I have presented to thousands of women on superannuation. I always ask my audience to raise their hands if they know how much money they will need to retire on. Usual response? Crickets. Honestly. I can only recall one presentation where a few hands in the room went up – and that was in Canberra, where the majority of the audience was government employees, so it wasn’t surprising.

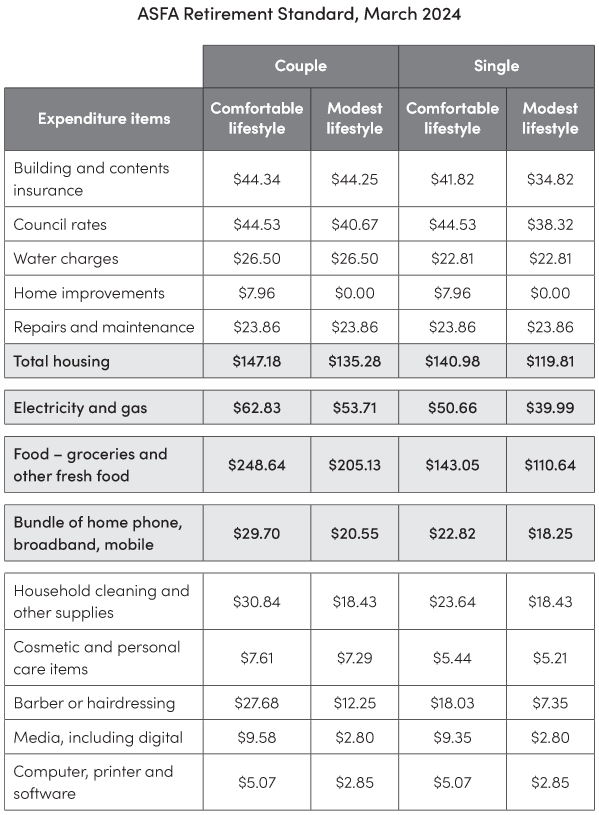

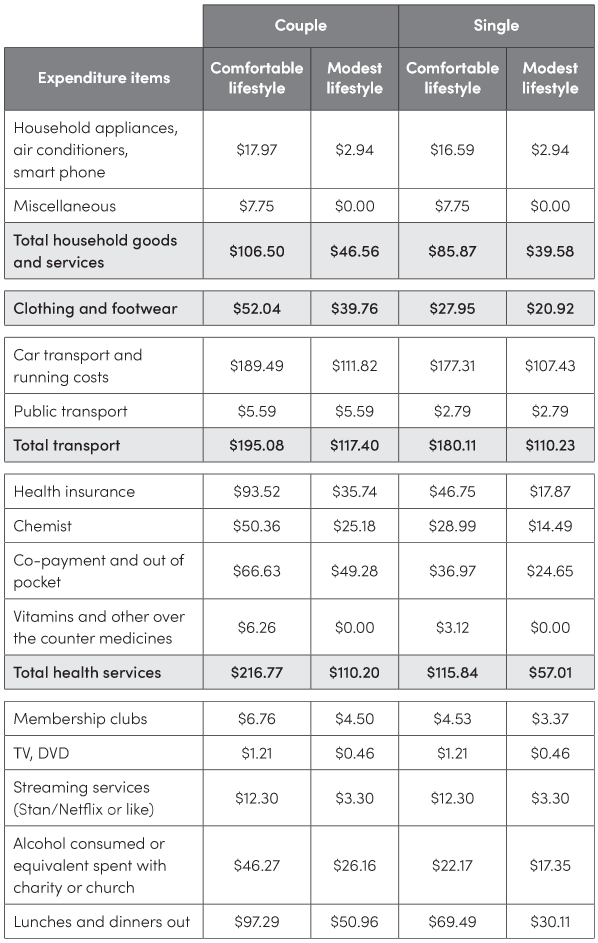

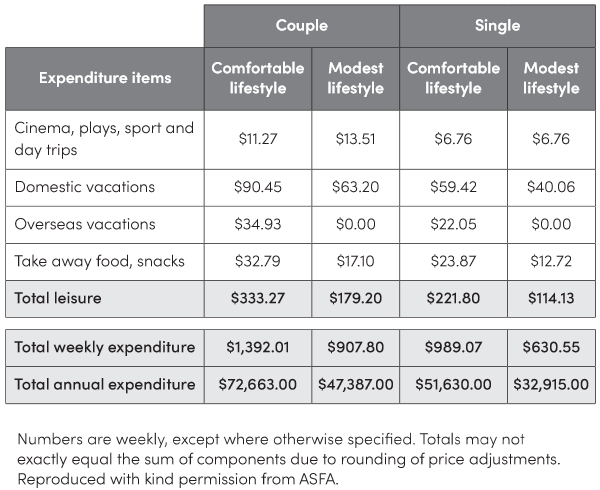

To give you an idea of how much you will need to live on in retirement, the Association of Superannuation Funds Australia (ASFA) provides the ASFA Retirement Standard, where it outlines annual and weekly budget figures for different standards of living – ‘modest’ and ‘comfortable’ – and based on whether you’re single or part of a couple.

ASFA updates their budget guidelines every quarter, factoring in inflation and a host of other inputs. For reference, at the time of writing the maximum Age Pension is $1116.30 per fortnight for a single person, including all available supplements. This works out to around $29,024 per annum, which is really a small supplement rather than anything that can be relied upon.

ASFA defines a ‘modest’ retirement lifestyle as one that is ‘considered better than the Age Pension, but still only allows for the basics’ – such as basic health insurance and infrequent exercise, leisure and social activities with family and friends. For the March 2024 quarter, the budget for this lifestyle worked out to be $32,915 per year for a single person aged 64 to 84.

‘Comfortable’ is defined as allowing ‘an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as; household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel’. For the March 2024 quarter, this lifestyle tallies to $51,630 per annum for a single person aged 64 to 84.

The following table provides a snapshot of ASFA’s living standards.

To check the most recent ASFA Retirement Standard, go to superannuation.asn.au/resources/retirement-standard/

