Today, investors have a dizzying array of choice when it comes to accessing hands-on professional investment management. They can invest in:

- Units in an unlisted actively managed fund – a structure where investors pool their capital with other investors. The combined capital is invested by a fund manager on their behalf into assets like shares or bonds.

- Units in an exchanged-traded managed fund (or active ETF) – similar to an unlisted investment trust except that investors can buy and sell units in the trust via an exchange; or

- Shares in a listed investment company (LIC) – a structure which allows investors to buy shares in a listed company whose business it is to invest in a range of companies (and other assets).

Never has it been so easy for everyday investors to access a range of asset classes. We’re not quite at Uber Eats-level convenience, but it’s a step in the right direction.

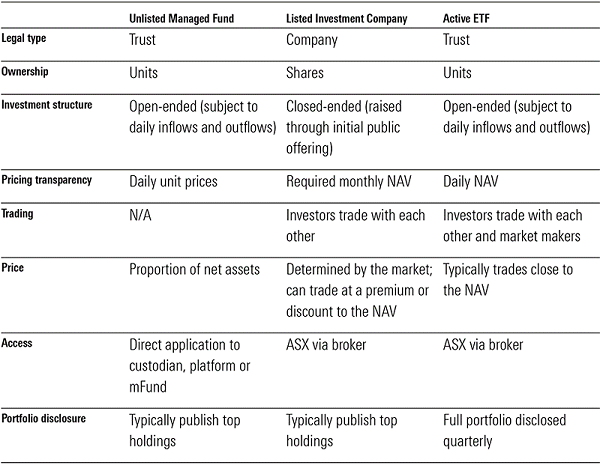

To the untrained eye, these structures offer different but equally beneficial ways to access an actively-managed investment portfolio. And there are many similarities, particularly around investment objective, style and management teams. But there are subtle differences in the ways each structure allows portfolio managers to manage your money and distribute income. There are also concerns around the way in which these structures are priced and traded.

How the three structures operate

Next time you’re presented with these three options – the ABC Global Equities Fund, the ABC Global Equities Exchange Traded Managed Fund or the ABC Global Equities Listed Investment Company – you should know what to look for.

How actively managed fund structures compare

Access for retail investors

Unlisted managed funds

For a retail investor without a financial adviser or access to an investment platform, buying units in an unlisted managed fund has historically been difficult. Download a paper application form, print it, fill it in, sign it and send it via snail mail. The forms are a headache. The Bennelong Funds Management application form, for instance, is 27 pages long and this is not unique to them.

The ASX’s mFund service now makes it easier for individuals to buy and sell unlisted managed funds through their broker. However, not all funds and brokers have signed up.

Active ETFs and LICs

As both structures are listed on the ASX, investors can access them as they would a normal share.

Portfolio disclosure

Unlisted managed funds and LICs

Australian unlisted managed funds are not required to disclose their portfolio holdings, and often only list their top 10 investments. Australia is now the only market (out of the 25 assessed) that does not have portfolio holdings disclosure requirements, according to the Morningstar Global Fund Investor Experience report.

Most LICs publish their top 20-25 holdings each month.

Active ETFs

Active ETFs, on the other hand, are required to disclose their full portfolio holdings, comprising the names and weights of the investments, on a quarterly basis. Product providers typically disclose their full positions to internal market makers so they can price the underlying securities. A market maker is a dealer in securities or other assets who undertakes to buy or sell at specified prices at all times.

Pricing and trading

Unlisted managed fund

When you invest in a fund, you’re buying units in that fund. The unit price is calculated by dividing the fund’s total assets minus the value of any liabilities – known as the net asset value (NAV) – by the number of units on issue at the end of each business day.

LICs

The pricing of LICs can be more confusing because of the way they’re structured and sold. Investors buy shares in a listed company whose business it is to invest in a range of companies (and other assets). The asset value of the LIC moves in line with its underlying investments. Under ASX listing rules, LICs have 14 calendar days after the end of each month to disclose their net tangible asset (NTA) backing – the measure for what a LIC’s portfolio is worth – although some voluntarily provide weekly or daily pricing online.

