The first Star Wars movie was released in 1977 to instant success, and A New Hope became the highest-grossing movie of its time due to its revolutionary visual effects. Star Wars soon established itself as a lucrative movie franchise for George Lucas, and he sold LucasFilm to Disney for US$4 billion in 2012. The Star Wars franchise now includes 12 movies with the most recent released in 2019.

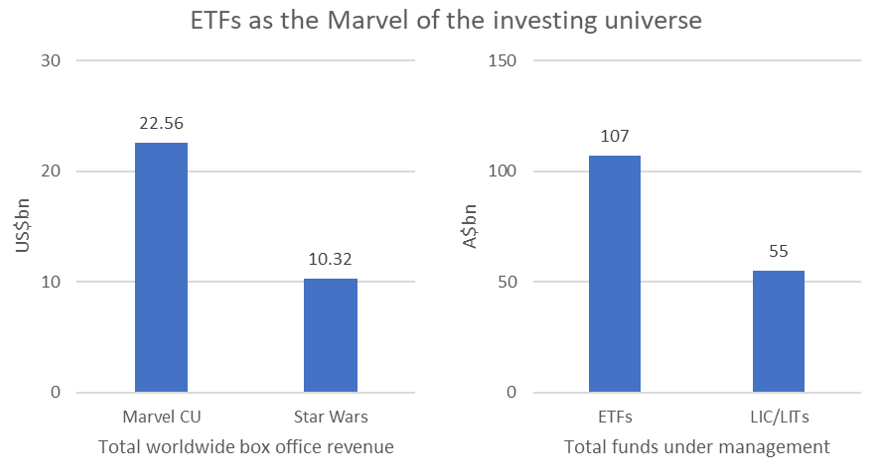

For most of the 44 years since the start, Star Wars was the world’s biggest movie franchise, but it has been overwhelmed in recent years by the Marvel comic characters, or Marvel Cinematic Universe. With 23 movies including the record-breaking Avengers: Endgame, Marvel is now undoubtedly the most lucrative movie franchise ever, with Avengers movies catching up with Star Wars after only four movies.

Marvel is to ETFs as Star Wars is to LICs

It’s a similar battle between two types of listed vehicles: the Star Wars equivalent are the LICs and LITs (Listed Investments Companies and Listed Investment trusts) and for Marvel, it is Exchange-Traded Funds (ETFs). ETFs have come from a long way behind to usurp LICs as the dominant listed fund vehicles and their lead will increase from here.

LICs started first by a long way. Our early heroes commenced when Whitefield (WHF) was established in 1923. Australia’s largest LIC, AFIC (AFI), began in 1928 and changed to its current name in 1938. LICs were well on their way in a galaxy far away before Jack Bogle of Vanguard had any inkling about index funds.

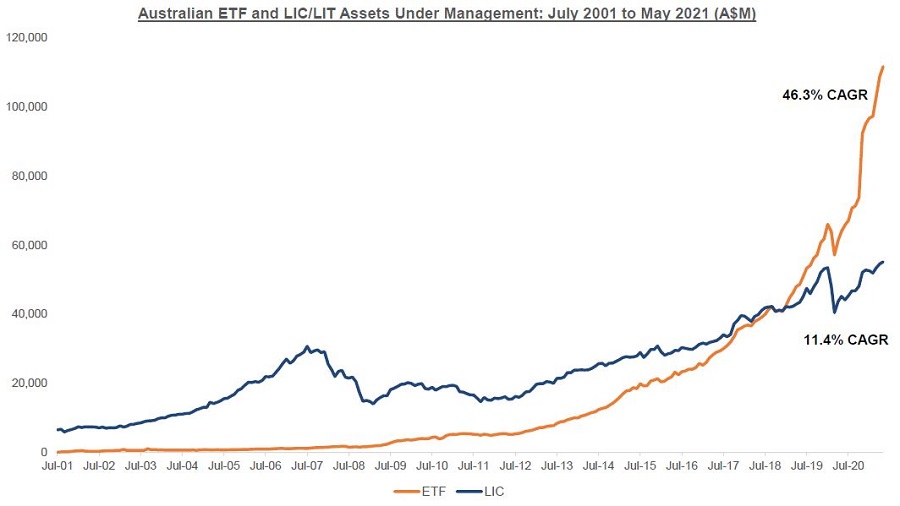

The first ETFs listed in the US were SPDRs in 1993, benchmarked to the S&P500. ETFs did not make their way onto the Australian exchange until 2001 with S&P/ASX200 and S&P/ASX50 funds. LICs therefore had a start of about 70 years but the ETF empire has struck back.

