During the Budget 2018 Lockup, a Treasury official told me there were no major changes in superannuation regulations in the Budget due to the many amendments made in 2017. The Government undertook not to meddle further with the system at the moment. Despite this, there were at least two important announcements on the retirement income framework and Pension Loans Scheme that create options for retirement planning. More on these later.

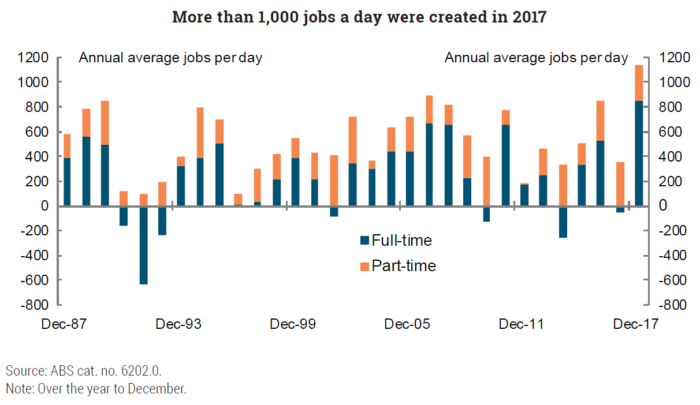

The 2018-2019 Budget is called ‘A Plan for a Stronger Economy’, and it starts by boasting of the 1,000 jobs a day created in 2017. This is a record for annual jobs, as shown below. Forecast tax receipts for 2017-2018 have increased by 9.8% over last year. In a recent revenue surge, tax receipts this financial year are $7 billion better than expected since MYEFO, and $26 billion better over the four years to 2021-2022. The main contributions are increases in personal, company and indirect taxes driven by growth in wages, profits and consumption. It gives the Government some fire power in a pre-election Budget.

The headline Budget estimates are:

- A Budget deficit in 2018-2019 of $14.5 billion, the lowest in a decade.

- A Budget surplus of $2.2 billion in 2019-2020, a surplus a year ahead of expected in last year’s Budget. Larger surpluses are forecast to follow.

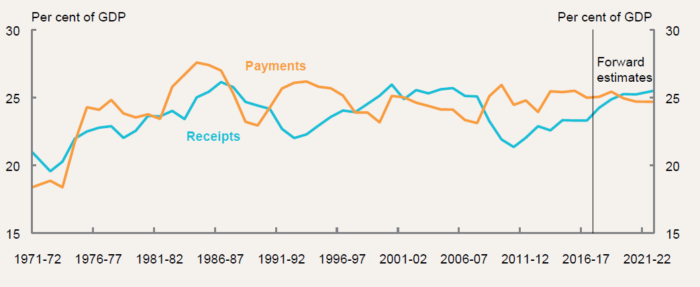

- Government spending at 24.7% of GDP, while taxes will stay at the 23.9% of GDP that this Government calls a ‘policy speed limit’. It needs an equivalent for spending.

The Government has focussed the politics on the improvements in the annual deficit, but it’s only with surpluses that debt is repaid. They believe net debt peaked in 2017-2018 at 18.6% of GDP and gross debt will be $126 billion less by 2027-2028. Achievement of these surpluses will take a lot of spending restraint over successive governments.

The other Budget aggregates for 2018-2019 include:

- CPI increase of 2.25% (up from 2% for 2017-2018)

- Unemployment rate of 5.25% (down from 5.5%)

- Real GDP 3% (up from 2.75%)