While I appreciate the good folk at ASFA are trying to strike a balance between catering for the average Aussie and not terrifying the daylights out of us, more than a few generous assumptions are baked in here:

- These prices are not reflective of pricing in any metro area – unusual, given that 87% of us live in metro areas, according to Statista. As a Sydneysider, the estimates around hair services, cinemas, snacks and dining out caused me great amusement.

- Chemist costs – something I would deem ‘essential’, particularly at retirement age – do not scale in the way shown in ASFA’s figures, simply based on whether you’re part of a couple or not. Similarly, water, electricity and gas costs don’t quite work the way they’re laid out either.

- Co-payment and out-of-pocket costs for health services – again, at this age and stage of your life, your biggest spend is likely to be on your medical bills – also look to be very low.

Among all these medium-sized flaws, this budget also contains a huge problem, an issue of which very few people – even those who work in the super industry – are aware.

Run your eye down the line items again. What do you see? Or rather, what do you not see? Well spotted. You do not see a line item for mortgage and rent payments.

That’s correct – the ASFA figures assume that you own your property outright by the time you reach retirement. This may have been a fair assumption to have made in 2004, when the ASFA Retirement Standard was created, however, we need to consider how the economic and property environments have iterated 20 years on.

These changes include the following:

- Mortgage and rent payments can comprise up to 44% and 31% of income respectively, according to the Real Estate Institute Australia Housing Affordability Report March 2023.

- The average Australian first home buyer is now aged 36, according to realestate.com.au – and will only become older, given property prices outstrip wage growth by a factor of 10.

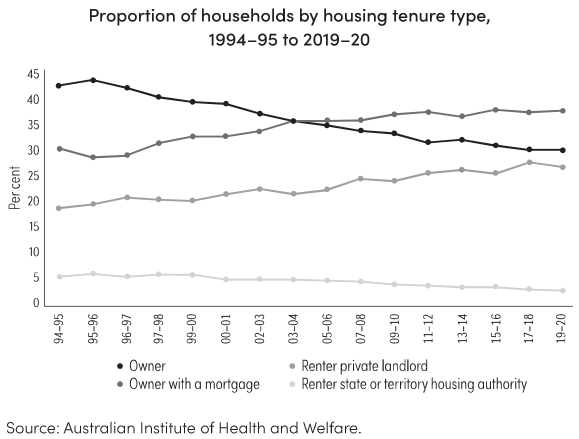

- Around 2.9 million people, or 31% of all households, were rent-payers in 2019–20, up from 28% over the last 15 years, according to the Australian Institute for Housing and Welfare (AIHW).