Total outstandings of ETFs are now $107 billion while LICs/LITs are about $55 billion. The proportions are the same as Star Wars and Marvel, with one around double the other.

Sources: Statistica, ASX

A long time for Marvel and ETFs to become established

The Marvel movies were not significant successes until Disney acquired Marvel Entertainment in 2009. Marvel now reigns with a range of superheroes including Iron Man, Spider Man, Captain America, Thor, Black Panther, Ant Man and the Incredible Hulk.

ETFs also had a slow start from that first transaction in 2001, making little progress by the time the GFC came in 2008. LICs flourished while they had the support of financial advisers and handsome stamping fees paid by issuers. It was not until the end of 2018 that ETFs finally took over LICs, as shown below. ETFs have since become the avengers, sweeping LICs aside with the inclusion of a wide range of indexes, sectors and niche products, and a big boost from the Magellan active funds.

CAGR: Compound Annual Growth Rate. Source: ASX, Chi-X, BetaShares.

The LIC number disguises the fact that there have been no new transactions since 2019 and the growth is overwhelmingly due to stock markets rising to all-time highs. In fact, in the 12 months between April 2020 and March 2021, the number of LICs/LITs fell from 111 to 102 while the number of ETFs rose from 212 to 220.

There are many reasons why ETFs dominate:

- The rise of passive, low cost index ETFs.

- The broad acceptance of ETFs among advisers and investors after a decade of intense education by the likes of Vanguard, BetaShares, VanEck and iShares.

- The removal of the ability of LICs to pay stamping fees to brokers and advisers to push their products to their clients.

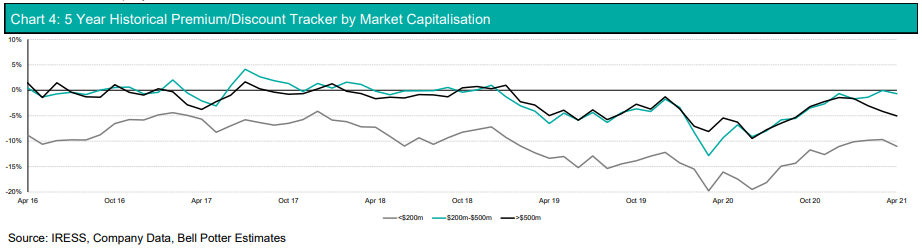

- The relatively poor investment experience of many LIC and LIT investors where issues traded at large discounts to the value of the underlying assets (Net Tangible Assets or NTA) whereas ETFs trade much closer to NTA.

- The development of Active ETFs, stealing the active management space once the domain of LICs.

The next generation of major investors is on the journey too. Rather than flocking to the Millennium Falcon, Millennials are flocking to ETFs.

It’s as if Chewy jumped to Marvel as some LICs switch

The problems with LICs and LITs trading at a discount became so acute that some managers have switched their LICs into either unlisted funds or Active ETF structures.

It’s as if Star Wars’ Chewbacca jumped out of Han Solo’s ship to become a Marvel character.

For example, two prominent LICs that gave up managing the discount to NTA discontent are Monash and Ellerston. On 10 May 2021, Monash’s MA1 shareholders voted to change the structure from a LIC to an Exchange Traded Managed Fund (ETMF). They will use a technique pioneered by Magellan with a dual registry structure which allows investors to buy and sell both on- and off-market.

Similarly, Ellerston Global Investments managed by well-known fund manager Ashok Jacob gave up its LIC structure in late 2019 and converted to an unlisted fund, immediately removing its material discount which Jacob had struggled with for years.

The following chart from Bell Potter shows historical premiums and discounts for LICs and LITs by market capitalisation. All segments have materially improved since the depths of COVID in April 2020 but the general discount to NTA problem continues, especially for small funds.

