In Australia, Listed Investment Companies (LICs) and other listed trusts now total about $34 billion, and Exchange Traded Funds (ETFs) have reached about $30 billion. Both have established themselves as mainstays in the portfolios of many individual investors and SMSFs.

In our Education Centre, Cuffelinks publishes regular updates on LICs here and ETFs here.

Listed Investment Companies

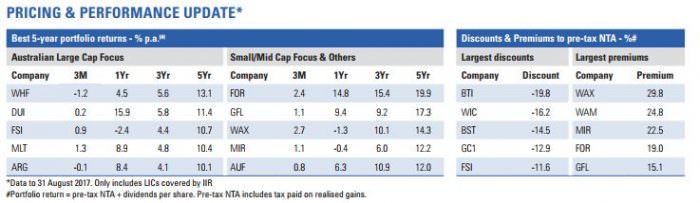

The latest monthly report from Independent Investment Research includes its full set of recommendations, plus this summary of the recent reporting season:

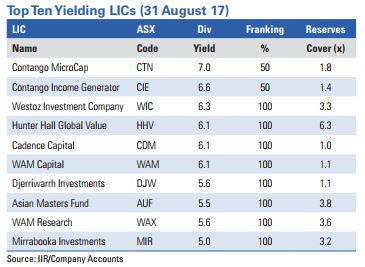

"Few LICs reduced their dividends during the recent reporting season despite many reporting lower earnings. This reflected the fact that most LICs have a level of profit reserves that enables them to smooth dividends by holding back when profits are strong. Our key measure for assessing LIC performance is total portfolio return, being growth in pre-tax NTA plus dividends, however, we understand that many investors in LICs are also focused on receiving attractive, fully franked dividends. So this month we take a look at the 10 highest yielding LICs in our coverage universe and consider the outlook and sustainability of these dividends.

In order to be able to pay dividends, LICs need to generate profits. However, it is possible for LICs to pay out more than they generate in profits in a given year by dipping into retained profit or dividend reserves from prior years. So it is possible for LICs to smooth dividend payments to their shareholders by retaining profits rather than simply paying out 100% of earnings each year. The table below shows our estimates (based on published accounts) of the number of years each LIC could retain its current dividend payments without generating any additional profits. This is a good indicator of dividend sustainability when markets turn down. Coverage of one means that a LIC could maintain its current dividend payout for one year without generating any profit in the current year."

Exchange Traded Funds

The latest monthly report by BetaShares includes this summary:

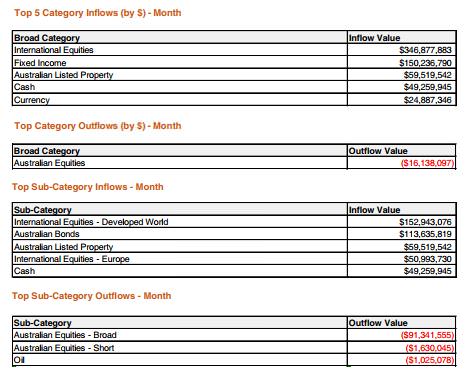

The Australian ETF industry recorded another strong month of growth, with the industry rising to a fresh record high:

• Total industry FuM at the month end was $30.9B, growth of 2.2% or $842m for the month

• While asset appreciation aided industry growth, the majority (75%) of the month’s growth came from net new money

• Unlike most of the year so far, which has seen strong inflows into Australian equities, the category with the highest level of inflows this month was global equities which received net inflows of $350m

• Australian bonds continued to received inflows with investors remaining cautious regarding the Australian sharemarket

• With continued macro-environmental instability gold exposures performed strongly this month with gold miners ETFs providing investors with the best performance for the month of August 2017.