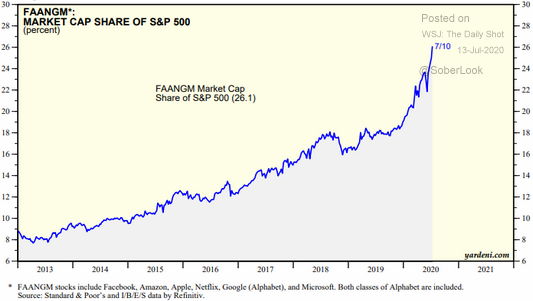

Much of the stock market’s buoyancy is attributable to just six tech companies – Facebook, Amazon, Apple, Microsoft, Netflix and Google. They have a market capitalisation of more than US$6.5 trillion or fully one quarter of the entire S&P500 index, as shown below. Their market share was only about 10% five years ago.

Graham Hand recently mentioned in his article Six ratios show the market is off the charts that the Nasdaq (the tech index) is again on a Price/Earnings (P/E) of 30 times. It was last here 16 years ago in 2004. By itself a high P/E ratio means little but it reminds us that P/Es can also decline. In 2002, the Nasdaq’s P/E was below 10 and in 2008, 2011 and 2012 the Nasdaq100’s P/E touched 13 times.

Even great companies can become too expensive

Over the past five years, Facebook, Amazon, Apple, Microsoft and Google have collectively increased their profits by US$80 billion but their market capitalisation has increased by US$4.4 trillion. That represents an expansion of the P/E multiple of 55 times!

Admittedly these businesses are scarce assets, they have long runways for growth, they are monopolists with pricing power. They are the very businesses long-term value investors like Warren Buffett salivate over. But poor investments can be made in even the highest quality businesses when the price paid is too high. It is a simple reality of investing that the higher the price you pay, the lower your return.

Another reality is that extreme multiples for scarce assets is a common event during periods of low interest rates, and particularly when rates are lower than trend economic growth rates. But extreme multiples are not usually sustained in history.

Low interest rates (whether they are artificial or not) have a disproportional effect on the present values of earnings further out. The present value of $100 earned in a year’s time rises by 4.76% when interest rates halve from 10% to 5%. But the present value of $100 earned in 15 years rises by 100% when interest rates halve from 10% to 5%.

Therefore, the biggest jump in intrinsic values occurs for those companies with the bulk of their value in the terminal part of the calculation. Start-ups and emerging companies with little profit today but expected to earn much out over the horizon see their theoretical value rise the most when interest rates are cut.

But again, low interest rates do not immunise a company’s shares from shocks and falls. Ultimately the growth in expected earnings must be delivered and for the price to continue rising from already-stretched levels, the P/E must expand. That means the company must exceed the already optimistic expectations. And life simply doesn’t work out that way. There are always potholes on the road to success.

Consider that earnings for US technology companies as represented by the Nasdaq have declined 27% since February 2020 and are now back to 2017 levels, but the index is 60% higher than it was in 2017.

The technology theme is a good one, but …

The thesis for buying the technology theme makes sense. Microsoft, for example, will benefit from an increased number of people working from home; Netflix has more subscribers watching from home; Amazon has more online shoppers. The pandemic will be around for much longer than current mainstream commentary seems to suggest.

But of course, all booms start with a legitimate and credible thesis. As that thesis gains acceptance, it also gains momentum, and many less sophisticated investors jump aboard. Eventually investors pile in, not on the basis of the original thesis, but simply because the shares keep going up. Eventually, prices become so extreme they bear no relationship to reality and a bubble forms.

I believe we are there today, not for all stocks but for many in the technology space.

While there is merit in the idea that COVID-19 lockdowns have accelerated the trend to digitisation of work, entertainment and logistics, there is little doubt the rally in technology stocks has also been extended by a veritable tidal wave of debutante investor buying, the poster boy for which is Barstool Sports founder David Portnoy. In June, this self-promoter called Warren Buffett an “idiot” and said day-trading is “literally the easiest game I’ve ever played” adding “all I do is print money”. Frame it!

According to Gavekal Data, if one removes the US market from the MSCI World Index, the rest of the world has gone nowhere, in aggregate, for six years. It is a testament to the failed experiment QE has been in attempting to inspire real economic growth.

The strength in US markets is despite S&P500 earnings forecast to fall 20% year-on-year over the next four quarters, according to analysts surveyed by Refinitiv. This represents a significant turnaround from the 10% growth forecast before COVID-19 hit.

My updated opinion on Afterpay

There is no better insight into the real and present madness of crowds than the Buy Now Pay Later (BNPL) leader Afterpay. Its share price is up almost eightfold since March, thanks in part to COVID-19 accelerating online and cashless retail sales. Government employment support programmes both here and in the US ensured millennials were able to meet their repayment obligations to the company. Share price support was also aided by the appearance of the Chinese company Tencent on the register.

Afterpay now has a market capitalisation of $19 billion, although the company generates just $230 million of revenue and a bottom-line loss. At the time of writing, Afterpay is the 18th largest listed company in Australia, bigger than Cochlear, Sydney Airport, Aristocrat, Brambles or shopping centre owner Scentre Group (formerly Westfield). It’s bigger than Bluescope, Qantas and Lendlease combined.

Its two founders recently sold $270 million worth of shares in their second sell down in 12 months, which is more than the annual revenue the company generated.

Afterpay is simply a factoring company. It buys a retailer’s receivables or debtors for a fee and then collects the amount owing directly from the debtor. Factoring businesses have always made thin margins which partly explains why this company will have to keep raising money and diluting shareholders to fund its expanding book.

In 2021, I will mark my 30th year in financial markets and I have seen many booms and busts in that time, not only in stocks but in currencies and commodities too. Stepping back from all the noise, there are a few occasions in one’s life where value simply slaps you in the face.

Oil trading at negative US$37 earlier this year or the US dollar at US$1.08 in 2011 are two relatively recent examples I took advantage of.

There are an equal number of occasions where value is so distant from the minds of the investor that the only safe course of action is to zip up one’s wallet. Technology stocks today appear to be one of those occasions.

Trading on revenue multiples, not profit

Putting sentimentality aside, paying 51 times revenue for Shopify, 37 times revenue for Zoom or 20 times revenue for Twilio will produce a low return over the next few years for investors. That low return however is accompanied by the risk of a sharp loss of capital. On a risk-adjusted basis, it makes more sense to secure a low return from cash at present.

Consequently, we are content to hold a higher allocation of cash in our funds. We might miss more of the party but it is a party we’d rather let David Portnoy and his friends enjoy. I wouldn’t be seen dead at it.

No fund manager or analyst can see the shape of employment and therefore true consumption because government largesse in the form of wage subsidies has replaced wages of those furloughed. Spending patterns must and will therefore change. Predicting those changes while government handouts remain in place is next to impossible.

Having some cash in this environment makes sense and so does reducing the ‘beta’ or risk of the portfolio.

Investors would be wise at this juncture to consider whether expectations of an imminent end to the pandemic are premature. If a vaccine is not developed, and first and second COVID-19 waves send cities and countries back into lockdown, keeping borders closed, then the unbridled enthusiasm currently gripping markets is equally misplaced and premature. This may be one time the Fed's liquidity cannot do 'whatever it takes'.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.