Australian Real Estate Investment Trusts (A-REITs) have been hit hard by this year’s sell off, underperforming the market by over 18%. But while REITs are down, they are not yet out. The REITs’ rough run has mainly been driven by a sharp increase in the 10-year bond yield, which has more than doubled. However, we believe long dated government bond yields could be close to reaching their peak, and with the Reserve Bank of Australia (RBA) prioritising growth over inflation, this could provide a tailwind for REIT performance in 2023.

The RBA has started to temper the rate of cash rate increases over the past two months despite Australian inflation reaching a 40-year high in Q3 and expectations it will further increase in Q4 2022. The RBA increased the cash rate in October and November by 25 basis points, below market expectations of 50 basis point hikes on both occasions.

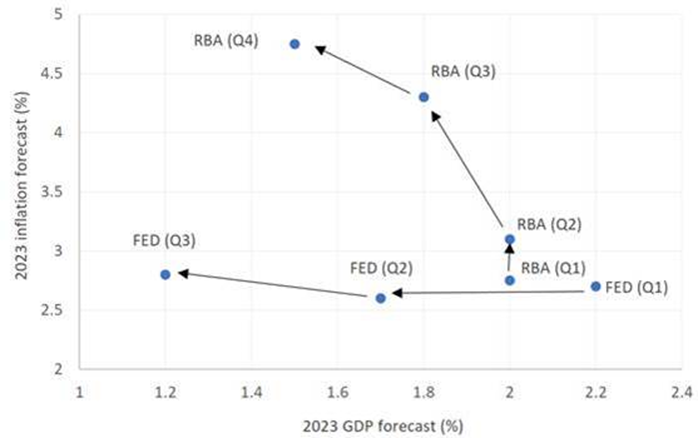

This approach indicates that for 2023 the RBA is prioritising economic growth over containing inflation quickly. RBA increased their Australian CPI forecast for 2023 from 2.75% to 4.75% over the past four quarters. In contrast, the US Federal Reserve (Fed) is resolute in driving down inflation to 2% despite its actions increasing the risk of a US recession ‘hard landing’.

The RBA’s focus is positive for potentially oversold A-REITs for 3 reasons.

1. REIT income is inflation linked

REITs historically outperform during persistent inflation periods. The RBA is forecasting inflation to be above its target in 2023.

Central bank forecasts for inflation and GDP growth in 2023

Source: RBA, Federal Reserve

Commercial leases and contracts in office and logistics typically have inflation-linked annual increases in rents written into the contract, providing inflation protection on income. Take for example the period between the end of the dot-com bubble and Global Financial Crisis. During these years, Australian CPI year-on-year was 2.9% on average and Australian 10-year government bond yields steadily increased over this time where Australian REITs as represented by S&P/ASX 200 A-REITs outperformed S&P/ASX 200 by 3.99% between 1 January 2002 and 31 December 2006.

2. In the case of peaking rates, pivot to A-REITS

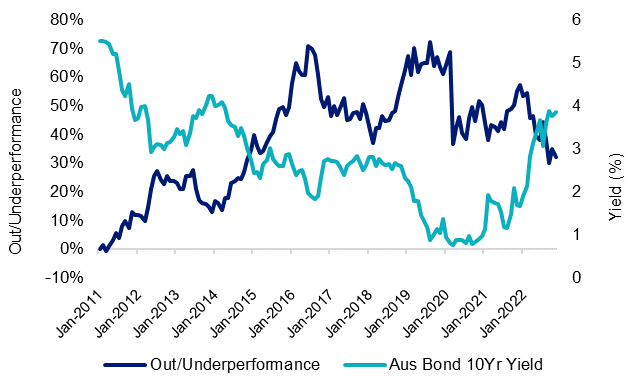

REIT performance is negatively correlated with bond yield movements due to the change in borrowing costs impacting property valuations. The increase in government bond yields year to date, due to rapid increases in the expected RBA cash terminal rate has been a major headwind for REIT performance.

A-REITs performance relative to S&PASX 200 versus Australian government 10-year bond yield

Source: Bloomberg, Out/Underperformance as MVIS Australia A-REIT cumulative performance relative to S&P/ASX 200. Past performance is not indicative of future results.

However, long dated government bond yields could be close to reaching their peak. Broker consensus is Australian Government bond 10-year yield will remain at similar levels over the next two years. Bond markets have priced in expected further RBA cash rate increases and there is a chance the RBA starts cutting the cash rate in late 2023 as the global economy slows, putting downward pressure on government yields.

If yields fall, this would be a tailwind for REIT performance.

3. Attractive valuations

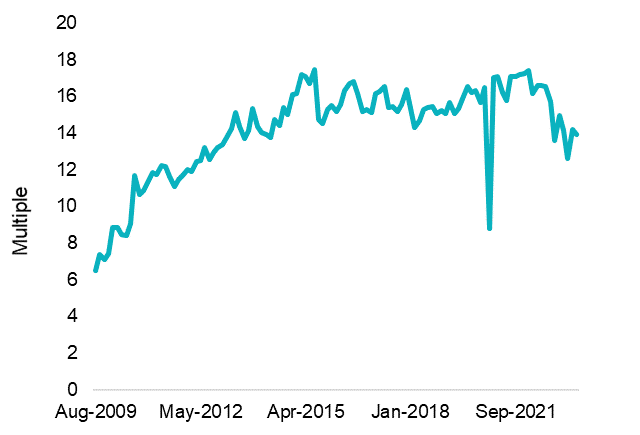

The asset deflation bear market we have seen year to date has improved the valuation profile of REITs. Price to Adjusted Funds from Operations (AFFO multiple) is at a 9-year low and price to net tangible assets (NTA) is at a 15% discount. These measures are preferred to metrics such as price-to-earnings ratios when it comes to REITs.

A-REIT AFFO Multiple

Source: Bloomberg, A-REIT as MVIS Australia A-REIT Index

A-REIT Price to NTA

Source: Bloomberg, A-REIT as MVIS Australia A-REIT Index

VanEck favours the outlook of industrial REITs such as Goodman Group and Centuria. We anticipate cap rates and net operating income to remain sticky as tenants manage excess inventory levels and expand e-commerce channels amid low vacancy rates. Retailers will continue to invest in optimising delivery chains as they address demand for both in-store and online consumer spending. Warehousing provided by industrial REITs will be key beneficiaries.

VanEck is cautious on Retail REITs including Scentre group and Vicinity Centres. Rapid RBA cash rate increases have yet to shift consumer spending patterns. Retail sales year-on-year growth is almost 7 times pre-COVID trends (2017-2019) which is not sustainable in a higher inflation and rates environment. These REITs will come under pressure when retail spending decelerates.

Cameron McCormack is a Portfolio Manager at VanEck Investments Limited, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, click here.