However, as LICs operate in a closed-end structure (more on that later), they don’t necessarily trade at the NTA value. Often, LICs trade at a substantial premium or discount. This is because the price of the shares can be influenced by the level of liquidity and demand for the asset (among other things). If you buy at a premium, you may be overpaying for those assets, while selling at a discount means you might not be getting the full value of the assets.

The LIC board may implement measures to close these gaps, such as share buybacks, rights issues, increased marketing efforts, or in extreme cases, winding up the LIC.

Investors must pay a broker to purchase LIC shares, which adds to the cost of investment.

Active ETFs

The value of an active ETF also represents the value of the securities it holds. Its value is determined intraday by dividing its total assets by the number of units on issue.

Active ETFs should trade close to the fund’s underlying NAV of its holdings because when there is excess supply or demand, an internal market-maker steps in to create or redeem units. However, there may also be circumstances where the iNAV – the estimated intraday net assets under value – is inaccurate, particularly where there is a major market event, according to ASIC.

ASIC last week called for a “pause” in the listings of new exchange-traded managed funds that rely on internal market makers to make their market, due to concerns around potential conflicts of interest. A review is currently underway and is expect to last till the end of the year.

Like LICs, investors must pay brokerage to purchase active ETF units, which adds to the cost of investment.

Entry and exit

Unlisted managed funds

For investors wanting to directly purchase units in an unlisted managed fund, managers will typically set a minimum entry threshold. Some managers allow investors to participate in a regular monthly investment plan. Direct investors can withdraw from the fund at any time, although some funds set minimums. Again, this is done via a paper form and payments can take up to a week to appear.

LICs and active ETFs

Investors can buy shares in LICs or units in active ETFs trading on the ASX via a broker. Providers typically have no minimums, but the broker may apply minimums, as they do with shares. To exit these structures, investors must find a willing buyer of their units or shares. In the case of active ETFs, this can be the market maker.

Structures

Unlisted managed fund and active ETFs

Unlisted managed funds are open-ended. This means they’re always open to daily inflows and outflows. If an investor wants to leave the fund, the manager may be forced to liquidate some assets to finance the redemption.

LICs

LICs are closed-ended structures. When an asset manager creates a LIC, they raise capital via an initial product offering (IPO). When the IPO is fully subscribed, they list the company on the ASX and issue shares to the participants. The funds are considered ‘captive’ in the sense that the assets are closed-in for the manager to invest and cannot be redeemed. Investors who did not participate in the IPO can trade shares on the ASX.

This type of closed-end structure can be advantageous for LICs because the portfolio manager doesn’t have to worry about investors pulling money out of the fund.

Distributions/dividends

Unlisted managed funds and active ETFs

In an unlisted managed fund, all net income is distributed on a pre-tax basis and the end investor is liable for any taxation at their marginal tax rate. This may result in unpredictable income streams. The biggest advantage is the investor may be eligible for a discounted capital gains tax concession for assets held longer than 12 months.

An unlisted fund may also present the manager with more flexibility in paying distributions, being able to pay over and above the underlying income levels, through a return of capital. This can be useful where a manager wishes to pay out a set proportion of the fund each year to provide investors with a predictable income stream.

LICs

There are two types of LICs: those that hold their investments on capital account, and those that hold their investments on income account.

The capital account LICs are also known as ‘Buy and Hold’ LICs. These are low turnover and trade rarely. Capital gains from these LICs are eligible for the CGT discount.

Income account LICs are also known as ‘Trading LICs’. These are higher turnover and the profits on trades are treated as income, so they are taxed at the company tax rate and are not eligible for the CGT discount.

Capital account LICs generally pay franked dividends by passing on the franking credits received from their underlying investments. They may withhold some dividend income and franking to be able to smooth dividends from year to year. If the underlying stocks drop their dividends, then more than likely the LIC will have to reduce its dividend.

Income LICs need to build up a profit and franking credit reserve to pay fully-franked dividends. The reserves can be eroded when the market falls, but the LIC may be able to continue to pay dividends for a time depending on the buffer built up.

Emma Rapaport is a reporter for Morningstar.com.au. This article is for general information only. It has been prepared without reference to your objectives, financial situation or needs. To obtain advice tailored to your situation, contact a licensed financial adviser. Article reproduced with permission.