Personal tax

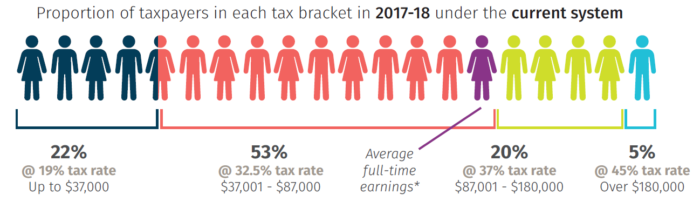

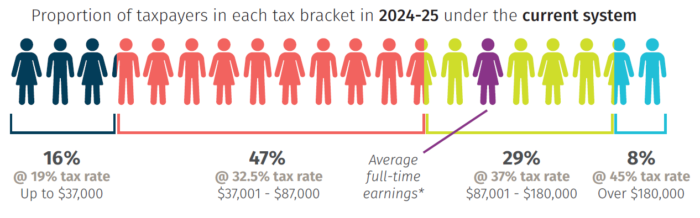

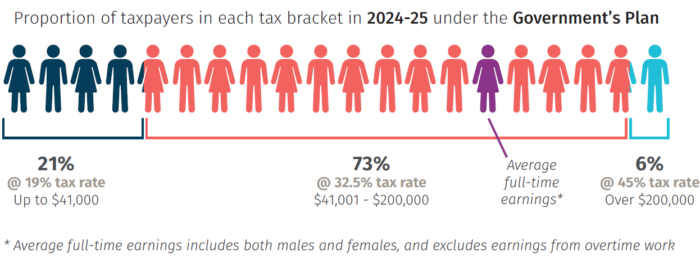

The main headline of the Budget is lower personal tax rates to make the system ‘fairer and simpler’. The Treasurer has recognised the prevailing low wages growth, which has averaged only 2.2% a year for the past five years, or negligible in real terms. The previous decade was about 3.5% a year. Creep in the tax brackets has seen personal income taxes as a proportion of all taxes rise from 17% to 19% in the last five years, and this would increase substantially without personal tax cuts. Addressing bracket creep, the new tax rates will mean that by 2024-2025, about 94% of taxpayers will have a marginal tax rate of 32.5% or less compared with 63% with the current rates.

The Coalition has been at pains for some time to point out that the personal income tax burden falls heavily on high earners, with the Top 1% of taxpayers incurring 17% of the $186 billion of personal tax. The Top 10% pay 45% compared with 36% 20 years ago, and 40% of Australian households receive more in Government payments than they pay in income taxes. Of course, lower income earners pay other taxes such as GST, and income tax is only part of the picture.

Here is the impact, keeping more Australians out of the higher brackets:

There will be a new tax offset of up to $530 for low to middle-income earners starting next year, giving tax relief to an estimated 10 million people with 4.5 million on the full amount. The top tax threshold of the 32.5% bracket will increase to $90,000 on 1 July 2018 from the current $87,000.

There are delays in further protecting against bracket creep until 2022-2023 when, for example, the top threshold of the 19% bracket rises from $37,000 to $41,000 and the top of the 32.5% bracket increases further to $120,000. Additional changes arrive from 1 July 2024 when the top 45% bracket will apply to those earning above $200,000.

Although these changes for higher income earners are some years off, this is a modest incentive to push income into next year where possible, or bringing deductions into this year, for example by prepaying interest on investment loans.

Superannuation and SMSFs

The Government announced a Protecting Your Super Package to commence on 1 July 2019 aimed at ‘reuniting’ Australians with their low balance, inactive superannuation accounts through the ATO. Inactive accounts below $6,000 will be transferred to the ATO to protect from further erosion, and data matching will be used to connect with the member’s active accounts. This technique is expected to push $6 billion in super back into 3 million active superannuation accounts.

The Government will also cap total fees on super accounts of less than $6,000 at 3%, and ban exit fees on all super accounts (exit fees cost members $37 million in 2015-2016). They will also make life insurance in superannuation an opt-in for people under the age of 25, plus those with low balance accounts or inactive accounts. An estimated $3 billion in insurance premiums may be saved by 5 million individuals.

Given the difficulty many superannuation funds have in identifying the exact fees on individual accounts, this measure might be difficult to implement. For example, funds might invest in a fund-of-funds with another level of fees. The wealth industry will need the time until the effective date of 1 July 2019 to sort it out.

Under ‘More Choices for a Longer Life’, the Government will introduce a one year exemption from the work test for voluntary contributions to super for people aged 65-74 and super balances below $300,000. This is intended to give retirees flexibility in the transition after work. The Budget Papers give an example of a person retiring on 1 June 2020 with only $150,000 in super who does not meet the work test. Under the new rules, he could put $45,000 at concessional rates (using the carry forward arrangements) and $100,000 in non-concessionals, almost doubling his super balance after leaving work.

The Budget confirms the maximum number of members allowed in an SMSF will rise from four to six to give more flexibility for larger families.

Additionally, some high income earners (above $263,157) with multiple employers will be able to nominate that their wages are not subject to Superannuation Guarantee from 1 July 2018. This will reduce the number of people who breach the $25,000 cap on concessional contributions, and allow some people to negotiate a higher income instead.