"I am your father" – but the new star WAR is not a LIC comeback

The father of LICs in Australia is Geoff Wilson of Wilson Asset Management (WAM), formed in 1997, well before any ETFs were listed in Australia. Wilson even calls his shareholders the 'Wilson Asset Family'. His own franchise of eight LICs includes a variety of sectors such as global, small cap, alternatives and large caps. Wilson’s business has thrived in the closed-end structure of LICs in a way none of the newer fund managers have come close to replicating.

If WAM were a movie, with its $4 billion in funds under management equivalent to gross takings at the box office, it would be in the same league as Jurassic Park and Lord of the Rings.

Wilson dominates public discourse on LICs although the largest LICs are the older structures such as AFIC (AFI, $9.2 billion) and Argo (ARG, $6.4 billion). He is currently in the market with the first new LIC since 2019 with WAM Strategic Value, which appropriately will trade on the exchange under the code WAR. WAR will target underperforming LICs which are trading at a discount to their NTA. Wilson talks of ‘buying $1 for 80 cents’ and there is no doubt he will raise his initial target of $225 million.

But Wilson going to WAR is not a LIC resurgence to threaten the recent dominance of ETFs. Wilson is a unique beast in the LIC universe, as unlike other new LICs, he does not need stockbrokers or financial advisers to sell his funds.

WAM has nurtured a direct retail buyer base with its weekly newsletter now sent to over 50,000 subscribers. It can sell new issues, including regular share purchase plans, readily without the assistance of brokers. Such is Wilson's following that most of his LICs trade at premiums, and he has successfully taken over other LICs and removed most if not all their discounts. Recent examples include Perennial Value’s Wealth Defender (which did little to defend wealth) and the alternatives portfolio of Blue Sky. WAR does not signal new demand for LICs, but it is a continuation of successful strategies at WAM.

There is irony in Wilson benefitting from LICs struggling at a discount when he is the biggest promoter of the LIC structure.

Wilson has also gained a profile as a retail investor’s friend. He was at the forefront of the campaign against the evil empire, the Labor Party, and its proposal to deny refunds of franking credits at the last election.

Another smaller LIC is coming from Salter Brothers Capital, an emerging companies issue for about $20 million. Salter specialises in unlisted assets including property, for which there is not a liquid market, and smaller companies, so it is suited to the permanent capital of a LIC. However, a $20 million transaction is more of a bit-part in a movie and hardly signs of a new franchise.

Prior to these two transactions, the previous LICs were in November 2019 with VGI’s VGI Partners Asian Investments Limited (VG8) and the KKR Credit Income Fund (KKC). KKC took a hammering in March 2020 and traded at less than 50% of its issue price, and VGI is facing considerable pressure from shareholder activists to convert to unlisted funds to remove persistent discounts, including on its larger flagship, VGI Partners Global Investments (VG1). VGI has responded by bringing in a new CEO, increasing its marketing activity, rolling out share buybacks and targeting a 4% annual dividend yield.

The (New) Empire Strikes Back

Star Wars has millions of fans who adore the movies and know the stories intimately. Similarly, many of the long-term LICs such as AFIC, Argo, Milton (MLT, $3.3 billion) and Djerriwarth (DJW, $660 million) have traded tightly around NTA during their long histories and delivered strong and growing dividends. The charitable Hearts and Minds (HM1, $891 million) is likewise well-supported. Some assets are well-suited to closed-end structures where the underlying assets are less liquid, such as corporate loans (for example, Metrics, MXT, $1.5 billion), non-investment grade credit (for example, Neuberger Berman, NBI, $832 million) and private equity (for example, Bailador, BTI, $192 million).

But outside of institutional placements, share purchase plans and the special case of WAM, new issuers will struggle to find a market when so many quality LIC managers cannot hold their transactions at NTA. A genuine resurgence of new LICs looks some way off.

Meanwhile, the Marvel characters and ETFs roll on, and in the 12 months to April 2021, the following new flows were generated into ETFs:

- Global equity, $12,026 million

- Domestic equity, $6,529 million

- Domestic fixed interest, $3,224 million

- Commodities, $812 million

- Global fixed interest, $730 million.

That’s $20 billion not including market rises. Luke Skywalker, Han Solo and Princess Leia may come flying across the limitless horizon but Iron Man and his fellow heroes are ready for them.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor. The author owns some of the securities mentioned in this article.