It’s worrying that the super industry standard does not include mortgage or rent in its retirement budget calculations. The standard is relied on for member guidance by the super funds’ retirement planning websites such as Super Guru and Moneysmart.

Another factor at the time of writing is that record numbers of retirees are accessing their super to pay down their mortgage. ABS statistics show that the rate of outright home ownership by those in the 55 to 64 age bracket was 40% for 2021, having dropped from 65.1% in 2001.

Meanwhile the number in that age group with a mortgage had more than doubled, increasing from 15.5 to 35.9% in the same 20-year period. These trends are best represented by the following figure, sourced from AIHW. Also note the trend shown in the figure for private renters.

This group has increased substantially, reflecting those who have been priced out of the property market. Without their own properties, these people will definitely be paying rent in their retirement.

Bottom line – when calculating how much you’ll need to live on in retirement, don’t forget to factor in some element of mortgage or rent payment.

How much will you need for retirement?

The average Australian woman lives to be 85.3 – so if she retires at 68, she will have almost 20 years of living expenses she will need to fund. The multiplication of these two numbers ($32,915 times 20) is over $650,000 – and that’s without indexing for inflation.

When articulating these calculations, a glacial chill fills the room. I look at my audience to discover that most of them have a look of terror on their faces. The remainder are fighting back tears – with no other emotion in between.

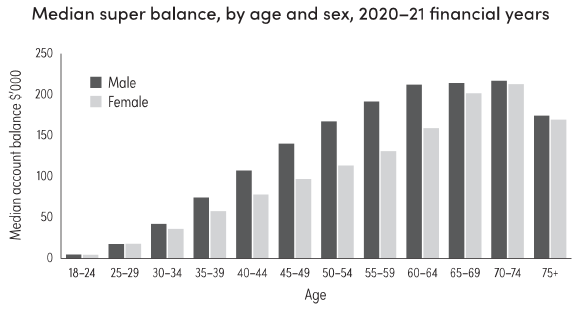

You see, these women are also calculating the gap: the gap between $650,000 and what their current super balance is – which, if you’re a 40- to 44-year-old woman, is likely to be around $107,000 according to 2021 ASFA data of super balances by age and gender.

Effectively, I have just spelled out to them that they need to grow their super balance by a factor of more than 3.5 over the course of the next decade or so. I may as well have told them to fly to the moon.

Australia’s shameful super gap

The super gap is reflected in the median super balance for men and women shown in the following figure, based on ‘Taxation statistics 2020–21’, available via the Australian Tax Office website (ato.gov.au). You can see how the data diverges between men and women as early as their post-graduate earnings; the gap then increases as women hit their 30s – typically the child-bearing years.

Even more stark are the following figures: the 2016 Senate Inquiry into Women’s Economic Security in Retirement found one in three women were retiring in Australia with no super at all. ABS figures from 2022–23 aren’t much better, with only 21.4% of women reporting superannuation as their main source of income in retirement, compared to 33.2% of men, and a further 18.4% of women reporting no personal income, compared to 4.4% of men.

The reason for these statistics is, quite simply, the gender super gap. Now, is it just me or do you find these statistics incredible? How is it that in a country as rich as ours, we treat 51% of the population this way? How have we built a retirement system in this country worth $3.5 trillion – trillion – yet we ‘forgot’ about half the population along the way?

Pascale Helyar-Moray OAM is the founder of Grow My Money, a platform where members can shop with scores of major Australian brands and receive a cashback into their superannuation account.

For a full guide to overhauling your super and wealth as a woman in modern-day Australia, read Pascale Helyar-Moray’s new book Rich Woman, Poor Woman, published by Major Street Publishing. The publisher is offering Firstlinks members a 25% discount off the purchase of Rich Woman Poor Woman from the Major Street website. Just key in MORNINGSTAR25 at the checkout and your discount will be applied.