An unexpected change is the move the requiring audits of SMSFs every three years instead of annually where the fund has a clean audit history

Pension Loans Scheme

This proposal is one of two significant changes in the Budget for retirement planning, recognising that many Australians have most of their wealth tied up in the family home. The Pension Loans Scheme (PLS) is a reverse mortgage which allows retirees to supplement their income (see article following in Cuffelinks for a longer explanation of the current PLS).

Also under the ‘More Choices for a Longer Life’ label, supposedly designed to ‘support Australians to be prepared to live a healthy, independent, connected and safe life’, the Government is expanding the PLS from 1 July 2019. The new arrangement will give all retirees of age pension age (not only part-rate pensioners as in the current scheme) access to this home equity release to supplement income in retirement. Full-rate pensioners can draw income of up to $11,799 for singles and $17,787 by unlocking equity in their home.

Also from 1 July 2019, the Government will increase the maximum allowable combined age pension and PLS income stream to 150% of the age pension rate.

PLS participants can stop or start at any time and repay the loan if they wish, although this usually happens when the home is sold. There are age-based limits on the loan-to-value ratio, and the current borrowing rate is 5.25% (not especially generous given it has been this rate since 1997). The Government estimates that 1.8 million age pensioners own their own home, including 1.1 million on the maximum age pension and 700,000 part-age pension.

The ability of full age pensioners to draw income up to an additional 50% of the age pension is an interesting change. Budget Fact Sheet 3.3 gives an example of a maximum rate pensioner on $908 a fortnight ($23,598 a year) who chooses to receive an additional $6,000 a year giving her 125% of the age pension, supported by her house valued at $400,000. Income streams from the PLS are non-taxable and not means tested. While 5.25% is no bargain in the current low rate market, it is a good rate for a reverse mortgage and the new rules will make PLS a serious competitor to commercial products.

(The Cuffelinks article on the website was written a year ago and discusses how the PLS could become a fourth pillar of the retirement system, in addition to the age pension, compulsory superannuation and voluntary savings. In fact, it makes the case for extending the scheme to all people of pension age).

Retirement income framework

The retirement income framework is less developed than the accumulation phase. Products that address the risk of people outliving their savings are currently limited in take-up and there is no obligation for superannuation funds to address the retirement income needs of their members.

The Government is introducing a ‘retirement income covenant’, requiring super funds to help members achieve retirement income objectives. Trustees must offer a Comprehensive Income Product for Retirement (CIPR) that provides income for life, no matter how long they live. This will be a major boost to providers of products like lifetime annuities.

From 1 July 2019, new age pension mean testing rules will apply to pooled lifetime income streams. A fixed 60% of all pooled lifetime product payments will be assessed as income for age pension eligibility, and 60% of the purchase price of the product will be assessed as assets. These apply until the age of 84 (or a minimum of 5 years), and then 30% for the rest of the person’s life.

The Government expects this clarity will pave the way for the development of CIPRs, a product recommended by David Murray’s Financial System Inquiry. A more detailed position paper for public discussion will be released soon, expecting CIPRs to become a core part of the implementation by super funds of retirement strategies. Policies bought before 1 July 2019 will be grandfathered.

Pension Work Bonus

From 1 July 2019, the Pension Work Bonus will rise by $50 to $300 per fortnight, meaning income from work will not count towards the pension income test up to this limit. When added to the income free area (currently $168 a fortnight for singles and $300 for couples), a single person with no other income will be able to earn up to $468 a fortnight from work and receive the maximum age pension. The Work Bonus applies only to actual engagement in gainful work, not income from investments.

Financial Service Royal Commission

Building on the measures already announced, such as $5.9 million for ASIC in 2017/2018, this Budget gives $10.6 million to ASIC and $2.7 million to APRA to assist in their involvement in the Royal Commission. The cost will be offset by various industry levies. These increases suggest the Royal Commission is providing regulatory authorities with a decent amount of extra work.

Infrastructure

Another major feature of the Budget is a 10-year national infrastructure plan to reduce congestion, improve safety and create jobs. It supplements major projects already underway across the nation. The largest projects are included in an extract from the Budget Paper below.

From a personal perspective, it's disappointing to see further cuts to the ABC's budget, with $84 million removed over the three-year funding. I watch and listen to more ABC than all other broadcast media combined, and it calls to account politicians and businesses, and highlights social trends, better than any other media in Australia. It's not perfect but it needs to be well-funded.

Other major sections of the Budget include:

- Incentives to encourage business to create more jobs

- Additional high-level home care packages

- Backing regional Australia

- Investments in health facilities

- Boosting child care, preschools and student opportunities

- Keeping Australia safe

- Targetting the welfare system

- Cracking down on the black economy

- Making multinationals pay more tax

- Protecting the integrity of the tax system

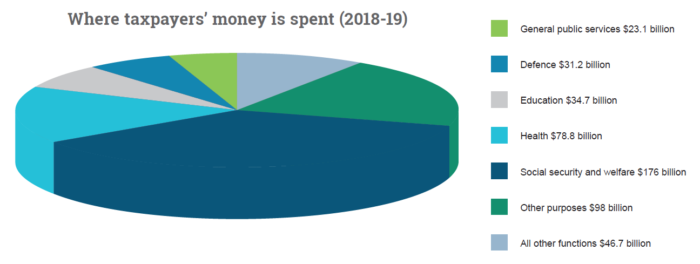

After all that effort on Budget revenue and expenses, this is where the money goes:

Graham Hand is Managing Editor of Cuffelinks. This summary is based on his understanding of the Budget during the Budget Lockup and no liability is accepted for its accuracy. It does not address the circumstances of any person. It is not comprehensive on the thousands of decisions in the Budget Paper, but targeted more at the Cuffelinks audience.

Budget 2018: Infrastructure projects by location

The Budget includes funding to invest in a number of new transport infrastructure projects:

- In New South Wales, the Government is providing $1.5 billion for new major projects, including $971 million for the Pacific Highway Coffs Harbour Bypass, $400 million for the Port Botany Rail Line Duplication and $155 million for the Nowra Bridge. In addition to funding these projects, the Commonwealth and New South Wales governments will be equal partners in funding the first stage of the North South Rail Link in Western Sydney.

In Victoria, the Government is providing $7.8 billion for new major projects, including a commitment of up to $5 billion for the Melbourne Airport Rail Link, $1.8 billion for the North East Link, $475 million for Monash Rail, $225 million for electrification for the Frankston Rail Line to Baxter, $140 million for a Victorian congestion package, $132 million to complete the duplication of the Princes Highway East from Traralgon to Sale and $50 million for Geelong Rail Line upgrades.

- In Queensland, the Government is providing $5.2 billion for new major projects, including an additional $3.3 billion for priority upgrades on the Bruce Highway, an additional $1 billion for the M1 Pacific Motorway, $390 million for the Beerburrum to Nambour Rail Upgrade, $300 million for the Brisbane Metro project and $170 million for the Cunningham Highway — Yamanto to Ebenezer (Amberley Interchange).

- In Western Australia, the Government is providing $2.6 billion for new major projects, including a further $1.1 billion for the METRONET rail project, $944 million for a Perth Congestion Package and $560 million for the Bunbury Outer Ring Road.

- In South Australia, the Government is providing $1.8 billion for new major projects, including $1.4 billion for North-South Road Corridor projects, with the Regency Road to Pym Street section of the Corridor to receive $177 million. The Government is providing $220 million for the Gawler Rail Line electrification and $160 million for the Joy Baluch Bridge.

- In Tasmania, the Government is providing $461 million for the Bridgewater Bridge replacement and an additional $59.8 million for the Tasmanian Freight Rail Revitalisation Package.

- In the Australian Capital Territory, the Government is providing $100 million for the Monaro Highway Upgrade.

- In the Northern Territory, the Government is providing $280 million for upgrades of the Central Arnhem Road and the Buntine Highway.

These new major projects will add to the more than 500 major projects that the Government has funded since 2013. There are 141 projects under construction or development, 142 are in the pre-construction stage involving detailed design and planning works, procurements, or environmental assessment and 227 are completed.

Construction on the Western Sydney Airport is due to commence this year and operations by 2026. The Government is providing equity of up to $5.3 billion in WSA Co to deliver stage one of Western Sydney Airport. Western Sydney Airport will support an estimated 28,000 direct and indirect jobs by 2031 and act as a major catalyst for the development of the broader Western Sydney region.